IDFC بینک میں SIP ٹرانزیکشنز کے لیے بلر کیسے شامل کریں؟

گھونٹ یا منظمسرمایہ کاری کا منصوبہ میں سرمایہ کاری کا ایک طریقہ ہے۔باہمی چندہ جہاں افراد باقاعدہ وقفوں پر تھوڑی سی رقم جمع کرتے ہیں۔ ایس آئی پی کے لین دین میں، لوگوں کو یہ سمجھنا چاہیے کہ رقم باقاعدہ وقفوں پر کٹ جاتی ہے۔ لہذا، اس بات کو یقینی بنانے کے لیے کہ پورا عمل پریشانی سے پاک ہے، لوگ اپنے بلرز کو شامل کر سکتے ہیں۔بینک نیٹ بینکنگ کے ذریعے اکاؤنٹ بنائیں تاکہ ادائیگی وقت پر ہو۔یہ بینک اکاؤنٹ میں SIP کا منفرد رجسٹریشن نمبر یا URN شامل کرکے کیا جا سکتا ہے۔. آپ کو یہ URN اپنے ای میل میں ملے گا یا آپ اسے اپنی پہلی ادائیگی کرنے کے بعد fincash.com کی ویب سائٹ پر جا کر حاصل کر سکتے ہیں۔ بینک اکاؤنٹ میں بلرز کو شامل کرنے کا یہ عمل ہر بینک کے لیے مختلف ہے۔ تو آئیے IDFC بینک میں بلر شامل کرنے کے عمل کو سمجھیں۔

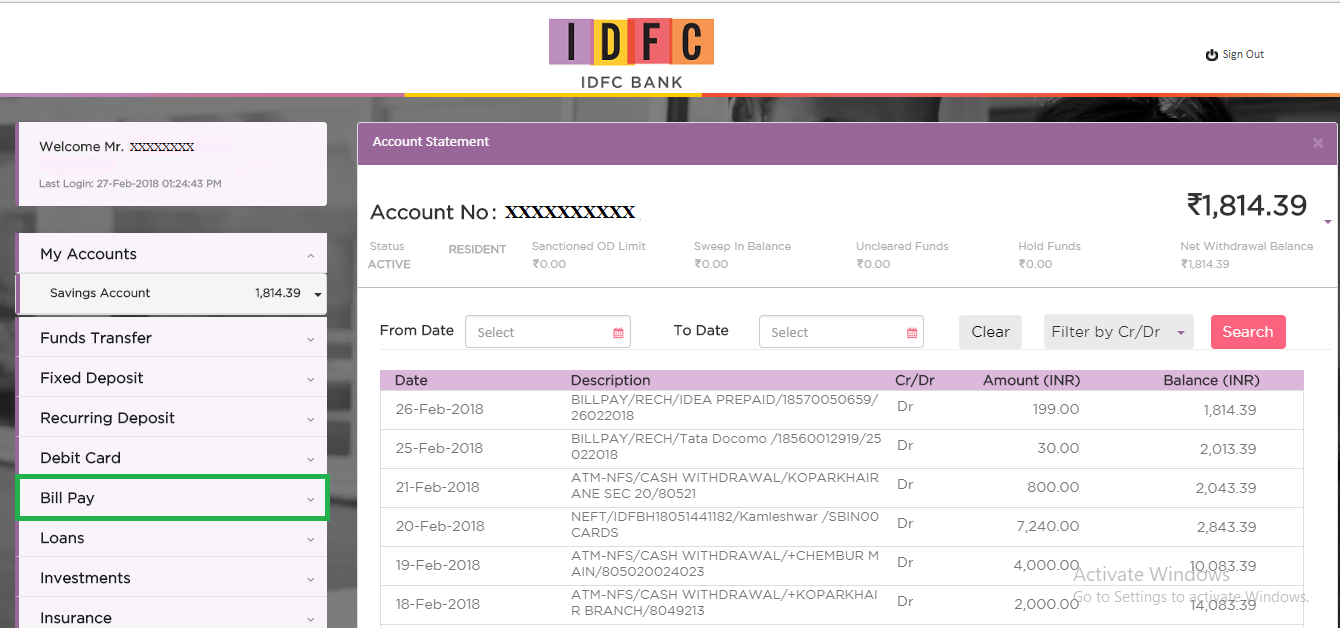

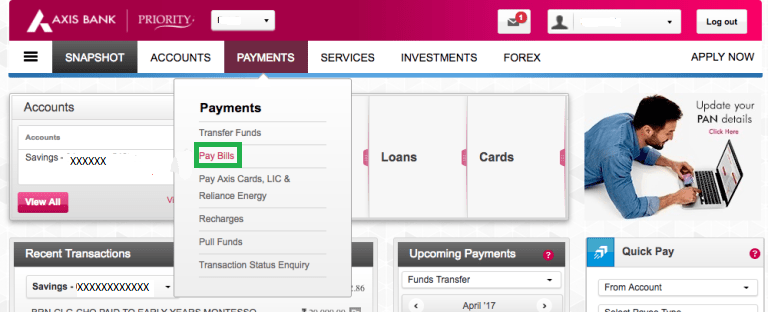

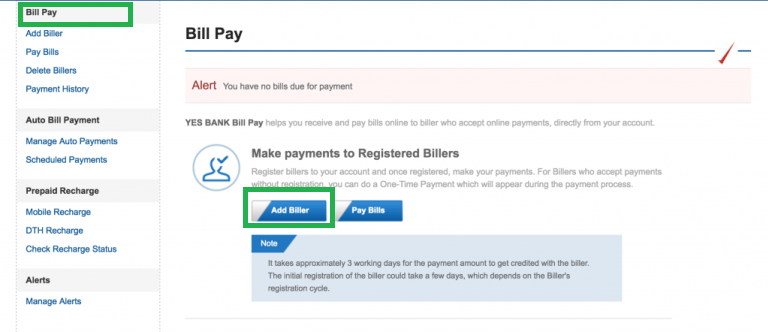

اپنے IDFC بینک اکاؤنٹ میں لاگ ان کریں اور بل پے آپشن پر کلک کریں۔

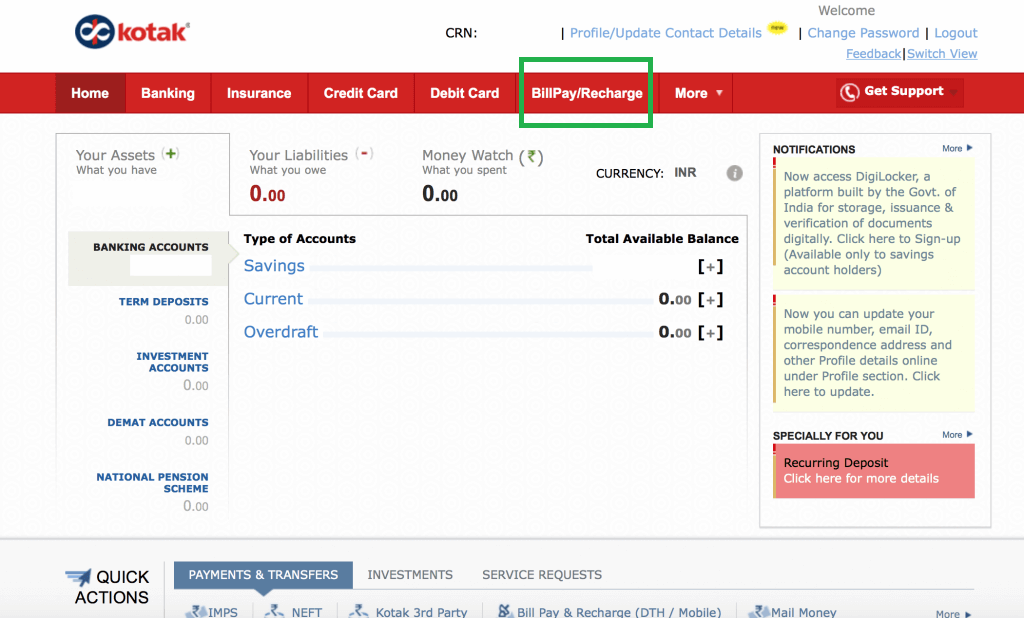

بینک اکاؤنٹ میں بلر کو شامل کرنے کا کوئی بھی عمل آپ کے بینک اکاؤنٹ میں لاگ ان ہونے سے شروع ہوتا ہے۔ سب سے پہلے، آپ کو اپنے لاگ ان کی اسناد کا استعمال کرکے اپنے بینک اکاؤنٹ میں لاگ ان کرنے کی ضرورت ہے۔ ایک بار لاگ ان ہونے کے بعد، آپ کو آپ کی ہوم اسکرین پر بھیج دیا جائے گا۔ ہوم اسکرین میں، آپ کو کلک کرنے کی ضرورت ہے۔بل کی ادائیگی ٹیب جو اسکرین کے بائیں جانب ہے۔ اس قدم کی تصویر اس طرح ہے جہاں بل پے آپشن کو سبز رنگ میں نمایاں کیا گیا ہے۔

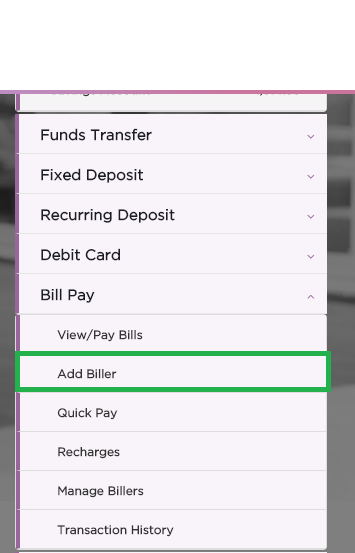

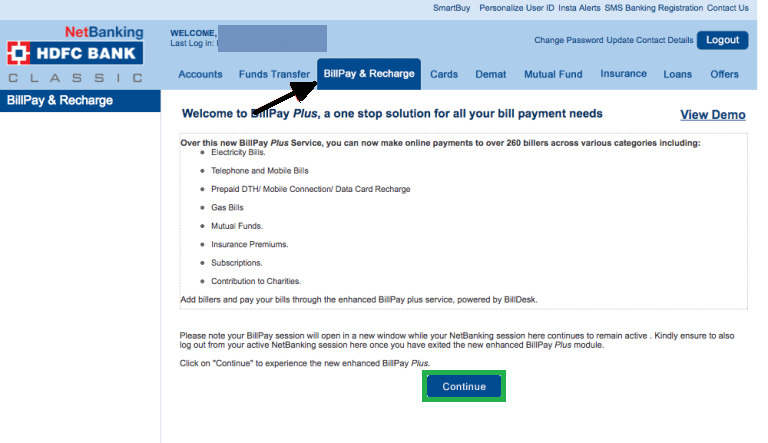

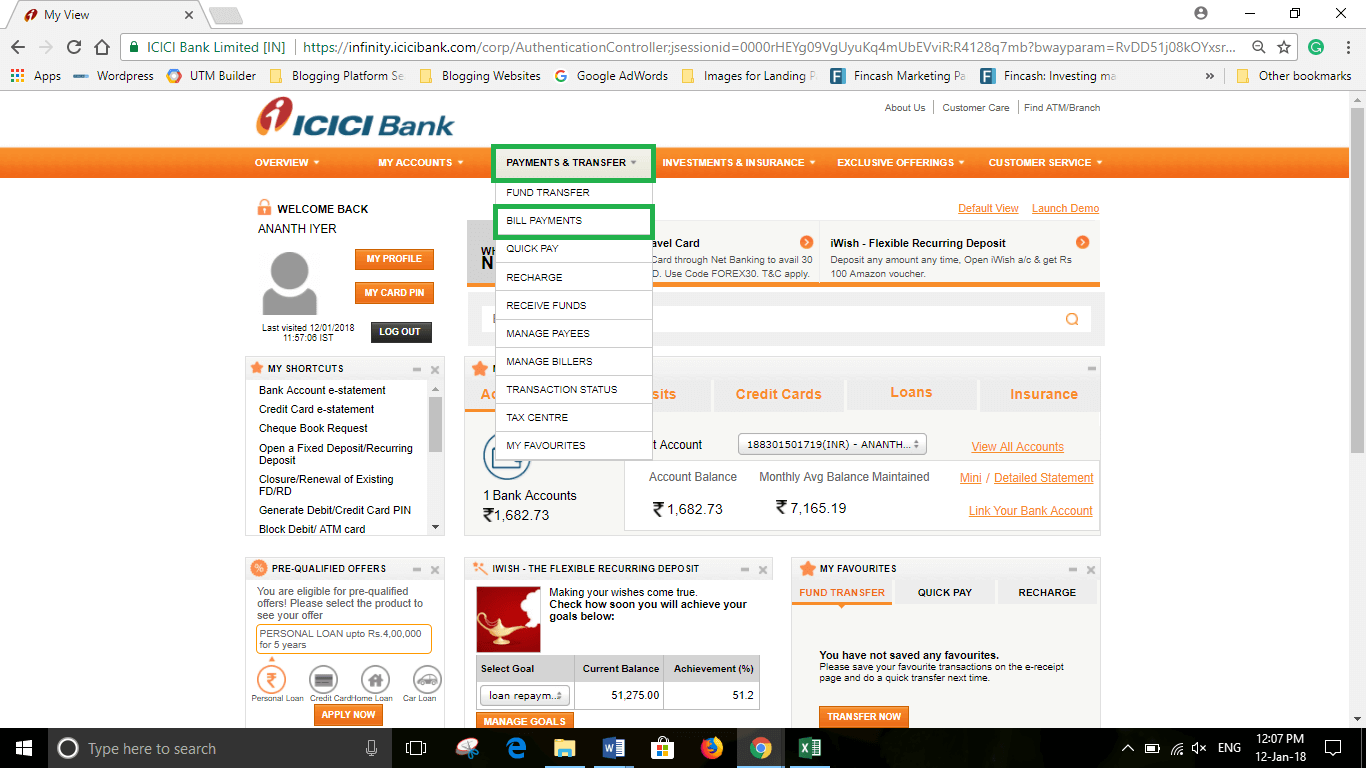

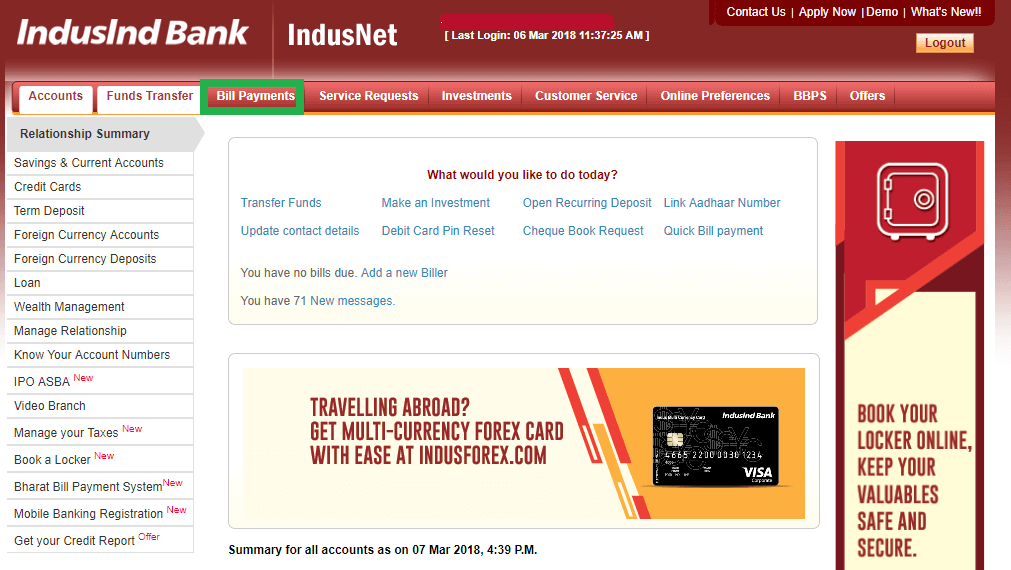

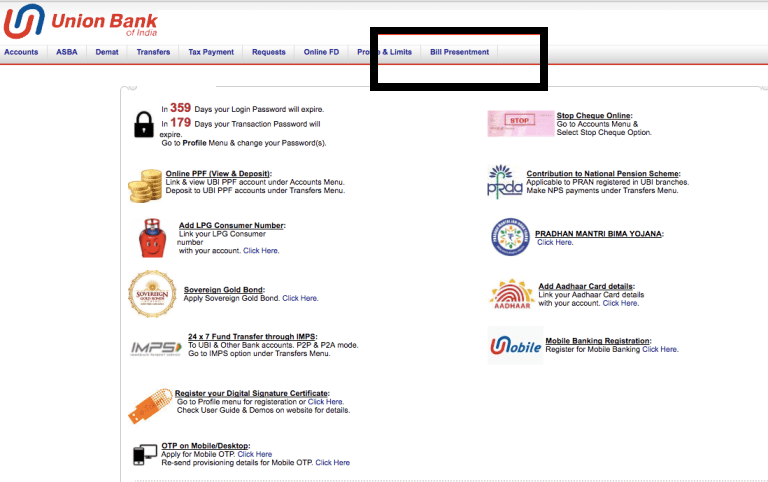

بل پے آپشن میں ایڈ بلر پر کلک کریں۔

ایک بار جب آپ کلک کریں۔بل کی ادائیگی ٹیب، ایک ڈراپ ڈاؤن کھلتا ہے، جس میں مختلف آپشنز ہوتے ہیں جیسے کہ ویو/پے بلز، کوئیک پے، ری چارجز، اور بہت کچھ۔ ان اختیارات میں سے، آپ کو منتخب کرنے کی ضرورت ہے۔بلر شامل کریں۔ اختیار اس قدم کی تصویر نیچے دی گئی ہے جہاں Add Biller آپشن کو سبز رنگ میں نمایاں کیا گیا ہے۔

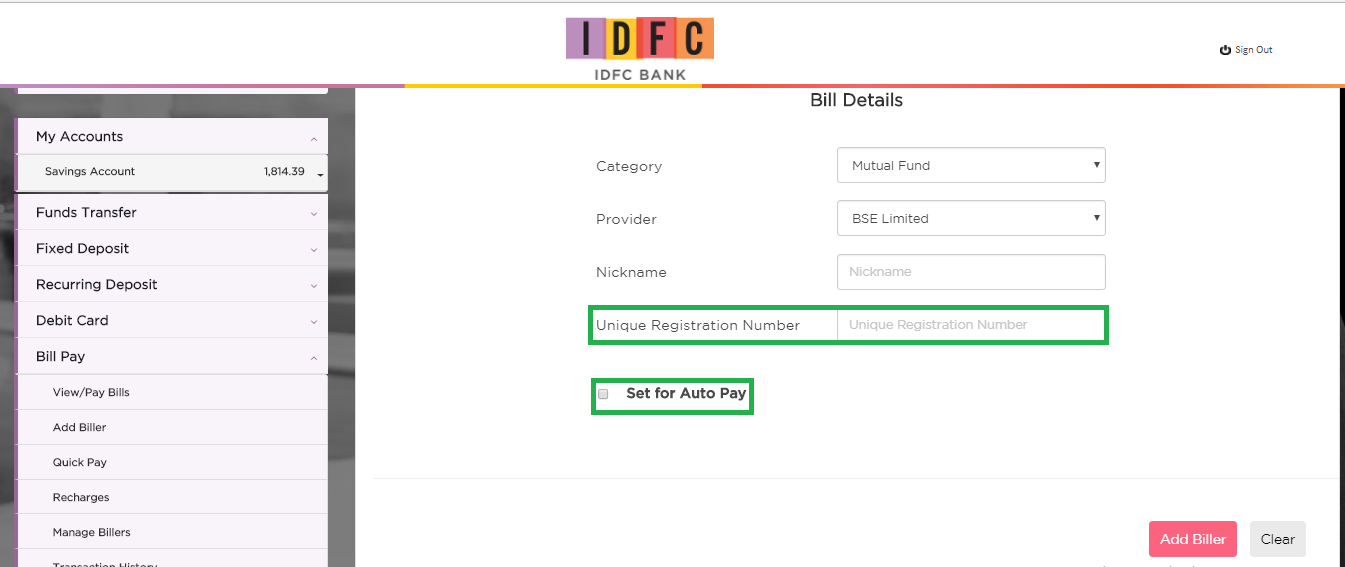

URN درج کریں اور آٹو پے کے لیے سیٹ کو منتخب کریں۔

یہ بلر کے اضافے کے عمل میں ایک اہم قدم ہے۔اس مرحلے میں، لوگوں کو URN نمبر داخل کرنے کی ضرورت ہے تاکہ ان کا آٹو پے آپشن خودکار ہو جائے۔. ایک بار جب آپ کلک کریں۔بلر شامل کریں۔ پچھلے مرحلے میں آپشن، ایک نئی اسکرین کھلتی ہے جہاں آپ کو داخل کرنے کی ضرورت ہے۔بل کی تفصیلات. یہاں، زمرہ کے معاملے میں، آپ کو منتخب کرنے کی ضرورت ہے۔باہمی چندہ. فراہم کنندہ میں، آپ کو اختیار منتخب کرنے کی ضرورت ہے۔بی ایس ای لمیٹڈ. فراہم کنندہ کو منتخب کرنے کے بعد، آپ کو URN نمبر درج کرنے کی ضرورت ہے جو آپ کو اپنے ای میل میں موصول ہوتا ہے یا آپ اس تک رسائی حاصل کر سکتے ہیں۔اپنے فنکاش اکاؤنٹ میں لاگ ان کرنا. URN داخل کرنے کے بعد، آپ کو منتخب کرنے کی ضرورت ہے۔آٹو پے کے لیے سیٹ کریں۔ اختیار اس قدم کی تصویر نیچے دی گئی ہے جہاں منفرد رجسٹریشن نمبر اور سیٹ فار آٹو پے آپشن دونوں کو سبز رنگ میں نمایاں کیا گیا ہے۔

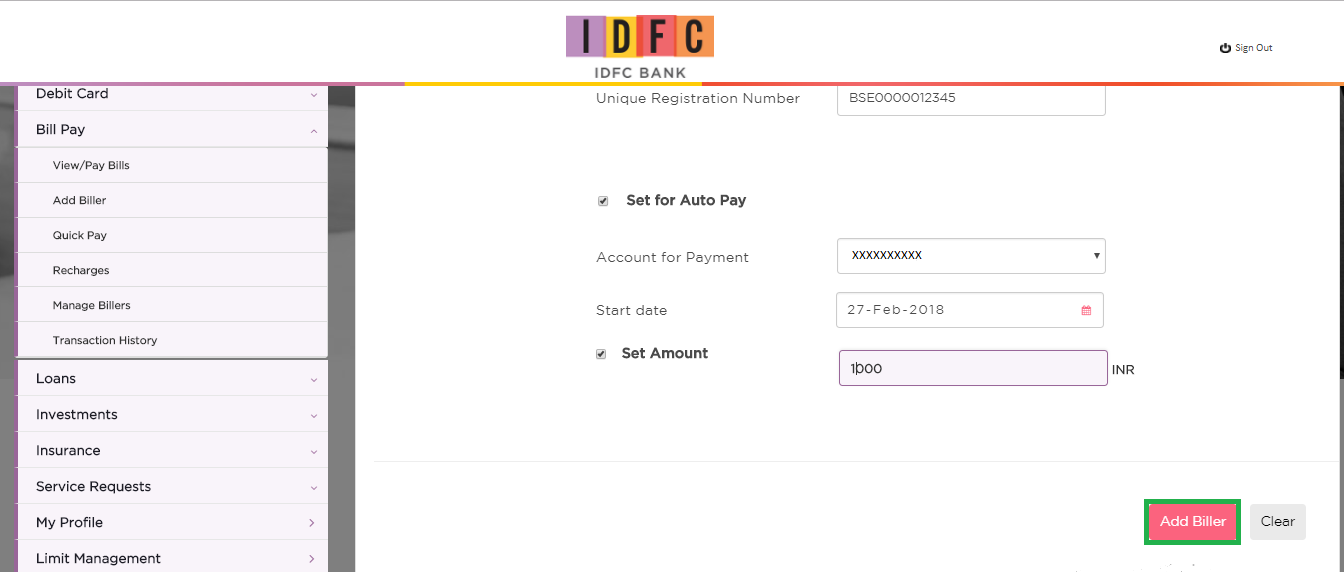

ادائیگی کی تفصیلات درج کریں۔

ایک بار جب آپ منتخب کریں۔آٹو پے کے لیے سیٹ کریں۔ پچھلے مرحلے میں، ایک ڈراپ ڈاؤن کھلتا ہے جس میں آپ کو ادائیگی کی تفصیلات درج کرنے کی ضرورت ہوتی ہے جیسے اکاؤنٹ نمبر جس سے SIP ادائیگی کی جانی ہے، SIP کی شروعات کی تاریخ، اور SIP کی رقم جس کی ضرورت ہے۔ ان تفصیلات کو داخل کرنے کے بعد، آپ کو کلک کرنے کی ضرورت ہے۔بلر شامل کریں۔ اختیار اس قدم کے لیے تصویر نیچے دی گئی ہے جہاں سبز رنگ میں Add Biller کا آپشن منتخب کیا گیا ہے۔

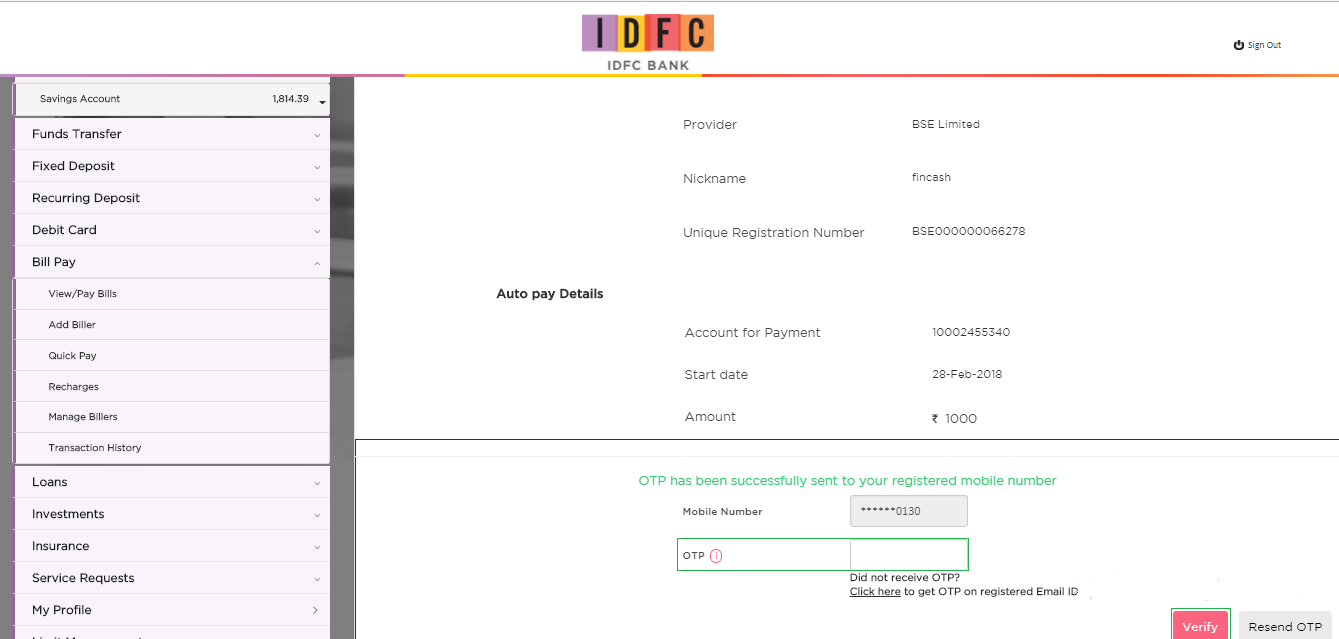

OTP درج کریں۔

ایک بار جب آپ کلک کریں۔بلر شامل کریں۔ پچھلے مرحلے میں، ایک نئی اسکرین کھلتی ہے جہاں آپ اپنے اکاؤنٹ کی تفصیلات دیکھ سکتے ہیں آپ اپنے SIP کا خلاصہ دیکھ سکتے ہیں۔ اس کے ساتھ، آپ یہ بھی دیکھ سکتے ہیں کہ ایک باکس جس میں آپ کو داخل کرنے کے لئے کہا جاتا ہےون ٹائم پاس ورڈ (OTP). یہ OTP نمبر وہ ہے جو آپ کو اپنے موبائل نمبر میں موصول ہوتا ہے۔ ایک بار جب آپ OTP نمبر داخل کرتے ہیں تو آپ کو کلک کرنا ہوگا۔تصدیق کریں۔ بٹن اس قدم کے لیے تصویر نیچے دی گئی ہے جہاں OTP باکس اور Verify بٹن دونوں کو سبز رنگ میں نمایاں کیا گیا ہے۔

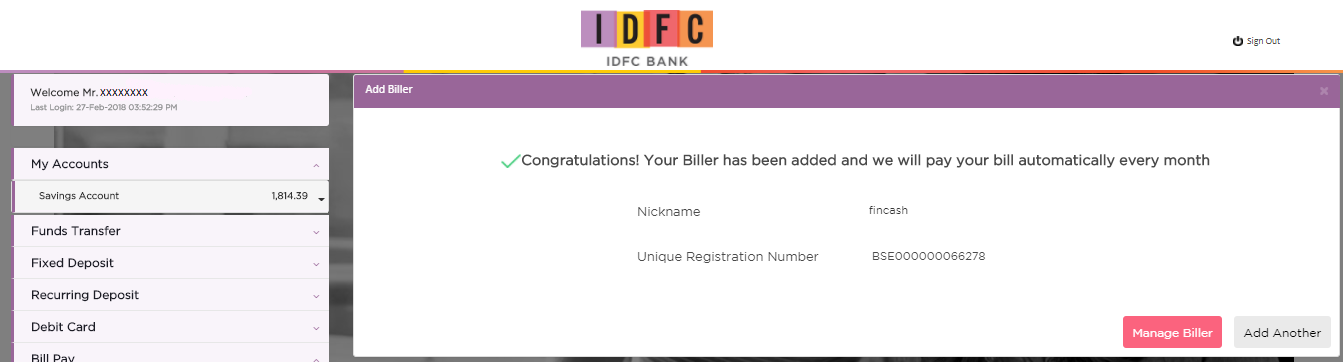

حتمی تصدیق

یہ آخری مرحلہ ہے جہاں آپ حتمی تصدیق حاصل کر سکتے ہیں کہ بلر کو کامیابی کے ساتھ شامل کر دیا گیا ہے۔ ایک بار جب آپ کلک کریں۔تصدیق کریں۔ بلر کو تصدیق شدہ پوسٹ مل جاتی ہے جس پر ایس آئی پی کی ادائیگی خود بخود کٹ جائے گی۔ اس قدم کی تصویر نیچے دی گئی ہے۔

اس طرح مندرجہ بالا اقدامات سے، یہ کہا جا سکتا ہے کہ IDFC بینک میں SIP ٹرانزیکشنز کے لیے بلر شامل کرنا آسان ہے۔

بہتر منافع کمانے کے لیے سرمایہ کاری کے لیے بہترین SIPs

یہاں کے مطابق کچھ تجویز کردہ SIPs ہیں۔5 سال سے زیادہ کی واپسی اور AUMINR 500 کروڑ:

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) DSP World Gold Fund Growth ₹62.6234

↑ 2.23 ₹1,975 500 39.2 84.2 156.2 58.2 29.3 167.1 SBI PSU Fund Growth ₹36.6508

↑ 0.35 ₹5,980 500 7.6 16.8 29.9 34.6 28 11.3 ICICI Prudential Infrastructure Fund Growth ₹197.5

↑ 1.28 ₹8,077 100 -0.5 1.5 15.5 25.3 26.7 6.7 Invesco India PSU Equity Fund Growth ₹68.35

↑ 0.53 ₹1,492 500 2.2 10 28.4 32 26 10.3 Axis Gold Fund Growth ₹44.6398

↑ 0.07 ₹2,835 1,000 25.8 55 74.6 37.7 25.7 69.8 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary DSP World Gold Fund SBI PSU Fund ICICI Prudential Infrastructure Fund Invesco India PSU Equity Fund Axis Gold Fund Point 1 Bottom quartile AUM (₹1,975 Cr). Upper mid AUM (₹5,980 Cr). Highest AUM (₹8,077 Cr). Bottom quartile AUM (₹1,492 Cr). Lower mid AUM (₹2,835 Cr). Point 2 Established history (18+ yrs). Established history (15+ yrs). Oldest track record among peers (20 yrs). Established history (16+ yrs). Established history (14+ yrs). Point 3 Top rated. Rating: 2★ (bottom quartile). Rating: 3★ (upper mid). Rating: 3★ (lower mid). Rating: 1★ (bottom quartile). Point 4 Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: Moderately High. Point 5 5Y return: 29.25% (top quartile). 5Y return: 27.99% (upper mid). 5Y return: 26.69% (lower mid). 5Y return: 26.01% (bottom quartile). 5Y return: 25.66% (bottom quartile). Point 6 3Y return: 58.17% (top quartile). 3Y return: 34.56% (lower mid). 3Y return: 25.34% (bottom quartile). 3Y return: 32.03% (bottom quartile). 3Y return: 37.71% (upper mid). Point 7 1Y return: 156.17% (top quartile). 1Y return: 29.87% (lower mid). 1Y return: 15.50% (bottom quartile). 1Y return: 28.36% (bottom quartile). 1Y return: 74.58% (upper mid). Point 8 Alpha: 2.12 (top quartile). Alpha: 0.05 (upper mid). Alpha: 0.00 (lower mid). Alpha: -2.70 (bottom quartile). 1M return: 1.31% (bottom quartile). Point 9 Sharpe: 3.41 (upper mid). Sharpe: 0.63 (lower mid). Sharpe: 0.15 (bottom quartile). Sharpe: 0.53 (bottom quartile). Alpha: 0.00 (bottom quartile). Point 10 Information ratio: -0.47 (lower mid). Information ratio: -0.63 (bottom quartile). Information ratio: 0.00 (top quartile). Information ratio: -0.50 (bottom quartile). Sharpe: 3.44 (top quartile). DSP World Gold Fund

SBI PSU Fund

ICICI Prudential Infrastructure Fund

Invesco India PSU Equity Fund

Axis Gold Fund

"The primary investment objective of the Scheme is to seek capital appreciation by investing predominantly in units of MLIIF - WGF. The Scheme may, at the discretion of the Investment Manager, also invest in the units of other similar overseas mutual fund schemes, which may constitute a significant part of its corpus. The Scheme may also invest a certain portion of its corpus in money market securities and/or units of money market/liquid schemes of DSP Merrill Lynch Mutual Fund, in order to meet liquidity requirements from time to time. However, there is no assurance that the investment objective of the Scheme will be realized." Below is the key information for DSP World Gold Fund Returns up to 1 year are on The objective of the scheme would be to provide investors with opportunities for long-term growth in capital along with the liquidity of an open-ended scheme through an active management of investments in a diversified basket of equity stocks of domestic Public Sector Undertakings and in debt and money market instruments issued by PSUs AND others. Research Highlights for SBI PSU Fund Below is the key information for SBI PSU Fund Returns up to 1 year are on To generate capital appreciation and income distribution to unit holders by investing predominantly in equity/equity related securities of the companies belonging to the infrastructure development and balance in debt securities and money market instruments. Research Highlights for ICICI Prudential Infrastructure Fund Below is the key information for ICICI Prudential Infrastructure Fund Returns up to 1 year are on To generate capital appreciation by investing in Equity and Equity Related Instruments of companies where the Central / State Government(s) has majority shareholding or management control or has powers to appoint majority of directors. However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved. The Scheme does not assure or guarantee any returns. Research Highlights for Invesco India PSU Equity Fund Below is the key information for Invesco India PSU Equity Fund Returns up to 1 year are on To generate returns that closely correspond to returns generated by Axis Gold ETF. Research Highlights for Axis Gold Fund Below is the key information for Axis Gold Fund Returns up to 1 year are on 1. DSP World Gold Fund

DSP World Gold Fund

Growth Launch Date 14 Sep 07 NAV (18 Feb 26) ₹62.6234 ↑ 2.23 (3.69 %) Net Assets (Cr) ₹1,975 on 31 Jan 26 Category Equity - Global AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆ Risk High Expense Ratio 1.41 Sharpe Ratio 3.41 Information Ratio -0.47 Alpha Ratio 2.12 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹8,807 31 Jan 23 ₹9,422 31 Jan 24 ₹8,517 31 Jan 25 ₹12,548 31 Jan 26 ₹33,170 Returns for DSP World Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 18 Feb 26 Duration Returns 1 Month 6.2% 3 Month 39.2% 6 Month 84.2% 1 Year 156.2% 3 Year 58.2% 5 Year 29.3% 10 Year 15 Year Since launch 10.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 167.1% 2023 15.9% 2022 7% 2021 -7.7% 2020 -9% 2019 31.4% 2018 35.1% 2017 -10.7% 2016 -4% 2015 52.7% Fund Manager information for DSP World Gold Fund

Name Since Tenure Jay Kothari 1 Mar 13 12.93 Yr. Data below for DSP World Gold Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Basic Materials 95.89% Asset Allocation

Asset Class Value Cash 1.55% Equity 95.89% Debt 0.01% Other 2.56% Top Securities Holdings / Portfolio

Name Holding Value Quantity BGF World Gold I2

Investment Fund | -74% ₹1,458 Cr 1,177,658

↓ -41,596 VanEck Gold Miners ETF

- | GDX25% ₹497 Cr 573,719 Treps / Reverse Repo Investments

CBLO/Reverse Repo | -2% ₹35 Cr Net Receivables/Payables

Net Current Assets | -1% -₹15 Cr 2. SBI PSU Fund

SBI PSU Fund

Growth Launch Date 7 Jul 10 NAV (20 Feb 26) ₹36.6508 ↑ 0.35 (0.98 %) Net Assets (Cr) ₹5,980 on 31 Jan 26 Category Equity - Sectoral AMC SBI Funds Management Private Limited Rating ☆☆ Risk High Expense Ratio 1.89 Sharpe Ratio 0.63 Information Ratio -0.63 Alpha Ratio 0.05 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹14,656 31 Jan 23 ₹17,067 31 Jan 24 ₹30,032 31 Jan 25 ₹32,242 31 Jan 26 ₹38,028 Returns for SBI PSU Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 18 Feb 26 Duration Returns 1 Month 9.1% 3 Month 7.6% 6 Month 16.8% 1 Year 29.9% 3 Year 34.6% 5 Year 28% 10 Year 15 Year Since launch 8.7% Historical performance (Yearly) on absolute basis

Year Returns 2024 11.3% 2023 23.5% 2022 54% 2021 29% 2020 32.4% 2019 -10% 2018 6% 2017 -23.8% 2016 21.9% 2015 16.2% Fund Manager information for SBI PSU Fund

Name Since Tenure Rohit Shimpi 1 Jun 24 1.67 Yr. Data below for SBI PSU Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Financial Services 34.09% Utility 29.59% Energy 13.91% Industrials 12.42% Basic Materials 7.01% Asset Allocation

Asset Class Value Cash 2.9% Equity 97.02% Debt 0.08% Top Securities Holdings / Portfolio

Name Holding Value Quantity State Bank of India (Financial Services)

Equity, Since 31 Jul 10 | SBIN18% ₹1,069 Cr 9,927,500 Bharat Electronics Ltd (Industrials)

Equity, Since 30 Jun 24 | BEL10% ₹583 Cr 12,975,000 NTPC Ltd (Utilities)

Equity, Since 31 Jul 10 | NTPC9% ₹550 Cr 15,443,244 Power Grid Corp Of India Ltd (Utilities)

Equity, Since 31 Jul 10 | POWERGRID9% ₹511 Cr 19,935,554

↑ 2,300,000 GAIL (India) Ltd (Utilities)

Equity, Since 31 May 24 | GAIL8% ₹488 Cr 29,150,000 Bharat Petroleum Corp Ltd (Energy)

Equity, Since 31 Aug 24 | BPCL6% ₹354 Cr 9,700,000 Bank of Baroda (Financial Services)

Equity, Since 31 Aug 24 | BANKBARODA6% ₹329 Cr 11,000,000 NMDC Ltd (Basic Materials)

Equity, Since 31 Oct 23 | NMDC4% ₹227 Cr 27,900,000 Indian Bank (Financial Services)

Equity, Since 30 Jun 21 | INDIANB4% ₹221 Cr 2,427,235 Oil India Ltd (Energy)

Equity, Since 31 Mar 24 | OIL3% ₹196 Cr 3,850,000 3. ICICI Prudential Infrastructure Fund

ICICI Prudential Infrastructure Fund

Growth Launch Date 31 Aug 05 NAV (20 Feb 26) ₹197.5 ↑ 1.28 (0.65 %) Net Assets (Cr) ₹8,077 on 31 Jan 26 Category Equity - Sectoral AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆ Risk High Expense Ratio 1.89 Sharpe Ratio 0.15 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹16,042 31 Jan 23 ₹19,152 31 Jan 24 ₹29,825 31 Jan 25 ₹34,393 31 Jan 26 ₹36,891 Returns for ICICI Prudential Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 18 Feb 26 Duration Returns 1 Month 4.9% 3 Month -0.5% 6 Month 1.5% 1 Year 15.5% 3 Year 25.3% 5 Year 26.7% 10 Year 15 Year Since launch 15.7% Historical performance (Yearly) on absolute basis

Year Returns 2024 6.7% 2023 27.4% 2022 44.6% 2021 28.8% 2020 50.1% 2019 3.6% 2018 2.6% 2017 -14% 2016 40.8% 2015 2% Fund Manager information for ICICI Prudential Infrastructure Fund

Name Since Tenure Ihab Dalwai 3 Jun 17 8.67 Yr. Sharmila D’mello 30 Jun 22 3.59 Yr. Data below for ICICI Prudential Infrastructure Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Industrials 48.97% Financial Services 12.33% Utility 9.63% Basic Materials 9.49% Real Estate 6.53% Energy 6% Consumer Cyclical 2.03% Communication Services 0.11% Asset Allocation

Asset Class Value Cash 4.63% Equity 95.37% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 09 | LT9% ₹690 Cr 1,755,704 InterGlobe Aviation Ltd (Industrials)

Equity, Since 28 Feb 23 | INDIGO8% ₹640 Cr 1,391,449

↑ 275,091 NTPC Ltd (Utilities)

Equity, Since 29 Feb 16 | NTPC4% ₹332 Cr 9,326,448

↓ -1,050,000 Oberoi Realty Ltd (Real Estate)

Equity, Since 31 May 23 | OBEROIRLTY3% ₹253 Cr 1,696,181

↑ 637,668 Adani Ports & Special Economic Zone Ltd (Industrials)

Equity, Since 31 May 24 | ADANIPORTS3% ₹241 Cr 1,700,000 AIA Engineering Ltd (Industrials)

Equity, Since 28 Feb 21 | AIAENG3% ₹229 Cr 574,561

↓ -37,559 Kalpataru Projects International Ltd (Industrials)

Equity, Since 30 Sep 06 | KPIL3% ₹221 Cr 1,931,967

↑ 20,847 IndusInd Bank Ltd (Financial Services)

Equity, Since 31 Oct 24 | INDUSINDBK3% ₹217 Cr 2,424,016 Reliance Industries Ltd (Energy)

Equity, Since 31 Jul 23 | RELIANCE3% ₹213 Cr 1,529,725 Axis Bank Ltd (Financial Services)

Equity, Since 31 Dec 20 | AXISBANK3% ₹209 Cr 1,527,307

↓ -156,250 4. Invesco India PSU Equity Fund

Invesco India PSU Equity Fund

Growth Launch Date 18 Nov 09 NAV (20 Feb 26) ₹68.35 ↑ 0.53 (0.78 %) Net Assets (Cr) ₹1,492 on 31 Jan 26 Category Equity - Sectoral AMC Invesco Asset Management (India) Private Ltd Rating ☆☆☆ Risk High Expense Ratio 2.14 Sharpe Ratio 0.53 Information Ratio -0.5 Alpha Ratio -2.7 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹13,872 31 Jan 23 ₹15,622 31 Jan 24 ₹26,577 31 Jan 25 ₹29,948 31 Jan 26 ₹35,297 Returns for Invesco India PSU Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 18 Feb 26 Duration Returns 1 Month 4.3% 3 Month 2.2% 6 Month 10% 1 Year 28.4% 3 Year 32% 5 Year 26% 10 Year 15 Year Since launch 12.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 10.3% 2023 25.6% 2022 54.5% 2021 20.5% 2020 31.1% 2019 6.1% 2018 10.1% 2017 -16.9% 2016 24.3% 2015 17.9% Fund Manager information for Invesco India PSU Equity Fund

Name Since Tenure Hiten Jain 1 Jul 25 0.59 Yr. Sagar Gandhi 1 Jul 25 0.59 Yr. Data below for Invesco India PSU Equity Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Industrials 31.92% Financial Services 29.89% Utility 18.15% Energy 12.64% Basic Materials 4.19% Consumer Cyclical 1.08% Asset Allocation

Asset Class Value Cash 2.14% Equity 97.86% Top Securities Holdings / Portfolio

Name Holding Value Quantity State Bank of India (Financial Services)

Equity, Since 28 Feb 21 | SBIN9% ₹139 Cr 1,294,989

↓ -92,628 Bharat Electronics Ltd (Industrials)

Equity, Since 31 Mar 17 | BEL9% ₹135 Cr 2,997,692 Indian Bank (Financial Services)

Equity, Since 30 Jun 21 | INDIANB7% ₹106 Cr 1,157,444 Bharat Petroleum Corp Ltd (Energy)

Equity, Since 30 Sep 18 | BPCL7% ₹99 Cr 2,717,009 Hindustan Aeronautics Ltd Ordinary Shares (Industrials)

Equity, Since 31 May 22 | HAL6% ₹87 Cr 187,643

↓ -8,515 NTPC Green Energy Ltd (Utilities)

Equity, Since 30 Nov 24 | NTPCGREEN5% ₹79 Cr 9,129,820 Dredging Corp of India Ltd (Industrials)

Equity, Since 31 Jul 25 | DREDGECORP5% ₹73 Cr 646,300 Bharat Dynamics Ltd Ordinary Shares (Industrials)

Equity, Since 31 May 22 | BDL5% ₹69 Cr 445,685 Bank of Baroda (Financial Services)

Equity, Since 30 Jun 21 | BANKBARODA5% ₹67 Cr 2,244,222 NTPC Ltd (Utilities)

Equity, Since 31 May 19 | NTPC4% ₹64 Cr 1,801,543 5. Axis Gold Fund

Axis Gold Fund

Growth Launch Date 20 Oct 11 NAV (20 Feb 26) ₹44.6398 ↑ 0.07 (0.15 %) Net Assets (Cr) ₹2,835 on 31 Jan 26 Category Gold - Gold AMC Axis Asset Management Company Limited Rating ☆ Risk Moderately High Expense Ratio 0.5 Sharpe Ratio 3.44 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹9,659 31 Jan 23 ₹11,397 31 Jan 24 ₹12,487 31 Jan 25 ₹16,126 31 Jan 26 ₹29,924 Returns for Axis Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 18 Feb 26 Duration Returns 1 Month 1.3% 3 Month 25.8% 6 Month 55% 1 Year 74.6% 3 Year 37.7% 5 Year 25.7% 10 Year 15 Year Since launch 11% Historical performance (Yearly) on absolute basis

Year Returns 2024 69.8% 2023 19.2% 2022 14.7% 2021 12.5% 2020 -4.7% 2019 26.9% 2018 23.1% 2017 8.3% 2016 0.7% 2015 10.7% Fund Manager information for Axis Gold Fund

Name Since Tenure Aditya Pagaria 9 Nov 21 4.23 Yr. Pratik Tibrewal 1 Feb 25 1 Yr. Data below for Axis Gold Fund as on 31 Jan 26

Asset Allocation

Asset Class Value Cash 2.53% Other 97.47% Top Securities Holdings / Portfolio

Name Holding Value Quantity Axis Gold ETF

- | -99% ₹2,810 Cr 215,661,784

↑ 19,832,646 Clearing Corporation Of India Ltd

CBLO/Reverse Repo | -1% ₹35 Cr Net Receivables / (Payables)

CBLO | -0% -₹9 Cr

مزید کسی بھی سوال کی صورت میں، آپ ہم سے 8451864111 پر کسی بھی کام کے دن صبح 9.30 بجے سے شام 6.30 بجے کے درمیان رابطہ کر سکتے ہیں یا ہمیں کسی بھی وقت ای میل لکھ سکتے ہیں۔support@fincash.com یا ہماری ویب سائٹ پر لاگ ان کرکے ہمارے ساتھ بات چیت کریں۔www.fincash.com.

یہاں فراہم کردہ معلومات کے درست ہونے کو یقینی بنانے کے لیے تمام کوششیں کی گئی ہیں۔ تاہم، ڈیٹا کی درستگی کے حوالے سے کوئی ضمانت نہیں دی جاتی ہے۔ براہ کرم کوئی بھی سرمایہ کاری کرنے سے پہلے اسکیم کی معلومات کے دستاویز کے ساتھ تصدیق کریں۔

Research Highlights for DSP World Gold Fund