Third Party Insurance in India

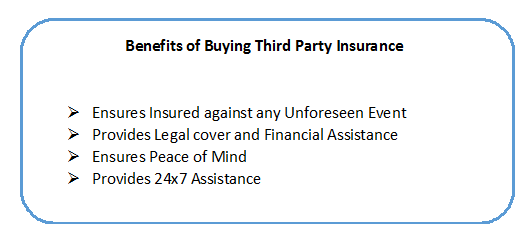

Third party insurance is a statutory requirement in India for Motor Insurance. Essentially, it covers the third person who has been injured in an accident. This policy covers your legal liability arising due to the damage caused by you to a third party only – death, bodily injury and damage to third party property – while using your car.

In India, under the provision of the Motor Vehicles Act, 1988, it is mandatory to have a valid third party liability insurance to drive a vehicle on the road. In this article, you will understand the importance and features of third party car insurance and the latest way to buy or renew third party insurance online.

Third Party Liability Insurance

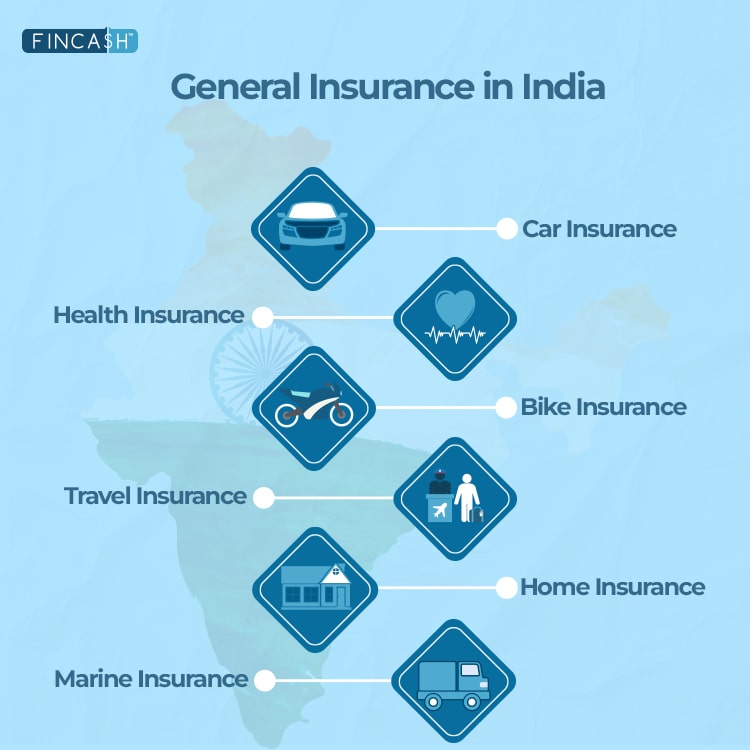

As per the Indian law, every vehicle – be it a car, bike or scooter – plying on the roads must be insured or have valid third party liability coverage. The policy ensures that you would not have to bear any sort of legal liability or expenses arising from an accident that has caused loss or damage to the third person. Having this insurance keeps you away from any legal repercussions arising out of the third party liability.

The plan does not provide coverage for any loss or damage caused to the owner's vehicle or to the insured. Although it is covered under motor or car insurance, customers can still buy this as a separate policy.

Features of Third Party Car Insurance

- The insurance does not cover loss or damage caused to the insured, but only to the third person.

- This policy covers death, injury or property damage caused to the third party.

- Third party insurance policy as an inclusion in the overall car insurance policy is extremely cost-effective and beneficial in terms of financial costs and premiums.

- Third party liability insurance involves a lawyer’s involvement.

Talk to our investment specialist

Third Party Insurance: Exclusions

These are some of the typical cover exclusions in the third party insurance policy.

- Loss or Damage caused by war.

- Loss or damage caused to the third person when being driven by someone who isn’t the owner or designated driver.

- Loss or damage sustained outside the specified geographical area.

- Claims that arises out of any contractual liability.

Best Third Party Car Insurance Provider

| Car Insurance companies in India | Property Damages to Third Party | Personal Accident Cover | Add ons |

|---|---|---|---|

| Reliance Car Insurance | Upto 7.5 Lakh | Available | Not Available |

| ICICI Lombard Car Insurance | Available | Up to 15 lakh | Not Available |

| IFFCO Tokio Car Insurance | Up to 7.5 lakhs | Covered under mandatory personal accident insurance | Not Available |

| Go Digit | Up to 7.5 lakhs | Up to 15 lakhs | Not Available |

| ACKO Car Insurance | Up to 7.5 lakh | Up to Rs. 15 | Not Available |

| TATA AIG Car Insurance | Available | Available | Not Available |

| Bajaj Finserv | Available | Treatment Cost | Not Available |

| Kotak Car Insurance | Available | Available | Not Available |

| SBI Car Insurance | Available | Up to 15 lakhs | Available |

Third Party Insurance Online

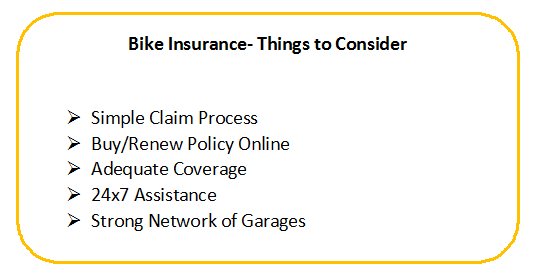

In this digital era, every sector is going online and so is the insurance industry! The biggest advantage of buying the third party insurance policy online is that it is easy, convenient and in all possibility, it simplifies your purchasing decision. Through this option, you can compare different motor insurance or Two Wheeler insurance plans and decide the one that suits best to your vehicle. Remember, never compromise on the quality of the insurance plan! Make an important investment today – buy a third party liability insurance!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

You Might Also Like