Steps to Open a Demat Account with SBI

Undoubtedly, the State Bank of India (SBI) is the largest bank of India, and it offers numerous services and products through all its subsidiaries. SBI Demat account is one of SBI’s key services. The bank also provides other related services via State Bank of India Cap Securities Ltd (SBICapSec or SBICap).

SBI Cap was incorporated in 2006, and it offers products related to a loan, broking, and investments for individuals and institutional customers. Its entire product Portfolio includes currency, equity, depository services, derivatives trading, Mutual Funds, IPO services, NCDs, Bonds, Home and Car Loans. This article contains all the details about the Demat account with SBI, its benefits, how to open and close the same, demat account sbi charger, along with other relevant information.

Trading in SBI Demat Account

There are three types of accounts in stock trading:

1. SBI Demat Account

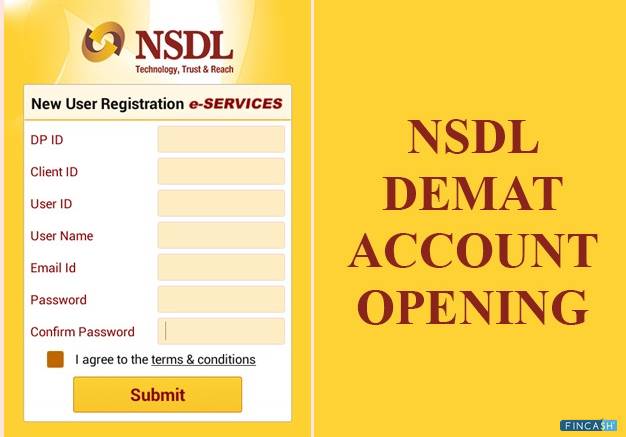

It’s a digital account that contains securities. It functions similarly to a bank account. The Demat account, like the bank account, holds securities. Shares, mutual funds, and shares assigned through an Initial Public Offering (IPO) are examples of securities. When a customer purchases new securities, the shares are credited to their Demat account, and they are deducted when they sell them. The Demat account is managed by the central depositories (CDSL and NSDL). SBO, for example, is merely an intermediary between you and the central depository.

2. SBI Trading Account

Stock trading is done with an SBI Trading Account (buying and selling the shares). Customers can place buy or sell orders for equity shares in their trading account online or over the phone.

3. SBI Bank Account

It is used to credit/debit money for trading account operations. When a customer purchases a stock, money is taken from their bank account. When a customer sells shares, the amount received from the sales is deposited into the customer's SBI Bank account. Trading is carried out using a Trading Account. The Demat and bank accounts give the necessary shares and funds.

Talk to our investment specialist

Benefits of Opening a Demat Account in SBI

There are various reasons why opening a Demat account with SBI is recommended, like:

- SBI 3-in-1 Account is offered as a platform combining a savings bank account, a Demat account, and an online trading account.

- You have the option of using Central Depository Services Limited (CDSL) or National Securities Depository Limited (NSDL).

- Online access to your Demat account is available at any time.

- You can get a chance to hold various securities, such as stocks, derivatives, mutual funds, and bonds.

- You can also freeze an account.

- You may get to use the ASBA net-banking facility to apply for an IPO online.

- Bonuses, dividends, and other corporate incentives are automatically credited to your account.

- SBICAP is a full-service broker that provides free research reports and branch support.

- SBI bank has over 1000 branches that can help you open a Demat account.

- Customer service executives are available anytime.

Demat Account SBI Charges

Customers may be required to pay Demat account opening charges when opening a new account with SBI Securities. Annual Maintenance Charges (AMC) is a yearly fee charged by the broker to maintain the Demat account. Here is the chart for Demat and trading account charges in SBI:

| Services | Charges |

|---|---|

| Opening Fee for Demat Account | Rs. 0 |

| Annual Charges for Demat Account | Rs. 350 |

Documents for Opening a Demat Account in SBI

Just like the other purposes, opening a Demat account with SBI also requires several essential documents, which are as follows:

- Identity proof (aadhaar card/ Driving license/ Passport)

- Voter ID

- Ration Card

- Address proof

- Photocopy of Income Tax Return (ITR)

- Income proof (statement of your bank’s account)

- Bank account’s proof (/ Passbook photocopy/ Cancelled cheque)

- PAN Card

- Three passport size photographs.

Key Points for Opening SBI Demat Account

There are certain things that you must know before opening an SBI Demat account, which is as follows:

- Using your current online banking login details, you can access your SBI Demat account by connecting it to your Savings Account.

- You can see the details of the account from your savings account, including holdings, transaction statement, and billing statement.

- Any investor may open multiple accounts under his or her name.

- If a consumer doesn’t plan to make any transactions shortly, his account can be frozen. This will aid in the prevention of the Demat account’s fraud and illegal usage.

- After the account has been frozen, it can only be unfrozen on the account holders' orders.

Opening SBI Trading Account and Demat Account

If you wish to open an SBI Demat account, you should follow the given procedure:

- Click "Open an Account" on the SBI Smart Website

- Fill in your information in the available space

- Enter the OTP as shared with you on the registered number

- Upload the documents you've selected. You can also upload your KYC papers online, such as your Aadhaar card, PAN card, and address proof.

- Submit the form

Your account will be enabled within 24-48 hours after verification. If you get stuck or have trouble uploading the documents, a sales representative will call you. You can also ask for a Relationship Manager to help you through the process.

Apply for Online Demat Account in SBI via YONO Mobile application

Opening an online paperless trading and Demat account is simple with the SBI Yono App. You will be led to the SBICAP Securities website to open a trading account if you are a registered user of the YONO mobile application. A reference number will be generated after all required fields have been completed and the form has been submitted online. This number can be used to contact SBICAP Securities.

Setting up a Demat account and a trading account using the Yono App on a mobile device will require following these steps:

- Login to the YONO mobile application using your credentials

- Navigate to the menu bar

- When you click on Invest, you'll find the option to "create a Demat account."

- Open a Demat account by clicking the button

- Fill in all of the needed information

- Accept and confirm the terms and conditions

Accessing SBI Demat and Trading Account

Securities (shares, mutual funds, bonds, and so on) are held in an electronic format in an SBI Demat account. You can access it and view all the details with the help of the given steps:

- Visit the SBI Smart Website to see the Demat holdings.

- Select “Login” and then click on “DP” from the drop-down menu.

- To view all the holdings available for sale, select the "Demat Holding" symbol from the "Menu" option.

You can also check your SBI Trading Account holdings at the SBI Website. For that, follow the given steps:

- To access your trading account, go to “Log in” and then click on “Trading Account.”

- Under “Menu,” select “Portfolio Screen.”

- There are three tabs on the Portfolio screen (Current Holding, Zero Holding, and Negative Holding). The current holding represents the amount of stock you have available for sale.

Frequently Asked Questions (FAQs)

1. What are the steps that I have to follow to check my SBI Demat account’s status?

A. It takes three working days for SBI to open your account when your documents arrive. If you do not receive any response within three days, you can check the progress of your application online or in person at the branch. You can check the status of your SBI Demat account by going to the SBI Smart Website’s Customer Service page. For checking your application status online, you'll need your application reference number and your PAN number. You may also verify your SBI account’s status by calling customer care toll-free number: 1800 425 3800.

2. How can I activate my SBI Demat account?

A. welcome letter is given to the customer after the SBI Demat account is opened. The account details, such as the Depository Participant (DP) number, bank account number, and Client Code, are included in this welcome letter. The password for online trading and the Demat account is supplied in a separate letter. As soon as you log in, your account will automatically be activated. Once you've logged into an online trading account, you can begin trading.

3. Why am I required to sign the Power of Attorney while opening a Demat account with SBICap?

A. For online stock trading, a limited Power of Attorney (PoA) to the broker is required. It’s impossible to perform online sales transactions without it. When you use the trading account to sell shares, the PoA permits the broker to withdraw the shares from your Demat account and deliver them to the buyer. The limited PoA also aids in the following:

- For margin requirements, block/lien/pledge securities.

- Transferring the charges on your Demat account to the trading ledger.

In specific ways, signing the PoA facilitates and speeds up the trading and management of your securities.

4. Who is eligible for opening a Demat account with SBICap?

A. A Demat account can be opened by any Indian resident, Non-Resident Indian (NRI), or Institution. A minor can also open an SBI Demat account. Until the child becomes an adult, the legal guardian manages the account on his behalf. When opening an SBI minor Demat account, the legal guardian's documents (PAN and Aadhar) are required. The guardian must also sign the required forms.

5. Can I open another account via SBICap even if I already have a Demat account?

A. A person can have multiple Demat accounts in their name. However, each depository member is limited to one Demat account. In case you have a Demat account already with another broker, you can open another one with SBI. This will not cause any issues because both Demat accounts operate independently. This is equivalent to having two or more saving accounts under your name. You cannot open another Demat account with SBI if you currently have one.

6. Am I allowed to open a joint Demat account with SBICap?

A. Yes, a shared Demat account with SBI is possible. In a Demat account, you can add up to three people. One person will be the primary account holder, while others will be referred to as joint account holders.

7. How can I close my SBI Demat account?

A. An Account Close Request Form can be used to close the account. You must present it personally. You can deactivate your SBI Demat account in one of two ways:

- You may get The SBI Demat & Trading Account Closure Request Form from SBI smart website. Fill it, print it, and then sign it. Send it, along with the needed documents, to the address listed on the form.

- You can also visit any SBI branch and then request a Demat account cancellation form. Then, after filling it out and signing it, return it to the branch with all the required documents.

To close your SBI Demat account, you only need to fill out any of the following SBI Demat account closing form:

- Form for Account Closure Request

- Submit the Remit Request Form (RRF Form) (Only if you want to move your Demat holdings to a different Demat account.)

Furthermore, when cancelling a Demat account, keep the following in mind:

- Check to see if your trading account has any balance (credit or debit).

- Check to see if you have any shares in your Demat account. If you're shifting allocations to a different Demat account, do so before requesting a closure.

- All the account holders have to sign on the closure form in the case of a joint account.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

You Might Also Like