How to Open an NPS Account?

National Pension Scheme (NPS) is a retirement savings scheme where both employer and an employee contribute towards building wealth which is payable to the employee at the time of retirement. All central/state government employees falling between the age brackets of 18 to 60 years can open an NPS account. However, non-government citizens who are looking for retirement savings can get themselves covered under the NPS umbrella, by following below-mentioned procedure.

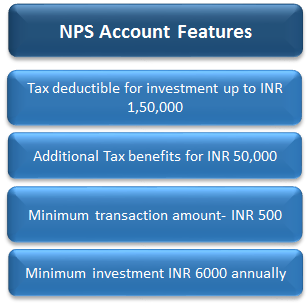

Features of NPS Account

Investments up to INR 1,50,000 are tax Deductible under Section 80C. So, investors looking for higher tax saving options can invest in NPS.

NPS also brings you an additional tax benefit of INR 50,000 under Section 80CCD (1B).

The minimum amount to invest in an NPS scheme is INR 6,000 annually.

The minimum transaction amount required is INR 500.

The investment made under NPS can be diversified into three classes of assets - equity, government Bonds and fixed return instruments. This gives and opportunity for investors to choose the allocation of assets based on their preference and risk appetite.

Types of NPS Account

NPS Account for Government Sector

This account is opened for government employees by their respective employers.

NPS Account for Corporate Sector

This account is designed for private sector employees.

NPS for All Citizen

This account is for citizens who are not covered in the above two categories.

NPS Lite/Swavalamban

This account is a government-sponsored with some subsidy offered by the government.

NPS Account Tiers

National Pension Scheme has two tiers:

- Tier I account is the primary account and this scheme has a lock-in period till retirement.

- Tier II account is an optional Savings Account. Here you can withdraw your money at any point of time.

How to Open an NPS Account?

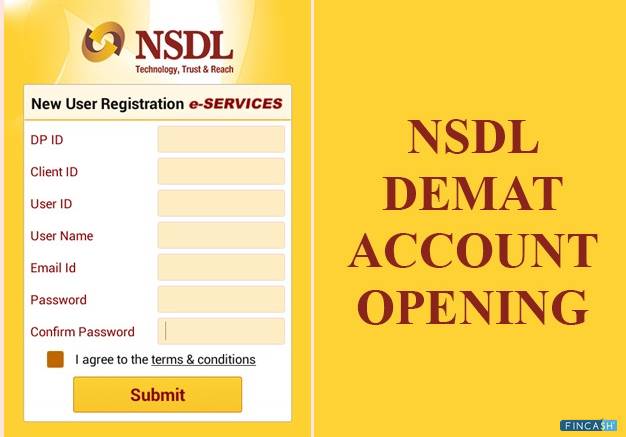

To open a pension scheme account, a subscriber has to take the following measures:

- Get the PRAN (Permanent Retirement Account Number) application form

- Fill out the form and submit it

- Receive the PRAN Card

Talk to our investment specialist

Procedure to Open an NPS Account

- A subscriber has to get PRAN application form, which can be collected from any Point of Presence - Service Providers (POP-SP). POP-SP is an interface for a subscriber who is not a government employee and wants to open a permanent retirement account with CRKA (the Central Record Keeping Agency).

- Fill the PRAN application with your personal details, scheme preferences, account details, etc.

- Submit your KYC documents along with your PRAN form, following which you will be subscribed to your NPS account.

- Once your account gets opened, you will get a PRAN card to your address.

Subscribers can access their account online with the unique password allotted to you.

A copy of the PRAN card is needed for activating the tier-II account. Any employee who is subscribed to the Tier I can open a Tier-II account by submitting the UOS-S10 form along with PRAN card and INR 1000 to a POP-SP.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.