How to Select Best Life Insurance Policy?

Choosing best Life Insurance policy for yourself can be a daunting task. With so many Term Insurance or Whole Life Insurance plans in the market, it becomes confusing to choose the best life insurance policy. Different life Insurance companies provide variable life insurance quotes which can add to the existing confusion. Choosing the best life insurance plan has to be through a systematic and focused approach. Let's have a further look into this to see how one can get the best life insurance policy.

How to Select Best Life Insurance Policy

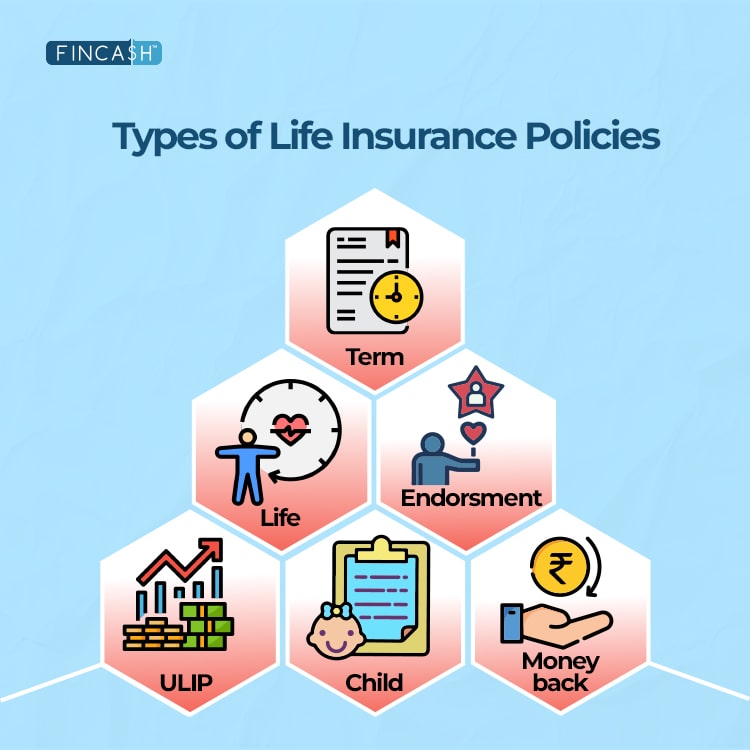

Let’s start the process of choosing the best life insurance plan by deciding what kind of insurance you are looking for? Are you looking for a term insurance or a whole life insurance? Because finding the best life insurance plan is not just about getting a cheap life insurance. For eg. If you are in your mid-50s, you may need insurance for a short time. On the other hand, if you are in your late 20s or early 30s, you might want to opt for whole life cover.

Once you finalise on your needs, you need to consider the cost of insurance based on certain factors like family medical history, tobacco consumption, personal health condition, etc. Insurers look at these risks and calculate the premium for your life cover.

The only thing you need to learn by looking at people’s insurance covers is that you need one and not what cover others have got for themselves. Insurance plans are different for different individuals and you should not try to copy others without doing a proper research on your needs or requirements.

Compare Life Insurance Quotes

Now that you are fully clear on what you want, next thing is to go online and compare life insurance quotes. Best life insurance companies have their best plans on their portals and you need to compare life insurance plans so as to understand which suits you the best. Also, you need to ponder over the following questions and make the decision:

- Do your premiums and benefits vary every year?

- How much cash value that you can accumulate?

- Does the policy have dividends?

In case you are comparing a policy with your current one, does this new insurance policy give you better risk-cover and life cover that your existing one?

Online Insurance: Better Option to Buy Best Life Insurance Policy

While choosing from term life insurance quotes or other insurance plans, buying insurance online would make a big difference to your purchase. Buying insurance policy online is advantageous and economical as well. There are no intermediaries involved and you can make an unbiased decision.

Count the Effect of Inflation

You need to consider the effect of inflation on your life cover. If you have a cover of 60 lakhs, it may not be enough for you after 10 years. Why? Well, even if we consider the inflation of just 5%, the value of 60 lakhs over the decade turns out to be 38 lakhs. To tackle this, some insurance companies offer policies where the covering amount hikes by 5-10% each year. This hike in the sum assured helps you to take care of the increase in the income and tackle the inflation as well.

Talk to our investment specialist

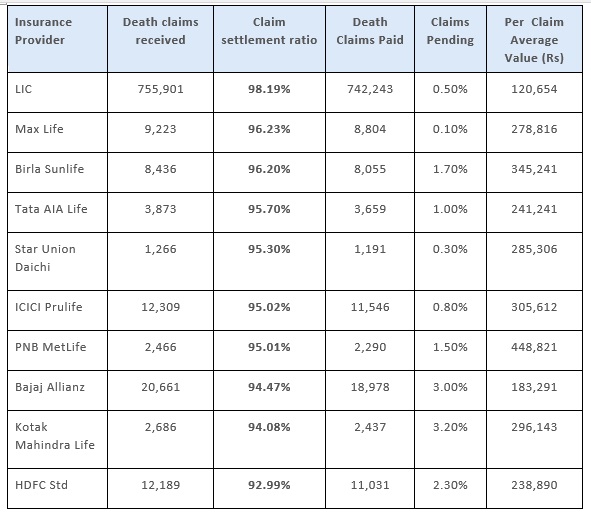

Claim Settlement Ratio of the Insurance Companies

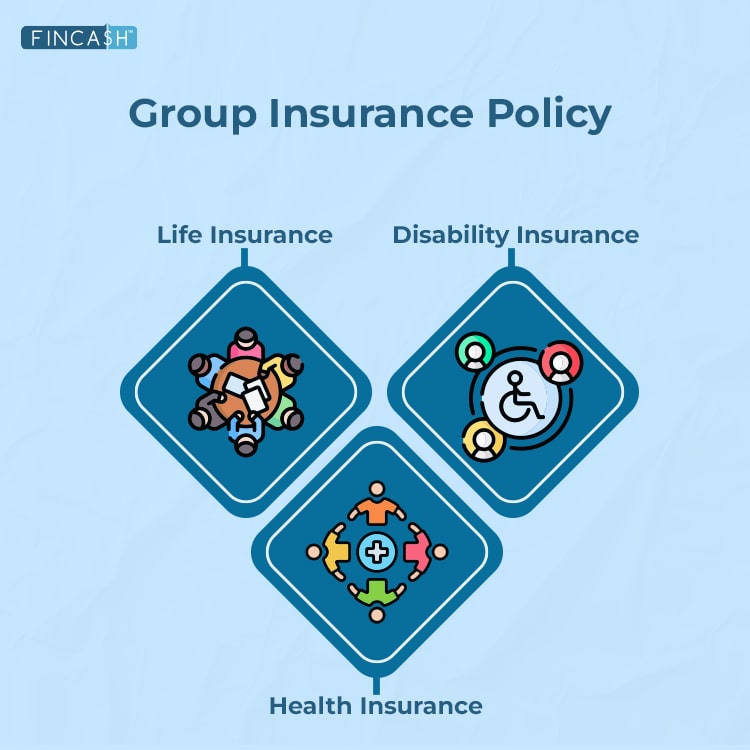

It is extremely important to have a good knowledge about the claim settlement ratio of the insurance company you are interested in buying the insurance policy from. Claim settlement ratio is the number of policies successfully settled by paying back the claims in case of death. The top 10 life insurance companies have a claim settlement ratio of over 90% and thus have the best life insurance plans in the business. Also, it is important for the client to be very transparent while disclosing their information to the insurer. This minimises the chances of claim rejection.

Conclusion

To sum up, in order to buy the best insurance policy:

- Get multiple insurance quotes and compare different insurance policies to get a good perspective on finding the best life insurance plan.

- Stay away from the organisation or agent who will not provide clear and precise knowledge about the life cover you are looking for.

- You are the client and you should be aware of what you are buying what are your needs.

- Do not try to copy insurance cover of others.

- Consider factors such as inflation before buying.

- Consider the claim settlement ratio of the insurance company before buying insurance from them.

- Disclose all the necessary information to the insurer to minimise the possibility of claim rejection.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.