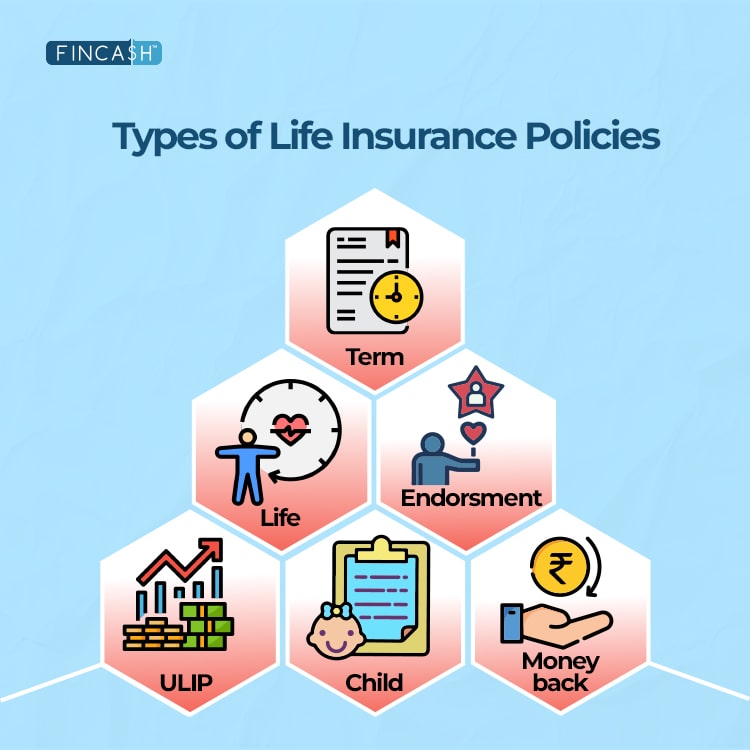

Types of Life Insurance Policies

A Life Insurance policy provides you with a financial cover and sense of assurance to you and your family during the time of crisis. Each life insurance type has its own specific type of cover along with other benefits.

These life insurance plans cover your basic financial needs and assets. We will look into each of the types of life insurance policies in detail.

Types of Life Insurance Policies

1. Term Insurance

Term Insurance is one of the most basic types of life insurance policies. In term plan, the policyholder gets a life cover for a specified period of time and they pay the premium for the same. In case of premature death, the beneficiary receives the sum assured to the policyholder. On the other hand, if the policyholder survives the term insurance period, there are no savings or profits gained from the policy. Online term insurance plans give pure risk coverage and that is the reason the premiums for such plans are relatively low.

Top 5 Term Insurance plans in India 2026

| Term Insurance Plan | Insurance Provider Company | Maximum Cover Age (Yrs) |

|---|---|---|

| ICICI Prudential iProtect | ICICI Prudential Life Insurnace | 30 |

| HDFC Life Click 2 Protect | HDFC Life Insurance | 30 |

| LIC e-Term Plan | Life Insurance Corporation of India - LIC | 35 |

| Max Life Online Term Plan | Max Life Insurance | 35 |

| Kotak Life Preferred e-Term | Kotak Mahindra Life Insurance | 40 |

Talk to our investment specialist

2. Whole Life Insurance

As the name suggests, this type of life insurance policy is for the whole life. The cover of the insurance policy is throughout the lifespan of the policyholder. The premium is paid at regular intervals and there is a final payout to the family upon the death of the insured. Naturally, as the insurance cover is for the lifetime, the premium amount is also higher for such whole life plans.

Top 5 Whole Life Insurance Plans in India 2026

| Whole Life Insurance Plan | Insurance Provider Company |

|---|---|

| ICICI Pru Whole Life | ICICI Prudential Life Insurance |

| Max Whole Life | Super |

| IDBI Federal Lifesurance | Whole Life Savings Insurance Plan IDBI Federal Life Insurance |

| SBI Life Shubh Nivesh | SBI Life Insurance |

| LIC Whole Life Policy | Life Insurance Corporation of India - LIC |

3. Endowment Plan

Endowment Plan is a special type of life insurance policy. In this, there is a maturity benefit i.e. if the policyholder survives the term of the insurance plan, they avail the sum assured. The beneficiary is also entitled to the basic death benefit in case the policyholder dies during the term of insurance. Endowment plans have higher premiums to cover the sum assured with profits for the possibility of either death or survival.

Top 5 Endowment Plans in India 2026

| Endowment Plan | Insurance Provider Company | Policy Term (Yrs) |

|---|---|---|

| Reliance Life Insurance Super Endowment Policy | Reliance Life Insurance | 14-20 |

| Kotak Classic Endowment Policy | Kotak Mahindra Life Insurance | 15-30 |

| LIC New Endowment Policy | Life Insurance Corporation of India - LIC | 12-35 |

| HDFC Life Endowment Assurance Policy | HDFC Life Insurance | 10-30 |

| SBI Life Endowment Policy | SBI Life Insurance | 5-30 |

4. Unit Linked Insurance Plan (ULIP)

Unit link insurance plans differ slightly from the regular endowment plan. ULIP does pay out the sum assured upon either death or maturity. Along with that, it also invests in the money markets. A policyholder can choose to invest in stock or debt market. The returns depend upon on the performance of the investment in the market. In short, ULIPs are a combination of insurance cover and investment option.

Top 5 ULIPs in India 2026

| Unit Linked Insurance Plan - ULIP | Insurance Provider Company | Minimum Premium (INR) |

|---|---|---|

| SBI Wealth Assure | SBI Life Insurance | 50,000 |

| Max Life Fast Track Growth Fund | Max Life Insurance | 25,000-1,00,000 |

| Tata AIG Life Invest Assure II - Balanced Fund | Tata AIG Insurance | 75,000-1,20,000 |

| PNB MetLife Smart Platinum | PNB MetLife Insurance | 30,000-60,000 |

| Bajaj Allianz Future Gain | Bajaj Allianz Life Insurance | 25,000 |

5. Money Back Policy

Money back is also a variant of endowment plan. In this, the policyholder receives regular payments over the term of the policy. That portion is paid from the sum assured to the policyholder. If they survive the term, the remaining amount of the sum assured is paid and in the case of death, the beneficiary receives the complete sum assured to the policyholder.

Top 5 Money Back Policies in India 2026

| Money Back | Insurance Provider Company | Maturity Age(Yrs) | Plan Type |

|---|---|---|---|

| LIC Money Back Policy - 20 years | Life Insurance Corporation of India - LIC | 70 | Traditional endowment plan with money back facility |

| SBI Life - Smart Money Back Gold SBI | Life Insurance | 27-70 | Life cover along with savings plan |

| Bajaj Allianz Cash Assure Bajaj Allianz | Life Insurance | 18-70 | Conventional money back policy |

| HDFC Life Super Income Plan HDFC | Life Insurance | 18-75 | Convetional participating endowment plan with life cover |

| Reliance Super Money Back Plan Reliance | Life Insurance | 28-80 | Non-linked, non-participating, non-variable endowment plan with life cover |

6. Child Plan

It helps to build long-term savings for child’s future.The funds are a great source for the child's education and marriage. Most of the insurer provides annual installments or one-time payout after the age of 18 years.

Top 5 Child Plan Policies in India 2026

| Child Plan | Insurance Provider Company | Cover Age (Yrs) |

|---|---|---|

| Aditya Birla Sun Life Vision Star Child Plan | Aditya Birla Life Insurance | 18-55 |

| Bajaj Allianz Young Assure | Bajaj Life Insurance | 28-60 |

| HDFC Life YoungStar Udaan | HDFC Life Insurance | Min 18 years old |

| LIC Jeevan Tarun | LIC Insurance | 12-25 years |

| SBI Life- Smart Champ Insurance Plan | SBI Life Insurance | 0-21 |

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.