Japanese Government Bond (JGB)

What is Japanese Government Bond?

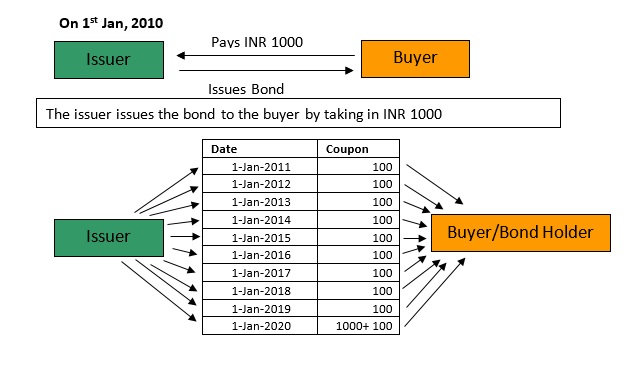

As per the Japanese Government Bond (JGB) meaning, it is known to refer to a proper bond that gets issued by the government of Japan. The government is also responsible for paying interest on the given bond until the time of maturity date. At the time of the maturity date, the bond’s full price gets returned to the holders of the bond. The Bonds of the Japanese government are known to play a vital role in the Market of financial securities in Japan.

Here are some important points to note down:

The JGBs or Japanese Government Bonds are referred to as bonds that are issued by the government in Japan. JGBs have become a major part of the central Bank effort of the country with respect to boosting Inflation.

There are three variants of JGBs –including fiscal investment, general bonds, and loan program bonds, and subsidy loans.

JGBs tend to be similar to the Treasuries of the United States of America in the fact that these are backed by the federal government and tend to be low-risk.

Getting an Understanding of JGB

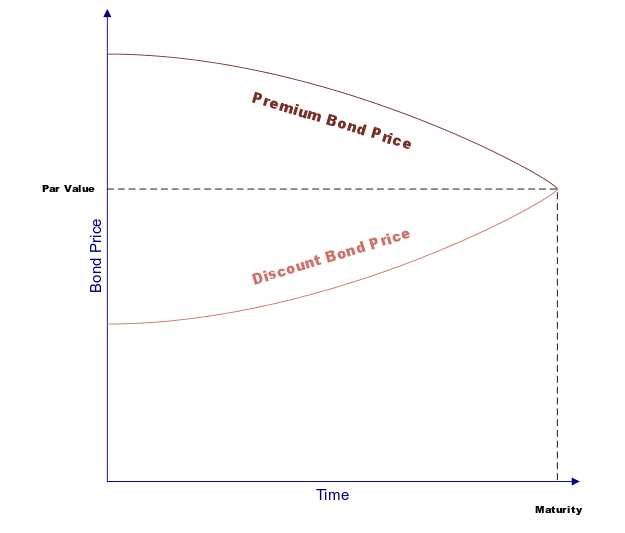

JGBs or Japanese Government Bonds tend to feature multiple maturities that typically Range from the period of six months to as many as 40 years. In the context of the short-term bonds, these feature maturity dates of less than one year that are issued at some discount while being structured in the form of zero-coupon bonds. However, at the time of maturity, the bond’s value can be redeemed at the full Face Value. The medium to long-term bonds tend to feature fixed coupon payments. These are determined during the issuance time while being paid on the semi-annual Basis until the maturity of security.

There are three variants of JGBs or Japanese Government Bonds. These are:

- Subsidy bonds

- General bonds like the construction bonds & debt financing bonds

- Flip or Fiscal Investment & Loan Program bonds that can be used for raising the funds for investment of the Fiscal Loan Fund

Talk to our investment specialist

Special Considerations

A decline occurring in the liquidity of the JGB market is observed in recent years because of the aggressive monetary actions implemented by the central bank –the BoJ or the Bank of Japan. Since the time of 2013, the bug has raised billions of amount of JGBs or Japanese Government Bonds. This has flooded the Economy with cash towards propelling the low inflation rates annually in the country towards the respective 2 per cent target. This is achieved by keeping the long-term interest rates to around zero percent. For maintaining the overall yield on the JGBs to zero for a period of 10 years, a rise in the overall yields of the respective bonds would trigger a buying action from the Bank of Japan.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.