6 सर्वोत्तम लिक्विड म्युच्युअल फंड 2022

सामान्य शब्दात,सर्वोत्तम लिक्विड फंड कर्ज आहेतम्युच्युअल फंड किंवा त्याऐवजीपैसा बाजार म्युच्युअल फंड फक्त गुंतवणुकीच्या कालावधीत फरक आहे.लिक्विड फंड खूप कमी पैशात गुंतवणूक कराबाजार सारखी साधनेठेव प्रमाणपत्र, ट्रेझरी बिले, व्यावसायिक कागदपत्रे इ.

या फंडांचा गुंतवणुकीचा कालावधी खूपच लहान असतो, साधारणपणे काही दिवसांपासून ते काही आठवड्यांपर्यंत (तो एक दिवसही असू शकतो!). लिक्विड फंडांची सरासरी अवशिष्ट मॅच्युरिटी 91 दिवसांपेक्षा कमी असते कारण ते सिक्युरिटीजमध्ये गुंतवणूक करतात ज्यांची वैयक्तिकरित्या मॅच्युरिटी 91 दिवसांपर्यंत असते. अल्पकालीन असल्यानेकर्ज निधी, हे फंड अल्प कालावधीसाठी कमी-जोखीम गुंतवणुकीसाठी शोधत असलेल्या गुंतवणूकदारांसाठी अत्यंत योग्य आहेत.

सर्वोत्कृष्ट लिक्विड फंडांचा कमी मॅच्युरिटी कालावधी निधी व्यवस्थापकांना पूर्ण करण्यास मदत करतोविमोचन गुंतवणूकदारांची मागणी सहज. बाजारात, विविध लिक्विड फंड गुंतवणूक उपलब्ध आहेत.

लिक्विड फंडात गुंतवणूक का करावी?

- लिक्विड फंडांना लॉक-इन किंवा खूप कमी लॉक-इन कालावधी नसतो.

- कमी मुदतीच्या कालावधीमुळे लिक्विड म्युच्युअल फंडाचा व्याजदर सर्व अल्पकालीन गुंतवणुकींमध्ये सर्वात कमी आहे.

- कोणतेही प्रवेश आणि निर्गमन भार लागू नाहीत.

- लिक्विड फंड हे गुंतवणूकदारांसाठी एक उत्तम उपाय आहे ज्यांना त्यांची निष्क्रिय रोकड अल्प कालावधीसाठी जोखीम न घेता ठेवायची आहे.भांडवली तोटा.

बचत बँक खात्यापेक्षा लिक्विड फंड चांगले?

गुंतवणूक लोकप्रिय बचतीमध्ये पैसे टाकण्यापेक्षा लिक्विड फंड्समध्ये गुंतवणुकीचा चांगला पर्याय आहेबँक खाते योजना.

बँक खाती जतन करण्याच्या त्याच्या परिचित आणि संस्थात्मक स्वरूपामुळे, सरासरी भारतीय करदात्याचा त्यांच्यावर अधिक विश्वास असतो. तथापि, असे दिसते की ते यापुढे सर्वात लोकप्रिय अल्पकालीन गुंतवणूक नाहीत. वेगवेगळ्या गुंतवणुकीची उद्दिष्टे असलेल्या गुंतवणुकदारांकडून म्युच्युअल फंडाची वाढती स्वीकृती हे कारण आहे. बचत बँक खात्यात असलेल्या तुमच्या कष्टाने कमावलेल्या पैशावर तुम्हाला वर्षाला फक्त ३.५% व्याज मिळते. तथापि, सर्वोत्तम लिक्विड फंडांनी मागील 1 वर्षाच्या कालावधीत वार्षिक सरासरी 6.5-7.5% इतका परतावा दिला आहे.आधार.

तर, केवळ परताव्यावर, लिक्विड फंड बचत बँक खात्यावर स्कोअर करतात. तुमच्याकडे वाढ किंवा बोनस येत असल्यास, लिक्विड फंडांमध्ये गुंतवणूक करा आणि नंतर पार्टी करा.

Talk to our investment specialist

6 सर्वोत्तम लिक्विड फंड भारत आर्थिक वर्ष 22 - 23

Fund NAV Net Assets (Cr) 1 MO (%) 3 MO (%) 6 MO (%) 1 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity Axis Liquid Fund Growth ₹3,015.9

↑ 0.50 ₹35,653 0.5 1.5 3 6.4 6.6 6.06% 1M 28D 2M 2D Edelweiss Liquid Fund Growth ₹3,463.74

↑ 0.60 ₹10,414 0.5 1.5 3 6.4 6.5 6.03% 2M 1D 2M 1D UTI Liquid Cash Plan Growth ₹4,443.01

↑ 0.75 ₹23,480 0.5 1.5 3 6.4 6.5 6.04% 1M 26D 1M 26D Tata Liquid Fund Growth ₹4,265.1

↑ 0.72 ₹18,946 0.5 1.5 2.9 6.4 6.5 6.08% 1M 28D 1M 28D DSP Liquidity Fund Growth ₹3,866.75

↑ 0.59 ₹17,777 0.5 1.5 3 6.4 6.5 5.98% 1M 2D 1M 6D Aditya Birla Sun Life Liquid Fund Growth ₹436.371

↑ 0.07 ₹47,273 0.5 1.5 2.9 6.4 6.5 6.19% 2M 1D 2M 1D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 17 Feb 26 Research Highlights & Commentary of 6 Funds showcased

Commentary Axis Liquid Fund Edelweiss Liquid Fund UTI Liquid Cash Plan Tata Liquid Fund DSP Liquidity Fund Aditya Birla Sun Life Liquid Fund Point 1 Upper mid AUM (₹35,653 Cr). Bottom quartile AUM (₹10,414 Cr). Upper mid AUM (₹23,480 Cr). Lower mid AUM (₹18,946 Cr). Bottom quartile AUM (₹17,777 Cr). Highest AUM (₹47,273 Cr). Point 2 Established history (16+ yrs). Established history (18+ yrs). Oldest track record among peers (22 yrs). Established history (21+ yrs). Established history (20+ yrs). Established history (21+ yrs). Point 3 Top rated. Rating: 2★ (bottom quartile). Rating: 3★ (lower mid). Rating: 4★ (upper mid). Rating: 3★ (bottom quartile). Rating: 4★ (upper mid). Point 4 Risk profile: Low. Risk profile: Low. Risk profile: Low. Risk profile: Low. Risk profile: Low. Risk profile: Low. Point 5 1Y return: 6.39% (top quartile). 1Y return: 6.37% (upper mid). 1Y return: 6.37% (upper mid). 1Y return: 6.36% (bottom quartile). 1Y return: 6.36% (lower mid). 1Y return: 6.36% (bottom quartile). Point 6 1M return: 0.54% (top quartile). 1M return: 0.54% (upper mid). 1M return: 0.54% (lower mid). 1M return: 0.53% (bottom quartile). 1M return: 0.54% (upper mid). 1M return: 0.54% (bottom quartile). Point 7 Sharpe: 3.47 (upper mid). Sharpe: 3.82 (top quartile). Sharpe: 3.28 (lower mid). Sharpe: 3.23 (bottom quartile). Sharpe: 3.55 (upper mid). Sharpe: 3.21 (bottom quartile). Point 8 Information ratio: 0.00 (top quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: 0.00 (bottom quartile). Information ratio: 0.00 (bottom quartile). Point 9 Yield to maturity (debt): 6.06% (upper mid). Yield to maturity (debt): 6.03% (bottom quartile). Yield to maturity (debt): 6.04% (lower mid). Yield to maturity (debt): 6.08% (upper mid). Yield to maturity (debt): 5.98% (bottom quartile). Yield to maturity (debt): 6.19% (top quartile). Point 10 Modified duration: 0.16 yrs (upper mid). Modified duration: 0.17 yrs (bottom quartile). Modified duration: 0.16 yrs (upper mid). Modified duration: 0.16 yrs (lower mid). Modified duration: 0.09 yrs (top quartile). Modified duration: 0.17 yrs (bottom quartile). Axis Liquid Fund

Edelweiss Liquid Fund

UTI Liquid Cash Plan

Tata Liquid Fund

DSP Liquidity Fund

Aditya Birla Sun Life Liquid Fund

द्रव वरील एयूएम/निव्वळ मालमत्ता असलेले निधी१०,000 कोटी आणि 5 किंवा अधिक वर्षांसाठी निधीचे व्यवस्थापन. वर क्रमवारी लावलीमागील 1 कॅलेंडर वर्षाचा परतावा.

To provide a high level of liquidity with reasonable returns commensurating with low risk through a portfolio of money market and debt securities. However there can be no assurance that the investment objective of the scheme will be achieved. Research Highlights for Axis Liquid Fund Below is the key information for Axis Liquid Fund Returns up to 1 year are on The investment objective of the Scheme is to provide reasonable returns, commensurate with low risk while providing a high level of liquidity, through a portfolio of money market and debt securities. However, there can be no assurance that the investment objectives of the Scheme will be realized. Research Highlights for Edelweiss Liquid Fund Below is the key information for Edelweiss Liquid Fund Returns up to 1 year are on The investment objective of the scheme is to generate steady and reasonable income, with low risk and high level of liquidity from a portfolio of money market securities and high quality debt. Research Highlights for UTI Liquid Cash Plan Below is the key information for UTI Liquid Cash Plan Returns up to 1 year are on (Erstwhile TATA Money Market Fund ) To create a highly liquid portfolio of money market instruments so as to provide reasonable returns and high liquidity to the unitholders. Research Highlights for Tata Liquid Fund Below is the key information for Tata Liquid Fund Returns up to 1 year are on The Scheme seeks to generate reasonable returns commensurate with low risk from a portfolio constituted of money market and high quality debts Research Highlights for DSP Liquidity Fund Below is the key information for DSP Liquidity Fund Returns up to 1 year are on (Erstwhile Aditya Birla Sun Life Cash Plus Fund) An Open-ended liquid scheme with the objective to provide reasonable returns at a high level of safety and liquidity through judicious investments in high quality debt and money market instruments. Research Highlights for Aditya Birla Sun Life Liquid Fund Below is the key information for Aditya Birla Sun Life Liquid Fund Returns up to 1 year are on 1. Axis Liquid Fund

Axis Liquid Fund

Growth Launch Date 9 Oct 09 NAV (17 Feb 26) ₹3,015.9 ↑ 0.50 (0.02 %) Net Assets (Cr) ₹35,653 on 31 Dec 25 Category Debt - Liquid Fund AMC Axis Asset Management Company Limited Rating ☆☆☆☆ Risk Low Expense Ratio 0.23 Sharpe Ratio 3.47 Information Ratio 0 Alpha Ratio 0 Min Investment 500 Min SIP Investment 1,000 Exit Load NIL Yield to Maturity 6.06% Effective Maturity 2 Months 2 Days Modified Duration 1 Month 28 Days Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹10,333 31 Jan 23 ₹10,864 31 Jan 24 ₹11,639 31 Jan 25 ₹12,497 31 Jan 26 ₹13,296 Returns for Axis Liquid Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Feb 26 Duration Returns 1 Month 0.5% 3 Month 1.5% 6 Month 3% 1 Year 6.4% 3 Year 7% 5 Year 5.9% 10 Year 15 Year Since launch 7% Historical performance (Yearly) on absolute basis

Year Returns 2024 6.6% 2023 7.4% 2022 7.1% 2021 4.9% 2020 3.3% 2019 4.3% 2018 6.6% 2017 7.5% 2016 6.7% 2015 7.6% Fund Manager information for Axis Liquid Fund

Name Since Tenure Devang Shah 5 Nov 12 13.25 Yr. Aditya Pagaria 13 Aug 16 9.48 Yr. Sachin Jain 3 Jul 23 2.59 Yr. Data below for Axis Liquid Fund as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 99.74% Other 0.26% Debt Sector Allocation

Sector Value Cash Equivalent 73.04% Corporate 24.53% Government 2.17% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity Clearing Corporation Of India Ltd

CBLO/Reverse Repo | -7% ₹2,872 Cr 27/03/2026 Maturing 91 DTB

Sovereign Bonds | -4% ₹1,434 Cr 144,500,000 Export Import Bank Of India

Commercial Paper | -3% ₹1,197 Cr 24,000 19/02/2026 Maturing 91 DTB

Sovereign Bonds | -3% ₹1,150 Cr 115,307,200

↓ -15,500,000 Small Industries Dev Bank Of India

Commercial Paper | -3% ₹998 Cr 20,000 Small Industries Dev Bank Of India

Commercial Paper | -3% ₹996 Cr 20,000 Indian Bank (25/02/2026) **

Certificate of Deposit | -3% ₹996 Cr 20,000 HDFC Bank Limited

Certificate of Deposit | -3% ₹992 Cr 20,000

↓ -500 HDFC Bank Ltd.

Debentures | -2% ₹967 Cr 19,500 Export Import Bank Of India

Commercial Paper | -2% ₹747 Cr 15,000 2. Edelweiss Liquid Fund

Edelweiss Liquid Fund

Growth Launch Date 21 Sep 07 NAV (17 Feb 26) ₹3,463.74 ↑ 0.60 (0.02 %) Net Assets (Cr) ₹10,414 on 31 Dec 25 Category Debt - Liquid Fund AMC Edelweiss Asset Management Limited Rating ☆☆ Risk Low Expense Ratio 0.23 Sharpe Ratio 3.82 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load NIL Yield to Maturity 6.03% Effective Maturity 2 Months 1 Day Modified Duration 2 Months 1 Day Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹10,326 31 Jan 23 ₹10,833 31 Jan 24 ₹11,585 31 Jan 25 ₹12,435 31 Jan 26 ₹13,228 Returns for Edelweiss Liquid Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Feb 26 Duration Returns 1 Month 0.5% 3 Month 1.5% 6 Month 3% 1 Year 6.4% 3 Year 6.9% 5 Year 5.8% 10 Year 15 Year Since launch 7% Historical performance (Yearly) on absolute basis

Year Returns 2024 6.5% 2023 7.3% 2022 6.9% 2021 4.7% 2020 3.2% 2019 4.1% 2018 6.6% 2017 7.4% 2016 6.6% 2015 6.8% Fund Manager information for Edelweiss Liquid Fund

Name Since Tenure Rahul Dedhia 11 Dec 17 8.15 Yr. Hetul Raval 22 Sep 25 0.36 Yr. Data below for Edelweiss Liquid Fund as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 99.72% Other 0.28% Debt Sector Allocation

Sector Value Cash Equivalent 67.3% Corporate 31.93% Government 0.49% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity Clearing Corporation Of India Ltd.

CBLO/Reverse Repo | -7% ₹751 Cr Tbill

Sovereign Bonds | -6% ₹596 Cr 60,000,000 Axis Bank Limited

Certificate of Deposit | -5% ₹547 Cr 55,000,000 HDFC Bank Ltd.

Debentures | -4% ₹446 Cr 45,000,000 Bank Of Baroda

Certificate of Deposit | -3% ₹348 Cr 35,000,000 Small Industries Development Bank Of India

Debentures | -3% ₹300 Cr 30,000,000 Punjab National Bank

Certificate of Deposit | -3% ₹298 Cr 30,000,000 Small Industries Dev Bank Of India

Commercial Paper | -3% ₹297 Cr 30,000,000 Axis Bank Limited

Certificate of Deposit | -2% ₹249 Cr 25,000,000 HDFC Bank Limited

Certificate of Deposit | -2% ₹248 Cr 25,000,000 3. UTI Liquid Cash Plan

UTI Liquid Cash Plan

Growth Launch Date 11 Dec 03 NAV (17 Feb 26) ₹4,443.01 ↑ 0.75 (0.02 %) Net Assets (Cr) ₹23,480 on 31 Dec 25 Category Debt - Liquid Fund AMC UTI Asset Management Company Ltd Rating ☆☆☆ Risk Low Expense Ratio 0.25 Sharpe Ratio 3.28 Information Ratio 0 Alpha Ratio 0 Min Investment 500 Min SIP Investment 1,500 Exit Load NIL Yield to Maturity 6.04% Effective Maturity 1 Month 26 Days Modified Duration 1 Month 26 Days Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹10,333 31 Jan 23 ₹10,859 31 Jan 24 ₹11,630 31 Jan 25 ₹12,481 31 Jan 26 ₹13,277 Returns for UTI Liquid Cash Plan

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Feb 26 Duration Returns 1 Month 0.5% 3 Month 1.5% 6 Month 3% 1 Year 6.4% 3 Year 6.9% 5 Year 5.9% 10 Year 15 Year Since launch 6.8% Historical performance (Yearly) on absolute basis

Year Returns 2024 6.5% 2023 7.3% 2022 7% 2021 4.8% 2020 3.3% 2019 4.2% 2018 6.6% 2017 7.4% 2016 6.7% 2015 7.7% Fund Manager information for UTI Liquid Cash Plan

Name Since Tenure Amit Sharma 7 Jul 17 8.58 Yr. Data below for UTI Liquid Cash Plan as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 99.73% Other 0.27% Debt Sector Allocation

Sector Value Cash Equivalent 73.75% Corporate 24.69% Government 1.3% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity Net Current Assets

Net Current Assets | -8% ₹2,087 Cr 19/03/2026 Maturing 91 DTB

Sovereign Bonds | -5% ₹1,192 Cr 12,000,000,000 Union Bank Of India

Certificate of Deposit | -3% ₹746 Cr 7,500,000,000

↑ 5,000,000,000 Small Industries Dev Bank Of India

Commercial Paper | -3% ₹744 Cr 7,500,000,000 Indian Overseas Bank

Debentures | -3% ₹694 Cr 7,000,000,000 Tbill

Sovereign Bonds | -3% ₹691 Cr 7,000,000,000

↑ 7,000,000,000 Punjab & Sind Bank

Debentures | -2% ₹545 Cr 5,500,000,000 Tata Capital Housing Finance Limited

Commercial Paper | -2% ₹500 Cr 5,000,000,000 Bank Of India

Certificate of Deposit | -2% ₹497 Cr 5,000,000,000 Small Industries Development Bank Of India

Commercial Paper | -2% ₹497 Cr 5,000,000,000 4. Tata Liquid Fund

Tata Liquid Fund

Growth Launch Date 1 Sep 04 NAV (17 Feb 26) ₹4,265.1 ↑ 0.72 (0.02 %) Net Assets (Cr) ₹18,946 on 31 Dec 25 Category Debt - Liquid Fund AMC Tata Asset Management Limited Rating ☆☆☆☆ Risk Low Expense Ratio 0.39 Sharpe Ratio 3.23 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load NIL Yield to Maturity 6.08% Effective Maturity 1 Month 28 Days Modified Duration 1 Month 28 Days Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹10,328 31 Jan 23 ₹10,847 31 Jan 24 ₹11,611 31 Jan 25 ₹12,459 31 Jan 26 ₹13,252 Returns for Tata Liquid Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Feb 26 Duration Returns 1 Month 0.5% 3 Month 1.5% 6 Month 2.9% 1 Year 6.4% 3 Year 6.9% 5 Year 5.8% 10 Year 15 Year Since launch 7% Historical performance (Yearly) on absolute basis

Year Returns 2024 6.5% 2023 7.3% 2022 7% 2021 4.8% 2020 3.2% 2019 4.3% 2018 6.6% 2017 7.4% 2016 6.7% 2015 7.7% Fund Manager information for Tata Liquid Fund

Name Since Tenure Amit Somani 16 Oct 13 12.3 Yr. Harsh Dave 1 Aug 24 1.5 Yr. Data below for Tata Liquid Fund as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 99.69% Other 0.31% Debt Sector Allocation

Sector Value Cash Equivalent 75.55% Corporate 23.08% Government 1.05% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity Tbill

Sovereign Bonds | -8% ₹1,733 Cr 175,000,000

↑ 175,000,000 Indian Overseas Bank

Debentures | -7% ₹1,460 Cr 29,500 National Bank for Agriculture and Rural Development

Certificate of Deposit | -6% ₹1,214 Cr 24,500

↑ 2,000 Reliance Jio Infocomm Ltd.

Commercial Paper | -4% ₹893 Cr 18,000 Bajaj Financial Securities Limited

Commercial Paper | -3% ₹694 Cr 14,000 Bank of India Ltd.

Debentures | -3% ₹623 Cr 12,500 Small Industries Development Bank Of India

Debentures | -3% ₹605 Cr 6,050 Aditya Birla Housing Finance Limited

Commercial Paper | -3% ₹600 Cr 12,000 Bajaj Finance Ltd.

Commercial Paper | -3% ₹596 Cr 12,000 D) Repo

CBLO/Reverse Repo | -3% ₹588 Cr 5. DSP Liquidity Fund

DSP Liquidity Fund

Growth Launch Date 23 Nov 05 NAV (17 Feb 26) ₹3,866.75 ↑ 0.59 (0.02 %) Net Assets (Cr) ₹17,777 on 31 Dec 25 Category Debt - Liquid Fund AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆ Risk Low Expense Ratio 0.21 Sharpe Ratio 3.55 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 500 Exit Load NIL Yield to Maturity 5.98% Effective Maturity 1 Month 6 Days Modified Duration 1 Month 2 Days Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹10,330 31 Jan 23 ₹10,854 31 Jan 24 ₹11,620 31 Jan 25 ₹12,475 31 Jan 26 ₹13,269 Returns for DSP Liquidity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Feb 26 Duration Returns 1 Month 0.5% 3 Month 1.5% 6 Month 3% 1 Year 6.4% 3 Year 6.9% 5 Year 5.9% 10 Year 15 Year Since launch 6.9% Historical performance (Yearly) on absolute basis

Year Returns 2024 6.5% 2023 7.4% 2022 7% 2021 4.8% 2020 3.3% 2019 4.2% 2018 6.5% 2017 7.4% 2016 6.6% 2015 7.6% Fund Manager information for DSP Liquidity Fund

Name Since Tenure Karan Mundhra 31 May 21 4.68 Yr. Shalini Vasanta 1 Aug 24 1.5 Yr. Kunal Khudania 1 Jan 26 0.08 Yr. Data below for DSP Liquidity Fund as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 99.71% Other 0.29% Debt Sector Allocation

Sector Value Cash Equivalent 55.96% Corporate 41.39% Government 2.36% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity Treps / Reverse Repo Investments

CBLO/Reverse Repo | -11% -₹1,845 Cr HDFC Bank Ltd.

Debentures | -5% ₹793 Cr 16,000 Tbill

Sovereign Bonds | -5% ₹770 Cr 77,500,000 5.63% Gs 2026

Sovereign Bonds | -4% ₹616 Cr 60,500,000

↑ 24,000,000 Small Industries Dev Bank Of India

Commercial Paper | -3% ₹574 Cr 11,500 HDFC Bank Limited

Certificate of Deposit | -3% ₹548 Cr 11,000 Small Industries Development Bank Of India

Commercial Paper | -3% ₹497 Cr 10,000 Punjab National Bank (18/03/2026)

Certificate of Deposit | -3% ₹496 Cr 10,000 Union Bank Of India

Certificate of Deposit | -3% ₹494 Cr 10,000

↑ 10,000 Bank Of Baroda

Certificate of Deposit | -3% ₹448 Cr 9,000 6. Aditya Birla Sun Life Liquid Fund

Aditya Birla Sun Life Liquid Fund

Growth Launch Date 30 Mar 04 NAV (17 Feb 26) ₹436.371 ↑ 0.07 (0.02 %) Net Assets (Cr) ₹47,273 on 31 Dec 25 Category Debt - Liquid Fund AMC Birla Sun Life Asset Management Co Ltd Rating ☆☆☆☆ Risk Low Expense Ratio 0.34 Sharpe Ratio 3.21 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load NIL Yield to Maturity 6.19% Effective Maturity 2 Months 1 Day Modified Duration 2 Months 1 Day Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹10,331 31 Jan 23 ₹10,856 31 Jan 24 ₹11,630 31 Jan 25 ₹12,483 31 Jan 26 ₹13,278 Returns for Aditya Birla Sun Life Liquid Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Feb 26 Duration Returns 1 Month 0.5% 3 Month 1.5% 6 Month 2.9% 1 Year 6.4% 3 Year 6.9% 5 Year 5.9% 10 Year 15 Year Since launch 7% Historical performance (Yearly) on absolute basis

Year Returns 2024 6.5% 2023 7.3% 2022 7.1% 2021 4.8% 2020 3.3% 2019 4.3% 2018 6.7% 2017 7.4% 2016 6.7% 2015 7.7% Fund Manager information for Aditya Birla Sun Life Liquid Fund

Name Since Tenure Sunaina Cunha 15 Jul 11 14.56 Yr. Kaustubh Gupta 15 Jul 11 14.56 Yr. Sanjay Pawar 1 Jul 22 3.59 Yr. Data below for Aditya Birla Sun Life Liquid Fund as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 99.74% Other 0.26% Debt Sector Allocation

Sector Value Cash Equivalent 70.45% Corporate 25.61% Government 3.69% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity RBL Bank Ltd.

Debentures | -5% ₹2,477 Cr 50,000 27/02/2026 Maturing 364 DTB

Sovereign Bonds | -3% ₹1,599 Cr 160,500,000 Union Bank Of India (20/03/2026) ** #

Certificate of Deposit | -2% ₹1,239 Cr 25,000

↑ 25,000 12/02/2026 Maturing 364 DTB

Sovereign Bonds | -2% ₹998 Cr 100,000,000 19/02/2026 Maturing 91 DTB

Sovereign Bonds | -2% ₹997 Cr 100,000,000 Yes Bank Limited

Certificate of Deposit | -2% ₹994 Cr 20,000 Karur Vysya Bank Ltd.

Debentures | -2% ₹993 Cr 20,000 The Jammu And Kashmir Bank Limited

Debentures | -2% ₹991 Cr 20,000 HDFC Bank Limited

Certificate of Deposit | -2% ₹947 Cr 19,000 Punjab National Bank

Certificate of Deposit | -2% ₹895 Cr 18,000

लिक्विड म्युच्युअल फंडाचे मूल्यांकन कसे करावे?

लिक्विड म्युच्युअल फंड शोधत असताना, फक्त मागील परतावा नसावाघटक विचारासाठी. इतर घटक जसे की निधीचा आकार, ट्रॅक रेकॉर्ड, क्रेडिट गुणवत्ताअंतर्निहित सिक्युरिटीज देखील लक्षात ठेवल्या पाहिजेत.

1. गुंतवणूक योजना

लिक्विड फंड वेगवेगळ्या योजनांसह येतात जसे दैनिक लाभांश योजना, साप्ताहिक लाभांश योजना, मासिक लाभांश योजना आणि वाढ योजना. वाढीच्या पर्यायामध्ये, योजनेद्वारे झालेला नफा त्यात परत गुंतवला जातो. याचा परिणाम होतोनाही योजनेचे (नेट अॅसेट व्हॅल्यू) कालांतराने वाढत आहे. लाभांश पर्यायामध्ये, फंडाने केलेला नफा पुन्हा गुंतवला जात नाही. ला लाभांश वितरित केला जातोगुंतवणूकदार वेळोवेळी. गुंतवणूकदार त्यांच्या सोयीनुसार त्यांची योजना निवडू शकतात आणितरलता गरजा

2. खर्चाचे प्रमाण

म्युच्युअल फंड तुमचे फंड व्यवस्थापित करण्यासाठी शुल्क आकारतात ज्याला एक्सपेन्स रेशो म्हणतात. नुसारसेबी मानदंड, खर्च गुणोत्तराची वरची मर्यादा आहे2.25%. लिक्विड फंडांच्या बाबतीत, ते कमी कालावधीत तुलनेने जास्त परतावा देण्यासाठी कमी खर्चाचे प्रमाण राखतात.

3. गुंतवणूक होरायझन

तुमच्या गुंतवणुकीच्या क्षितिजाचे नियोजन करा. लिक्विड फंड हे केवळ 91 दिवसांच्या अगदी कमी कालावधीत अतिरिक्त रोख गुंतवणूक करण्यासाठी असतात. त्यामुळे, तुमच्याकडे निष्क्रिय रोख असल्यास, तुम्ही येथे अल्प कालावधीसाठी गुंतवणूक करू शकता आणि बँकेपेक्षा चांगला परतावा मिळवू शकताबचत खाते. जर तुमच्याकडे 1 वर्षापर्यंतची गुंतवणूक क्षितिज जास्त असेल, तर तुलनेने जास्त परतावा मिळविण्यासाठी तुम्ही कमी कालावधीच्या फंडांमध्ये गुंतवणूक करण्याचा विचार करू शकता.

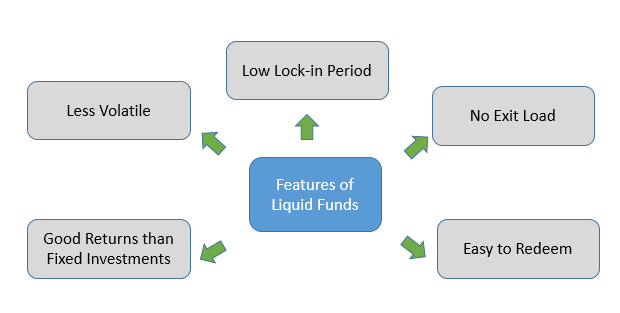

लिक्विड म्युच्युअल फंडाची वैशिष्ट्ये

1. लिक्विड म्युच्युअल फंडाचा एक्झिट लोड

लिक्विड म्युच्युअल फंड ही कमी मॅच्युरिटी कालावधी असलेली अल्प-मुदतीची गुंतवणूक आहे हे लक्षात घेऊन, या श्रेणीतील बहुतांश फंड रिडेम्पशनवर कोणतेही एक्झिट लोड आकारत नाहीत. तसेच, जर तेथे कोणतेही एक्झिट लोड असेल, तर ते अगदी नाममात्र असते आणि सामान्यतः एका आठवड्यापेक्षा जास्त नसते. लिक्विड फंडांमध्ये साधारणपणे एक्झिट लोड नसतो कारण ते खूप कमी गुंतवणूक उत्पादने असतात.

2. लिक्विड फंड गुंतवणुकीची अस्थिरता

साधारणपणे, लिक्विड फंडाची अस्थिरता कमी असते कारण गुंतवणूक काही दिवस ते आठवडे टिकते. त्यामुळे गुंतवणुकीत नुकसान होण्याचा धोका खूपच कमी आहे. तथापि, नुकसानीची संधी टाळण्यासाठी बाजाराची स्थिती लक्षात घेऊन लिक्विड फंड गुंतवणूक करण्याचे सुचवले आहे.

3. सर्वोत्तम लिक्विड फंडांचा लॉक-इन कालावधी

लिक्विड म्युच्युअल फंड हे अल्पकालीन गुंतवणुकीचे पर्याय आहेत हे लक्षात घेता, लिक्विड फंडांना कोणताही लॉक-इन कालावधी नसतो. लिक्विड फंड्स एक दिवसाच्या कमी कालावधीसाठी दोन आठवड्यांपर्यंत गुंतवले जाऊ शकतात.

4. लिक्विड फंड परतावा

लिक्विड फंड हा उच्च कालावधीत सर्वोत्तम अल्पकालीन गुंतवणूक आहेमहागाई कालावधी उच्च चलनवाढीच्या काळात लिक्विड फंडावरील व्याजदर जास्त असतो. अशा प्रकारे, लिक्विड म्युच्युअल फंडांना चांगला परतावा मिळण्यास मदत होते. बँक मुदत ठेवी किंवा बचत खात्यांसारख्या इतर पारंपारिक गुंतवणुकीपेक्षा लिक्विड फंडाचा परतावा सहसा जास्त असतो. तथापि, तुमच्या गरजेनुसार योग्य पर्याय (वृद्धी, लाभांश पेआउट, लाभांश री-गुंतवणूक) निवडून सर्वोत्तम लिक्विड फंडांमध्ये गुंतवणूक करण्याचा सल्ला दिला जातो.

5. लिक्विड फंड कर आकारणी

साधारणपणे, लिक्विड फंड रिटर्न्स लाभांशाच्या रूपात मिळतात त्यावर गुंतवणूकदारांच्या हातात कर आकारला जात नाही. तथापि, म्युच्युअल फंड कंपनीकडून अंदाजे २८% लाभांश वितरण कर (DDT) वजा केला जातो. शिवाय, ज्या गुंतवणूकदारांनी वाढीचा पर्याय निवडला आहे त्यांच्यासाठी अल्पकालीनभांडवली लाभ व्यक्तीच्या कर स्लॅबनुसार कर कापला जातो. हा करवजावट बचत खात्याप्रमाणेच आहे.

लिक्विड फंड्समध्ये ऑनलाइन गुंतवणूक कशी करावी?

Fincash.com वर आजीवन मोफत गुंतवणूक खाते उघडा

तुमची नोंदणी आणि KYC प्रक्रिया पूर्ण करा

दस्तऐवज अपलोड करा (PAN, आधार इ.).आणि, तुम्ही गुंतवणूक करण्यास तयार आहात!

लिक्विड फंडांबद्दल जागरूकता नसल्यामुळे, लोक त्यामध्ये गुंतवणूक करत नाहीत आणि त्याऐवजी बचत खात्यात मोठी रक्कम ठेवतात. परंतु, काहीतरी चांगले सुरू करण्यास कधीही उशीर झालेला नाही. तर, आजच सर्वोत्तम लिक्विड फंडांमध्ये गुंतवणूक करा!

येथे प्रदान केलेली माहिती अचूक असल्याची खात्री करण्यासाठी सर्व प्रयत्न केले गेले आहेत. तथापि, डेटाच्या अचूकतेबद्दल कोणतीही हमी दिली जात नाही. कृपया कोणतीही गुंतवणूक करण्यापूर्वी योजना माहिती दस्तऐवजासह सत्यापित करा.

Good knowledgeable information, you should have to give an example