FD Vs ಸಾಲ ಮ್ಯೂಚುಯಲ್ ಫಂಡ್

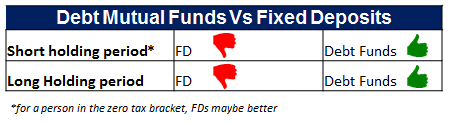

FD ವಿರುದ್ಧಸಾಲ ನಿಧಿ? ಆಲೋಚನೆಎಲ್ಲಿ ಹೂಡಿಕೆ ಮಾಡಬೇಕು ಉತ್ತಮ ಆದಾಯವನ್ನು ಗಳಿಸಲು ನಿಮ್ಮ ಉಳಿತಾಯ. ಸಾಮಾನ್ಯವಾಗಿ, ಜನರು ಪರಿಗಣಿಸುತ್ತಾರೆಹೂಡಿಕೆ ಸ್ಥಿರ ಠೇವಣಿ ಅಥವಾ ಎಫ್ಡಿಯಲ್ಲಿ ಇದು ಅತ್ಯಂತ ಅನುಕೂಲಕರ ಆಯ್ಕೆಯಾಗಿದೆ ಏಕೆಂದರೆ ಅದು ಸುರಕ್ಷಿತವಾಗಿದೆ ಮತ್ತು ಸ್ಥಿರ ಆದಾಯವನ್ನು ನೀಡುತ್ತದೆ. ಆದರೆ ಇದು ಉತ್ತಮ ಮಾರ್ಗವೇ? ಫಿಕ್ಸೆಡ್ ಡೆಪಾಸಿಟ್ ಎಲ್ಲರಿಗೂ ಸುಲಭವಾದ ಹೂಡಿಕೆಯ ಆಯ್ಕೆಯಾಗಿದ್ದರೂ, ತೆರಿಗೆಗೆ ಒಳಪಡುವ ಸ್ಥಿರ ಠೇವಣಿಗಳ ಆದಾಯವು ಸಾಲ ನಿಧಿಗೆ ಹೋಲಿಸಿದರೆ ತುಂಬಾ ಕಡಿಮೆ. ಇದಲ್ಲದೆ, ದೀರ್ಘಾವಧಿಯವರೆಗೆ ಹಿಡಿದಿಟ್ಟುಕೊಂಡಾಗ, ಸಾಲಮ್ಯೂಚುಯಲ್ ಫಂಡ್ಗಳು ಉತ್ತಮ ಆದಾಯವನ್ನು ನೀಡುತ್ತವೆ. ಸಾಲ ಮ್ಯೂಚುವಲ್ ಫಂಡ್ಗಳು ಅಥವಾ ಸ್ಥಿರ ಠೇವಣಿಗಳಲ್ಲಿ ಹೂಡಿಕೆ ಮಾಡಲು ಅಂತಿಮ ನಿರ್ಧಾರವನ್ನು ತೆಗೆದುಕೊಳ್ಳುವ ಮೊದಲು, ಈ ಹೂಡಿಕೆಗಳ ವಿವರವಾದ ಹೋಲಿಕೆಯ ಮೂಲಕ ಹೋಗಿ.

ಸಾರಾಂಶದಲ್ಲಿ:

ಸಾಲ ಮ್ಯೂಚುಯಲ್ ಫಂಡ್ಗಳು (ಸಾಲ ನಿಧಿ) Vs ಸ್ಥಿರ ಠೇವಣಿ (ಎಫ್ಡಿ)

ಅಪಾಯವನ್ನು ತೆಗೆದುಕೊಳ್ಳುವ ಸಾಮರ್ಥ್ಯ ಮತ್ತು ಉದ್ದೇಶಿತ ಹಿಡುವಳಿ ಅವಧಿಯಿಂದ ನಾವು ಇದನ್ನು ಮುರಿಯಬೇಕಾಗಿದೆಹೂಡಿಕೆದಾರ ಪ್ರಶ್ನೆಯಲ್ಲಿ.

ಕಡಿಮೆ ಹಿಡುವಳಿ ಅವಧಿ (1 ವರ್ಷ ಅಥವಾ ಕಡಿಮೆ)

ಇಲ್ಲಿ ಸಾಲ ನಿಧಿಯ ಆಯ್ಕೆಗಳು ಸೀಮಿತವಾಗಿರುತ್ತವೆದ್ರವ ನಿಧಿಗಳು, ಅಲ್ಟ್ರಾ-ಅಲ್ಪಾವಧಿ ನಿಧಿಗಳು ಮತ್ತು ಅಲ್ಪಾವಧಿಆದಾಯ ನಿಧಿಗಳು. ರಿಟರ್ನ್ಸ್ ಅಥವಾ ಇಳುವರಿಗಳು ಸಾಮಾನ್ಯವಾಗಿ ದ್ರವದಿಂದ ಅಲ್ಟ್ರಾ-ಶಾರ್ಟ್ಗೆ ಅಲ್ಪಾವಧಿಯ ನಿಧಿಗೆ ಹೆಚ್ಚಿನದಾಗಿದ್ದರೂ, ಈ ಸಾಲ ನಿಧಿಗಳು ಮತ್ತು ಸ್ಥಿರ ಠೇವಣಿಗಳ ನಡುವಿನ ಇಳುವರಿ ವ್ಯತ್ಯಾಸವನ್ನು ಕಳೆದ ಒಂದು ವರ್ಷದಲ್ಲಿ ಅವರ ಆದಾಯವನ್ನು ಪರಿಗಣಿಸಿ ನಿರ್ಧರಿಸಬಹುದು.

ಸಾಲ ಮ್ಯೂಚುಯಲ್ ಫಂಡ್ (ವರ್ಗದ ಸರಾಸರಿ ಆದಾಯ)

| ಸಾಲ ಮ್ಯೂಚುಯಲ್ ಫಂಡ್ ವಿಧ | ಕಳೆದ 1 ವರ್ಷ ರಿಟರ್ನ್ (%) |

|---|---|

| ಲಿಕ್ವಿಡ್ ಫಂಡ್ | 7.36 |

| ಅಲ್ಟ್ರಾ ಅಲ್ಪಾವಧಿಯ ಸಾಲ ನಿಧಿಗಳು | 9.18 |

| ಅಲ್ಪಾವಧಿಯ ಸಾಲ ನಿಧಿಗಳು | 9.78 |

| ಡೈನಾಮಿಕ್ ಸಾಲ ನಿಧಿಗಳು | 13.89 |

| ದೀರ್ಘಾವಧಿಯ ಸಾಲ ನಿಧಿಗಳು | 13.19 |

| ಗಿಲ್ಟ್ ಅಲ್ಪಾವಧಿಯ ನಿಧಿಗಳು | 11.76 |

| ಗಿಲ್ಟ್ ದೀರ್ಘಾವಧಿಯ ನಿಧಿಗಳು | 15.06 |

| 20ನೇ ಫೆಬ್ರವರಿ 2017 ರ ಡೇಟಾ |

ಸ್ಥಿರ ಠೇವಣಿ ಅಥವಾ FD ಸರಾಸರಿ ರಿಟರ್ನ್ ದರ

ಸ್ಥಿರ ಠೇವಣಿಗಳ ಸರಾಸರಿ ರಿಟರ್ನ್ ದರವು 8-8.5% p.a. 2016 ರಲ್ಲಿ (ಆದ್ದರಿಂದ ಒಬ್ಬರು ಮೇಲಿನ ಆದಾಯವನ್ನು ಕೋಷ್ಟಕದಲ್ಲಿ ಹೋಲಿಸಬಹುದು). ಆದಾಗ್ಯೂ, ಕಳೆದ ಒಂದು ವರ್ಷದಲ್ಲಿ, ರಿಟರ್ನ್ ದರವು 6.6-7.5% p.a ಗೆ ಇಳಿದಿದೆ.

ಮೇಲಿನ ವಿವರಣೆಯೊಂದಿಗೆ, ಸಾಲ ನಿಧಿಗಳ ಆದಾಯದ ಸರಾಸರಿ ದರವು ಸ್ಥಿರ ಠೇವಣಿಗಳಿಗಿಂತ ಉತ್ತಮವಾಗಿದೆ ಎಂಬುದು ಸ್ಪಷ್ಟವಾಗಿದೆ.

Talk to our investment specialist

ದೀರ್ಘಾವಧಿಯ ಹಿಡುವಳಿ ಅವಧಿ

ದೀರ್ಘ ಉದ್ದೇಶಿತ ಹಿಡುವಳಿ ಅವಧಿಯೊಂದಿಗೆ, ಸಾಲ ನಿಧಿಗಳು FD ಗಳಿಗಿಂತ ಉತ್ತಮವೆಂದು ಸಾಬೀತುಪಡಿಸಬಹುದು.

ಇಲ್ಲಿ ಹೂಡಿಕೆ ಮಾಡುವ ಆಯ್ಕೆಗಳೆಂದರೆ:

- ದೀರ್ಘಾವಧಿಯ ಆದಾಯ ನಿಧಿಗಳು

- ದೀರ್ಘಕಾಲದ ಗಿಲ್ಟ್,

- ಕಾರ್ಪೊರೇಟ್ಕರಾರುಪತ್ರ ನಿಧಿಗಳು (ಹೆಚ್ಚಿನ ಇಳುವರಿ ನಿಧಿಗಳು), ದ್ರವದ ಮೇಲೆ ತಿಳಿಸಲಾದ ಆಯ್ಕೆಗಳ ಜೊತೆಗೆ, ಅಲ್ಟ್ರಾ-ಶಾರ್ಟ್ ಮತ್ತು ಅಲ್ಪಾವಧಿಯ ಹಣವನ್ನು ಸಹ ಬಳಸಬಹುದು.

ಹಿಡುವಳಿ ಅವಧಿಯು 3 ವರ್ಷಗಳು ಅಥವಾ ಅದಕ್ಕಿಂತ ಹೆಚ್ಚಿನದಾಗಿರಬಹುದು, ನಾವು ಈ ಕೆಳಗಿನವುಗಳನ್ನು ಹೇಳಬಹುದು:

- ಜೊತೆಗೆಬಂಡವಾಳ ಇಂಡೆಕ್ಸೇಶನ್ ಪ್ರಯೋಜನಗಳೊಂದಿಗೆ 20% ರಷ್ಟು ತೆರಿಗೆಯನ್ನು ಗಳಿಸಿದರೆ, ನಿವ್ವಳ ತೆರಿಗೆ ಸಂಭವವು ಕನಿಷ್ಠವಾಗಿರುತ್ತದೆ (ಆದಾಗ್ಯೂ ಒಬ್ಬರು ತೆರಿಗೆಗೆ ಒಳಗಾದ ವರ್ಷವನ್ನು ನೀಡಿದ ತೆರಿಗೆ ಘಟನೆಯನ್ನು ಲೆಕ್ಕ ಹಾಕಬೇಕು)

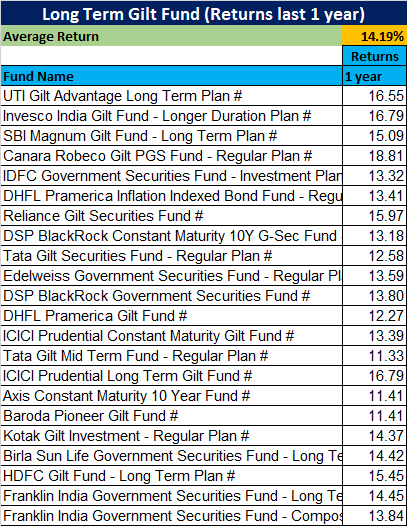

- ದೀರ್ಘಾವಧಿಯ ಆದಾಯ ನಿಧಿಗಳು/ಗಿಲ್ಟ್ ನಿಧಿಗಳು ಹೆಚ್ಚಿನ ಇಳುವರಿಯೊಂದಿಗೆ ಮತ್ತು ಹೆಚ್ಚುವರಿಯಾಗಿ, ಬಡ್ಡಿದರಗಳು ಕಡಿಮೆಯಾದರೆ ಹೆಚ್ಚಿನ ಆದಾಯವನ್ನು ನೀಡುತ್ತದೆ.

- ಈ ಸಾಲ ನಿಧಿಗಳೊಂದಿಗೆ ಹೆಚ್ಚಿನ ಎರಡಂಕಿಯ ಆದಾಯದೊಂದಿಗೆ ಒಬ್ಬರು ಕೊನೆಗೊಳ್ಳಬಹುದು.

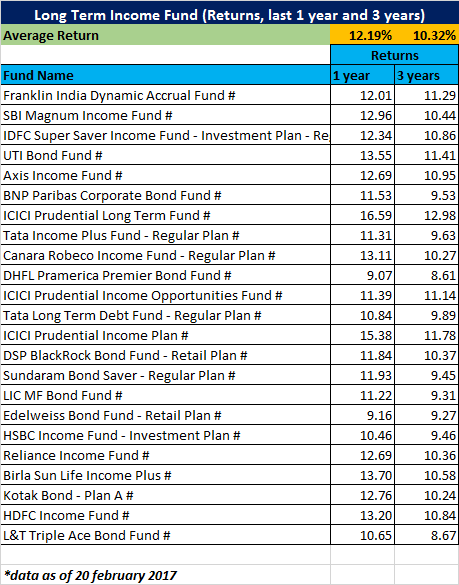

ದೀರ್ಘಾವಧಿಯ ಆದಾಯ ನಿಧಿಗಳ ಮೇಲಿನ ಆದಾಯದ ಕೆಳಗಿನ ಉದಾಹರಣೆಯನ್ನು ತೆಗೆದುಕೊಳ್ಳಿ, ವರ್ಗಕ್ಕೆ ಸರಾಸರಿ ಕೊನೆಯ 1-ವರ್ಷದ ಆದಾಯವು 12.19% ಮತ್ತು ಕಳೆದ 3 ವರ್ಷಗಳಲ್ಲಿ 10.32% p.a. ಈ ಅವಧಿಯಲ್ಲಿ ಯಾವುದೇ ಎಫ್ಡಿ ಇದೇ ರೀತಿಯ ರಿಟರ್ನ್ ನೀಡುತ್ತಿರಲಿಲ್ಲ. ಗಿಲ್ಟ್ ಫಂಡ್ ರಿಟರ್ನ್ಸ್ ಇನ್ನೂ ಹೆಚ್ಚಾಗಿರುತ್ತದೆ. ಅದೇ ಅವಧಿಯಲ್ಲಿ, ಕಳೆದ ವರ್ಷದ ಎಫ್ಡಿ ದರಗಳು ಹೆಚ್ಚಿನ ಬ್ಯಾಂಕ್ಗಳಲ್ಲಿ ವಾರ್ಷಿಕ 8-8.5% ರ ಸಮೀಪ ಇರುತ್ತಿತ್ತು, (ಇಂದು ದರಗಳು ಇನ್ನೂ 6.5 - 7.5% ಕ್ಕೆ ಇಳಿದಿವೆ)

ಆದ್ದರಿಂದ ಹೂಡಿಕೆದಾರರು ದೀರ್ಘಾವಧಿಯ ಹಿಡುವಳಿ ಅವಧಿಯನ್ನು ಹೊಂದಿರುವ ಮತ್ತು ಬಡ್ಡಿದರಗಳು ಕಡಿಮೆಯಾಗುವುದರೊಂದಿಗೆ, ಸಾಲ ನಿಧಿ (ದೀರ್ಘಾವಧಿಯ ಆದಾಯ ಅಥವಾ ಗಿಲ್ಟ್) FD ಗಿಂತ ಉತ್ತಮ ಆದಾಯವನ್ನು ನೀಡುತ್ತದೆ. ಬಡ್ಡಿದರಗಳು ಕಡಿಮೆಯಾಗದಿದ್ದರೂ ಸಹ, ಹೆಚ್ಚಿನ ಇಳುವರಿ ಕಾರ್ಪೊರೇಟ್ ಬಾಂಡ್ ಫಂಡ್ಗಳು ಅದೇ ಅವಧಿಯಲ್ಲಿ FD ಗಳನ್ನು ಸೋಲಿಸುತ್ತವೆ.

ಸಾಲ ಮ್ಯೂಚುವಲ್ ಫಂಡ್ಗಳು ಮತ್ತು ಸ್ಥಿರ ಠೇವಣಿಗಳ ಮೇಲಿನ ತೆರಿಗೆ

ಸಾಲ ನಿಧಿಗಳು ಮತ್ತು ಸ್ಥಿರ ಠೇವಣಿಗಳ ಆದಾಯವನ್ನು ನಿರ್ಧರಿಸುವಲ್ಲಿ ತೆರಿಗೆಯು ಪ್ರಮುಖ ಪಾತ್ರವನ್ನು ವಹಿಸುತ್ತದೆ. ವಿಶಿಷ್ಟವಾಗಿ, ಸ್ಥಿರ ಠೇವಣಿಗಳ ಮೇಲಿನ ತೆರಿಗೆಯು 33% (ತೆರಿಗೆಯ ಕನಿಷ್ಠ ದರ) ಆದರೆ ಡೆಟ್ ಫಂಡ್ಗಳಲ್ಲಿ ಒಬ್ಬರು 3-ವರ್ಷಕ್ಕಿಂತ ಕಡಿಮೆ ವೀಕ್ಷಣೆಯೊಂದಿಗೆ ಹೂಡಿಕೆ ಮಾಡಿದರೆ ಡಿಡಿಟಿ (ಡಿವಿಡೆಂಡ್ ಡಿಸ್ಟ್ರಿಬ್ಯೂಷನ್ ಟ್ಯಾಕ್ಸ್) ಕಡಿತಗೊಳಿಸಿದರೆ ಡಿವಿಡೆಂಡ್ ವಿತರಣಾ ತೆರಿಗೆಯನ್ನು ಪಾವತಿಸುವುದು ಉತ್ತಮ ಆಯ್ಕೆಯಾಗಿದೆ. ಸರಿಸುಮಾರು 25% (+ಸರ್ಚಾರ್ಜ್ ಇತ್ಯಾದಿ). ಸಾಲ ಮ್ಯೂಚುವಲ್ ಫಂಡ್ಗಳ ಮೇಲಿನ ತೆರಿಗೆಯು ಸ್ಥಿರ ಠೇವಣಿಗಳಿಗಿಂತ ತುಲನಾತ್ಮಕವಾಗಿ ಕಡಿಮೆಯಾಗಿದೆ ಎಂದು ಇದು ತೋರಿಸುತ್ತದೆ.

ಸಾಲ ನಿಧಿಗಳೊಂದಿಗೆ ಬರುವ ಹೆಚ್ಚುವರಿ ಪ್ರಯೋಜನಗಳೆಂದರೆ:

- ದ್ರವ್ಯತೆ: 1-2 ದಿನಗಳಲ್ಲಿ ಹಣ ಲಭ್ಯವಿದೆವಿಮೋಚನೆ

- ವೃತ್ತಿಪರ ನಿರ್ವಹಣೆ: ಕಾರ್ಯತಂತ್ರವನ್ನು ಕ್ರಿಯಾತ್ಮಕವಾಗಿ ಬದಲಾಯಿಸುವ ಮತ್ತು ಮಾರುಕಟ್ಟೆಗಳ ಲಾಭವನ್ನು ಪಡೆಯುವ ಸಾಮರ್ಥ್ಯ

- ಯಾವುದೇ ಅಕಾಲಿಕ ವಾಪಸಾತಿ ದಂಡವಿಲ್ಲ.

ಸಂಕ್ಷಿಪ್ತವಾಗಿ ಹೇಳುವುದಾದರೆ:

| ನಿಯತಾಂಕಗಳು | ಮ್ಯೂಚುಯಲ್ ಫಂಡ್ಗಳು | ಸ್ಥಿರ ಠೇವಣಿ |

|---|---|---|

| ರಿಟರ್ನ್ಸ್ ದರ | ಯಾವುದೇ ಖಚಿತವಾದ ರಿಟರ್ನ್ಸ್ ಇಲ್ಲ | ಸ್ಥಿರ ರಿಟರ್ನ್ಸ್ |

| ಹಣದುಬ್ಬರ ಸರಿಹೊಂದಿಸಿದ ರಿಟರ್ನ್ಸ್ | ಅಧಿಕ ಹಣದುಬ್ಬರ ಹೊಂದಾಣಿಕೆಯ ಆದಾಯದ ಸಾಮರ್ಥ್ಯ | ಸಾಮಾನ್ಯವಾಗಿ ಕಡಿಮೆ ಹಣದುಬ್ಬರ ಹೊಂದಾಣಿಕೆಯ ಆದಾಯ |

| ಅಪಾಯ | ಕಡಿಮೆಯಿಂದ ಹೆಚ್ಚಿನ ಅಪಾಯ (ನಿಧಿಯನ್ನು ಅವಲಂಬಿಸಿರುತ್ತದೆ | ಕಡಿಮೆ ಅಪಾಯ |

| ದ್ರವ್ಯತೆ | ದ್ರವ | ದ್ರವ |

| ಅಕಾಲಿಕ ಹಿಂತೆಗೆದುಕೊಳ್ಳುವಿಕೆ | ನಿರ್ಗಮನ ಲೋಡ್ನೊಂದಿಗೆ ಅನುಮತಿಸಲಾಗಿದೆ/ಲೋಡ್ ಇಲ್ಲ | ದಂಡದೊಂದಿಗೆ ಅನುಮತಿಸಲಾಗಿದೆ |

| ಹೂಡಿಕೆಯ ವೆಚ್ಚ | ನಿರ್ವಹಣಾ ವೆಚ್ಚ/ವೆಚ್ಚದ ಅನುಪಾತ | ಯಾವುದೇ ವೆಚ್ಚವಿಲ್ಲ |

ಟಾಪ್ 8 ಅತ್ಯುತ್ತಮ ಕಾರ್ಯಕ್ಷಮತೆಯ ಸಾಲ ನಿಧಿಗಳು 2022

ಮೇಲಿನ ನಿವ್ವಳ ಸ್ವತ್ತುಗಳು/AUM ಹೊಂದಿರುವ ಸಾಲ ನಿಧಿಗಳ ಪಟ್ಟಿಯನ್ನು ಕೆಳಗೆ ನೀಡಲಾಗಿದೆ1000 ಕೋಟಿ ಮತ್ತು 3 ವರ್ಷದ ಸಂಯೋಜನೆಯಲ್ಲಿ ವಿಂಗಡಿಸಲಾಗಿದೆ (ಸಿಎಜಿಆರ್) ಹಿಂದಿರುಗಿಸುತ್ತದೆ.

(Erstwhile Aditya Birla Sun Life Corporate Bond Fund) The investment objective of the Scheme is to generate returns by predominantly investing in a portfolio of corporate debt securities with short to medium term maturities across the credit spectrum within the investment grade. The Scheme does not guarantee/indicate any returns. There can be no assurance that the schemes’ objectives will be achieved. Below is the key information for Aditya Birla Sun Life Credit Risk Fund Returns up to 1 year are on The primary investment objective of the Scheme is to generate regular income through investments in debt & money market instruments in order to make regular dividend payments to unit holders & secondary objective is growth of capital. Research Highlights for Aditya Birla Sun Life Medium Term Plan Below is the key information for Aditya Birla Sun Life Medium Term Plan Returns up to 1 year are on The fund’s objective is to provide reasonable returns, by maintaining an optimum balance of safety, liquidity and yield, through investments in a basket of debt and money market instruments with a view to delivering consistent performance. However, there can be no assurance that the investment objective of the Scheme will be realized. Research Highlights for ICICI Prudential Regular Savings Fund Below is the key information for ICICI Prudential Regular Savings Fund Returns up to 1 year are on (Erstwhile Reliance Regular Savings Fund - Debt Plan) The primary investment objective of this option is to generate optimal returns consistent with moderate level of risk. This income may be complemented by capital appreciation of the portfolio. Accordingly investments shall predominantly be made in Debt & Money Market Instruments. Research Highlights for Nippon India Credit Risk Fund Below is the key information for Nippon India Credit Risk Fund Returns up to 1 year are on The investment objective of the scheme is to generate regular income and capital appreciation by investing in a portfolio of medium term debt and money market instruments. There is no assurance or guarantee that the investment objective of the scheme will be achieved Research Highlights for Kotak Medium Term Fund Below is the key information for Kotak Medium Term Fund Returns up to 1 year are on The Scheme aims to provide reasonable returns by investing in portfolio of Government Securities with average maturity of around 10 years. However, there can be no assurance that the investment objective of the

Scheme will be realized. Research Highlights for ICICI Prudential Constant Maturity Gilt Fund Below is the key information for ICICI Prudential Constant Maturity Gilt Fund Returns up to 1 year are on (Erstwhile SBI Corporate Bond Fund) The investment objective will be to actively manage a portfolio of good

quality corporate debt as well as Money Market Instruments so as to provide

reasonable returns and liquidity to the Unit holders. However there is no

guarantee or assurance that the investment objective of the scheme will

be achieved. Research Highlights for SBI Credit Risk Fund Below is the key information for SBI Credit Risk Fund Returns up to 1 year are on (Erstwhile Axis Income Fund) To generate optimal returns in the medium term while maintaining liquidity of the portfolio by investing in debt and money market instruments. Research Highlights for Axis Strategic Bond Fund Below is the key information for Axis Strategic Bond Fund Returns up to 1 year are on 1. Aditya Birla Sun Life Credit Risk Fund

Aditya Birla Sun Life Credit Risk Fund

Growth Launch Date 17 Apr 15 NAV (18 Feb 26) ₹24.3116 ↓ -0.01 (-0.03 %) Net Assets (Cr) ₹1,092 on 31 Dec 25 Category Debt - Credit Risk AMC Birla Sun Life Asset Management Co Ltd Rating Risk Moderate Expense Ratio 1.54 Sharpe Ratio 2.08 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 100 Exit Load 0-365 Days (1%),365 Days and above(NIL) Yield to Maturity 7.96% Effective Maturity 3 Years 2 Months 23 Days Modified Duration 2 Years 4 Months 28 Days Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹10,598 31 Jan 23 ₹11,371 31 Jan 24 ₹12,166 31 Jan 25 ₹13,642 31 Jan 26 ₹15,895 Returns for Aditya Birla Sun Life Credit Risk Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 18 Feb 26 Duration Returns 1 Month 0.9% 3 Month 4.9% 6 Month 7.4% 1 Year 13.2% 3 Year 12% 5 Year 9.9% 10 Year 15 Year Since launch 8.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 13.4% 2023 11.9% 2022 6.9% 2021 7.1% 2020 6.4% 2019 9.4% 2018 2.1% 2017 6.6% 2016 8.1% 2015 10.3% Fund Manager information for Aditya Birla Sun Life Credit Risk Fund

Name Since Tenure Sunaina Cunha 17 Apr 15 10.8 Yr. Mohit Sharma 6 Aug 20 5.49 Yr. Data below for Aditya Birla Sun Life Credit Risk Fund as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 9.54% Equity 7.14% Debt 83.01% Other 0.31% Debt Sector Allocation

Sector Value Corporate 60.11% Government 22.9% Cash Equivalent 9.54% Credit Quality

Rating Value A 14.57% AA 54.68% AAA 30.75% Top Securities Holdings / Portfolio

Name Holding Value Quantity 6.79% Gs 2034

Sovereign Bonds | -4% ₹50 Cr 5,000,000

↓ -1,000,000 Aditya Birla Real Estate Limited

Debentures | -4% ₹45 Cr 4,500 Jubilant Bevco Limited

Debentures | -4% ₹43 Cr 4,000

↑ 1,000 National Bank For Agriculture And Rural Development

Debentures | -4% ₹40 Cr 4,000 GMR Airports Limited

Debentures | -3% ₹38 Cr 3,700 7.10% Gs 2034

Sovereign Bonds | -3% ₹36 Cr 3,500,000 IKF Finance Limited

Debentures | -3% ₹35 Cr 3,500 National Bank For Agriculture And Rural Development

Debentures | -3% ₹35 Cr 3,500 Hinduja Leyland Finance Limited

Debentures | -3% ₹34 Cr 3,500 Kogta Financial (India) Limited

Debentures | -3% ₹32 Cr 3,250 2. Aditya Birla Sun Life Medium Term Plan

Aditya Birla Sun Life Medium Term Plan

Growth Launch Date 25 Mar 09 NAV (18 Feb 26) ₹42.276 ↓ -0.01 (-0.02 %) Net Assets (Cr) ₹2,905 on 31 Dec 25 Category Debt - Medium term Bond AMC Birla Sun Life Asset Management Co Ltd Rating ☆☆☆☆ Risk Moderate Expense Ratio 1.57 Sharpe Ratio 2.01 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 1,000 Exit Load 0-365 Days (1%),365 Days and above(NIL) Yield to Maturity 7.78% Effective Maturity 4 Years 6 Months 7 Days Modified Duration 3 Years 4 Months 24 Days Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹10,660 31 Jan 23 ₹13,326 31 Jan 24 ₹14,282 31 Jan 25 ₹15,800 31 Jan 26 ₹17,695 Returns for Aditya Birla Sun Life Medium Term Plan

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 18 Feb 26 Duration Returns 1 Month 0.8% 3 Month 2.9% 6 Month 5.1% 1 Year 10.2% 3 Year 10.1% 5 Year 12.1% 10 Year 15 Year Since launch 8.9% Historical performance (Yearly) on absolute basis

Year Returns 2024 10.9% 2023 10.5% 2022 6.9% 2021 24.8% 2020 7.1% 2019 8.1% 2018 -4.4% 2017 5.6% 2016 7% 2015 10.9% Fund Manager information for Aditya Birla Sun Life Medium Term Plan

Name Since Tenure Sunaina Cunha 1 Sep 14 11.43 Yr. Mohit Sharma 6 Aug 20 5.49 Yr. Data below for Aditya Birla Sun Life Medium Term Plan as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 3.17% Equity 4% Debt 92.55% Other 0.27% Debt Sector Allocation

Sector Value Corporate 57.6% Government 34.95% Cash Equivalent 3.17% Credit Quality

Rating Value A 10.07% AA 38.92% AAA 51.02% Top Securities Holdings / Portfolio

Name Holding Value Quantity 6.79% Gs 2034

Sovereign Bonds | -9% ₹281 Cr 28,000,000 7.10% Gs 2034

Sovereign Bonds | -8% ₹227 Cr 22,196,700

↓ -1,500,000 7.18% Gs 2033

Sovereign Bonds | -6% ₹190 Cr 18,500,000 National Bank For Agriculture And Rural Development

Debentures | -4% ₹113 Cr 11,500 Hinduja Leyland Finance Limited

Debentures | -4% ₹108 Cr 11,000 Nuvama Wealth Finance Limited

Debentures | -3% ₹96 Cr 9,500 GMR Airports Limited

Debentures | -3% ₹82 Cr 8,000 Jubilant Bevco Limited

Debentures | -3% ₹80 Cr 7,400 Jtpm Metal TRaders Limited

Debentures | -3% ₹79 Cr 7,673 Kogta Financial (India) Limited

Debentures | -2% ₹72 Cr 7,250 3. ICICI Prudential Regular Savings Fund

ICICI Prudential Regular Savings Fund

Growth Launch Date 3 Dec 10 NAV (18 Feb 26) ₹33.5203 ↓ -0.03 (-0.08 %) Net Assets (Cr) ₹5,920 on 31 Dec 25 Category Debt - Credit Risk AMC ICICI Prudential Asset Management Company Limited Rating ☆ Risk Moderate Expense Ratio 1.43 Sharpe Ratio 3.32 Information Ratio 0 Alpha Ratio 0 Min Investment 10,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Yield to Maturity 8.28% Effective Maturity 2 Years 11 Months 19 Days Modified Duration 1 Year 10 Months 24 Days Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹10,637 31 Jan 23 ₹11,163 31 Jan 24 ₹12,051 31 Jan 25 ₹13,030 31 Jan 26 ₹14,220 Returns for ICICI Prudential Regular Savings Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 18 Feb 26 Duration Returns 1 Month 0.8% 3 Month 1.7% 6 Month 4.3% 1 Year 9.6% 3 Year 8.6% 5 Year 7.4% 10 Year 15 Year Since launch 8.3% Historical performance (Yearly) on absolute basis

Year Returns 2024 9.5% 2023 8.5% 2022 7.2% 2021 5.1% 2020 6.2% 2019 9.8% 2018 9.5% 2017 6.6% 2016 6.8% 2015 9.5% Fund Manager information for ICICI Prudential Regular Savings Fund

Name Since Tenure Manish Banthia 7 Nov 16 9.24 Yr. Akhil Kakkar 22 Jan 24 2.03 Yr. Data below for ICICI Prudential Regular Savings Fund as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 13.75% Equity 9.52% Debt 76.34% Other 0.38% Debt Sector Allocation

Sector Value Corporate 62.53% Government 14.64% Cash Equivalent 12.93% Credit Quality

Rating Value A 21.46% AA 57.58% AAA 20.96% Top Securities Holdings / Portfolio

Name Holding Value Quantity 6.68% Gs 2040

Sovereign Bonds | -6% ₹336 Cr 34,926,400 Embassy Office Parks REIT (Real Estate)

-, Since 30 Apr 25 | EMBASSY4% ₹252 Cr 5,791,885 Keystone Realtors Limited

Debentures | -4% ₹234 Cr 23,500 Millennia Realtors Private Limited

Debentures | -4% ₹210 Cr 2,100 Vedanta Limited

Debentures | -3% ₹201 Cr 20,000 Adani Enterprises Limited

Debentures | -3% ₹198 Cr 20,000 Bamboo Hotel And Global Centre (Delhi) Private Limited

Debentures | -3% ₹187 Cr 18,500 Jtpm Metal TRaders Limited

Debentures | -3% ₹186 Cr 18,000 Varroc Engineering Limited

Debentures | -3% ₹172 Cr 25,000 Nirma Limited

Debentures | -3% ₹151 Cr 15,000 4. Nippon India Credit Risk Fund

Nippon India Credit Risk Fund

Growth Launch Date 8 Jun 05 NAV (18 Feb 26) ₹36.6682 ↑ 0.00 (0.01 %) Net Assets (Cr) ₹1,016 on 31 Dec 25 Category Debt - Credit Risk AMC Nippon Life Asset Management Ltd. Rating ☆☆ Risk Moderate Expense Ratio 1.46 Sharpe Ratio 2.73 Information Ratio 0 Alpha Ratio 0 Min Investment 500 Min SIP Investment 100 Exit Load 0-12 Months (1%),12 Months and above(NIL) Yield to Maturity 6.91% Effective Maturity 9 Months 7 Days Modified Duration 8 Months 19 Days Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹11,334 31 Jan 23 ₹11,791 31 Jan 24 ₹12,743 31 Jan 25 ₹13,804 31 Jan 26 ₹14,967 Returns for Nippon India Credit Risk Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 18 Feb 26 Duration Returns 1 Month 1% 3 Month 1.5% 6 Month 3.5% 1 Year 8.9% 3 Year 8.5% 5 Year 8.5% 10 Year 15 Year Since launch 6.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 8.9% 2023 8.3% 2022 7.9% 2021 3.9% 2020 13.5% 2019 -5.9% 2018 1.9% 2017 6.1% 2016 7% 2015 10% Fund Manager information for Nippon India Credit Risk Fund

Name Since Tenure Kinjal Desai 25 May 18 7.7 Yr. Sushil Budhia 1 Feb 20 6.01 Yr. Lokesh Maru 5 Sep 25 0.41 Yr. Divya Sharma 5 Sep 25 0.41 Yr. Data below for Nippon India Credit Risk Fund as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 12.38% Debt 87.33% Other 0.29% Debt Sector Allocation

Sector Value Corporate 69.67% Government 17.66% Cash Equivalent 12.38% Credit Quality

Rating Value A 29.3% AA 37.99% AAA 32.71% Top Securities Holdings / Portfolio

Name Holding Value Quantity 7.02% Gs 2031

Sovereign Bonds | -7% ₹77 Cr 7,500,000 Renew Solar Energy (Jharkhand Five) Private Limited

Debentures | -5% ₹47 Cr 5,000 TRuhome Finance Limited

Debentures | -4% ₹41 Cr 4,000 Navi Finserv Limited

Debentures | -4% ₹40 Cr 40,000 GAursons India Private Limited

Debentures | -4% ₹40 Cr 4,000 The Sandur Manganese And Iron Ores Limited

Debentures | -4% ₹37 Cr 4,000 Mancherial Repallewada Road Private Limited

Debentures | -3% ₹36 Cr 4,500 Delhi International Airport Limited

Debentures | -3% ₹36 Cr 3,500 Vedanta Limited

Debentures | -3% ₹35 Cr 3,500 Renserv Global Private Limited

Debentures | -3% ₹35 Cr 3,500 5. Kotak Medium Term Fund

Kotak Medium Term Fund

Growth Launch Date 25 Mar 14 NAV (18 Feb 26) ₹23.8393 ↓ -0.03 (-0.11 %) Net Assets (Cr) ₹2,015 on 31 Dec 25 Category Debt - Medium term Bond AMC Kotak Mahindra Asset Management Co Ltd Rating ☆☆☆ Risk Moderate Expense Ratio 1.63 Sharpe Ratio 1.71 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-18 Months (2%),18 Months and above(NIL) Yield to Maturity 7.89% Effective Maturity 4 Years 8 Months 8 Days Modified Duration 3 Years 2 Months 23 Days Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹10,484 31 Jan 23 ₹10,809 31 Jan 24 ₹11,582 31 Jan 25 ₹12,584 31 Jan 26 ₹13,614 Returns for Kotak Medium Term Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 18 Feb 26 Duration Returns 1 Month 0.9% 3 Month 1.4% 6 Month 4% 1 Year 8.8% 3 Year 8.3% 5 Year 6.7% 10 Year 15 Year Since launch 7.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 8.9% 2023 9% 2022 6.1% 2021 3.2% 2020 4.7% 2019 8.5% 2018 7% 2017 5.4% 2016 6.6% 2015 10.9% Fund Manager information for Kotak Medium Term Fund

Name Since Tenure Deepak Agrawal 25 Mar 14 11.87 Yr. Vihag Mishra 1 Jun 25 0.67 Yr. Data below for Kotak Medium Term Fund as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 7.59% Equity 9.74% Debt 82.39% Other 0.29% Debt Sector Allocation

Sector Value Corporate 72.02% Government 10.36% Cash Equivalent 7.59% Credit Quality

Rating Value A 8.05% AA 53.96% AAA 37.99% Top Securities Holdings / Portfolio

Name Holding Value Quantity Jtpm Metal TRaders Limited

Debentures | -5% ₹103 Cr 10,000 L&T Metro Rail (Hyderabad) Limited

Debentures | -5% ₹100 Cr 10,000 Bamboo Hotel And Global Centre (Delhi) Private Limited

Debentures | -5% ₹91 Cr 9,000 Adani Power Ltd

Debentures | -5% ₹90 Cr 9,000

↑ 9,000 Embassy Office Parks REIT (Real Estate)

-, Since 31 May 21 | EMBASSY4% ₹87 Cr 1,998,346 TATA Steel Limited

Debentures | -4% ₹76 Cr 750 Pipeline Infrastructure Limited

Debentures | -3% ₹64 Cr 6,280 Aditya Birla Renewables Limited

Debentures | -3% ₹60 Cr 6,000 Aditya Birla Real Estate Limited

Debentures | -3% ₹55 Cr 5,500 Indigrid Infrastructure Trust

Debentures | -3% ₹51 Cr 5,000 6. ICICI Prudential Constant Maturity Gilt Fund

ICICI Prudential Constant Maturity Gilt Fund

Growth Launch Date 12 Sep 14 NAV (18 Feb 26) ₹25.4107 ↓ -0.02 (-0.07 %) Net Assets (Cr) ₹2,550 on 31 Dec 25 Category Debt - 10 Yr Govt Bond AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆ Risk Moderate Expense Ratio 0.39 Sharpe Ratio 0.45 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-7 Days (0.25%),7 Days and above(NIL) Yield to Maturity 6.82% Effective Maturity 9 Years 7 Months 13 Days Modified Duration 6 Years 9 Months 25 Days Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹10,202 31 Jan 23 ₹10,450 31 Jan 24 ₹11,300 31 Jan 25 ₹12,356 31 Jan 26 ₹13,180 Returns for ICICI Prudential Constant Maturity Gilt Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 18 Feb 26 Duration Returns 1 Month 1% 3 Month 1.1% 6 Month 2.7% 1 Year 7.1% 3 Year 8.2% 5 Year 6.2% 10 Year 15 Year Since launch 8.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 7.5% 2023 9.3% 2022 7.7% 2021 1.2% 2020 2.8% 2019 13.6% 2018 12.8% 2017 9.7% 2016 2.4% 2015 16.2% Fund Manager information for ICICI Prudential Constant Maturity Gilt Fund

Name Since Tenure Manish Banthia 22 Jan 24 2.03 Yr. Raunak Surana 22 Jan 24 2.03 Yr. Data below for ICICI Prudential Constant Maturity Gilt Fund as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 7.5% Debt 92.5% Debt Sector Allocation

Sector Value Government 92.5% Cash Equivalent 7.5% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity 6.64% Gs 2035

Sovereign Bonds | -29% ₹725 Cr 73,000,000 7.18% Gs 2037

Sovereign Bonds | -17% ₹420 Cr 41,200,000 7.10% Gs 2034

Sovereign Bonds | -16% ₹406 Cr 39,719,850 7.41% Gs 2036

Sovereign Bonds | -14% ₹348 Cr 33,500,000 6.68% Gs 2040

Sovereign Bonds | -13% ₹318 Cr 32,992,500 6.79% Gs 2034

Sovereign Bonds | -7% ₹173 Cr 17,208,200 6.19% Gs 2034

Sovereign Bonds | -1% ₹29 Cr 3,000,000 6.48% Gs 2035

Sovereign Bonds | -1% ₹26 Cr 2,666,300

↓ -1,000,000 6.67% Gs 2035

Sovereign Bonds | -1% ₹25 Cr 2,500,000 Interest Rate Swaps- Md -06-Jan-2031 (Pay Fixed/Receive Float)

- | -6% -₹150 Cr 7. SBI Credit Risk Fund

SBI Credit Risk Fund

Growth Launch Date 19 Jul 04 NAV (18 Feb 26) ₹47.539 ↓ -0.01 (-0.01 %) Net Assets (Cr) ₹2,175 on 31 Dec 25 Category Debt - Credit Risk AMC SBI Funds Management Private Limited Rating ☆☆☆☆ Risk Moderate Expense Ratio 1.55 Sharpe Ratio 1.8 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-12 Months (3%),12-24 Months (1.5%),24-36 Months (0.75%),36 Months and above(NIL) Yield to Maturity 8.15% Effective Maturity 2 Years 10 Months 17 Days Modified Duration 2 Years 1 Month 24 Days Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹10,519 31 Jan 23 ₹10,972 31 Jan 24 ₹11,900 31 Jan 25 ₹12,873 31 Jan 26 ₹13,827 Returns for SBI Credit Risk Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 18 Feb 26 Duration Returns 1 Month 1% 3 Month 1.3% 6 Month 3.3% 1 Year 7.8% 3 Year 8.2% 5 Year 6.9% 10 Year 15 Year Since launch 7.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 7.9% 2023 8.1% 2022 8.3% 2021 4.2% 2020 5% 2019 9.8% 2018 6.5% 2017 6.2% 2016 6.9% 2015 10.5% Fund Manager information for SBI Credit Risk Fund

Name Since Tenure Lokesh Mallya 1 Feb 17 9.01 Yr. Data below for SBI Credit Risk Fund as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 14.08% Equity 4.2% Debt 81.34% Other 0.38% Debt Sector Allocation

Sector Value Corporate 64.06% Government 17.28% Cash Equivalent 14.08% Credit Quality

Rating Value A 18.19% AA 60.03% AAA 21.78% Top Securities Holdings / Portfolio

Name Holding Value Quantity 7.02% Gs 2031

Sovereign Bonds | -7% ₹153 Cr 15,000,000 Infopark Properties Limited

Debentures | -5% ₹105 Cr 10,500 Renew Solar Energy (Jharkhand Five) Private Limited

Debentures | -5% ₹103 Cr 11,000 H.G. Infra Engineering Limited

Debentures | -5% ₹99 Cr 10,000 Nj Capital Private Limited

Debentures | -5% ₹99 Cr 10,000 6.48% Gs 2035

Sovereign Bonds | -5% ₹98 Cr 10,000,000 Jtpm Metal TRaders Limited

Debentures | -4% ₹93 Cr 9,000 Renserv Global Private Limited

Debentures | -4% ₹80 Cr 8,000 Avanse Financial Services Limited

Debentures | -4% ₹80 Cr 8,000 The Sandur Manganese And Iron Ores Limited

Debentures | -4% ₹80 Cr 8,500 8. Axis Strategic Bond Fund

Axis Strategic Bond Fund

Growth Launch Date 28 Mar 12 NAV (18 Feb 26) ₹29.1382 ↓ -0.01 (-0.03 %) Net Assets (Cr) ₹2,059 on 31 Dec 25 Category Debt - Medium term Bond AMC Axis Asset Management Company Limited Rating ☆☆☆☆ Risk Moderate Expense Ratio 1.08 Sharpe Ratio 1.39 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-12 Months (1%),12 Months and above(NIL) Yield to Maturity 7.86% Effective Maturity 4 Years 7 Months 6 Days Modified Duration 3 Years 3 Months 29 Days Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹10,526 31 Jan 23 ₹10,958 31 Jan 24 ₹11,778 31 Jan 25 ₹12,796 31 Jan 26 ₹13,780 Returns for Axis Strategic Bond Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 18 Feb 26 Duration Returns 1 Month 0.8% 3 Month 1.2% 6 Month 3.2% 1 Year 8% 3 Year 8.1% 5 Year 6.8% 10 Year 15 Year Since launch 8% Historical performance (Yearly) on absolute basis

Year Returns 2024 8.2% 2023 8.7% 2022 7.3% 2021 3.8% 2020 5.2% 2019 10.5% 2018 7.1% 2017 6.7% 2016 7.5% 2015 11.6% Fund Manager information for Axis Strategic Bond Fund

Name Since Tenure Devang Shah 5 Nov 12 13.25 Yr. Sachin Jain 1 Feb 23 3 Yr. Akhil Thakker 1 Feb 23 3 Yr. Data below for Axis Strategic Bond Fund as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 3.04% Equity 2.39% Debt 94.28% Other 0.29% Debt Sector Allocation

Sector Value Corporate 64.52% Government 29.75% Cash Equivalent 3.04% Credit Quality

Rating Value A 12.29% AA 48.07% AAA 39.64% Top Securities Holdings / Portfolio

Name Holding Value Quantity 6.48% Gs 2035

Sovereign Bonds | -8% ₹156 Cr 15,800,000

↓ -5,000,000 7.10% Gs 2034

Sovereign Bonds | -6% ₹115 Cr 11,200,000 Jubilant Beverages Limited

Debentures | -3% ₹70 Cr 6,500 GMR Hyderabad International Airport Ltd

Debentures | -3% ₹66 Cr 6,500 7.18% Tamilnadu Sgs 2033

Sovereign Bonds | -3% ₹63 Cr 6,358,600

↑ 6,358,600 Vedanta Limited

Debentures | -3% ₹60 Cr 6,000 Adani Power Ltd

Debentures | -3% ₹60 Cr 6,000

↑ 6,000 Jubilant Bevco Limited

Debentures | -3% ₹59 Cr 5,500 Nuvama Wealth Finance Limited

Debentures | -3% ₹58 Cr 5,800 Delhi International Airport Limited

Debentures | -3% ₹56 Cr 5,500

ಇಲ್ಲಿ ಒದಗಿಸಲಾದ ಮಾಹಿತಿಯು ನಿಖರವಾಗಿದೆ ಎಂದು ಖಚಿತಪಡಿಸಿಕೊಳ್ಳಲು ಎಲ್ಲಾ ಪ್ರಯತ್ನಗಳನ್ನು ಮಾಡಲಾಗಿದೆ. ಆದಾಗ್ಯೂ, ಡೇಟಾದ ನಿಖರತೆಯ ಬಗ್ಗೆ ಯಾವುದೇ ಗ್ಯಾರಂಟಿಗಳನ್ನು ನೀಡಲಾಗುವುದಿಲ್ಲ. ಯಾವುದೇ ಹೂಡಿಕೆ ಮಾಡುವ ಮೊದಲು ದಯವಿಟ್ಟು ಸ್ಕೀಮ್ ಮಾಹಿತಿ ದಾಖಲೆಯೊಂದಿಗೆ ಪರಿಶೀಲಿಸಿ.

Research Highlights for Aditya Birla Sun Life Credit Risk Fund