Meaning of Enterprise Value (EV)

The total value of a corporation is measured by its enterprise value (EV). It considers the whole Market worth, not just the equity value. Therefore it takes into account all ownership rights and asset claims from both equity and debt. The effective price of purchasing a firm or the theoretical price of a target company can be conceived of as EV (before considering a takeover premium).

Enterprise Value Formula

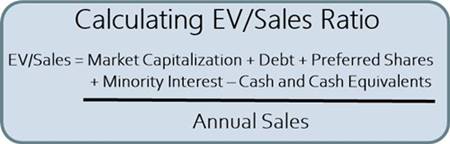

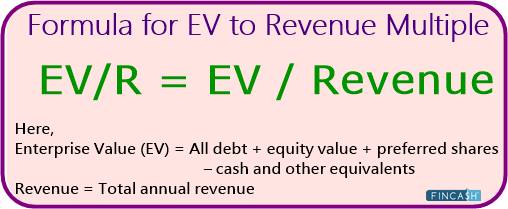

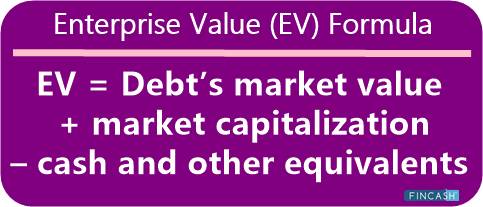

The following is a simple formula for calculating EV:

EV = Debt’s market value + market capitalization – cash and other equivalents

Here is another formula for EV calculation:

EV = Debt’s market value + preferred shares + common shares + minority interest – cash and other equivalents

The assets that the company holds can be used to calculate its value. Obtaining each asset's market value, on the other hand, can be time-consuming and complicated. Instead, we could investigate how the assets were purchased.

The simple accounting equation serves as a guide by looking at assets as the application of funds, the liabilities, and the shareholder's equity as the sources of funds utilized to finance those assets. When we say value, we refer to the company's present or market value, which includes the market value of liabilities and the equity.

Elements of EV

1. Equity Value

A corporation's equity value is calculated by multiplying the number of fully diluted shares outstanding by the stock's current market price, aside from the basic shares outstanding, fully diluted, meaning that it includes in-the-money options, warrants, and convertible securities.

If a firm wants to buy another company, it must pay at least the market capitalization value to the shareholders of that company. As seen in the EV equation, other items are added because this alone is not an accurate indicator of a company's actual value.

2. Debt Total

The contribution of other creditors to the Bank is called total debt. They are interest-bearing obligations that include both short- and long-term debt. Because, in theory, when a firm is bought, the acquirer might use the target company's cash to settle a portion of the assumed debt, the amount of debt is modified by deducting money from it. The debt's Book Value can be used instead of the market value of debt if the debt's market value is unclear.

3. Stock with Preferred Status

Preferred stocks refer to a type of hybrid security that has both equity and debt characteristics. Because they pay a predetermined amount of dividends and prioritize asset and earning claims more than common stock, they are viewed more like debt in this scenario. They usually have to be repaid in the same way that debt is.

Talk to our investment specialist

4. Non-commanding (Minority) Interest

The portion of a subsidiary not held by the parent business is known as a non-controlling interest. The financial statements of this subsidiary are combined into the Parent Company's financial results.

We include this minority investment in the EV calculation because the parent company has consolidated financial statements with that minority interest. The parent firm comprises 100% of the revenues, expenses, and cash flow in its statistics despite not owning 100% of the company. The subsidiary's total value is reflected in EV by including the minority investment.

5. Money and its Equivalents

In a company's financial statement, this is the most Liquid asset. Short-term investments, Commercial Paper, marketable securities, and Money market funds are examples of Cash Equivalents. We deduct this amount from EV since it lowers the target company's acquisition expenses. The acquirer is expected to utilize the cash to pay off a portion of the potential purchase price right away. It would be used to pay a dividend or buy back debt right away.

What is the Purpose of Enterprise Value?

For comparable analysis such as trading comps, Enterprise Value is frequently utilized for multiples such as EV/EBITDA, EV/EBIT, EV/FCF, or EV/Sales. Other formulae, such as the P/E ratio, typically do not account for cash and debt the way EV does. As a result, two similar companies with the same market capitalization could have different enterprise values.

Enterprise Value is precious in Mergers and Acquisitions, particularly when controlling ownership interests are involved. It's also beneficial for comparing organizations with different Capital structures because the amount of enterprise value is affected by Capital Structure changes.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.