Table of Contents

Steps to Claim Benefits of DTAA with Form 10A

A person who earns Income has to pay tax in the country in which they reside. But if you are an NRI you can avoid paying tax twice as per DTAA. The full form of DTAA is the Double Tax Avoidance Agreement. Usually, Non-Resident Indians earn in India and have to pay tax in India as well as in their country. To avoid this, the Government has taken good steps to give relief to the assessee. Know how to Claim Benefits Under DTAA.

What is DTAA?

The Double Tax Avoidance Agreement is an agreement which is signed between two countries. This agreement is signed to give relief to NRI’s from paying multiple Taxes. With DTAA the NRI’s cannot avoid the tax completely, but they will get relief from paying multiple taxes in both the countries. Also, it does not allow an NRI to cut down their tax implications on the income earned in India.

Countrywise DTAA Rates

DTAA has a specific rate from which the tax has to be deducted on the income paid to residents of the country. In this scenario, the NRI Earned Income in India then the TDS will be applicable according to the rates in the Double Tax Avoidance Agreement with the NRI’s country.

Check the following country list with DTAA rates.

| Countries | DTAA Rates |

|---|---|

| Albania | 15% |

| Armenia | 10.0% |

| Australia | 10.0% |

| Austria | 10.0% |

| Bangladesh | 15.0% |

| Belarus | 10.0% |

| Belgium | 10.0% |

| Bhutan | 15.0% |

| Botswana | 15.0% |

| Brazil | 15.0% |

| Bulgaria | 10.0% |

| Canada | 10.0% |

| China | 10.0% |

| Columbia | 10.0% |

| Croatia | 10.0% |

| Cyprus | 15.0% |

| Czech Republic | 10.0% |

| Denmark | 10.0% |

| Estonia | 10.0% |

| Ethopia | 10.0% |

| Finland | 10.0% |

| Fiji | 10.0% |

| France | 10.0% |

| Gerogia | 10.0% |

| Germany | 10.0% |

| Hong Kong | 10.0% |

| Hungary | 10.0% |

| Indonesia | 10.0% |

| Iceland | 10.0% |

| Ireland | 15.0% |

| Israel | 10.0% |

| Italy | 10.0% |

| Japan | 10.0% |

| Jordan | 10.0% |

| Kazakhstan | 10.0% |

| Kenya | 10.0% |

| Korea | 10.0% |

| Kuwait | 10.0% |

| Kyrgyz Republic | 10.0% |

| Latvia | 10.0% |

| Lithuania | 10.0% |

| Luxembourg | 10.0% |

| Malaysia | 15.0% |

| Malta | 7.5% |

| Mongolia | 10.0% |

| Mauritius | 10.0% |

| Montenegro | 10.0% |

| Myanmar | 10.0% |

| Morocco | 10.0% |

| Mozambique | 10.0% |

| Macedonia | 10.0% |

| Namibia | 10.0% |

| Nepal | 10.0% |

| Netherlands | 10.0% |

| New Zealand | 10.0% |

| Norway | 15.0% |

| Oman | 10.0% |

| Phillipines | 10.0% |

| Poland | 10.0% |

| Porteguese Republic | 10.0% |

| Qatar | 10.0% |

| Romania | 10.0% |

| Russain Federation | 10.0% |

| Saudi Arabia | 15.0% |

| Serbia | 10.0% |

| Singapore | 10.0% |

| Slovenia | 15.0% |

| South Africa | 10.0% |

| Spain | 10.0% |

| Sri Lanka | 10.0% |

| Sudan | 10.0% |

| Sweden | 10.0% |

| Swiss | 10.0% |

| Syrain Arab Republic | 10.0% |

| Tajikistan | 10.0% |

| Tanzania | 10.0% |

| Thailand | 15.0% |

| Trinidad and Tobago | 10.0% |

| Turkey | 10.0% |

| Turkmenistan | 12.5% |

| Uganda | 10.0% |

| Ukraine | 15.0% |

| United Mexican States | 15.0% |

| United Kingdom | 10.0% |

| United States (USA) | 10.0% |

| Uruguay | 10.0% |

| Uzbekistan | 10.0% |

| Vietnam | 10.0% |

| Zambia | 10.0% |

Talk to our investment specialist

How to Claim DTAA Benefits?

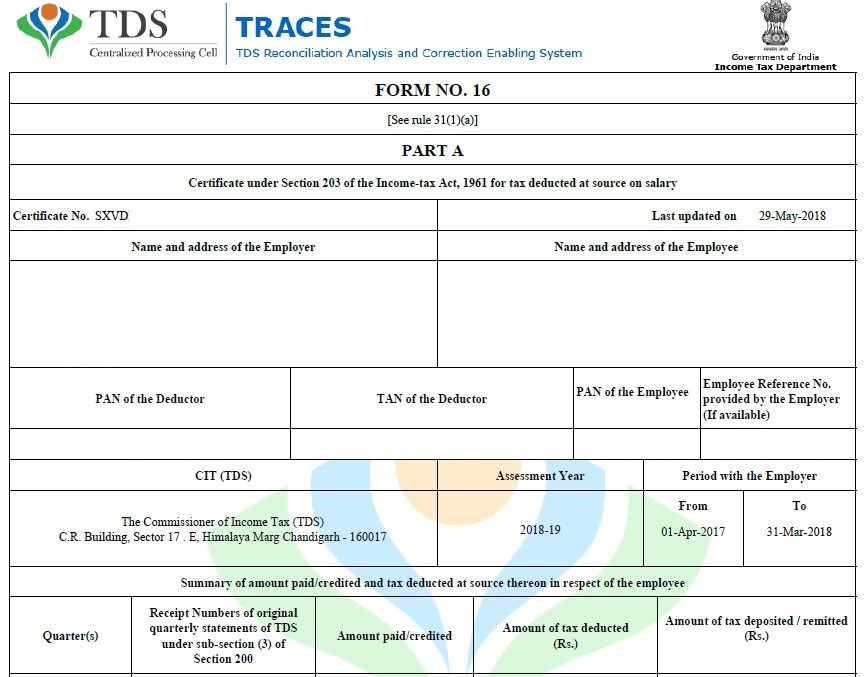

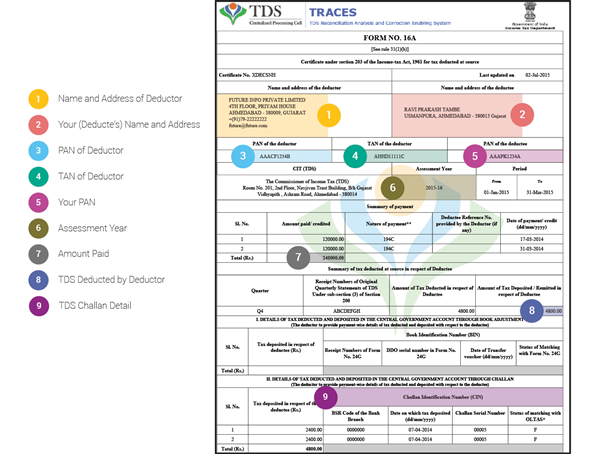

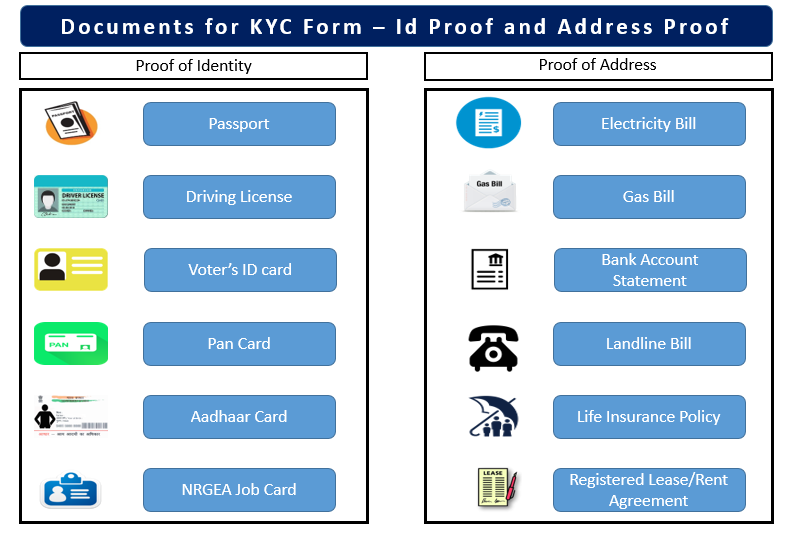

An individual has to check whether their country has DTAA with India. One has to file Form no 10 and has to provide the following documents:

- Self-declaration cum indemnity format

- Self-attested PAN Card copy

- PIO proof copy (if applicable)

- Tax Residency Certificate (TRC)

Form 10 F

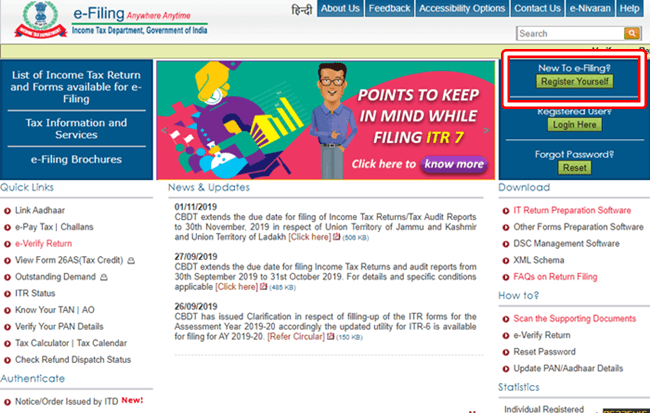

You can take this form from the Bank or download from incometaxindia.gov. in website. Fill the mandatory details like applicant’s nationality, Tax Identification Number, address and period of residential status.

Self Declaration

Self-declaration is the information that an individual has to provide information about the country which will be covered under the DTAA with India.

Tax Residency Certificate

This certificate must be obtained from the country in which the assessee is residing in a particular financial year. A tax residency certificate is issued on the submission of the required documents and payments of prescribed fees.

Income Types Under DTAA

The NRI’s don’t have to pay double tax on the income earned from the following sources:

- Services provided in India

- Salary received in India

- House property located in India

- Capital gains on transfer of assets in India

- Fixed deposits in India

- Savings bank accounts in India

DTAA Methods

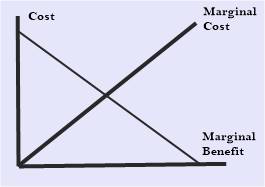

There are two ways to claim DTAA benefits:

- Tax Credit Method

- Exemption Method

Tax Credit Method

Tax Credit Method is a popular way of taking DTAA benefits. An individual has to take all his income into consideration (foreign country + home country income) and compute the taxes. Calculate the taxes as per the home country and take credit while paying taxes.

For instance, a person has a bank interest in India of Rs. 20 lakh then 30% tax rates are applicable. Currently, if a person is living in a foreign country and the taxes are at 40% then the person will be able to take back 30%, and only 10% of taxes would be applicable.

Exemption Method

Exemption Method is another way in which you don’t have to consider your home country income. You have to just pay taxes on the income you have earned in the foreign country. In this method, you can pay taxes in any one of the two countries.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.