What is a Demat Account?

The shares and securities that you invest in are held electronically in a dematerialised account or a Demat account instead of possessing physical certificates. In 1996, dematerialisation was adopted by share market. It is the process which involves the conversion of physical share certificates – owned by the investors – into equivalent digital securities. These electronic securities are then credited into investors’ Demat account.

Simply put, Demat account is a kind of Bank account which holds all your shares in a digital or dematerialised form. So just like a bank account, it holds all the certificates to your financial investments like shares, Bonds, Mutual Funds, Exchange Traded Fund (ETFs), and government securities.

Demat - Not Compulsory for Mutual Funds

It is not compulsory to have a Demat account to invest in Mutual Funds but, it is essential to have one in order to trade in the stock market.

How does a Demat Account Work?

There are four components involved in the working of a Demat account. We will look into each one separately:

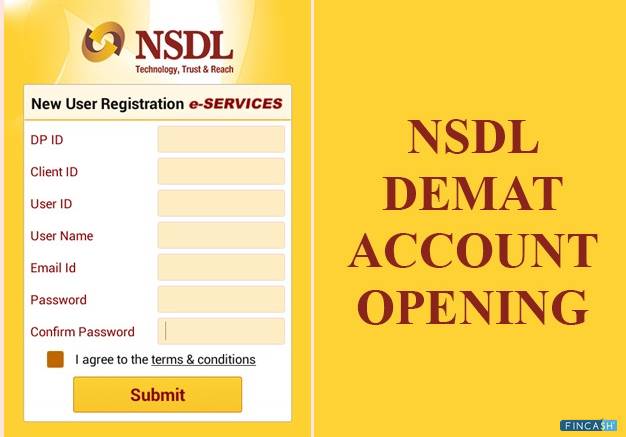

1. Central Depository

National Securities Depository Limited(NSDL) and Central Depository Services Limited(CDSL) are the two depositories in India which hold all the Demat accounts. These depositories hold the details of your share certificates and other financial instruments just like a bank.

2. Unique Identification Number

Each Demat account has been assigned a Unique Identification Number or a UID. This number is used for online trading purposes. This number helps the company and the stock exchange to identify you and credit the shares in your account

3. Depository Participants

Depository Participants or DPs provide the access to the central depository and act as the intermediary between the central depository and the investor. A DP could be a bank, brokers or some financial institute empowered to offer the Demat services. You have to open a Demat account or a Beneficial Owner account with a DP to get the access of the UID to the central depository

4. Portfolio Details

Whenever you access your Demat account you can see all the details of your Portfolio. These details are updated automatically after every transaction, be it buying or selling

Talk to our investment specialist

How to Open a Demat Account?

For opening a Demat account, first, you have to reach out to any stockbroker, for example, Bajaj Financial Securities Limited (BFSL). Further, you need to fill the provided online account opening application form. Here is how you can get a Demat account opened with any prominent stockbroker -

Select a depository participant (DP)

Fill up the form of registration and submit it with the required documents and a passport sized photo. PAN Card is a must to open a Demat account. Also, you must be ready with the original documents in case of verification

Carefully read the rules and regulations and the terms of the agreement. Also, examine the charges that will be imposed on you

Once the application form is processed, you will have your account number and UID. You can also use these details to access your account online

You would need to pay account charges like the annual maintenance and the transaction fee. These charges differ for different DPs

There is no minimum balance of shares required to open the account

You will soon receive a confirmation link for opening your Demat account along with your login credentials.

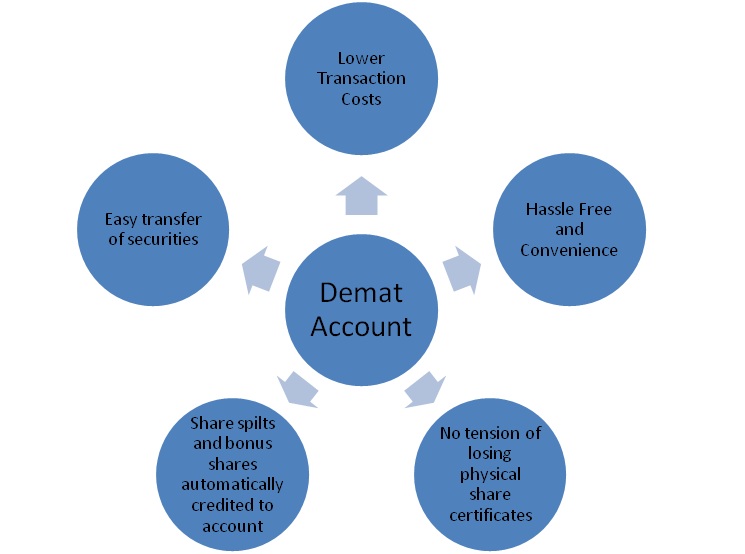

Demat Account Benefits

- It is very convenient and easy to operate

- Transactions are paperless

- Nomination requirements are simplified in the case of a single nominee for all your investments

- In the case of a change in contact information, Demat account helps a lot to make the change(s) easier and convenient

- You can get a detailed analysis and useful stock-related recommendations provided by expert analysts

- You can get to complete the trades in just a few minutes using the high-tech trading services and platforms offered by multiple stockbrokers

Facilities Offered by Demat Account

Demat accounts offer various services and facilities, like:

1. Transferring shares

A Demat Account is used to transfer an investor's stock holdings. To undertake share trading, you may use a Delivery Instruction Slip (DIS). You can fill out this slip with all the necessary information to ensure a seamless transaction.

2. Facilities of loan

The securities in your Demat Account may be used to qualify for a range of bank loans. These securities can be used as Collateral to secure a loan from your bank account.

3. Rematerialization and Dematerialization

Converting securities into multiple forms becomes a straightforward procedure if you have a Demat Account. You can offer your Depository Participant (DP) the required instructions for dematerialization. It is the process of converting physical share certificates into electronic forms. Alternatively, you can have electronic assets converted to physical securities (rematerialize) to meet your needs.

4. Multiple options for accessing

A Demat Account can be accessed through various media due to its electronic operation. You can use the Internet to undertake Investing, trading, monitoring, and other security-related operations on a computer, smartphone, or other handheld devices.

5. Corporate-related actions

Having a Demat Account allows you to take advantage of the perks that come with owning stocks. When a corporation pays dividends, interest, or refunds to its investors, all Demat account holders automatically receive these benefits. Corporate actions, including equity shares, such as stock splits, right shares, and bonus issues, are also updated in the shareholders' Demat Accounts.

6. Freezing accounts

Demat account holders can freeze their accounts for a set period, depending on their needs. It is done to prevent any unexpected debits or credits to the Demat Account. To use the freezing feature, the account holder must have a certain number of securities in their account.

7. Faster E-facilities

The National Securities Depository Limited (NSDL) offers various services to Demat account customers. The account holder can transmit instruction slips to the depository participant electronically instead of physically submitting them. It's done to make the procedure more manageable, smoother, and quicker.

Essential Documents for Opening Demat Account

Here is a list of all the essential documents you need to keep handy while opening a Demat account.

- ID proof - Passport/ aadhaar card/ Driving license/ PAN card

- Address Proof - Passport/ Rent Agreement/ Ration card/ Telephone Bills/ Electricity Bills/ Bank passbook

- Proof of Income - Salary slip/ Income Tax Returns / Latest bank statement

- Latest Photo - A passport size photograph

Demat Account Charges

Before opening a Demat account you should compare and check the Demat account charges. Opening an account can vary for different financial institutes. The charges depend on the intensity of the investment as well.

Kotak Securities’ Demat Account Fees

| Account Head | Rate | Minimum Payable |

|---|---|---|

| Dematerialisation | INR 50 for each request and / INR 3 for each certificate | - |

| Rematerialisation | INR 10 for 100 securities (including bonds, shares, mutual funds units, etc.) | INR 15 |

| Regular (Non- BSDA Account ) (Only for the Individual Accounts) | 0.04% of securities’ value (along with the NSDL Charges) | INR 27 (with NSDL Charges) |

| Market or off-market Transactions related to sales | 0.06% of securities’ value (along with the NSDL Charges) | INR 44.50 (with NSDL charges) |

| BSDA Account (Only for the Individual Accounts) | - | - |

| Market or off-market Transactions related to sales | - | - |

| Charges for Regular Account Maintenance | RESIDENT: INR 65 every month for maximum 10 debit transactions / INR 50 every month for 11 to 30 debit transactions / INR 35 every month for more than 30 debit transactions / NRI: INR 75 every month | - |

SBI Demat Account Fees

| Fee Head | Type | Fees |

|---|---|---|

| Opening an account | - | INR 850 |

| Dematerialization | Request for Dematerialisation + Certificate | INR 5 per certificate + INR 35 per request |

| Rematerialisation | Request for Rematerialisation | INR 35 per request + INR 10 for every hundred securities or a part; or a flat fee of INR 10 per certificate, whichever is higher |

| Charges of Annual Maintenance | Holding Less than 50,000 / Holding greater than 50,000 Less than 2,00,000 / Holding greater than 2,00,000 | Nil / INR 100 per annum / INR 500 per annum |

Fees for Demat Account with ICICI Bank

| Transaction | Charges |

|---|---|

| Charges for opening the account | INR 0 (Free) |

| Annual Maintenance charges for Demat account | INR 300 per year |

| Charges of Demat Debit Transaction (Sell Orders) | INR 20 per transaction |

| Charges related to Call & Trade | INR 50 per order |

Conclusion

Currently, as trading is becoming a common activity for individuals, they are often required to have a Demat account. A Demat account serves various purposes and is highly beneficial due to various factors. For easier trading and holding of stocks and shares, it is recommended to have a Demat account with a trusted stockbroker and link it with your trading accounts.

Frequently Asked Questions

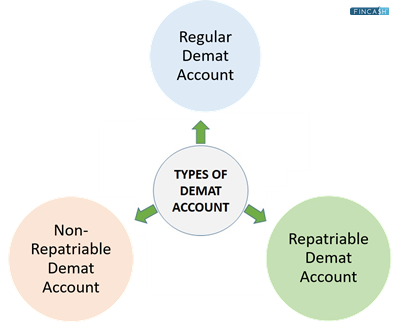

1. How many types of Demat accounts are there?

A. For different investors, there are three types of Demat accounts:

- Regular Demat Account: This account is for Indian people who live in India.

- Repatriable Demat Account: Non-resident Indians (NRIs) who want to move money outside of India need to have this account. It has to be linked to the non-resident external's bank account.

- Non-Repatriable Demat Account: This account is likewise for NRIs; however, it does not allow for international financial transfers. It must be linked to a bank account held by a Non-Resident Ordinary (NRO).

2. Is it essential to link a Demat and a trading account?

A. No, linking a Trading Account to a Demat account is not mandatory. You may have one or more Demat accounts that are unlinked to your trading account. However, you must link your Demat account to your trading account for easier trading in the cash market. For example, to buy shares, you'll need to make an order and withdraw funds from your trading account. The shares will reflect in your Demat account once the order is executed. For a more seamless trading experience, several brokers combine Demat and trading accounts.

3. Is it allowed to have multiple Demat accounts?

A. Having multiple Demat accounts is entirely acceptable. The only restriction is that you can't have more than one Demat account with the same broker or depository.

4. In India, who is eligible for opening a Demat account?

A. Anyone with sufficient documents can open a Demat account. Residents, foreign nationals, non-resident Indians, minors (via guardians), and businesses are all included. However, the approach and circumstances in each situation may change.

5. What is the time frame for opening a Demat account?

A. On average, it takes 7 to 14 days to open and activate your Demat account.

6. Is it possible for me to make a nominee manage my Demat account?

A. Individuals with single or dual Demat accounts can make a nomination. If the account holder dies, the nominee must fulfil a few formalities with the depository participant and have the securities transferred to their account. When you open the account, you will be requested to name a nominee.

Only one person can be named as a nominee. Nominees cannot be trusts, corporations, Hindu United Families (HUF), Associations of Persons (AOP), or other non-individual entities. Legal heirs, dependents, family members, or others could be your nominee.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

You Might Also Like