म्युच्युअल फंड कॅल्क्युलेटर

म्युच्युअल फंड म्हणजे काय?

म्युच्युअल फंड ही एक व्यावसायिक व्यवस्थापित गुंतवणूक योजना आहे. हे मालमत्ता व्यवस्थापन कंपनीद्वारे चालवले जाते (AMC) जे किरकोळ गुंतवणूकदारांसाठी मध्यस्थासारखे काम करते. AMC मोठ्या संख्येने गुंतवणूकदारांकडून पैसे गोळा करते आणि ते इक्विटी शेअर्समध्ये गुंतवते,बंध,पैसा बाजार उपकरणे आणि इतर प्रकारच्या सिक्युरिटीज. म्युच्युअल फंड खरेदी करणे म्हणजे मोठ्या पिझ्झाचा छोटासा स्लाइस खरेदी करण्यासारखे आहे. प्रत्येकगुंतवणूकदार, त्या बदल्यात, त्याने फंडात गुंतवलेल्या रकमेच्या प्रमाणात युनिट्सची विशिष्ट संख्या नियुक्त केली जाते. गुंतवणूकदाराला युनिट धारक म्हणून ओळखले जाते. युनिटधारक नफा, तोटा शेअर करतो,उत्पन्न आणि फंडातील त्याच्या गुंतवणुकीच्या प्रमाणात फंडाचा खर्च.

म्युच्युअल फंड कॅल्क्युलेटर म्हणजे काय?

म्युच्युअल फंड कॅल्क्युलेटर आम्हाला आमच्या व्याज परताव्याची गणना करण्यात मदत करतेSIP खाली Fincash म्युच्युअल फंड कॅल्क्युलेटरच्या मदतीने गुंतवणूक किंवा एकरकमी गुंतवणूक.

म्युच्युअल फंड कॅल्क्युलेटर कसे कार्य करते?

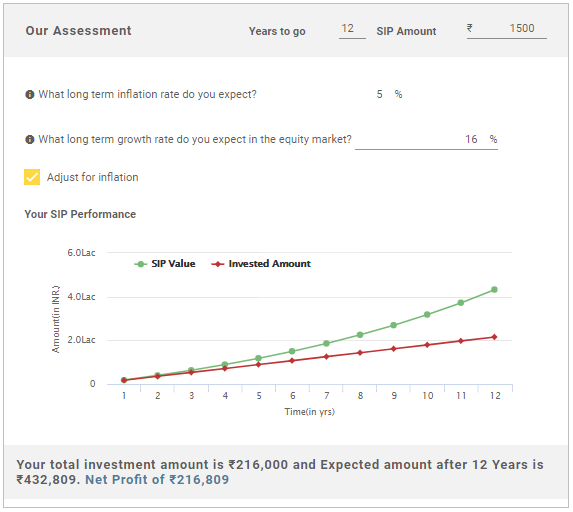

तुमची म्युच्युअल फंड योजना तुमच्या अपेक्षेनुसार परतावा देत आहे का? तुम्ही विचार करत आहात का की SIP ची किती रक्कम तुम्हाला वैयक्तिक ध्येय साध्य करण्यात मदत करेल? आमचे म्युच्युअल फंड कॅल्क्युलेटर वापरून तुमची उत्तरे मिळवा! म्युच्युअल फंड कॅल्क्युलेटर तुमच्या गुंतवणुकीच्या क्षितिजानुसार फंड परताव्याची गणना करून तुम्हाला मुदतपूर्तीच्या वेळी गुंतवणूक मूल्य देईल. तुम्ही कॅल्क्युलेटरचे व्हेरिएबल्स जसे की SIP/एकरकमी, गुंतवणुकीची रक्कम, SIP ची वारंवारता, अपेक्षित परताव्याचा दर आणि SIP चा कालावधी समायोजित करू शकता.

गुंतवणुकीचे स्वरूप ( SIP / Lumpsum )

मुळात दोन मार्ग आहेतगुंतवणूक तुमच्या आवडीचे पैसेम्युच्युअल फंड. तुम्ही SIP किंवा एकरकमी मार्गाने जाऊ शकता

1. एकरकमी गुंतवणूक

एकरकमी अंतर्गत, तुम्ही तुमच्या फंडाचा एक मोठा हिस्सा तुमच्या आवडीच्या म्युच्युअल फंड योजनेत गुंतवता. सामान्यतः असे होते जेव्हा तुम्हाला एखाद्या मालमत्तेच्या विक्रीतून मोठा निधी प्राप्त होतो किंवासेवानिवृत्ती फायदे पण एकरकमी गुंतवणुकीत जास्त जोखीम असते. म्हणूनच नेहमी SIP मार्गाने जाण्याची शिफारस केली जाते

2. पद्धतशीर गुंतवणूक योजना (SIP)

एसआयपी अंतर्गत, तुम्ही सूचना द्याबँक एक वजा करण्यासाठी? तुमच्याकडून निश्चित रक्कमबचत खाते दर महिन्याला आणि त्या म्युच्युअल फंड योजनेत गुंतवा. अशाप्रकारे, प्रवेशासाठी योग्य वेळेची काळजी न करता तुम्ही सतत युनिट्स खरेदी करू शकताबाजार. तुम्हाला रुपयाच्या सरासरी खर्चाचा फायदा मिळेल आणि त्याचा आनंद घ्याकंपाउंडिंगची शक्ती

Talk to our investment specialist

कॅल्क्युलेटरचे प्रकार

लम्पसम कॅल्क्युलेटर

एसआयपी कॅल्क्युलेटर

Know Your SIP Returns

2022 साठी शीर्ष निधी

*1 वर्षाच्या कामगिरीवर आधारित सर्वोत्तम निधी.

"The primary investment objective of the Scheme is to seek capital appreciation by investing predominantly in units of MLIIF - WGF. The Scheme may, at the discretion of the Investment Manager, also invest in the units of other similar overseas mutual fund schemes, which may constitute a significant part of its corpus. The Scheme may also invest a certain portion of its corpus in money market securities and/or units of money market/liquid schemes of DSP Merrill Lynch Mutual Fund, in order to meet liquidity requirements from time to time. However, there is no assurance that the investment objective of the Scheme will be realized." Below is the key information for DSP World Gold Fund Returns up to 1 year are on The primary investment objective of the Scheme is to seek capital appreciation by investing predominantly in the units of BlackRock Global Funds – World Mining Fund. The Scheme may, at the discretion of the Investment Manager, also invest in the units of other similar overseas mutual fund schemes, which may

constitute a significant part of its corpus. The Scheme may also invest a certain portion of its corpus in money market securities and/or money market/liquid schemes of DSP BlackRock Mutual Fund, in order to meet liquidity requirements from time to time. Research Highlights for DSP World Mining Fund Below is the key information for DSP World Mining Fund Returns up to 1 year are on The primary investment objective of the Scheme is to seek to provide long term capital growth by investing predominantly in the JPMorgan Funds - Emerging Markets Opportunities Fund, an equity fund which invests primarily in an aggressively managed portfolio of emerging market companies Research Highlights for Edelweiss Emerging Markets Opportunities Equity Off-shore Fund Below is the key information for Edelweiss Emerging Markets Opportunities Equity Off-shore Fund Returns up to 1 year are on 1. DSP World Gold Fund

DSP World Gold Fund

Growth Launch Date 14 Sep 07 NAV (17 Feb 26) ₹60.3973 ↓ -2.23 (-3.56 %) Net Assets (Cr) ₹1,756 on 31 Dec 25 Category Equity - Global AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆ Risk High Expense Ratio 1.41 Sharpe Ratio 3.42 Information Ratio -0.67 Alpha Ratio 1.32 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹8,807 31 Jan 23 ₹9,422 31 Jan 24 ₹8,517 31 Jan 25 ₹12,548 31 Jan 26 ₹33,170 Returns for DSP World Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Feb 26 Duration Returns 1 Month 2.5% 3 Month 32.8% 6 Month 78.1% 1 Year 143% 3 Year 56.3% 5 Year 28.1% 10 Year 15 Year Since launch 10.3% Historical performance (Yearly) on absolute basis

Year Returns 2024 167.1% 2023 15.9% 2022 7% 2021 -7.7% 2020 -9% 2019 31.4% 2018 35.1% 2017 -10.7% 2016 -4% 2015 52.7% Fund Manager information for DSP World Gold Fund

Name Since Tenure Jay Kothari 1 Mar 13 12.93 Yr. Data below for DSP World Gold Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Basic Materials 95.89% Asset Allocation

Asset Class Value Cash 1.55% Equity 95.89% Debt 0.01% Other 2.56% Top Securities Holdings / Portfolio

Name Holding Value Quantity BGF World Gold I2

Investment Fund | -74% ₹1,458 Cr 1,177,658

↓ -41,596 VanEck Gold Miners ETF

- | GDX25% ₹497 Cr 573,719 Treps / Reverse Repo Investments

CBLO/Reverse Repo | -2% ₹35 Cr Net Receivables/Payables

Net Current Assets | -1% -₹15 Cr 2. DSP World Mining Fund

DSP World Mining Fund

Growth Launch Date 29 Dec 09 NAV (17 Feb 26) ₹30.722 ↓ -1.26 (-3.95 %) Net Assets (Cr) ₹154 on 31 Dec 25 Category Equity - Global AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆ Risk High Expense Ratio 1.14 Sharpe Ratio 3.27 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹11,733 31 Jan 23 ₹14,422 31 Jan 24 ₹12,454 31 Jan 25 ₹12,799 31 Jan 26 ₹25,833 Returns for DSP World Mining Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Feb 26 Duration Returns 1 Month 2.8% 3 Month 31.6% 6 Month 62.3% 1 Year 85.4% 3 Year 21.8% 5 Year 18.1% 10 Year 15 Year Since launch 7.2% Historical performance (Yearly) on absolute basis

Year Returns 2024 79% 2023 -8.1% 2022 0% 2021 12.2% 2020 18% 2019 34.9% 2018 21.5% 2017 -9.4% 2016 21.1% 2015 49.7% Fund Manager information for DSP World Mining Fund

Name Since Tenure Jay Kothari 1 Mar 13 12.93 Yr. Data below for DSP World Mining Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Basic Materials 95.77% Energy 1.05% Asset Allocation

Asset Class Value Cash 3.15% Equity 96.82% Debt 0.02% Top Securities Holdings / Portfolio

Name Holding Value Quantity BGF World Mining I2

Investment Fund | -99% ₹180 Cr 149,227

↓ -1,163 Treps / Reverse Repo Investments

CBLO/Reverse Repo | -1% ₹2 Cr Net Receivables/Payables

Net Current Assets | -0% ₹0 Cr 3. Edelweiss Emerging Markets Opportunities Equity Off-shore Fund

Edelweiss Emerging Markets Opportunities Equity Off-shore Fund

Growth Launch Date 7 Jul 14 NAV (13 Feb 26) ₹23.9895 ↓ -0.33 (-1.35 %) Net Assets (Cr) ₹169 on 31 Dec 25 Category Equity - Global AMC Edelweiss Asset Management Limited Rating ☆☆☆ Risk High Expense Ratio 1.04 Sharpe Ratio 2.63 Information Ratio -0.95 Alpha Ratio -0.64 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹8,938 31 Jan 23 ₹8,042 31 Jan 24 ₹7,669 31 Jan 25 ₹8,630 31 Jan 26 ₹13,335 Returns for Edelweiss Emerging Markets Opportunities Equity Off-shore Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Feb 26 Duration Returns 1 Month 8.2% 3 Month 14% 6 Month 31.3% 1 Year 51.7% 3 Year 18.6% 5 Year 4.6% 10 Year 15 Year Since launch 7.8% Historical performance (Yearly) on absolute basis

Year Returns 2024 41.1% 2023 5.9% 2022 5.5% 2021 -16.8% 2020 -5.9% 2019 21.7% 2018 25.1% 2017 -7.2% 2016 30% 2015 9.8% Fund Manager information for Edelweiss Emerging Markets Opportunities Equity Off-shore Fund

Name Since Tenure Bhavesh Jain 9 Apr 18 7.82 Yr. Bharat Lahoti 1 Oct 21 4.34 Yr. Data below for Edelweiss Emerging Markets Opportunities Equity Off-shore Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Technology 27.66% Financial Services 24.86% Consumer Cyclical 12.11% Communication Services 11.31% Industrials 5.06% Energy 4.92% Basic Materials 2% Real Estate 1.66% Utility 1.05% Consumer Defensive 0.96% Health Care 0.94% Asset Allocation

Asset Class Value Cash 6.29% Equity 93.03% Other 0.4% Top Securities Holdings / Portfolio

Name Holding Value Quantity JPM Emerging Mkts Opps I (acc) USD

Investment Fund | -97% ₹185 Cr 96,682 Clearing Corporation Of India Ltd.

CBLO/Reverse Repo | -3% ₹7 Cr Net Receivables/(Payables)

CBLO | -0% -₹1 Cr Accrued Interest

CBLO | -0% ₹0 Cr

येथे प्रदान केलेली माहिती अचूक असल्याची खात्री करण्यासाठी सर्व प्रयत्न केले गेले आहेत. तथापि, डेटाच्या अचूकतेबद्दल कोणतीही हमी दिली जात नाही. कृपया कोणतीही गुंतवणूक करण्यापूर्वी योजना माहिती दस्तऐवजासह सत्यापित करा.

Research Highlights for DSP World Gold Fund