What does Car Insurance Cover?

car insurance or Motor Insurance provides coverage that protects your vehicle (car, truck, etc.) against unforeseen risks. The car insurance cover takes care of financial losses that may arise from accident, theft, or natural/man-made calamity. It provides protection to you, your vehicle and the third party against uncertain events like accident or collision. The car insurance cover in a policy may vary from company to company. That is why it is advisable for you to ensure that you get a right coverage for your vehicle. To guide you on this, we have listed down the car insurance covers that you may need to consider before buying a policy.

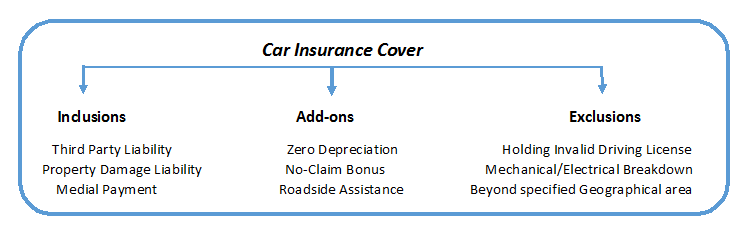

Car Insurance Cover - Inclusions

These are the following perils covered in a Motor Insurance policy:

- Man-made calamities such as burglary, theft, riot, strike, explosion, terrorism, etc.

- Natural calamities such as typhoon, earthquake, flood, fire, lightning, storm, etc.

- Third party legal liability

- Property damage liability

- While in transit by road, rail, air or waterway

- Accident or collision

- Medical payment

- Uninsured and underinsured motorist

- Rental reimbursement

- Car accessories

Car Insurance Cover - Exclusions

- Wear and tear of vehicle due to ageing

- Electrical or mechanical breakdown of vehicle

- Accident caused by a person who is not holding a valid driving license

- Loss or damage by a person when under the influence of an intoxicated substance

- Loss or damage sustained outside the specified geographical area

- Loss or damage caused due to war, mutiny or nuclear risk

Car Insurance Addon Covers

There can be extra car insurance cover add-ons, such as-

- Zero Depreciation

- Engine protect

- No-Claim bonus

- Roadside assistance

- Accidental cover for car passenger

- Key replacement compensation

- Daily wash allowance

Car Insurance- Types of Cover

Car insurance is packaged into different coverage which is broadly divided into two types as mentioned below-

Comprehensive Car Insurance

Comprehensive Car Insurance is a type of insurance that provides cover against the third party plus loss/damage occurred to the insured vehicle or to the insured by means of bodily injury. This scheme also covers damages caused to the vehicle due to thefts, legal liabilities, personal accidents, man-made/natural calamities, etc. Since this policy offers a wide coverage, even though the premium cost is higher, consumers tend to opt for this policy.

Talk to our investment specialist

Third Party Insurance

Third party car insurance policy ensures that you would not have to bear any sort of legal liability or expenses arising from an accident that has caused loss or damage to the third person. Having Third Party Insurance keeps you away from any legal repercussions arising out of third party liability. Third party liability insurance does not provide coverage for any loss or damage caused to the owner’s vehicle or to the insured. Although third party liability insurance is covered under motor or car insurance, customers can still buy this as a separate policy.

Car insurance cover strengthens your policy. A right add-on can improve your policy, which may give overall protection to your vehicle. So weigh your requirements and choose wisely!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.