Motor Insurance: A Necessity for Safe Rides!

Motor insurance provides protection to your vehicle (car, truck, etc.) against loss or damage that has caused due to unforeseen risks. It basically covers financial losses that may arise from accidents, thefts, or natural/man-made calamities. Motor Insurance is also known as vehicle insurance/ car insurance/ Auto Insurance.

In India, carrying Third Party Insurance is a legal requirement. The Motor Vehicles Act, 1988, mandates that driving a vehicle without motor insurance is a legal offence.

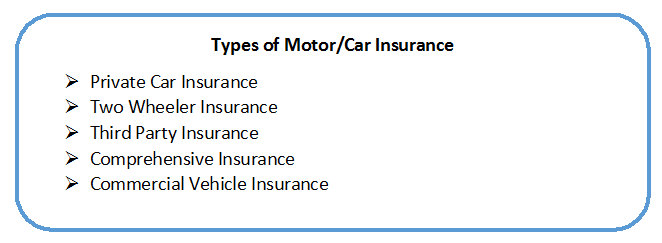

Types of Motor Insurance

Types of Motor Insurance or Car Insurance can be broadly classified as below-

1. Private Car Insurance

Car Insurance gives coverage against accidental damages or losses caused to your own car or to the third party. It is compulsory for all the car owners to have a motor/car insurance. The amount of premium for this policy would depend on the make & value of the car, state from where the car is registered and manufacturing year.

2. Two Wheeler Insurance

Two Wheeler insurance protects the owner of the vehicle from any unforeseen incidents like an accident. A two wheeler insurance policy is provided by any of the authorised Insurance companies registered under the IRDAI i.e. The Insurance Regulatory Development Authority of India.

3. Third Party Insurance

As the name suggests, this covers the third person who has been injured in an accident. Third party insurance covers your legal liability arising due to the damage caused by you to a third party only – death, bodily injury and damage to third party property – while using your car. This policy does not cover loss arising from damage caused to the vehicle or the insured.

Having third party insurance keeps you away from any legal repercussions arising out of the third party liability. Carrying third party insurance is compulsory by the law of India.

4. Comprehensive Insurance

Comprehensive Insurance is a type of insurance that provides cover against the third party plus loss/damage occurred to the insured vehicle or to the insured by means of bodily injury. This scheme also covers damages caused to the vehicle due to thefts, legal liabilities, personal accidents, man-made/natural calamities, etc. Since this policy offers a wide coverage, even though the premium cost is higher, consumers tend to opt this policy.

Talk to our investment specialist

5. Commercial Vehicle Insurance

As the name indicates, these are the vehicle used for commercial purposes and not for personal purposes. This policy provides cover for all the vehicle that carry goods, like Tempos, Trucks, etc. A commercial vehicle insurance ensures protections against financial losses that may arise due to third party liability. It also pays for damages caused to your own vehicle.

Motor Insurance Coverage

These are the following perils covered in a Motor Insurance policy.

- Man-made calamities such as burglary, theft, riot, strike, explosion, terrorism, etc.

- Natural calamities such as typhoon, earthquake, flood, fire, lightning, storm, etc.

- Third party legal liability

- While in transit by road, rail, air or waterway

Motor Insurance Claims

The Motor insurance claim process will mainly depend upon the type of vehicle and nature of loss that has incurred.

To process the claim, the insured is required to submit a detail of estimated loss to the insurer. The insured also needs to submit documents of Driving License, Police Report, Final bill of Repairs and Fitness Certificate. The insurer then carefully inspects the damages caused to the vehicle. When it comes to third party claim, the complete matter is transferred to advocate.

Car Insurance Companies in India

Some of the top insurance companies who provide car/motor insurance are-

- ICICI Lombard General Insurance

- Bhartix Axa general insurance

- TATA AIG General Insurance

- The Oriental Insurance

- The New India Assurance

- HDFC ERGO General Insurance

Motor Insurance Renewal

Renewing the policy can be done online in just a few steps. All most all insurance and banking sector have gone online and are using high end-tech. You can visit the official website of your insurer and renew the motor insurance.

Before renewing, it is ideally suggested to compare policies, calculate your premiums, and accordingly renew the plan. Here are some important motor insurance policy renewal tips:

Don't miss the renewal date. Generally, insurance companies send reminders to the customers via email or SMS, about the expiry of the policy and prompting them to renew the same. At the same time, it is advised to set a reminder for yourself on the phone or laptop so that you don't slip the renewal date.

Fill the policy details carefully. Follow the instructions, recheck twice and then continue with the next step of making the payment.

If your policy is set to expire, remember to consider the no-claim bonus. If you haven't lodged any claims the whole previous year, then you will be eligible for a discount on your premium. However, there could be some T&Cs on this.

Make the most of offers and discounts.

While renewing the plan, consider going for add-on covers that offer greater coverage such as medical expenses cover and zero depreciation cover.

Conclusion

The most important step while buying a car is to avail the insurance policy immediately. Before buying a policy, make sure you look for an insurer who provides a wide range of features such as cashless claims, adequate covers, 24-hour assistance, etc. Also, compare motor insurance policies with different insurers to opt for a quality plan!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.