ایف ڈی کیلکولیٹر - فکسڈ ڈپازٹ کیلکولیٹر

فکسڈ ڈپازٹ طویل مدتی سرمایہ کاری کا آلہ ہے جو سرمایہ کاروں کی مدد کرتا ہے۔پیسے بچانا طویل مدت کے لئے. سرمایہ کار ایک مقررہ مدت کا انتخاب کر سکتے ہیں جس کے لیے ڈپازٹ کے پاس رکھا جائے گا۔بینک. عام طور پر،ایف ڈی سرمایہ کاری ان لوگوں کے لیے بہتر ہے جو طویل مدتی دولت کی تخلیق کے خواہاں ہیں کیونکہ وہ بچت کھاتوں کے مقابلے میں زیادہ شرح سود پیش کرتے ہیں۔

FD سود کا حساب کیسے لگایا جاتا ہے؟

زیادہ تر بینکوں میں، FD پر سود سہ ماہی میں بڑھایا جاتا ہے۔ اس کا فارمولا یہ ہے:

A = P * (1+ r/n) ^ n*t، کہاں

- میں = اے - پی

- اے = پختگی کی قیمت

- پی = اصل رقم

- r = شرح سود

- t = سالوں کی تعداد

- n = مرکب سود کی تعدد

- میں = سود سے کمائی گئی رقم

ایف ڈی کے فوائد

- FD بطور استعمال کیا جا سکتا ہے۔ضمانت قرض لینے کے لیے۔ آپ اپنی FD رقم پر 80-90% تک قرض لے سکتے ہیں۔

- جمع کنندہ مزید فکسڈ ڈپازٹ کے لیے میچورٹی کے وقت رقم منتقل کرنے کا انتخاب کر سکتا ہے۔

- رقم صرف ایک بار جمع کی جا سکتی ہے۔ ایک بار جمع ہونے کے بعد، اکاؤنٹ سے رقم نکالنے پر جرمانہ عائد ہوگا۔

- FD اسکیمیں ان لوگوں کے لیے سرمایہ کاری کے اچھے اوزار ہیں جن کے پاس فاضل فنڈز ہیں اور وہ اس سے پیسہ کمانا چاہتے ہیں۔

Investment Amount:₹100,000 Interest Earned:₹28,930.22 Maturity Amount: ₹128,930.22فکسڈ ڈپازٹ (FD) کیلکولیٹر

Talk to our investment specialist

ایف ڈی پر ٹیکس کے فوائد

دوسرے ذاتی ٹیکس کی بچت اور سرمایہ کاری کے آلات کی طرح، فکسڈ ڈپازٹ اسکیمیں بھی اپنی طرف متوجہ کرتی ہیں۔ٹیکس. اگر کل سود روپے سے زیادہ ہو تو FD سے جمع ہونے والے ریٹرن پر 10% کا TDS کاٹا جاتا ہے۔ 10،000 ایک مالی سال میں

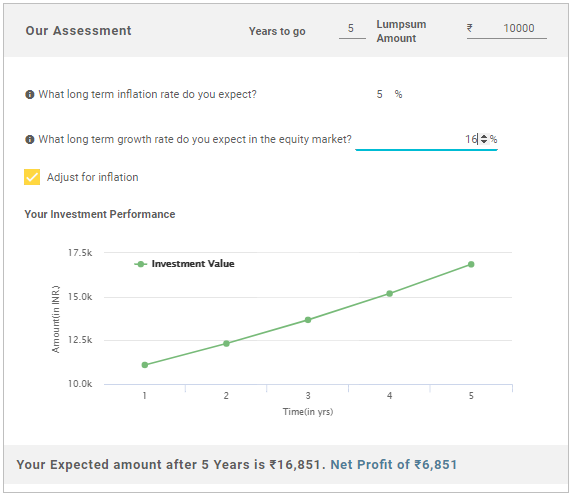

آئیے اس کا موازنہ کرتے ہیں۔گھونٹ اسکیم اور آپ دیکھ سکتے ہیں کہ SIPs طویل مدتی کے لیے زیادہ فائدہ مند ہیں۔ چونکہ ایکویٹی سے طویل مدتی فوائد ٹیکس سے پاک ہوتے ہیں، اس لیے کوئی بھی ایس آئی پی جو سرمایہ کاری کرتا ہے۔ای ایل ایس ایس (ایکویٹی لنکڈباہمی چندہ) ایک سال کے بعد بھی ٹیکس سے پاک ہے۔

*ذیل میں پچھلے 1 سال کی کارکردگی اور فنڈ کی عمر> 1 سال کی بنیاد پر فنڈ کی فہرست ہے۔

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) DSP World Gold Fund Growth ₹62.799

↑ 0.52 ₹1,975 500 28.2 58.2 154.1 60.6 29.4 167.1 DSP World Mining Fund Growth ₹30.7343

↓ -0.10 ₹181 500 24.4 47 88.6 23.3 18.2 79 DSP World Energy Fund Growth ₹25.4244

↑ 0.02 ₹103 500 8.8 21.6 53.7 13.3 10.6 39.2 Edelweiss Emerging Markets Opportunities Equity Off-shore Fund Growth ₹23.1

↓ -0.21 ₹191 1,000 10.9 23.9 44.5 19.4 5.5 41.1 Kotak Global Emerging Market Fund Growth ₹32.509

↓ -0.81 ₹539 1,000 7.4 16.1 39.4 19.5 7.3 39.1 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 9 Mar 26 Research Highlights & Commentary of 5 Funds showcased

Commentary DSP World Gold Fund DSP World Mining Fund DSP World Energy Fund Edelweiss Emerging Markets Opportunities Equity Off-shore Fund Kotak Global Emerging Market Fund Point 1 Highest AUM (₹1,975 Cr). Bottom quartile AUM (₹181 Cr). Bottom quartile AUM (₹103 Cr). Lower mid AUM (₹191 Cr). Upper mid AUM (₹539 Cr). Point 2 Oldest track record among peers (18 yrs). Established history (16+ yrs). Established history (16+ yrs). Established history (11+ yrs). Established history (18+ yrs). Point 3 Top rated. Rating: 3★ (upper mid). Rating: 2★ (bottom quartile). Rating: 3★ (lower mid). Rating: 3★ (bottom quartile). Point 4 Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Point 5 5Y return: 29.40% (top quartile). 5Y return: 18.22% (upper mid). 5Y return: 10.63% (lower mid). 5Y return: 5.45% (bottom quartile). 5Y return: 7.26% (bottom quartile). Point 6 3Y return: 60.64% (top quartile). 3Y return: 23.30% (upper mid). 3Y return: 13.25% (bottom quartile). 3Y return: 19.40% (bottom quartile). 3Y return: 19.47% (lower mid). Point 7 1Y return: 154.15% (top quartile). 1Y return: 88.60% (upper mid). 1Y return: 53.70% (lower mid). 1Y return: 44.47% (bottom quartile). 1Y return: 39.37% (bottom quartile). Point 8 Alpha: 2.12 (top quartile). Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: -0.75 (bottom quartile). Alpha: -1.44 (bottom quartile). Point 9 Sharpe: 3.41 (top quartile). Sharpe: 3.17 (upper mid). Sharpe: 1.88 (bottom quartile). Sharpe: 2.68 (lower mid). Sharpe: 2.63 (bottom quartile). Point 10 Information ratio: -0.47 (lower mid). Information ratio: 0.00 (top quartile). Information ratio: 0.00 (upper mid). Information ratio: -0.84 (bottom quartile). Information ratio: -0.59 (bottom quartile). DSP World Gold Fund

DSP World Mining Fund

DSP World Energy Fund

Edelweiss Emerging Markets Opportunities Equity Off-shore Fund

Kotak Global Emerging Market Fund

2022 کے لیے سرفہرست فنڈز

*1 سال کی کارکردگی کی بنیاد پر بہترین فنڈز۔

"The primary investment objective of the Scheme is to seek capital appreciation by investing predominantly in units of MLIIF - WGF. The Scheme may, at the discretion of the Investment Manager, also invest in the units of other similar overseas mutual fund schemes, which may constitute a significant part of its corpus. The Scheme may also invest a certain portion of its corpus in money market securities and/or units of money market/liquid schemes of DSP Merrill Lynch Mutual Fund, in order to meet liquidity requirements from time to time. However, there is no assurance that the investment objective of the Scheme will be realized." Below is the key information for DSP World Gold Fund Returns up to 1 year are on The primary investment objective of the Scheme is to seek capital appreciation by investing predominantly in the units of BlackRock Global Funds – World Mining Fund. The Scheme may, at the discretion of the Investment Manager, also invest in the units of other similar overseas mutual fund schemes, which may

constitute a significant part of its corpus. The Scheme may also invest a certain portion of its corpus in money market securities and/or money market/liquid schemes of DSP BlackRock Mutual Fund, in order to meet liquidity requirements from time to time. Research Highlights for DSP World Mining Fund Below is the key information for DSP World Mining Fund Returns up to 1 year are on 1. DSP World Gold Fund

DSP World Gold Fund

Growth Launch Date 14 Sep 07 NAV (09 Mar 26) ₹62.799 ↑ 0.52 (0.84 %) Net Assets (Cr) ₹1,975 on 31 Jan 26 Category Equity - Global AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆ Risk High Expense Ratio 1.41 Sharpe Ratio 3.41 Information Ratio -0.47 Alpha Ratio 2.12 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹10,843 28 Feb 23 ₹9,241 29 Feb 24 ₹8,778 28 Feb 25 ₹13,911 28 Feb 26 ₹41,909 Returns for DSP World Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 9 Mar 26 Duration Returns 1 Month 2.6% 3 Month 28.2% 6 Month 58.2% 1 Year 154.1% 3 Year 60.6% 5 Year 29.4% 10 Year 15 Year Since launch 10.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 167.1% 2023 15.9% 2022 7% 2021 -7.7% 2020 -9% 2019 31.4% 2018 35.1% 2017 -10.7% 2016 -4% 2015 52.7% Fund Manager information for DSP World Gold Fund

Name Since Tenure Jay Kothari 1 Mar 13 12.93 Yr. Data below for DSP World Gold Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Basic Materials 95.89% Asset Allocation

Asset Class Value Cash 1.55% Equity 95.89% Debt 0.01% Other 2.56% Top Securities Holdings / Portfolio

Name Holding Value Quantity BGF World Gold I2

Investment Fund | -74% ₹1,458 Cr 1,177,658

↓ -41,596 VanEck Gold Miners ETF

- | GDX25% ₹497 Cr 573,719 Treps / Reverse Repo Investments

CBLO/Reverse Repo | -2% ₹35 Cr Net Receivables/Payables

Net Current Assets | -1% -₹15 Cr 2. DSP World Mining Fund

DSP World Mining Fund

Growth Launch Date 29 Dec 09 NAV (09 Mar 26) ₹30.7343 ↓ -0.10 (-0.32 %) Net Assets (Cr) ₹181 on 31 Jan 26 Category Equity - Global AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆ Risk High Expense Ratio 1.14 Sharpe Ratio 3.17 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 28 Feb 21 ₹10,000 28 Feb 22 ₹12,307 28 Feb 23 ₹12,279 29 Feb 24 ₹10,745 28 Feb 25 ₹11,677 28 Feb 26 ₹25,661 Returns for DSP World Mining Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 9 Mar 26 Duration Returns 1 Month -1.9% 3 Month 24.4% 6 Month 47% 1 Year 88.6% 3 Year 23.3% 5 Year 18.2% 10 Year 15 Year Since launch 7.2% Historical performance (Yearly) on absolute basis

Year Returns 2024 79% 2023 -8.1% 2022 0% 2021 12.2% 2020 18% 2019 34.9% 2018 21.5% 2017 -9.4% 2016 21.1% 2015 49.7% Fund Manager information for DSP World Mining Fund

Name Since Tenure Jay Kothari 1 Mar 13 12.93 Yr. Data below for DSP World Mining Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Basic Materials 95.77% Energy 1.05% Asset Allocation

Asset Class Value Cash 3.15% Equity 96.82% Debt 0.02% Top Securities Holdings / Portfolio

Name Holding Value Quantity BGF World Mining I2

Investment Fund | -99% ₹180 Cr 149,227

↓ -1,163 Treps / Reverse Repo Investments

CBLO/Reverse Repo | -1% ₹2 Cr Net Receivables/Payables

Net Current Assets | -0% ₹0 Cr

یہاں فراہم کردہ معلومات کے درست ہونے کو یقینی بنانے کے لیے تمام کوششیں کی گئی ہیں۔ تاہم، ڈیٹا کی درستگی کے حوالے سے کوئی ضمانت نہیں دی جاتی ہے۔ براہ کرم کوئی بھی سرمایہ کاری کرنے سے پہلے اسکیم کی معلومات کے دستاویز کے ساتھ تصدیق کریں۔

Research Highlights for DSP World Gold Fund