ICICI Bank Wedding Loan - A Complete Detail

Weddings are the grandest seasons. It’s a once in a lifetime moment that drives everyone wild with excitement and joy. Right from choosing the perfect dress to booking the right venue, everything seems surreal. However, things might start getting intense with the wedding dates drawing closer and the expenses that usually take a toll. But, expenses should not be the reason you stop booking that favourite band or that dream honeymoon vacation.

ICICI Wedding loans offer great interest rates and features for anyone looking to make that wedding dream come true. Sometimes the savings might fall short, but there is help. ICICI Wedding loans are Collateral-free that offer the flexibility of a long repayment tenure with EMI option.

Benefits of ICICI Bank Marriage Loan

1. Interest Rate

ICICI Bank offers wedding loan starting at just 10.50% p.a. Please note that the final rate of interest will depend on your credit score, income level, etc.

2. Loan Amount

ICICI bank is one of the few banks offering high wedding loan amount. You can avail loan amount ranging from Rs. 50,000 to Rs. 25 Lakhs

3. Collateral-Free Loan

One of the best features of the wedding loan is that you don’t have to submit any collateral or have a guarantor.

4. Minimum Paperwork

ICICI bank offers loans with minimum paper work. You can get your loan approved within a few minutes.

Talk to our investment specialist

6. Fast Fund Disbursal

Once you are done with the submission of the important documents, you will directly get the approved loan amount into your savings bank account within a few hours (or a few working days in case).

7. No Restrictions

You can use the loan amount for anything you wish. It could be booking the dream venue, caterers, designer clothes, makeup artist, flight tickets for the dream vacation and more.

8. EMI and Tenure

You can repay the loan within 1 to 5 years with a flexible EMI repayment option.

Eligibility for ICICI Bank Wedding Loan

Mentioned below is the eligibility criteria to avail the loan from ICICI bank:

1. Age

You should be minimum 23 years of age or above to avail ICICI wedding loan.

2. Occupation

Both salaried and self-employed individuals should have a minimum work experience of 2 years with proof of steady income.

Documents Required

Mentioned below are the documents required for applying the wedding loan:

Salaried Individuals

- Application form

- Photographs

- Identity Proof (Voter ID Card, PAN Card, Passport, Driving License)

- Address Proof (Utility Bill, Leave and License Agreement, Passport)

- Age Proof

- Bank statements

- Signature verification

- Latest Salary Slip/Form 16

- Employment Stability Proof

Self-Employed Professional

- Application Form

- Photographs

- Identity Proof

- Address Proof

- Age Proof

- Bank Statements

- Signature Verification

- Incomes Tax returns of two previous financial years

- Business stability proof/Ownership proof

How to Apply for ICICI Wedding Loan?

- Internet Banking: You can apply for the loan through the official site of ICICI bank.

- iMobile App: Download the mobile App for availing and managing ICICI wedding loan.

- SMS: Apply for loan by sending SMS PL to 5676766.

- Branch: Visit the nearest ICICI branch for submitting application for loan.

ICICI Bank Loan Customer Care

Call on 1860 120 7777 for any queries or complaints.

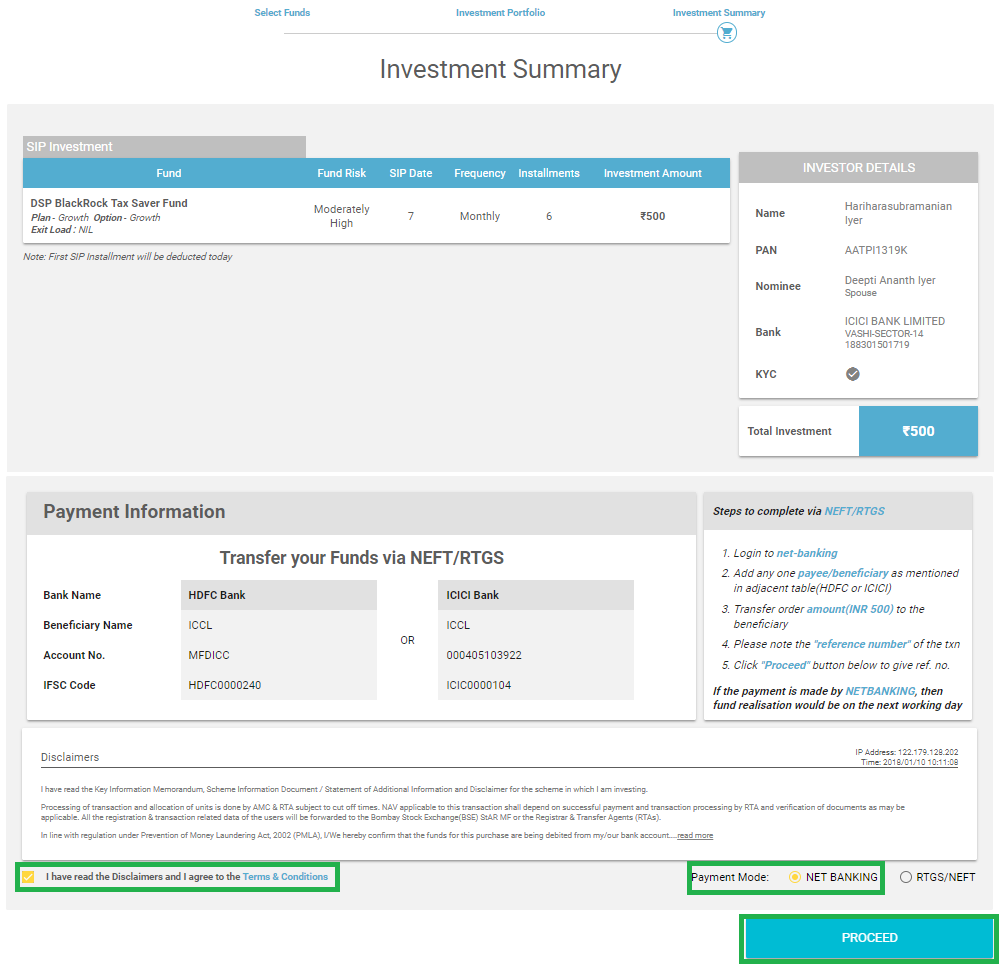

Achieving Financial Goals Via SIP!

While attractive loan repayment options are available, another popular option doesn’t require taking a loan. Yes, Systematic Investment plan (SIP)! It is one of the best ways to fund your daughter’s wedding. Here’s why:

1. Disciplined Investment

You can make a monthly contribution to save for the dream wedding day. This will also help you stay focussed on the financial planning for the wedding.

2. Great Return on Investment

Saving for the wedding day also comes with some perks. Monthly and regular savings for 1-5 years will generate a high return on your investment. This will give you the extra edge when it comes to creating a budget for the wedding.

SIP Calculator - Estimate Wedding Expenses

If you are planning to fulfil a certain goal, then a sip calculator will help you to calculate the amount you need to invest.

SIP calculator is a tool for investors to determine the expected return of the SIP investment. With the help of a SIP calculator, one can calculate the amount of investment and time period of Investing requires to reach one's financial goal.

Know Your SIP Returns

Conclusion

Make your dream wedding come true with ICICI bank wedding loan. Make sure to have all the required documents in hand before applying for the loan. Read all the loan related documents carefully before applying for the loan.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.