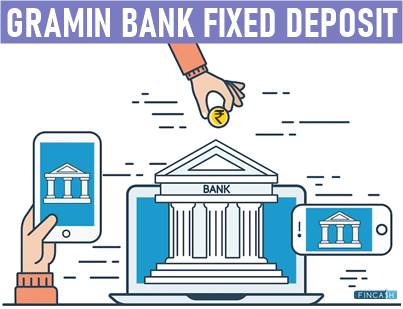

Gramin Bank Fixed Deposit

Bank Fixed Deposits (FDs) are among the most common ways to invest your money in India as they are regarded as risk-free and secure investments. Also they yield significantly higher interest rates than a Savings Account. Aside from that, opening an FD account with any bank is pretty simple. You have to deposit a lump sum amount for a defined period. You receive the amount you invested plus compound interest when the FD expires. FDs, also known as term deposits, allow taking out a loan.

Keeping the benefits in mind, Gramin fixed deposits have been introduced by India's Regional Rural Banks (RRB). The Indian government established these banks to help grow the rural economy by meeting their basic financial needs. These FDs pay a higher interest rate than those offered by commercial banks. As a result, consumers looking for safer Investing options have a fantastic alternative with these. Gramin FDs are risk-free and provide a steady cash flow in the form of interest. FD Interest Rates in Gramin bank range from 2.5% to 6.5% per annum.

Investors have the option of withdrawing their funds early. They can also borrow against their FD holdings. The interest is taxed according to the investors' income tax bracket. TDS will also be applied following the IT standards.

This article includes more details about Gramin bank fixed deposit interest rates and a complete state wise list with all the RRBs providing these services.

Benefits of Gramin Bank FD

Here is a list of the benefits associated with Gramin bank fixed deposits:

- Flexible investment tenure where you can open an account for seven days to ten years

- Allows you to pay interest on a monthly, quarterly, or half-yearly basis

- Provides the benefits of early closure with a penalty of only 1% on the appropriate interest rate for the time during which the deposit was held at the bank

- The scheme allows for nominations

- You can also take a loan against the deposit

- Offers fixed deposit auto-renewal

- No upper limit on deposits, and they can be as small as Rs.1000

Eligibility for Gramin Bank FDs

To open an FD account with a Gramin bank of India, you must fulfil the following criteria:

- You should be at least 18 years of age

- You must be a permanent Indian resident

- The group must be a company, partnership firm, any government department, a local organisation, or a hindu undivided family (HUF)

Talk to our investment specialist

Documents required for a Gramin Bank FD

To apply for a Gramin Bank Fixed Deposit, you'll need the following documents:

- Address proof: PAN Card, Aadhar card, Voter ID, etc

- ID proof: electric bill, Ration card, etc

- A passport size photograph

Opening a Gramin Bank FD Account

To open a Gramin bank FD account, you will have to visit the bank's branch. Here is the step-by-step procedure for the same:

- Go to the Gramin bank branch where you want to open your FD account

- Fill out the application for a fixed deposit account by providing the relevant personal and other details, such as name, address, phone number, PAN, email address, type of account, nominee information, and so on

- Mention the length of time (tenure) for the FD

- Attach a cheque for the amount of the FD account to be opened. However, internet banking can also be used to transfer funds

- Along with the account opening form, attach any required documentation

- The banker will next double-check all of the information and documentation and will issue an acknowledgement slip after satisfactory verification

Gramin Bank FD Interest Rates 2026

Here is the table showing the Gramin bank FD rates for the tenure of 12 months:

| Bank | FD Interest Rate (p.a.) |

|---|---|

| Kashi Gomti Samyut Gramin Bank | 9.05% |

| Chaitanya Godavari Grameena Bank | 8.00% |

| Saurashtra Gramin Bank | 7.65% |

| Kerala Gramin Bank | 7.50% |

| Pandyan Grama Bank | 7.35% |

| Jammu And Kashmir Grameen Bank | 7.30% |

| Pragathi Krishna Gramin Bank | 7.30% |

| Telangana Grameena Bank | 7.25% |

| Rajasthan Marudhara Gramin Bank | 7.25% |

| Andhra Pragathi Grameena Bank | 7.25% |

| Puduvai Bharathiar Grama Bank | 7.25% |

| Pallavan Grama Bank | 7.15% |

| Saptagiri Grameena Bank | 7.10% |

| Andhra Pradesh Grameena Vikas Bank | 7.10% |

| Tripura Gramin Bank | 7.05% |

| Prathama Bank | 7.05% |

| Malwa Gramin Bank | 7.00% |

| Punjab Gramin Bank | 7.00% |

| Ellaquai Dehati Bank | 7.00% |

| Karnataka Vikas Grameena Bank | 7.00% |

| Sarva Haryana Gramin Bank | 7.00% |

| Sutlej Kshetriya Gramin Bank | 7.00% |

| Baroda Rajasthan Kshetriya Gramin Bank | 6.85% |

| Narmada Jhabua Gramin Bank | 6.85% |

| Baroda Up Gramin Bank | 6.80% |

| Allahabad Up Gramin Bank | 6.80% |

| Utkal Grameen Bank | 6.80% |

| Maharashtra Gramin Bank | 6.80% |

| Kaveri Grameena Bank | 6.80% |

| Central Madhya Pradesh Gramin Bank | 6.75% |

| Meghalaya Rural Bank | 6.75% |

| Mizoram Rural Bank | 6.75% |

| Dena Gujarat Gramin Bank | 6.75% |

| Odisha Gramya Bank | 6.75% |

| Chhattisgarh Rajya Gramin Bank | 6.70% |

Calculating Gramin Bank Fixed Deposit Interest Rates 2026

Calculating how much your fixed deposit will be at maturity can help you plan and compare the rates for different tenures. It thus helps to pick the one that will give you the best interest rate and hence the most money at maturity.

This can be done quickly and easily using the online FD calculator, which is free, dependable, and accurate. Here's an example about Kerala Gramin bank to help you understand:

To compare using the online free FD calculator, if you invest Rs. 1 lakh in an FD account with Kerala Gramin Bank for a year, the current interest rate for that tenure is 5.05% PA for the general public.

Your amount on maturity will be Rs. 1,05,050, with the interest component being Rs. 5,050 (assuming you are under the age of 60). If you choose a 5-year term for the same amount, and the current interest rate is 5.40% PA, your total amount at maturity will be Rs. 1.3 lakh, plus Rs. 30,078 in interest.

How do I Check the Balance of My Account in Gramin Banks?

You can use an ATM to check the account balances; here is how to do it:

- Insert your ATM card into the machine

- Input your ATM PIN, and choose 'Balance Enquiry'

- On the screen, the machine shows the account balance

- Additionally, the balance information can be printed as a receipt

Conclusion

A Gramin Bank was founded by the Indian government and regulated by the Reserve Bank of India. The Government of India (50%), Sponsor Bank (35%), and the appropriate State Government (15%) jointly own these banks.

They were established under the RRB Act of 1976 to help promote the rural economy by meeting their basic banking demands. Having an FD account with one of these banks allows you to save and invest more effectively. To receive further benefits, contact the local Gramin bank.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.