Difference Between Flexi-Cap and Hybrid Fund

Investors in Mutual Funds can be divided into three types, such as:

- One group is individuals willing to take a risk and invest in Equity Funds

- Those who want to be safe by Investing in debt funds provide some returns while keeping their money safe

- The ones who wish to get the best of both worlds by investing in hybrid funds

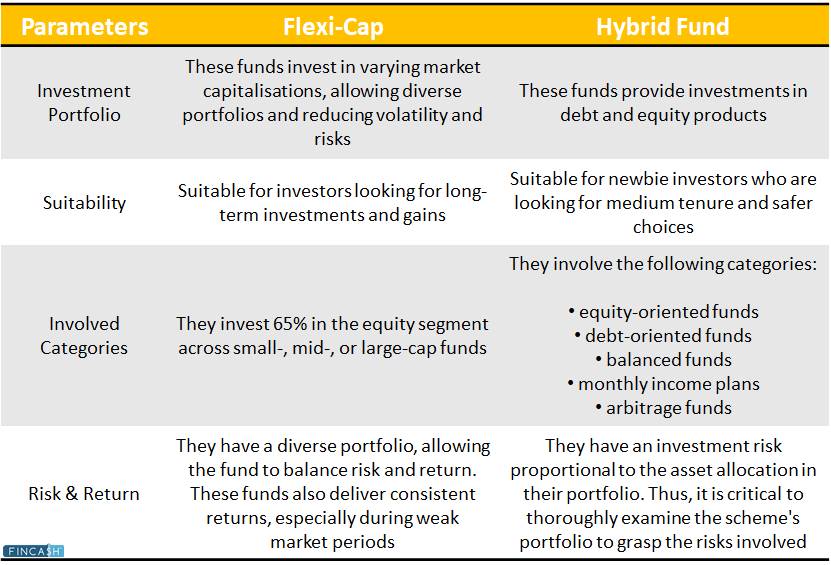

Within the equity category, there are various sub-categories of mutual funds. Two of them are multi-cap and hybrid funds. While these fund types invest in companies with varying market capitalisations, their methods differ.

This article contains a brief guide on flexi-cap funds vs hybrid funds and which one is the best suited as per the varying needs.

What are Flexi-Cap Funds?

Flexi-cap funds invest in companies with a range of market capitalisations, such as large-, mid- and small-cap equities. Unlike multi-cap and Small cap funds, which invest in equities depending on their market capitalisation, flexi-cap funds allow investors to diversify their portfolios by investing in firms with varying market capitalisations, reducing risk and Volatility.

The fund manager is responsible for evaluating the growth potential of various businesses, regardless of their size. The manager then allocates funds to numerous market segments and businesses.

Returns of Flexi-Cap Funds

The returns for the top 5 flexi-cap funds are as follows:

| Fund Name | 1-Year | 3-Years | 5-Years | AUM | Returns Since Inception | Minimum Investment |

|---|---|---|---|---|---|---|

| Quant Flexi-Cap Direct-Growth | 47.16% | 33.16% | 20.82% | Rs. 198.02 crores | 20.08% | Rs. 63.14 |

| HDFC Flexi-Cap Direct-Growth | 34.87% | 16.28% | 14.60% | Rs. 27496.23 crores | 15.52% | Rs. 5000 |

| IDBI Flexi-Cap FD Direct-Growth | 32.20% | 20.11% | 14.94% | Rs. 389.41 crores | 18.43% | Rs. 5000 |

| PGIM India Flexi-Cap Direct-Growth | 30.17% | 27.78% | 19.19% | Rs. 4082.87 crores | 16.33% | Rs. 1000 |

| Franklin India Flexi-Cap Direct-Growth | 29.50% | 18.05% | 14.19% | Rs. 9,729.93 crores | 16.7% | Rs. 5000 |

Benefits of Investing in Flexi-Cap

Here are some key benefits of the fund:

- Fund managers are free to invest across the market capitalisation spectrum

- A well-diversified equity strategy with a 'go-anywhere' attitude is offered

- You get the ability to capitalise on opportunities across the market spectrum - regardless of market capitalisation, sector, or style

- It aims to take advantage of investing possibilities across the board

- Due to a diverse Portfolio, it effectively balances risk and reward

Talk to our investment specialist

Who Should Consider Investing in Flexi-Cap MF?

It is a good option for investors searching for long-term financial gains, dividends, or both. It primarily invests in a wide portfolio of actively managed equities and other related assets, such as derivatives.

This product is appropriate for investors seeking a Large cap fund with a small-cap and mid-cap equity allocation. You can probably invest in this category if you have a 5-year time horizon.

However, you should consult with financial advisors if you have any doubts about whether the item is right for you.

What are Hybrid Funds?

Hybrid funds invest in equity and debt products to achieve diversification and prevent concentration risk. A proper mix of the two (equity and debt products) provides better returns than a traditional debt fund while avoiding the risks of equity funds.

Your risk tolerance and investing objective determine the type of Hybrid Fund you should choose. Hybrid funds use a balanced portfolio to produce long-term wealth growth while generating short-term income.

The fund manager divides your money between equities and debt in variable quantities based on the fund's investment objective. To profit from market fluctuations, the fund manager may buy or sell securities.

How do Hybrid Funds Work?

Hybrid funds may invest in more than one asset type depending on the scheme's investment objective. They invest in various asset classes, including stock, debt, gold-related products, cash, and others.

Asset Allocation is based on the investment objective and market conditions to achieve optimal risk-adjusted returns.

How to Pick Good Hybrid Funds?

The performance since inception, fund management team, average returns, risk exposure, expense ratio are some of the basic factors to look while picking a good fund. The best performing hybrid funds have regularly ranked in the top 25% of their peer group throughout time.

However, it is critical to recognise the risk they have taken to attain those results. It's also vital to look at the debut date to understand how long the company has been around and how efficiently it has performed over time.

In addition, the best hybrid funds have a manageable corpus size. It should not be too little to receive insufficient attention, nor too large to be difficult to manage.

Fund Selection Methodology used to find 5 funds

Top Performing Hybrid Funds for Investment

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) ICICI Prudential Equity and Debt Fund Growth ₹409.05

↑ 1.60 ₹49,257 -0.7 2.9 14.5 19.1 19.1 13.3 BOI AXA Mid and Small Cap Equity and Debt Fund Growth ₹38.23

↑ 0.10 ₹1,329 -0.3 0.6 12.6 18.6 18.5 -0.9 JM Equity Hybrid Fund Growth ₹117.781

↑ 0.37 ₹753 -3.6 -2 4.8 17.3 15 -3.1 Bandhan Hybrid Equity Fund Growth ₹26.995

↑ 0.06 ₹1,632 -0.3 3 17 16.4 13.7 7.7 UTI Hybrid Equity Fund Growth ₹413.808

↑ 0.36 ₹6,654 -0.6 2.6 10 16.3 14.8 6.4 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 20 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary ICICI Prudential Equity and Debt Fund BOI AXA Mid and Small Cap Equity and Debt Fund JM Equity Hybrid Fund Bandhan Hybrid Equity Fund UTI Hybrid Equity Fund Point 1 Highest AUM (₹49,257 Cr). Bottom quartile AUM (₹1,329 Cr). Bottom quartile AUM (₹753 Cr). Lower mid AUM (₹1,632 Cr). Upper mid AUM (₹6,654 Cr). Point 2 Established history (26+ yrs). Established history (9+ yrs). Established history (30+ yrs). Established history (9+ yrs). Oldest track record among peers (31 yrs). Point 3 Top rated. Not Rated. Rating: 1★ (lower mid). Not Rated. Rating: 3★ (upper mid). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 19.12% (top quartile). 5Y return: 18.47% (upper mid). 5Y return: 14.99% (lower mid). 5Y return: 13.71% (bottom quartile). 5Y return: 14.80% (bottom quartile). Point 6 3Y return: 19.10% (top quartile). 3Y return: 18.59% (upper mid). 3Y return: 17.32% (lower mid). 3Y return: 16.37% (bottom quartile). 3Y return: 16.34% (bottom quartile). Point 7 1Y return: 14.53% (upper mid). 1Y return: 12.64% (lower mid). 1Y return: 4.81% (bottom quartile). 1Y return: 17.00% (top quartile). 1Y return: 9.96% (bottom quartile). Point 8 1M return: 2.19% (lower mid). 1M return: 3.86% (top quartile). 1M return: 0.84% (bottom quartile). 1M return: 2.86% (upper mid). 1M return: 1.23% (bottom quartile). Point 9 Alpha: 3.54 (upper mid). Alpha: 0.00 (lower mid). Alpha: -6.31 (bottom quartile). Alpha: 4.01 (top quartile). Alpha: -0.75 (bottom quartile). Point 10 Sharpe: 0.62 (top quartile). Sharpe: 0.08 (bottom quartile). Sharpe: -0.36 (bottom quartile). Sharpe: 0.57 (upper mid). Sharpe: 0.15 (lower mid). ICICI Prudential Equity and Debt Fund

BOI AXA Mid and Small Cap Equity and Debt Fund

JM Equity Hybrid Fund

Bandhan Hybrid Equity Fund

UTI Hybrid Equity Fund

Assets > 500 Crore & Sorted on 3 Year CAGR Returns.

Flexi Cap Vs Hybrid Funds - What Should I Pick?

In comparison to equity funds, hybrid funds are thought to be a safer investment. These are more popular amongst conservative investors since they offer larger returns than true debt funds.

Hybrid funds are an ideal option for new investors who want to get a taste of the stock market. The inclusion of equity components in the portfolio increases the likelihood of better returns.

Simultaneously, the fund's debt component protects it from excessive market changes. As a result, you get consistent returns rather than the absolute burnout with pure equities funds. The feature of the dynamic asset allocation of a few of the hybrid funds provides a terrific method for less conservative investors to get the most out of market volatility.

Both types of funding are suitable for the stated purpose. Both groups, however, are relevant to two distinct types of investors. Assume you've been investing in equity funds for the past 3-4 years and have faced the market's fluctuations without panicking, or you were unconcerned when the market dropped by 30-40% in a matter of weeks in March of last year. In such a case, it is better for you to invest in an aggressive fund category like equity funds. Else, the other option is a better choice.

Conclusion

If you can withstand the market volatility and stay invested for a longer duration, then you will be able to achieve bigger returns than other categories. However, many investors find it difficult to do so. Such investors should not even consider an equities category. Even if you want to start with risky funds, make sure you start with a low amount and diversify your portfolio with at least two different funds. A mix of both equity and debt would be better.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

like the comparisons made