Marine Insurance: A Detailed Synopsis

Marine insurance is another variant of the general term ‘insurance’. As the name suggests, it is a policy provided to ships, cargo, boats, etc., as a cover against various losses and damages. Incidents like damages to containers, accidents of vehicles carrying cargo, damages or losses caused due to the sinking of ships, etc., are very common in this sector.

That is why it is always beneficial to have a back-up like a marine insurance. Let’s understand more about this policy in a detailed manner.

Marine Insurance

Marine insurance covers damages/losses of cargo, ships, terminals, etc., by which goods are transferred to reach their destination. The marine insurance policy is a contract wherein the insurer indemnifies the loss/damage caused by perils of the sea.

This policy helps to control losses that may arise from marine risks. It protects containers from damage upon exposure to a broad range of risks, such as failure in the port area, any damage incurred at sea, etc.

Import/export merchants, ship/yacht owners, buying agents, contractors, etc., can avail the facility of marine insurance. In this policy, a transporter can choose the insurance plan as per the size of his ship, and also the routes that are taken from his ship for transportation of goods.

Types of Marine Insurance Policy

This policy mainly has three sub-categories, such as-

1. Cargo Insurance

The person who sends the goods via sea often seeks safety. The goods to be insured are called as the cargo. Any loss or damage of goods during the journey is indemnified by the insurance company. The goods are usually insured according to their value, but some amount of profit can also be included in the value.

Talk to our investment specialist

2. Hull Insurance

When the ship is insured against any type of danger it is called Hull Insurance. The ship may be insured for a particular trip or for a particular period.

3. Freight Insurance

The shipping company may insure the freight to be received safely, that is why it is known as freight insurance. The freight may be paid on the arrival of goods or even advance. However, the shipping company may not get freight if the goods are lost during transit.

Marine Insurance Coverage

These are some of the common instances or losses which marine insurance provides cover against:

- Goods transported via sea, road, rail or post

- Goods transported via containers

- Discharge of cargo at the port of distress

- Washing overboard

- Collision or contact of vessels with any other object than water

- Piracy

- Sinking, stranding, fire or explosion

Some of the common exclusions are –

- Routine wear or tear or ordinary leakage

- Damage caused due to civil commotion, strike, war, riot, etc

- Damage caused due to delay

- Incorrect and inadequate packaging of goods being transported

Features of Marine Insurance

Here're the following features of Marine Insurance Policy:

- Good faith

- Claims

- Deliberate act

- Period of marine insurance

- Contribution

- Insurable interest

- Payment of premium

- Contract of indemnity

- Offer and the acceptance

- Warranties

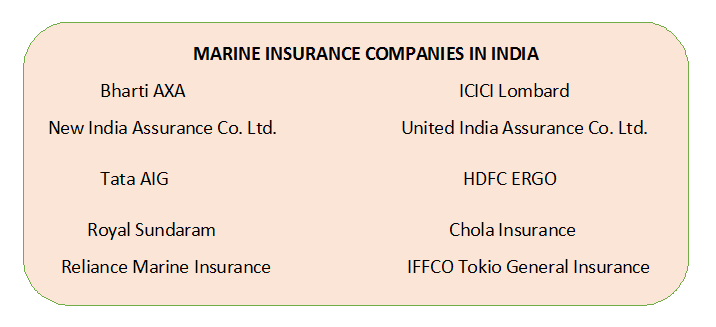

Marine Insurance Companies in India

Now, when you know everything about marine insurance, take a step to safeguard your valuable assets that are being transported via sea.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.