IndiaFirst Life Insurance

IndiaFirst Life Insurance Company was founded in the year 2010 making it one of the youngest Insurance companies in India. IndiaFirst Life is a joint venture between two Indian public sector banks Bank of Baroda and Andhra Bank; and a UK-based investment agency Legal & General. Bank of Baroda has 44% stake in the venture while Andhra Bank and Legal & General have 30% and 26% of stake respectively. IndiaFirst Life insurance has its headquarters in Mumbai. IndiaFirst Life Insurance is now active across 1000 cities across the country with the help of its 8000 bank branch partners. The company has so far insured more than 50 million customers.

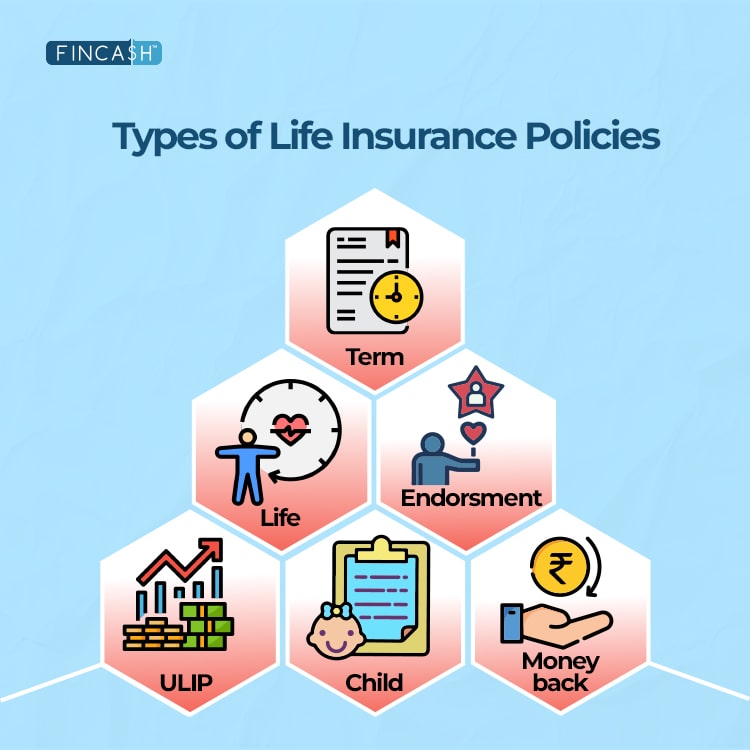

IndiaFirst Life Insurance offers Term Insurance as its primary insurance product but also offers health insurance along with savings and wealth creation plans. It also offers a wide range of Group Insurance products. The company boasts of a combined experience of over 360 years in the finance market. The company has bagged the ISO 9001:2008 certificate in its very first year since inception.

IndiaFirst Life Insurance Plans Details

IndiaFirst Life ULIP Plans

- IndiaFirst Smart Save Plan

- IndiaFirst Money Balance Plan

IndiaFirst Life Protection Plans

- IndiaFirst Life Plan

- IndiaFirst Anytime Plan

India First Life Pension Plans

- IndiaFirst annuity Plan

IndiaFirst Life Child Plans

- IndiaFirst Life Young India Plan

IndiaFirst Life Traditional Insurance Plans

- IndiaFirst Secure Save Plan

- IndiaFirst Maha Jeevan Plan

Talk to our investment specialist

IndiaFirst Life Insurance Online

IndiFirst Life Insurance policy status can be checked on its online portal. IndiaFirst term life Insurance quotes can also be checked and you can compare life insurance plans online to check which suits you better. Also, the company offers an e-IA account i.e. an Electronic-Insurance Account. This account works similarly as a Demat account for shares and Mutual Funds. The company works on the principle of bancassurance and uses the base of its founder banks to promote itself.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.