Two Wheeler Insurance Online

A majority of Insurance companies have created a simple interface on their websites through which one can directly buy and renew policies online. Today, Two Wheeler insurance online is not only a mode to buy/ renew a policy, but is also a hassle-free medium to find out bike insurance quotes and information about the companies that offer bike insurance plans.

When looking to buy 2 wheeler insurance online, one needs to know the bike’s make, value, model, year of manufacture, and driving license number of the person to be insured.

How to Buy 2 Wheeler Insurance Online?

1. Know Bike Insurance Plans

Bike insurance mainly has two types- Third Party liability insurance and Comprehensive Insurance. Third party bike insurance covers the third person who has been injured in an accident or collision. It covers your legal liability arising due to the damage caused by you resulting in personal injury, property damage or death to a third party.

Whereas, comprehensive insurance provides cover against the third party plus loss/damage occurred to the owner (typically personal accident insurance) or to the insured vehicle. This scheme also covers damages caused to the vehicle due to legal liabilities, personal accidents, thefts, man-made/natural calamities, etc.

Talk to our investment specialist

2. Compare Two Wheeler Insurance Online

Today, you can obtain quotes online from multiple insurance companies to compare premiums and features to take a concerted decision on which policy to opt for. While doing a bike insurance comparison, you need to consider the premium you are willing to pay, with respect to the adequate coverage being offered.

While comparing two wheeler insurance online, it is important to look for an insurer who provides efficient features like adequate coverage, easy claim process, 24x7 customer service, etc., in a plan. Apart from this, check the availability of optional coverage such as Zero Depreciation, Medical Cover, Accessories Cover, etc.

3. Use Two Wheeler Insurance Calculator

Two wheeler insurance calculator or bike insurance calculator is a valuable online tool that helps you get the best bike insurance plans on the basis of your specifications. You can also compare two wheeler insurance quotes by using this tool. The bike insurance calculator helps a buyer to evaluate their needs and get an appropriate plan.

While using two wheeler insurance calculator you may need to fill following details, which will determine your two wheeler insurance premium:

- Bike Model and Make

- Year of Manufacture

- Engine Capacity

- Geographic Location

- Anti-Theft Discount

- Voluntary Deductible

- No Claim Bonus

4. Shortlist Two Wheeler Insurance Companies

Some of the reputed Bike Insurance Companies that you need to consider while buying a plan are as follows-

- HDFC ERGO General Insurance Company Limited

- Bajaj Allianz General Insurance Company Limited

- SBI General Insurance Company Limited

- New India Assurance Company Limited

- Oriental Insurance Company Limited

- TATA AIG General Insurance Company Limited

5. Online Bike Insurance Renewal

Renewing bike insurance policy online can save your time. Many insurance companies offer policy renewal through their web portal and sometimes even through a mobile application. Usually, bike Insurance has a policy period of one year. Consumers can renew their insurance plan before the expiry date through the company’s website. To avoid any hassles, it is advisable for customers to renew their policy before an expiry date.

Bike Insurance Renewal

Renewing insurance on time is extremely important to avoid uninsured. Also, it keeps you safe against any financial losses & legal liabilities, which may arise anytime due to misfortunes. In todays time, as per online provisions, renewing 2 wheeler insurance has become quick and simple irrespective of the location.

If your policy is about to expire, get in touch with you insurance agency and intimate about the same. For renewal, there are certain documents required as a statutory list issued by the Insurance Regulatory and Development Authority of India (IRDAI).

- Policyholder’s name, date of birth, address, gender, occupation

- Driving licence information

- Old 2 wheeler insurance policy number

- Vehicle registration number and registration certificate (RC) number

- Payment details

Before renewing you can discover different policies. You may find a better policy that offers a greater degree of coverage at reasonable cost. Also, remember to make use of No Claim Bonus (NCB) to avail discount on the premium.

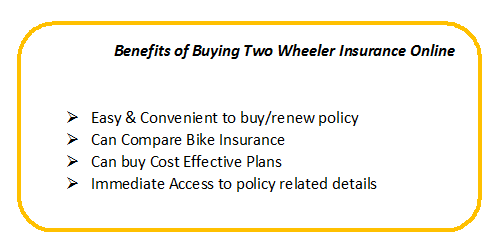

5 Reasons to Buy Two Wheeler Insurance Online

Convenient

Buying two wheeler insurance online takes less time compared to the conventional method, which makes it a convenient and easy way to buy a policy.

Plans Comparison

The best part of two wheeler insurance online is that you can compare the policies that different insurers have to offer. You can compare features likes covers, benefits, quotes, etc., and choose the one that suits you the best.

Online Support

Most insurers provide round the clock online services to the customers. This becomes easy to resolve queries immediately.

Cost Effective

Buying two wheeler insurance online helps you get discounts, which are often offered by the bike insurance companies while buying.

Immediate Access

Online insurance ensures that you get your digitally signed documents (policy) as soon as the payment process is completed. Thus, you have an immediate investment proof and access to all your documents regarding bike insurance policy.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.