सर्वोत्तम लाभांश देणारे म्युच्युअल फंड 2022 - 2023

पासून, आजकाल अनेक गुंतवणूकदारम्युच्युअल फंडात गुंतवणूक करा नियमित कमाई करण्यासाठीउत्पन्न, म्युच्युअल फंड सल्लागार या योजना पुढे नेण्यासाठी "नियमित लाभांश" वापरतात. अशा प्रकारे, आम्ही चालू वर्षात उच्च लाभांश उत्पन्न देणार्या काही सर्वोत्तम योजनांची निवड केली आहे.

![]()

भारतातील म्युच्युअल फंड योजना गेल्या काही वर्षांत वाढल्या आहेत. परिणामी, दसर्वोत्तम कामगिरी करणारे म्युच्युअल फंड मध्येबाजार बदलत रहा. क्रिसिल, मॉर्निंग स्टार, ICRA या म्युच्युअल फंड योजनेचा न्याय करण्यासाठी विविध रेटिंग प्रणाली आहेत. या प्रणाली म्युच्युअल फंडाचे विविध पॅरामीटर्स द्वारे मूल्यांकन करतात जसे की मागील परतावा,प्रमाणित विचलन, माहिती गुणोत्तर, इ. काही रेटिंग प्रणाली गुणात्मक आणि परिमाणात्मक घटकांचा देखील विचार करतातम्युच्युअल फंड. या सर्व घटकांच्या बेरजेमुळे भारतातील सर्वोत्तम कामगिरी करणाऱ्या म्युच्युअल फंडांचे रेटिंग मिळते.

लाभांश देणाऱ्या म्युच्युअल फंडात गुंतवणूक का करावी?

लाभांश देणारे म्युच्युअल फंड गुंतवणूकदारांना वार्षिक पेआउट देतात. हे पेआउट सहसा नियमित केले जातातआधार आणि म्हणून, एकगुंतवणूकदार या निधीसह सुरक्षित आणि सुरक्षित वाटते. हा लाभांश मागील वर्षात योजनेद्वारे कमावलेल्या महसुलातून दिला जाईल.

विशिष्ट स्तरावर पोहोचल्यावर लगेचच लाभांश दिला जात असल्याने, लाभांश पर्यायासह म्युच्युअल फंड त्यांच्या निव्वळ मालमत्ता मूल्यात उच्च वाढ दर्शवत नाहीत (नाही).AMCs च्या बाबतीत 28.84 टक्के लाभांश वितरण कर (DDT) भरणे आवश्यक आहे.कर्ज निधी आणि यात उपकर आणि अधिभार समाविष्ट आहे.इक्विटी डीडीटी आकर्षित करू नका. हे फंड अशांसाठी आदर्श आहेत ज्यांना जोखीम घेण्याची भूक नाही आणि ज्यांना उत्पन्नाचा स्रोत म्हणून नियमित पेआउट मिळवायचे आहे.

लाभांश उत्पन्नाची गणना मुदतीदरम्यान दिलेल्या लाभांशाच्या बेरीजला त्याच्या वर्तमान NAV (नेट मालमत्ता मूल्य) द्वारे विभाजित करून केली जाते. त्यानंतर निकाल वार्षिक केला जातो. म्युच्युअल फंड योजना त्यांच्या नफ्यातून लाभांश देतात. अशा प्रकारे, प्रत्येक वेळी जेव्हा एखादी योजना लाभांश घोषित करते तेव्हा तिची NAV प्रमाणानुसार कमी होते.

ऑनलाइन लाभांश देणाऱ्या म्युच्युअल फंडामध्ये गुंतवणूक कशी करावी?

Fincash.com वर आजीवन मोफत गुंतवणूक खाते उघडा.

तुमची नोंदणी आणि KYC प्रक्रिया पूर्ण करा

दस्तऐवज अपलोड करा (PAN, आधार इ.).आणि, तुम्ही गुंतवणूक करण्यास तयार आहात!

Talk to our investment specialist

आर्थिक वर्ष 22 - 23 साठी सर्वाधिक लाभांश देणारे फंड

टॉप 5 लार्ज कॅप इक्विटी डिव्हिडंड फंड FY 22 - 23

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Indiabulls Blue Chip Fund Normal Dividend, Payout ₹25.18

↑ 0.10 ₹132 1 4.1 16.9 15 11.7 7.5 Nippon India Large Cap Fund Normal Dividend, Payout ₹27.452

↑ 0.14 ₹50,876 0.2 2.9 16.3 18.6 16.9 9 SBI Bluechip Fund Normal Dividend, Payout ₹54.735

↑ 0.28 ₹55,879 1.4 4.6 14.9 14.7 12.4 9.7 ICICI Prudential Bluechip Fund Normal Dividend, Payout ₹30.86

↑ 0.12 ₹78,502 -1.2 2.6 13.8 17.4 14.8 10.5 Aditya Birla Sun Life Frontline Equity Fund Normal Dividend, Payout ₹40.21

↑ 0.13 ₹31,386 -0.6 2.4 13.6 15.2 12.8 9 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Indiabulls Blue Chip Fund Nippon India Large Cap Fund SBI Bluechip Fund ICICI Prudential Bluechip Fund Aditya Birla Sun Life Frontline Equity Fund Point 1 Bottom quartile AUM (₹132 Cr). Lower mid AUM (₹50,876 Cr). Upper mid AUM (₹55,879 Cr). Highest AUM (₹78,502 Cr). Bottom quartile AUM (₹31,386 Cr). Point 2 Established history (14+ yrs). Established history (18+ yrs). Established history (20+ yrs). Established history (17+ yrs). Oldest track record among peers (23 yrs). Point 3 Top rated. Rating: 4★ (upper mid). Rating: 4★ (lower mid). Rating: 4★ (bottom quartile). Rating: 4★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 11.75% (bottom quartile). 5Y return: 16.94% (top quartile). 5Y return: 12.36% (bottom quartile). 5Y return: 14.76% (upper mid). 5Y return: 12.81% (lower mid). Point 6 3Y return: 14.99% (bottom quartile). 3Y return: 18.58% (top quartile). 3Y return: 14.66% (bottom quartile). 3Y return: 17.44% (upper mid). 3Y return: 15.20% (lower mid). Point 7 1Y return: 16.90% (top quartile). 1Y return: 16.33% (upper mid). 1Y return: 14.93% (lower mid). 1Y return: 13.82% (bottom quartile). 1Y return: 13.62% (bottom quartile). Point 8 Alpha: -2.54 (bottom quartile). Alpha: -1.11 (bottom quartile). Alpha: -0.41 (upper mid). Alpha: 0.51 (top quartile). Alpha: -1.03 (lower mid). Point 9 Sharpe: 0.16 (bottom quartile). Sharpe: 0.28 (bottom quartile). Sharpe: 0.34 (upper mid). Sharpe: 0.41 (top quartile). Sharpe: 0.28 (lower mid). Point 10 Information ratio: -0.28 (bottom quartile). Information ratio: 1.12 (top quartile). Information ratio: -0.28 (bottom quartile). Information ratio: 1.07 (upper mid). Information ratio: 0.30 (lower mid). Indiabulls Blue Chip Fund

Nippon India Large Cap Fund

SBI Bluechip Fund

ICICI Prudential Bluechip Fund

Aditya Birla Sun Life Frontline Equity Fund

टॉप 5 मिड कॅप इक्विटी डिव्हिडंड फंड FY 22 - 23

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Sundaram Mid Cap Fund Normal Dividend, Payout ₹66.9098

↑ 0.30 ₹13,293 0.4 4.4 22.2 24.9 19.6 3.5 Kotak Emerging Equity Scheme Normal Dividend, Payout ₹75.859

↑ 0.48 ₹60,637 0.3 1.4 21.8 21.8 19.6 1.8 Taurus Discovery (Midcap) Fund Normal Dividend, Payout ₹104.78

↑ 0.10 ₹129 -4.9 -1.7 13.1 15.6 14.5 0.8 HDFC Mid-Cap Opportunities Fund Normal Dividend, Payout ₹56.521

↑ 0.17 ₹92,642 0.7 6.1 22.3 26.3 23 6.9 Edelweiss Mid Cap Fund Normal Dividend, Payout ₹60.03

↑ 0.38 ₹13,650 0.1 3.2 21.7 26.1 21.3 3.8 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Sundaram Mid Cap Fund Kotak Emerging Equity Scheme Taurus Discovery (Midcap) Fund HDFC Mid-Cap Opportunities Fund Edelweiss Mid Cap Fund Point 1 Bottom quartile AUM (₹13,293 Cr). Upper mid AUM (₹60,637 Cr). Bottom quartile AUM (₹129 Cr). Highest AUM (₹92,642 Cr). Lower mid AUM (₹13,650 Cr). Point 2 Oldest track record among peers (23 yrs). Established history (18+ yrs). Established history (17+ yrs). Established history (18+ yrs). Established history (18+ yrs). Point 3 Top rated. Rating: 4★ (upper mid). Rating: 4★ (lower mid). Rating: 3★ (bottom quartile). Rating: 3★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: High. Point 5 5Y return: 19.57% (bottom quartile). 5Y return: 19.60% (lower mid). 5Y return: 14.48% (bottom quartile). 5Y return: 23.00% (top quartile). 5Y return: 21.35% (upper mid). Point 6 3Y return: 24.86% (lower mid). 3Y return: 21.85% (bottom quartile). 3Y return: 15.64% (bottom quartile). 3Y return: 26.26% (top quartile). 3Y return: 26.05% (upper mid). Point 7 1Y return: 22.23% (upper mid). 1Y return: 21.83% (lower mid). 1Y return: 13.14% (bottom quartile). 1Y return: 22.30% (top quartile). 1Y return: 21.70% (bottom quartile). Point 8 Alpha: -2.31 (lower mid). Alpha: -3.77 (bottom quartile). Alpha: -5.01 (bottom quartile). Alpha: 0.66 (top quartile). Alpha: -1.98 (upper mid). Point 9 Sharpe: -0.04 (lower mid). Sharpe: -0.11 (bottom quartile). Sharpe: -0.18 (bottom quartile). Sharpe: 0.12 (top quartile). Sharpe: -0.02 (upper mid). Point 10 Information ratio: -0.05 (lower mid). Information ratio: -0.44 (bottom quartile). Information ratio: -1.62 (bottom quartile). Information ratio: 0.45 (top quartile). Information ratio: 0.40 (upper mid). Sundaram Mid Cap Fund

Kotak Emerging Equity Scheme

Taurus Discovery (Midcap) Fund

HDFC Mid-Cap Opportunities Fund

Edelweiss Mid Cap Fund

टॉप 5 स्मॉल कॅप डिव्हिडंड फंड FY 22 - 23

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Aditya Birla Sun Life Small Cap Fund Normal Dividend, Payout ₹35.4648

↑ 0.16 ₹4,938 -2 0.8 19.8 18.1 15.2 -4.1 SBI Small Cap Fund Normal Dividend, Payout ₹96.697

↑ 0.29 ₹36,268 -4.6 -4.8 9.4 13.5 16 -4.9 DSP Small Cap Fund Normal Dividend, Payout ₹53.846

↑ 0.23 ₹16,935 -0.8 1 20 20.6 20 -2.8 HDFC Small Cap Fund Normal Dividend, Payout ₹43.455

↑ 0.10 ₹37,753 -4.7 -3.8 15.6 18.8 20.8 -0.5 Nippon India Small Cap Fund Normal Dividend, Payout ₹84.5373

↑ 0.27 ₹68,287 -3.7 -1.8 14.1 20.6 24 -5.4 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Aditya Birla Sun Life Small Cap Fund SBI Small Cap Fund DSP Small Cap Fund HDFC Small Cap Fund Nippon India Small Cap Fund Point 1 Bottom quartile AUM (₹4,938 Cr). Lower mid AUM (₹36,268 Cr). Bottom quartile AUM (₹16,935 Cr). Upper mid AUM (₹37,753 Cr). Highest AUM (₹68,287 Cr). Point 2 Oldest track record among peers (18 yrs). Established history (16+ yrs). Established history (15+ yrs). Established history (17+ yrs). Established history (15+ yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 4★ (lower mid). Rating: 4★ (bottom quartile). Rating: 4★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 15.16% (bottom quartile). 5Y return: 15.95% (bottom quartile). 5Y return: 20.03% (lower mid). 5Y return: 20.83% (upper mid). 5Y return: 24.03% (top quartile). Point 6 3Y return: 18.11% (bottom quartile). 3Y return: 13.53% (bottom quartile). 3Y return: 20.64% (top quartile). 3Y return: 18.84% (lower mid). 3Y return: 20.57% (upper mid). Point 7 1Y return: 19.83% (upper mid). 1Y return: 9.39% (bottom quartile). 1Y return: 20.03% (top quartile). 1Y return: 15.55% (lower mid). 1Y return: 14.15% (bottom quartile). Point 8 Alpha: 0.00 (top quartile). Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 0.00 (bottom quartile). Alpha: -1.73 (bottom quartile). Point 9 Sharpe: -0.33 (lower mid). Sharpe: -0.54 (bottom quartile). Sharpe: -0.25 (upper mid). Sharpe: -0.23 (top quartile). Sharpe: -0.44 (bottom quartile). Point 10 Information ratio: 0.00 (top quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: 0.00 (bottom quartile). Information ratio: -0.12 (bottom quartile). Aditya Birla Sun Life Small Cap Fund

SBI Small Cap Fund

DSP Small Cap Fund

HDFC Small Cap Fund

Nippon India Small Cap Fund

टॉप 5 डायव्हर्सिफाइड/मल्टी कॅप इक्विटी डिव्हिडंड फंड FY 22 - 23

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Kotak Standard Multicap Fund Normal Dividend, Payout ₹53.663

↑ 0.19 ₹56,460 1.8 5.1 20.5 17.9 14.1 9.5 Mirae Asset India Equity Fund Normal Dividend, Payout ₹29.722

↑ 0.08 ₹41,802 -1.4 2.8 13.8 13.2 11.1 10.2 Motilal Oswal Multicap 35 Fund Normal Dividend, Payout ₹33.0362

↓ -0.01 ₹13,862 -6.6 -4.5 6.9 21.5 12.1 -6 BNP Paribas Multi Cap Fund Normal Dividend, Payout ₹19.0914

↓ 0.00 ₹588 -4.5 -2.6 19.3 15 11.5 Aditya Birla Sun Life Equity Fund Normal Dividend, Payout ₹162.26

↑ 0.45 ₹25,098 0.2 5.1 18.5 18.2 14.1 10.8 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Kotak Standard Multicap Fund Mirae Asset India Equity Fund Motilal Oswal Multicap 35 Fund BNP Paribas Multi Cap Fund Aditya Birla Sun Life Equity Fund Point 1 Highest AUM (₹56,460 Cr). Upper mid AUM (₹41,802 Cr). Bottom quartile AUM (₹13,862 Cr). Bottom quartile AUM (₹588 Cr). Lower mid AUM (₹25,098 Cr). Point 2 Established history (16+ yrs). Established history (17+ yrs). Established history (11+ yrs). Established history (20+ yrs). Oldest track record among peers (27 yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 5★ (lower mid). Rating: 4★ (bottom quartile). Rating: 4★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 14.09% (top quartile). 5Y return: 11.05% (bottom quartile). 5Y return: 12.11% (lower mid). 5Y return: 11.52% (bottom quartile). 5Y return: 14.06% (upper mid). Point 6 3Y return: 17.85% (lower mid). 3Y return: 13.21% (bottom quartile). 3Y return: 21.51% (top quartile). 3Y return: 15.02% (bottom quartile). 3Y return: 18.23% (upper mid). Point 7 1Y return: 20.48% (top quartile). 1Y return: 13.81% (bottom quartile). 1Y return: 6.93% (bottom quartile). 1Y return: 19.32% (upper mid). 1Y return: 18.45% (lower mid). Point 8 Alpha: 1.61 (upper mid). Alpha: 0.23 (lower mid). Alpha: -13.33 (bottom quartile). Alpha: 0.00 (bottom quartile). Alpha: 2.83 (top quartile). Point 9 Sharpe: 0.28 (bottom quartile). Sharpe: 0.38 (upper mid). Sharpe: -0.54 (bottom quartile). Sharpe: 2.84 (top quartile). Sharpe: 0.38 (lower mid). Point 10 Information ratio: -0.04 (bottom quartile). Information ratio: -0.42 (bottom quartile). Information ratio: 0.47 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: 0.56 (top quartile). Kotak Standard Multicap Fund

Mirae Asset India Equity Fund

Motilal Oswal Multicap 35 Fund

BNP Paribas Multi Cap Fund

Aditya Birla Sun Life Equity Fund

टॉप 5 डिव्हिडंड (ELSS) इक्विटी लिंक्ड सेव्हिंग स्कीम FY 22 - 23

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Tata India Tax Savings Fund Normal Dividend, Payout ₹103.679

↑ 0.35 ₹4,748 0.5 5.8 17.1 16.4 13.4 4.7 Bandhan Tax Advantage (ELSS) Fund Normal Dividend, Payout ₹33.946

↑ 0.11 ₹7,333 0.2 4.3 13.6 15.6 15.5 7.4 Aditya Birla Sun Life Tax Relief '96 Normal Dividend, Payout ₹203.75

↑ 0.40 ₹15,415 0.1 2.7 17.6 15.7 9.5 8.8 DSP Tax Saver Fund Normal Dividend, Payout ₹23.763

↑ 0.09 ₹17,609 1.5 6 16.4 20.8 16.9 7.5 HDFC Long Term Advantage Fund Normal Dividend, Payout ₹51.722

↑ 0.03 ₹1,318 1.2 15.4 35.6 19.6 16.8 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Tata India Tax Savings Fund Bandhan Tax Advantage (ELSS) Fund Aditya Birla Sun Life Tax Relief '96 DSP Tax Saver Fund HDFC Long Term Advantage Fund Point 1 Bottom quartile AUM (₹4,748 Cr). Lower mid AUM (₹7,333 Cr). Upper mid AUM (₹15,415 Cr). Highest AUM (₹17,609 Cr). Bottom quartile AUM (₹1,318 Cr). Point 2 Oldest track record among peers (29 yrs). Established history (17+ yrs). Established history (29+ yrs). Established history (19+ yrs). Established history (25+ yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 4★ (lower mid). Rating: 4★ (bottom quartile). Rating: 3★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 13.41% (bottom quartile). 5Y return: 15.46% (lower mid). 5Y return: 9.52% (bottom quartile). 5Y return: 16.90% (top quartile). 5Y return: 16.79% (upper mid). Point 6 3Y return: 16.40% (lower mid). 3Y return: 15.55% (bottom quartile). 3Y return: 15.72% (bottom quartile). 3Y return: 20.75% (top quartile). 3Y return: 19.62% (upper mid). Point 7 1Y return: 17.07% (lower mid). 1Y return: 13.61% (bottom quartile). 1Y return: 17.62% (upper mid). 1Y return: 16.40% (bottom quartile). 1Y return: 35.57% (top quartile). Point 8 Alpha: -2.81 (bottom quartile). Alpha: -0.04 (lower mid). Alpha: 1.01 (upper mid). Alpha: -0.19 (bottom quartile). Alpha: 1.80 (top quartile). Point 9 Sharpe: -0.01 (bottom quartile). Sharpe: 0.16 (lower mid). Sharpe: 0.25 (upper mid). Sharpe: 0.16 (bottom quartile). Sharpe: 2.27 (top quartile). Point 10 Information ratio: -0.32 (lower mid). Information ratio: -0.22 (upper mid). Information ratio: -0.96 (bottom quartile). Information ratio: 0.92 (top quartile). Information ratio: -0.36 (bottom quartile). Tata India Tax Savings Fund

Bandhan Tax Advantage (ELSS) Fund

Aditya Birla Sun Life Tax Relief '96

DSP Tax Saver Fund

HDFC Long Term Advantage Fund

टॉप 5 सेक्टर इक्विटी डिव्हिडंड फंड FY 22 - 23

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) DSP Natural Resources and New Energy Fund Normal Dividend, Payout ₹34.165

↓ -0.18 ₹1,573 9.2 21.7 34.4 22.3 20.8 17.5 Aditya Birla Sun Life Banking And Financial Services Fund Normal Dividend, Payout ₹23.94

↑ 0.16 ₹3,694 1.1 7.6 25.2 17.5 12.3 16.8 Franklin Build India Fund Normal Dividend, Payout ₹42.6075

↑ 0.22 ₹3,036 2 5.5 23 27.2 22.7 2.9 Bandhan Infrastructure Fund Normal Dividend, Payout ₹38.12

↑ 0.11 ₹1,522 -3.6 -2.9 12.8 23.9 21.3 -7.4 Sundaram Rural and Consumption Fund Normal Dividend, Payout ₹26.4289

↑ 0.09 ₹1,584 -7 -5.3 4.6 14.9 12.9 -0.6 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 17 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary DSP Natural Resources and New Energy Fund Aditya Birla Sun Life Banking And Financial Services Fund Franklin Build India Fund Bandhan Infrastructure Fund Sundaram Rural and Consumption Fund Point 1 Bottom quartile AUM (₹1,573 Cr). Highest AUM (₹3,694 Cr). Upper mid AUM (₹3,036 Cr). Bottom quartile AUM (₹1,522 Cr). Lower mid AUM (₹1,584 Cr). Point 2 Established history (17+ yrs). Established history (12+ yrs). Established history (16+ yrs). Established history (14+ yrs). Oldest track record among peers (19 yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 5★ (lower mid). Rating: 5★ (bottom quartile). Rating: 5★ (bottom quartile). Point 4 Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: Moderately High. Point 5 5Y return: 20.83% (lower mid). 5Y return: 12.32% (bottom quartile). 5Y return: 22.73% (top quartile). 5Y return: 21.28% (upper mid). 5Y return: 12.86% (bottom quartile). Point 6 3Y return: 22.28% (lower mid). 3Y return: 17.53% (bottom quartile). 3Y return: 27.19% (top quartile). 3Y return: 23.92% (upper mid). 3Y return: 14.91% (bottom quartile). Point 7 1Y return: 34.35% (top quartile). 1Y return: 25.23% (upper mid). 1Y return: 22.97% (lower mid). 1Y return: 12.81% (bottom quartile). 1Y return: 4.61% (bottom quartile). Point 8 Alpha: 0.00 (top quartile). Alpha: -2.05 (bottom quartile). Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: -9.37 (bottom quartile). Point 9 Sharpe: 0.74 (upper mid). Sharpe: 0.79 (top quartile). Sharpe: -0.09 (lower mid). Sharpe: -0.46 (bottom quartile). Sharpe: -0.41 (bottom quartile). Point 10 Information ratio: 0.00 (upper mid). Information ratio: 0.15 (top quartile). Information ratio: 0.00 (lower mid). Information ratio: 0.00 (bottom quartile). Information ratio: -0.63 (bottom quartile). DSP Natural Resources and New Energy Fund

Aditya Birla Sun Life Banking And Financial Services Fund

Franklin Build India Fund

Bandhan Infrastructure Fund

Sundaram Rural and Consumption Fund

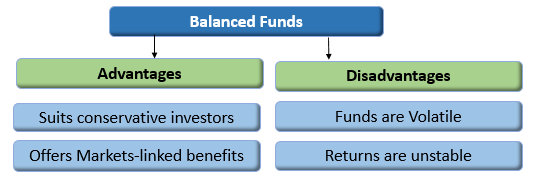

शीर्ष 5 लाभांश बॅलन्स्ड/हायब्रीड फंड FY 22 - 23

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Aditya Birla Sun Life Equity Hybrid 95 Fund Normal Dividend, Payout ₹177.43

↑ 0.34 ₹7,533 -0.1 2.8 10.8 12.5 9.9 5.3 Edelweiss Arbitrage Fund Normal Dividend, Payout ₹14.7464

↑ 0.00 ₹16,270 1.5 3 6.2 7 5.9 6.3 SBI Equity Hybrid Fund Normal Dividend, Payout ₹65.4259

↑ 0.14 ₹82,847 -0.7 2.6 14.2 15.1 12 12.3 Nippon India Equity Hybrid Fund Normal Dividend, Payout ₹28.9329

↑ 0.07 ₹4,102 0.3 3.5 13.4 13.2 13.6 5.6 HDFC Balanced Advantage Fund Normal Dividend, Payout ₹38.681

↑ 0.12 ₹108,205 0.1 3.9 12.4 18.1 16.9 7.2 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Aditya Birla Sun Life Equity Hybrid 95 Fund Edelweiss Arbitrage Fund SBI Equity Hybrid Fund Nippon India Equity Hybrid Fund HDFC Balanced Advantage Fund Point 1 Bottom quartile AUM (₹7,533 Cr). Lower mid AUM (₹16,270 Cr). Upper mid AUM (₹82,847 Cr). Bottom quartile AUM (₹4,102 Cr). Highest AUM (₹108,205 Cr). Point 2 Oldest track record among peers (31 yrs). Established history (11+ yrs). Established history (30+ yrs). Established history (16+ yrs). Established history (25+ yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 4★ (lower mid). Rating: 4★ (bottom quartile). Rating: 4★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately Low. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 9.94% (bottom quartile). 5Y return: 5.94% (bottom quartile). 5Y return: 11.95% (lower mid). 5Y return: 13.59% (upper mid). 5Y return: 16.87% (top quartile). Point 6 3Y return: 12.49% (bottom quartile). 3Y return: 7.01% (bottom quartile). 3Y return: 15.09% (upper mid). 3Y return: 13.23% (lower mid). 3Y return: 18.10% (top quartile). Point 7 1Y return: 10.84% (bottom quartile). 1Y return: 6.15% (bottom quartile). 1Y return: 14.22% (top quartile). 1Y return: 13.38% (upper mid). 1Y return: 12.44% (lower mid). Point 8 1M return: 0.44% (bottom quartile). 1M return: 0.54% (bottom quartile). 1M return: 0.79% (lower mid). 1M return: 1.78% (top quartile). 1M return: 0.88% (upper mid). Point 9 Alpha: -3.20 (bottom quartile). Alpha: -0.82 (lower mid). Alpha: 3.30 (top quartile). Alpha: -2.93 (bottom quartile). Alpha: 0.00 (upper mid). Point 10 Sharpe: -0.03 (bottom quartile). Sharpe: 0.73 (top quartile). Sharpe: 0.63 (upper mid). Sharpe: 0.00 (bottom quartile). Sharpe: 0.09 (lower mid). Aditya Birla Sun Life Equity Hybrid 95 Fund

Edelweiss Arbitrage Fund

SBI Equity Hybrid Fund

Nippon India Equity Hybrid Fund

HDFC Balanced Advantage Fund

शीर्ष 5 लाभांश अल्ट्रा शॉर्ट टर्म डेट फंड FY 22 - 23

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity DSP Money Manager Fund Normal Dividend, Payout ₹1,124.13

↓ -0.02 ₹3,972 1.2 2.6 6.4 6.7 5.4 6.49% 5M 12D 7M 2D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 1 Funds showcased

Commentary DSP Money Manager Fund Point 1 Highest AUM (₹3,972 Cr). Point 2 Oldest track record among peers (13 yrs). Point 3 Top rated. Point 4 Risk profile: Moderately Low. Point 5 1Y return: 6.39% (top quartile). Point 6 1M return: 1.72% (top quartile). Point 7 Sharpe: -0.19 (top quartile). Point 8 Information ratio: 0.00 (top quartile). Point 9 Yield to maturity (debt): 6.49% (top quartile). Point 10 Modified duration: 0.45 yrs (top quartile). DSP Money Manager Fund

शीर्ष 5 लाभांश शॉर्ट टर्म डेट फंड FY 22 - 23

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity Nippon India Short Term Fund Normal Dividend, Payout ₹22.2835

↑ 0.01 ₹9,723 1.3 3.8 11.5 12 12.3 0% Aditya Birla Sun Life Short Term Opportunities Fund Normal Dividend, Payout ₹14.7364

↓ 0.00 ₹10,575 0.6 2.4 6.9 6.8 7.4 7.22% 2Y 9M 18D 3Y 6M 25D Axis Short Term Fund Normal Dividend, Payout ₹21.4701 ₹12,708 1 2.7 7.7 7.6 8.1 7.04% 2Y 3M 14D 2Y 10M 2D HDFC Short Term Debt Fund Normal Dividend, Payout ₹19.7432

↓ 0.00 ₹18,079 1 2.8 7.4 7.8 7.8 7.11% 2Y 5M 12D 3Y 6M 25D Edelweiss Short Term Fund Normal Dividend, Payout ₹13.4217

↑ 0.00 ₹9 0.3 3 8 3.5 0% 9M 6D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Nippon India Short Term Fund Aditya Birla Sun Life Short Term Opportunities Fund Axis Short Term Fund HDFC Short Term Debt Fund Edelweiss Short Term Fund Point 1 Bottom quartile AUM (₹9,723 Cr). Lower mid AUM (₹10,575 Cr). Upper mid AUM (₹12,708 Cr). Highest AUM (₹18,079 Cr). Bottom quartile AUM (₹9 Cr). Point 2 Established history (12+ yrs). Oldest track record among peers (22 yrs). Established history (11+ yrs). Established history (11+ yrs). Established history (13+ yrs). Point 3 Top rated. Rating: 4★ (upper mid). Rating: 3★ (lower mid). Rating: 3★ (bottom quartile). Rating: 2★ (bottom quartile). Point 4 Risk profile: Moderately Low. Risk profile: Moderate. Risk profile: Moderately Low. Risk profile: Moderately Low. Risk profile: Moderately Low. Point 5 1Y return: 11.52% (top quartile). 1Y return: 6.92% (bottom quartile). 1Y return: 7.67% (lower mid). 1Y return: 7.42% (bottom quartile). 1Y return: 8.01% (upper mid). Point 6 1M return: 0.89% (top quartile). 1M return: 0.79% (lower mid). 1M return: 0.78% (bottom quartile). 1M return: 0.79% (upper mid). 1M return: -1.82% (bottom quartile). Point 7 Sharpe: 2.45 (top quartile). Sharpe: 0.78 (bottom quartile). Sharpe: 1.41 (upper mid). Sharpe: 1.26 (lower mid). Sharpe: -0.30 (bottom quartile). Point 8 Information ratio: 0.00 (top quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: 0.00 (bottom quartile). Information ratio: 0.00 (bottom quartile). Point 9 Yield to maturity (debt): 0.00% (bottom quartile). Yield to maturity (debt): 7.22% (top quartile). Yield to maturity (debt): 7.04% (lower mid). Yield to maturity (debt): 7.11% (upper mid). Yield to maturity (debt): 0.00% (bottom quartile). Point 10 Modified duration: 0.00 yrs (top quartile). Modified duration: 2.80 yrs (bottom quartile). Modified duration: 2.29 yrs (lower mid). Modified duration: 2.45 yrs (bottom quartile). Modified duration: 0.00 yrs (upper mid). Nippon India Short Term Fund

Aditya Birla Sun Life Short Term Opportunities Fund

Axis Short Term Fund

HDFC Short Term Debt Fund

Edelweiss Short Term Fund

शीर्ष 5 लाभांश लिक्विड फंड FY 22 - 23

Fund NAV Net Assets (Cr) 1 MO (%) 3 MO (%) 6 MO (%) 1 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity LIC MF Liquid Fund Normal Dividend, Payout ₹1,000.18 ₹12,672 0.5 1.5 2.9 6.3 6.4 6.06% 1M 23D 1M 23D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 1 Funds showcased

Commentary LIC MF Liquid Fund Point 1 Highest AUM (₹12,672 Cr). Point 2 Oldest track record among peers (23 yrs). Point 3 Top rated. Point 4 Risk profile: Low. Point 5 1Y return: 6.26% (top quartile). Point 6 1M return: 0.54% (top quartile). Point 7 Sharpe: 2.54 (top quartile). Point 8 Information ratio: 0.00 (top quartile). Point 9 Yield to maturity (debt): 6.06% (top quartile). Point 10 Modified duration: 0.15 yrs (top quartile). LIC MF Liquid Fund

टॉप 5 डिव्हिडंड गिल्ट फंड FY 22 - 23

"The primary investment objective of the Scheme is to seek capital appreciation by investing predominantly in units of MLIIF - WGF. The Scheme may, at the discretion of the Investment Manager, also invest in the units of other similar overseas mutual fund schemes, which may constitute a significant part of its corpus. The Scheme may also invest a certain portion of its corpus in money market securities and/or units of money market/liquid schemes of DSP Merrill Lynch Mutual Fund, in order to meet liquidity requirements from time to time. However, there is no assurance that the investment objective of the Scheme will be realized." Below is the key information for DSP World Gold Fund Returns up to 1 year are on The primary investment objective of the Scheme is to seek capital appreciation by investing predominantly in the units of BlackRock Global Funds – World Mining Fund. The Scheme may, at the discretion of the Investment Manager, also invest in the units of other similar overseas mutual fund schemes, which may

constitute a significant part of its corpus. The Scheme may also invest a certain portion of its corpus in money market securities and/or money market/liquid schemes of DSP BlackRock Mutual Fund, in order to meet liquidity requirements from time to time. Research Highlights for DSP World Mining Fund Below is the key information for DSP World Mining Fund Returns up to 1 year are on An Open ended Fund of Funds Scheme with the investment objective to provide returns that tracks returns provided by Birla Sun Life Gold ETF (BSL Gold ETF). Research Highlights for Aditya Birla Sun Life Gold Fund Below is the key information for Aditya Birla Sun Life Gold Fund Returns up to 1 year are on The scheme seeks to provide returns that closely correspond to returns provided by SBI - ETF Gold (Previously known as SBI GETS). Research Highlights for SBI Gold Fund Below is the key information for SBI Gold Fund Returns up to 1 year are on The investment objective of the Scheme is to seek to provide returns that closely correspond to returns provided by Reliance ETF Gold BeES. Research Highlights for Nippon India Gold Savings Fund Below is the key information for Nippon India Gold Savings Fund Returns up to 1 year are on Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity ICICI Prudential Gilt Fund Normal Dividend, Payout ₹18.0934

↓ -0.02 ₹9,181 0.8 2 5.4 7.3 6.2 7.25% 6Y 6M 7D 18Y 4M 17D SBI Magnum Gilt Fund Normal Dividend, Payout ₹20.494

↓ 0.00 ₹10,817 0.4 1.8 4.2 7 4.5 6.44% 5Y 1M 6D 8Y 2M 16D UTI Gilt Fund Normal Dividend, Payout ₹38.6264

↓ -0.03 ₹545 1.1 2.8 3.7 6 3.7 6.65% 5Y 2M 1D 7Y 1M 2D Canara Robeco Gilt Fund Normal Dividend, Payout ₹14.8822

↓ -0.01 ₹145 0.3 1.1 3 5.9 3.5 6.94% 8Y 6M 23D 17Y 8M 16D Nippon India Gilt Securities Fund Normal Dividend, Payout ₹38.0435

↓ -0.03 ₹1,850 0.3 1.3 2.9 6.2 3.7 0% Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary ICICI Prudential Gilt Fund SBI Magnum Gilt Fund UTI Gilt Fund Canara Robeco Gilt Fund Nippon India Gilt Securities Fund Point 1 Upper mid AUM (₹9,181 Cr). Highest AUM (₹10,817 Cr). Bottom quartile AUM (₹545 Cr). Bottom quartile AUM (₹145 Cr). Lower mid AUM (₹1,850 Cr). Point 2 Oldest track record among peers (26 yrs). Established history (25+ yrs). Established history (24+ yrs). Established history (25+ yrs). Established history (17+ yrs). Point 3 Top rated. Rating: 4★ (upper mid). Rating: 4★ (lower mid). Rating: 4★ (bottom quartile). Rating: 4★ (bottom quartile). Point 4 Risk profile: Moderate. Risk profile: Moderate. Risk profile: Moderate. Risk profile: Moderate. Risk profile: Moderate. Point 5 1Y return: 5.37% (top quartile). 1Y return: 4.17% (upper mid). 1Y return: 3.69% (lower mid). 1Y return: 2.98% (bottom quartile). 1Y return: 2.90% (bottom quartile). Point 6 1M return: 0.56% (bottom quartile). 1M return: 0.69% (lower mid). 1M return: 1.08% (top quartile). 1M return: 0.70% (upper mid). 1M return: 0.62% (bottom quartile). Point 7 Sharpe: 0.06 (top quartile). Sharpe: -0.32 (upper mid). Sharpe: -0.58 (bottom quartile). Sharpe: -0.49 (bottom quartile). Sharpe: -0.47 (lower mid). Point 8 Information ratio: 0.00 (top quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: 0.00 (bottom quartile). Information ratio: 0.00 (bottom quartile). Point 9 Yield to maturity (debt): 7.25% (top quartile). Yield to maturity (debt): 6.44% (bottom quartile). Yield to maturity (debt): 6.65% (lower mid). Yield to maturity (debt): 6.94% (upper mid). Yield to maturity (debt): 0.00% (bottom quartile). Point 10 Modified duration: 6.52 yrs (bottom quartile). Modified duration: 5.10 yrs (upper mid). Modified duration: 5.17 yrs (lower mid). Modified duration: 8.56 yrs (bottom quartile). Modified duration: 0.00 yrs (top quartile). ICICI Prudential Gilt Fund

SBI Magnum Gilt Fund

UTI Gilt Fund

Canara Robeco Gilt Fund

Nippon India Gilt Securities Fund

1. DSP World Gold Fund

DSP World Gold Fund

Normal Dividend, Payout Launch Date 14 Sep 07 NAV (17 Feb 26) ₹36.5874 ↓ -1.35 (-3.56 %) Net Assets (Cr) ₹1,756 on 31 Dec 25 Category Equity - Global AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆ Risk High Expense Ratio 1.41 Sharpe Ratio 3.42 Information Ratio -0.68 Alpha Ratio 1.33 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹8,807 31 Jan 23 ₹9,400 31 Jan 24 ₹8,491 31 Jan 25 ₹12,486 31 Jan 26 ₹33,007 Returns for DSP World Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Feb 26 Duration Returns 1 Month 2.5% 3 Month 32.8% 6 Month 78.1% 1 Year 143% 3 Year 56.1% 5 Year 28% 10 Year 15 Year Since launch 10.1% Historical performance (Yearly) on absolute basis

Year Returns 2024 167.1% 2023 15.7% 2022 6.9% 2021 -7.9% 2020 -9% 2019 31.4% 2018 35.1% 2017 -10.7% 2016 -4% 2015 52.7% Fund Manager information for DSP World Gold Fund

Name Since Tenure Jay Kothari 1 Mar 13 12.93 Yr. Data below for DSP World Gold Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Basic Materials 95.89% Asset Allocation

Asset Class Value Cash 1.55% Equity 95.89% Debt 0.01% Other 2.56% Top Securities Holdings / Portfolio

Name Holding Value Quantity BGF World Gold I2

Investment Fund | -74% ₹1,458 Cr 1,177,658

↓ -41,596 VanEck Gold Miners ETF

- | GDX25% ₹497 Cr 573,719 Treps / Reverse Repo Investments

CBLO/Reverse Repo | -2% ₹35 Cr Net Receivables/Payables

Net Current Assets | -1% -₹15 Cr 2. DSP World Mining Fund

DSP World Mining Fund

Normal Dividend, Payout Launch Date 29 Dec 09 NAV (17 Feb 26) ₹27.7928 ↓ -1.14 (-3.95 %) Net Assets (Cr) ₹154 on 31 Dec 25 Category Equity - Global AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆ Risk High Expense Ratio 1.14 Sharpe Ratio 3.27 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹11,733 31 Jan 23 ₹14,422 31 Jan 24 ₹12,454 31 Jan 25 ₹12,799 31 Jan 26 ₹25,833 Returns for DSP World Mining Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Feb 26 Duration Returns 1 Month 2.8% 3 Month 31.6% 6 Month 62.3% 1 Year 85.4% 3 Year 21.8% 5 Year 18.1% 10 Year 15 Year Since launch 7.2% Historical performance (Yearly) on absolute basis

Year Returns 2024 79% 2023 -8.1% 2022 0% 2021 12.2% 2020 18% 2019 34.9% 2018 21.5% 2017 -9.4% 2016 21.1% 2015 49.7% Fund Manager information for DSP World Mining Fund

Name Since Tenure Jay Kothari 1 Mar 13 12.93 Yr. Data below for DSP World Mining Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Basic Materials 95.77% Energy 1.05% Asset Allocation

Asset Class Value Cash 3.15% Equity 96.82% Debt 0.02% Top Securities Holdings / Portfolio

Name Holding Value Quantity BGF World Mining I2

Investment Fund | -99% ₹180 Cr 149,227

↓ -1,163 Treps / Reverse Repo Investments

CBLO/Reverse Repo | -1% ₹2 Cr Net Receivables/Payables

Net Current Assets | -0% ₹0 Cr 3. Aditya Birla Sun Life Gold Fund

Aditya Birla Sun Life Gold Fund

Normal Dividend, Payout Launch Date 20 Mar 12 NAV (18 Feb 26) ₹43.5432 ↓ -0.16 (-0.37 %) Net Assets (Cr) ₹1,266 on 31 Dec 25 Category Gold - Gold AMC Birla Sun Life Asset Management Co Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 0.51 Sharpe Ratio 4.49 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 100 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹9,602 31 Jan 23 ₹11,314 31 Jan 24 ₹12,322 31 Jan 25 ₹15,884 31 Jan 26 ₹31,281 Returns for Aditya Birla Sun Life Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Feb 26 Duration Returns 1 Month 5.6% 3 Month 23.6% 6 Month 50% 1 Year 72.9% 3 Year 37% 5 Year 24.7% 10 Year 15 Year Since launch 11.2% Historical performance (Yearly) on absolute basis

Year Returns 2024 72% 2023 18.7% 2022 14.5% 2021 12.3% 2020 -5% 2019 26.1% 2018 21.3% 2017 6.8% 2016 1.6% 2015 11.5% Fund Manager information for Aditya Birla Sun Life Gold Fund

Name Since Tenure Priya Sridhar 31 Dec 24 1.09 Yr. Data below for Aditya Birla Sun Life Gold Fund as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 2.07% Other 97.93% Top Securities Holdings / Portfolio

Name Holding Value Quantity Aditya BSL Gold ETF

- | -99% ₹1,770 Cr 122,558,766

↑ 14,664,583 Clearing Corporation Of India Limited

CBLO/Reverse Repo | -3% ₹45 Cr Net Receivables / (Payables)

Net Current Assets | -2% -₹34 Cr 4. SBI Gold Fund

SBI Gold Fund

Normal Dividend, Payout Launch Date 12 Sep 11 NAV (18 Feb 26) ₹43.8883 ↓ -0.02 (-0.04 %) Net Assets (Cr) ₹10,775 on 31 Dec 25 Category Gold - Gold AMC SBI Funds Management Private Limited Rating ☆☆ Risk Moderately High Expense Ratio 0.3 Sharpe Ratio 4.38 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹9,629 31 Jan 23 ₹11,359 31 Jan 24 ₹12,463 31 Jan 25 ₹16,115 31 Jan 26 ₹30,815 Returns for SBI Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Feb 26 Duration Returns 1 Month 5.6% 3 Month 23.5% 6 Month 50.1% 1 Year 72.6% 3 Year 37.3% 5 Year 24.9% 10 Year 15 Year Since launch 10.8% Historical performance (Yearly) on absolute basis

Year Returns 2024 71.5% 2023 19.6% 2022 14.1% 2021 12.6% 2020 -5.7% 2019 27.4% 2018 22.8% 2017 6.4% 2016 3.5% 2015 10% Fund Manager information for SBI Gold Fund

Name Since Tenure Raviprakash Sharma 12 Sep 11 14.4 Yr. Data below for SBI Gold Fund as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 1.93% Other 98.07% Top Securities Holdings / Portfolio

Name Holding Value Quantity SBI Gold ETF

- | -100% ₹14,966 Cr 1,097,211,666

↑ 145,868,881 Treps

CBLO/Reverse Repo | -2% ₹306 Cr Net Receivable / Payable

CBLO | -2% -₹248 Cr 5. Nippon India Gold Savings Fund

Nippon India Gold Savings Fund

Normal Dividend, Payout Launch Date 7 Mar 11 NAV (18 Feb 26) ₹57.4018 ↑ 0.03 (0.05 %) Net Assets (Cr) ₹5,301 on 31 Dec 25 Category Gold - Gold AMC Nippon Life Asset Management Ltd. Rating ☆☆ Risk Moderately High Expense Ratio 0.35 Sharpe Ratio 4.46 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (2%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹9,635 31 Jan 23 ₹11,321 31 Jan 24 ₹12,369 31 Jan 25 ₹15,957 31 Jan 26 ₹31,222 Returns for Nippon India Gold Savings Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Feb 26 Duration Returns 1 Month 5.8% 3 Month 23.4% 6 Month 50.3% 1 Year 72.5% 3 Year 37% 5 Year 24.8% 10 Year 15 Year Since launch 12.4% Historical performance (Yearly) on absolute basis

Year Returns 2024 71.2% 2023 19% 2022 14.3% 2021 12.3% 2020 -5.5% 2019 26.6% 2018 22.5% 2017 6% 2016 1.7% 2015 11.6% Fund Manager information for Nippon India Gold Savings Fund

Name Since Tenure Himanshu Mange 23 Dec 23 2.11 Yr. Data below for Nippon India Gold Savings Fund as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 1.5% Other 98.5% Top Securities Holdings / Portfolio

Name Holding Value Quantity Nippon India ETF Gold BeES

- | -100% ₹7,154 Cr 527,059,679

↑ 44,753,946 Triparty Repo

CBLO/Reverse Repo | -1% ₹36 Cr Net Current Assets

Net Current Assets | -0% -₹29 Cr Cash Margin - Ccil

CBLO/Reverse Repo | -0% ₹0 Cr Cash

Net Current Assets | -0% ₹0 Cr 00

येथे प्रदान केलेली माहिती अचूक असल्याची खात्री करण्यासाठी सर्व प्रयत्न केले गेले आहेत. तथापि, डेटाच्या अचूकतेबद्दल कोणतीही हमी दिली जात नाही. कृपया कोणतीही गुंतवणूक करण्यापूर्वी योजना माहिती दस्तऐवजासह सत्यापित करा.

Research Highlights for DSP World Gold Fund