Mutual Fund vs FD (Fixed Deposit)

Mutual Fund vs FD? When thinking of saving money, the first thing that most people consider doing is Investing in fixed deposits (FDs). That’s usually because it is easy to understand and is being done since generations. But is it the most appropriate investment? And does it provide the best returns? Or mutual fund investments can serve the purpose better? To know the answers to these questions, read below!

FD or Fixed Deposit

Fixed Deposit, also known as FD is a popular Bank investment option suitable for both long-term and short-term investments. FD returns are fixed as the FD interest rate is pre-decided by the government of India. The interest rate on Fixed Deposits being fixed, there is no effect of inflation on these investments.

Also, the FD returns are taxable in the hands of investors. However, FD investments are liable for tax deductions under Section 80C of income tax Act.

Mutual Funds

Mutual Fund is of three types, Debt, Equity and Balanced Mutual Funds. Debt Mutual Funds are those that invest most of the assets in government Bonds, corporate bonds and the rest in equity markets. Contrarily, Equity Mutual Funds invest more than 65% of its assets in equity markets and the rest in government bonds, corporate bonds and securities. While Balanced Mutual Funds are those that invest partially in debt and partially in Equity Funds. Mutual Fund is an inflation beating instrument, so it is more tax efficient and is expected to offer better returns on long-term investments.

Which is a Better Long Term Investment?

Now that we know that Mutual Funds and Fixed Deposits (FDs) are both Tax Saving Investments, the question that arises is - Where should one invest? Though it is a subjective question and the answer to it may vary from person to person, below is a comparison mentioned based on various parameters that might help you choose better.

1. Mutual Fund Returns & FD Returns

The returns on Fixed Deposit is pre-specified and does not change throughout the tenure. While Mutual Funds, being linked to the financial market, offer better returns on long-term investments.

2. FD Interest Rates & Mutual Fund Returns

The interest rate on FDs are fixed depending on the type of FD or the period of FD, so one cannot expect higher interest rates on Fixed Deposits. On the other hand, the returns on Mutual Funds vary as different kinds of funds offer volatile returns. If the market goes high the returns increase and vice-a-versa.

3. Risk Factors

Fixed Deposits hardly pose any risk as the returns are pre-determined. Also, if the bank gets busted all bank accounts are insured upto INR 1 lakh. On the other hand, Mutual Funds carry a higher risk as they invest their assets in the financial market. Equity Mutual Funds, having most of its assets invested in equity markets, carry a much higher risk. While investing in Debt Mutual Funds is less risky, as very less portion of these funds is invested in stock market.

Talk to our investment specialist

4. The Impact of Inflation

The interest rate being pre-decided, there is no effect of inflation on Fixed Deposits. While, for Mutual Funds, the returns are inflation-adjusted that enhances its potential to earn better returns.

5. Capital Gains

There are no Capital Gains possible in the case of FDs. For Mutual funds, capital gains depend on the holding period. Different Mutual Funds offer varied capital gains.

6. Liquidity

Fixed deposits are illiquid, as the invested amount is locked for a certain amount of time. If the money is withdrawn before that period, a certain penalty is deducted. While Mutual Funds are liquid as they can be sold in a short period of time without causing much depreciation in the fund value. However, it is important to keep a check the exit loads applicable on selling a few Mutual Funds.

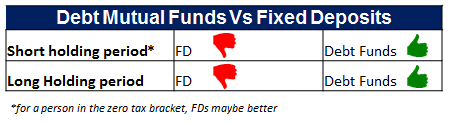

7. Taxation

The interest on Fixed Deposit is taxed as per the tax slab of the individual. On the other hand, Mutual Fund Taxation majorly depends on the holding period. Both Short Term Capital Gains (STCG) and Long Term Capital Gains (LTCG) are taxed differently.

8. Tax Saving FD's V/S Equity Linked Saving Schemes (ELSS)

For investors who are considering FD's for Tax Saving purpose under section 80c of IT Act. (5 Year Lockin) ELSS Mutual Funds are good alternative as they have lock in of 3 Years and has offered better returns historically.

Which is a Better Investment Plan ?

Let's look briefly:

| Parameter | Mutual Fund | Fixed Deposit |

|---|---|---|

| Rate of Returns | No Assured Returns | Fixed Returns |

| Inflation Adjusted Returns | Potential for High Inflation Adjusted Returns | Usually Low Inflation Adjusted Returns |

| Risk | Medium to High Risk | Low Risk |

| Liquidity | Liquid | Liquid |

| Premature Withdrawal | Allowed with Exit Load/ No Load | Allowed with Penalty |

| Cost of Investment | Management Cost/Expense Ratio | No Cost |

| Tax Status | Favorable Tax Status | As Per Tax Slab |

Fund Selection Methodology used to find 7 funds

Best Mutual Funds to Invest in 2026

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) DSP World Gold Fund Growth ₹67.9493

↓ -0.10 ₹1,975 42.1 90.1 185.1 64.8 32.4 167.1 SBI PSU Fund Growth ₹37.1063

↓ -0.20 ₹5,980 9.9 21.3 36.4 36.1 28 11.3 ICICI Prudential Infrastructure Fund Growth ₹196.6

↓ -1.81 ₹8,077 -1 2.5 18.2 25.6 26.2 6.7 Invesco India PSU Equity Fund Growth ₹68.32

↓ -0.70 ₹1,492 4.2 13.1 34.5 32.5 25.8 10.3 DSP India T.I.G.E.R Fund Growth ₹327.007

↓ -1.79 ₹5,184 2.9 6 24.5 27.2 24.7 -2.5 Franklin Build India Fund Growth ₹148.681

↓ -1.28 ₹3,003 2.1 6.6 24.2 28.6 24 3.7 LIC MF Infrastructure Fund Growth ₹50.5051

↓ -0.33 ₹946 1.6 5.4 26.6 29.6 24 -3.7 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 26 Feb 26 Research Highlights & Commentary of 7 Funds showcased

Commentary DSP World Gold Fund SBI PSU Fund ICICI Prudential Infrastructure Fund Invesco India PSU Equity Fund DSP India T.I.G.E.R Fund Franklin Build India Fund LIC MF Infrastructure Fund Point 1 Lower mid AUM (₹1,975 Cr). Upper mid AUM (₹5,980 Cr). Highest AUM (₹8,077 Cr). Bottom quartile AUM (₹1,492 Cr). Upper mid AUM (₹5,184 Cr). Lower mid AUM (₹3,003 Cr). Bottom quartile AUM (₹946 Cr). Point 2 Established history (18+ yrs). Established history (15+ yrs). Established history (20+ yrs). Established history (16+ yrs). Oldest track record among peers (21 yrs). Established history (16+ yrs). Established history (18+ yrs). Point 3 Rating: 3★ (upper mid). Rating: 2★ (bottom quartile). Rating: 3★ (lower mid). Rating: 3★ (lower mid). Rating: 4★ (upper mid). Top rated. Not Rated. Point 4 Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Point 5 5Y return: 32.37% (top quartile). 5Y return: 27.98% (upper mid). 5Y return: 26.18% (upper mid). 5Y return: 25.77% (lower mid). 5Y return: 24.67% (lower mid). 5Y return: 24.04% (bottom quartile). 5Y return: 23.97% (bottom quartile). Point 6 3Y return: 64.81% (top quartile). 3Y return: 36.09% (upper mid). 3Y return: 25.64% (bottom quartile). 3Y return: 32.48% (upper mid). 3Y return: 27.22% (bottom quartile). 3Y return: 28.56% (lower mid). 3Y return: 29.60% (lower mid). Point 7 1Y return: 185.11% (top quartile). 1Y return: 36.41% (upper mid). 1Y return: 18.24% (bottom quartile). 1Y return: 34.54% (upper mid). 1Y return: 24.51% (lower mid). 1Y return: 24.24% (bottom quartile). 1Y return: 26.65% (lower mid). Point 8 Alpha: 2.12 (top quartile). Alpha: 0.05 (upper mid). Alpha: 0.00 (upper mid). Alpha: -2.70 (bottom quartile). Alpha: 0.00 (lower mid). Alpha: 0.00 (lower mid). Alpha: -6.08 (bottom quartile). Point 9 Sharpe: 3.41 (top quartile). Sharpe: 0.63 (upper mid). Sharpe: 0.15 (lower mid). Sharpe: 0.53 (upper mid). Sharpe: 0.08 (bottom quartile). Sharpe: 0.21 (lower mid). Sharpe: 0.03 (bottom quartile). Point 10 Information ratio: -0.47 (lower mid). Information ratio: -0.63 (bottom quartile). Information ratio: 0.00 (upper mid). Information ratio: -0.50 (bottom quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: 0.29 (top quartile). DSP World Gold Fund

SBI PSU Fund

ICICI Prudential Infrastructure Fund

Invesco India PSU Equity Fund

DSP India T.I.G.E.R Fund

Franklin Build India Fund

LIC MF Infrastructure Fund

*Below is the list of 7 best mutual funds having Net Assets/AUM higher than "The primary investment objective of the Scheme is to seek capital appreciation by investing predominantly in units of MLIIF - WGF. The Scheme may, at the discretion of the Investment Manager, also invest in the units of other similar overseas mutual fund schemes, which may constitute a significant part of its corpus. The Scheme may also invest a certain portion of its corpus in money market securities and/or units of money market/liquid schemes of DSP Merrill Lynch Mutual Fund, in order to meet liquidity requirements from time to time. However, there is no assurance that the investment objective of the Scheme will be realized." Research Highlights for DSP World Gold Fund Below is the key information for DSP World Gold Fund Returns up to 1 year are on The objective of the scheme would be to provide investors with opportunities for long-term growth in capital along with the liquidity of an open-ended scheme through an active management of investments in a diversified basket of equity stocks of domestic Public Sector Undertakings and in debt and money market instruments issued by PSUs AND others. Research Highlights for SBI PSU Fund Below is the key information for SBI PSU Fund Returns up to 1 year are on To generate capital appreciation and income distribution to unit holders by investing predominantly in equity/equity related securities of the companies belonging to the infrastructure development and balance in debt securities and money market instruments. Research Highlights for ICICI Prudential Infrastructure Fund Below is the key information for ICICI Prudential Infrastructure Fund Returns up to 1 year are on To generate capital appreciation by investing in Equity and Equity Related Instruments of companies where the Central / State Government(s) has majority shareholding or management control or has powers to appoint majority of directors. However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved. The Scheme does not assure or guarantee any returns. Research Highlights for Invesco India PSU Equity Fund Below is the key information for Invesco India PSU Equity Fund Returns up to 1 year are on To generate capital appreciation, from a portfolio that is substantially constituted of equity securities and equity related securities of corporates, which could benefit from structural changes brought about by continuing liberalization in economic policies by the government and/or continuing investments in infrastructure, both by the public and private sector. Research Highlights for DSP India T.I.G.E.R Fund Below is the key information for DSP India T.I.G.E.R Fund Returns up to 1 year are on The Scheme seeks to achieve capital appreciation by investing in companies engaged directly or indirectly in infrastructure related activities. Research Highlights for Franklin Build India Fund Below is the key information for Franklin Build India Fund Returns up to 1 year are on The investment objective of the scheme is to provide long term growth from a portfolio of equity / equity related instruments of companies engaged either directly or indirectly in the infrastructure sector. Research Highlights for LIC MF Infrastructure Fund Below is the key information for LIC MF Infrastructure Fund Returns up to 1 year are on 100 Crore. Sorted on 5 year CAGR/Annualized returns.

1. DSP World Gold Fund

DSP World Gold Fund

Growth Launch Date 14 Sep 07 NAV (26 Feb 26) ₹67.9493 ↓ -0.10 (-0.14 %) Net Assets (Cr) ₹1,975 on 31 Jan 26 Category Equity - Global AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆ Risk High Expense Ratio 1.41 Sharpe Ratio 3.41 Information Ratio -0.47 Alpha Ratio 2.12 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹8,807 31 Jan 23 ₹9,422 31 Jan 24 ₹8,517 31 Jan 25 ₹12,548 31 Jan 26 ₹33,170 Returns for DSP World Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 26 Feb 26 Duration Returns 1 Month 3.7% 3 Month 42.1% 6 Month 90.1% 1 Year 185.1% 3 Year 64.8% 5 Year 32.4% 10 Year 15 Year Since launch 10.9% Historical performance (Yearly) on absolute basis

Year Returns 2024 167.1% 2023 15.9% 2022 7% 2021 -7.7% 2020 -9% 2019 31.4% 2018 35.1% 2017 -10.7% 2016 -4% 2015 52.7% Fund Manager information for DSP World Gold Fund

Name Since Tenure Jay Kothari 1 Mar 13 12.93 Yr. Data below for DSP World Gold Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Basic Materials 95.89% Asset Allocation

Asset Class Value Cash 1.55% Equity 95.89% Debt 0.01% Other 2.56% Top Securities Holdings / Portfolio

Name Holding Value Quantity BGF World Gold I2

Investment Fund | -74% ₹1,458 Cr 1,177,658

↓ -41,596 VanEck Gold Miners ETF

- | GDX25% ₹497 Cr 573,719 Treps / Reverse Repo Investments

CBLO/Reverse Repo | -2% ₹35 Cr Net Receivables/Payables

Net Current Assets | -1% -₹15 Cr 2. SBI PSU Fund

SBI PSU Fund

Growth Launch Date 7 Jul 10 NAV (27 Feb 26) ₹37.1063 ↓ -0.20 (-0.53 %) Net Assets (Cr) ₹5,980 on 31 Jan 26 Category Equity - Sectoral AMC SBI Funds Management Private Limited Rating ☆☆ Risk High Expense Ratio 1.89 Sharpe Ratio 0.63 Information Ratio -0.63 Alpha Ratio 0.05 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹14,656 31 Jan 23 ₹17,067 31 Jan 24 ₹30,032 31 Jan 25 ₹32,242 31 Jan 26 ₹38,028 Returns for SBI PSU Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 26 Feb 26 Duration Returns 1 Month 9.6% 3 Month 9.9% 6 Month 21.3% 1 Year 36.4% 3 Year 36.1% 5 Year 28% 10 Year 15 Year Since launch 8.7% Historical performance (Yearly) on absolute basis

Year Returns 2024 11.3% 2023 23.5% 2022 54% 2021 29% 2020 32.4% 2019 -10% 2018 6% 2017 -23.8% 2016 21.9% 2015 16.2% Fund Manager information for SBI PSU Fund

Name Since Tenure Rohit Shimpi 1 Jun 24 1.67 Yr. Data below for SBI PSU Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Financial Services 34.09% Utility 29.59% Energy 13.91% Industrials 12.42% Basic Materials 7.01% Asset Allocation

Asset Class Value Cash 2.9% Equity 97.02% Debt 0.08% Top Securities Holdings / Portfolio

Name Holding Value Quantity State Bank of India (Financial Services)

Equity, Since 31 Jul 10 | SBIN18% ₹1,069 Cr 9,927,500 Bharat Electronics Ltd (Industrials)

Equity, Since 30 Jun 24 | BEL10% ₹583 Cr 12,975,000 NTPC Ltd (Utilities)

Equity, Since 31 Jul 10 | NTPC9% ₹550 Cr 15,443,244 Power Grid Corp Of India Ltd (Utilities)

Equity, Since 31 Jul 10 | POWERGRID9% ₹511 Cr 19,935,554

↑ 2,300,000 GAIL (India) Ltd (Utilities)

Equity, Since 31 May 24 | GAIL8% ₹488 Cr 29,150,000 Bharat Petroleum Corp Ltd (Energy)

Equity, Since 31 Aug 24 | BPCL6% ₹354 Cr 9,700,000 Bank of Baroda (Financial Services)

Equity, Since 31 Aug 24 | BANKBARODA6% ₹329 Cr 11,000,000 NMDC Ltd (Basic Materials)

Equity, Since 31 Oct 23 | NMDC4% ₹227 Cr 27,900,000 Indian Bank (Financial Services)

Equity, Since 30 Jun 21 | INDIANB4% ₹221 Cr 2,427,235 Oil India Ltd (Energy)

Equity, Since 31 Mar 24 | OIL3% ₹196 Cr 3,850,000 3. ICICI Prudential Infrastructure Fund

ICICI Prudential Infrastructure Fund

Growth Launch Date 31 Aug 05 NAV (27 Feb 26) ₹196.6 ↓ -1.81 (-0.91 %) Net Assets (Cr) ₹8,077 on 31 Jan 26 Category Equity - Sectoral AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆ Risk High Expense Ratio 1.89 Sharpe Ratio 0.15 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹16,042 31 Jan 23 ₹19,152 31 Jan 24 ₹29,825 31 Jan 25 ₹34,393 31 Jan 26 ₹36,891 Returns for ICICI Prudential Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 26 Feb 26 Duration Returns 1 Month 5.1% 3 Month -1% 6 Month 2.5% 1 Year 18.2% 3 Year 25.6% 5 Year 26.2% 10 Year 15 Year Since launch 15.6% Historical performance (Yearly) on absolute basis

Year Returns 2024 6.7% 2023 27.4% 2022 44.6% 2021 28.8% 2020 50.1% 2019 3.6% 2018 2.6% 2017 -14% 2016 40.8% 2015 2% Fund Manager information for ICICI Prudential Infrastructure Fund

Name Since Tenure Ihab Dalwai 3 Jun 17 8.67 Yr. Sharmila D’mello 30 Jun 22 3.59 Yr. Data below for ICICI Prudential Infrastructure Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Industrials 48.97% Financial Services 12.33% Utility 9.63% Basic Materials 9.49% Real Estate 6.53% Energy 6% Consumer Cyclical 2.03% Communication Services 0.11% Asset Allocation

Asset Class Value Cash 4.63% Equity 95.37% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 09 | LT9% ₹690 Cr 1,755,704 InterGlobe Aviation Ltd (Industrials)

Equity, Since 28 Feb 23 | INDIGO8% ₹640 Cr 1,391,449

↑ 275,091 NTPC Ltd (Utilities)

Equity, Since 29 Feb 16 | NTPC4% ₹332 Cr 9,326,448

↓ -1,050,000 Oberoi Realty Ltd (Real Estate)

Equity, Since 31 May 23 | OBEROIRLTY3% ₹253 Cr 1,696,181

↑ 637,668 Adani Ports & Special Economic Zone Ltd (Industrials)

Equity, Since 31 May 24 | ADANIPORTS3% ₹241 Cr 1,700,000 AIA Engineering Ltd (Industrials)

Equity, Since 28 Feb 21 | AIAENG3% ₹229 Cr 574,561

↓ -37,559 Kalpataru Projects International Ltd (Industrials)

Equity, Since 30 Sep 06 | KPIL3% ₹221 Cr 1,931,967

↑ 20,847 IndusInd Bank Ltd (Financial Services)

Equity, Since 31 Oct 24 | INDUSINDBK3% ₹217 Cr 2,424,016 Reliance Industries Ltd (Energy)

Equity, Since 31 Jul 23 | RELIANCE3% ₹213 Cr 1,529,725 Axis Bank Ltd (Financial Services)

Equity, Since 31 Dec 20 | AXISBANK3% ₹209 Cr 1,527,307

↓ -156,250 4. Invesco India PSU Equity Fund

Invesco India PSU Equity Fund

Growth Launch Date 18 Nov 09 NAV (27 Feb 26) ₹68.32 ↓ -0.70 (-1.01 %) Net Assets (Cr) ₹1,492 on 31 Jan 26 Category Equity - Sectoral AMC Invesco Asset Management (India) Private Ltd Rating ☆☆☆ Risk High Expense Ratio 2.14 Sharpe Ratio 0.53 Information Ratio -0.5 Alpha Ratio -2.7 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹13,872 31 Jan 23 ₹15,622 31 Jan 24 ₹26,577 31 Jan 25 ₹29,948 31 Jan 26 ₹35,297 Returns for Invesco India PSU Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 26 Feb 26 Duration Returns 1 Month 3.8% 3 Month 4.2% 6 Month 13.1% 1 Year 34.5% 3 Year 32.5% 5 Year 25.8% 10 Year 15 Year Since launch 12.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 10.3% 2023 25.6% 2022 54.5% 2021 20.5% 2020 31.1% 2019 6.1% 2018 10.1% 2017 -16.9% 2016 24.3% 2015 17.9% Fund Manager information for Invesco India PSU Equity Fund

Name Since Tenure Hiten Jain 1 Jul 25 0.59 Yr. Sagar Gandhi 1 Jul 25 0.59 Yr. Data below for Invesco India PSU Equity Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Industrials 31.92% Financial Services 29.89% Utility 18.15% Energy 12.64% Basic Materials 4.19% Consumer Cyclical 1.08% Asset Allocation

Asset Class Value Cash 2.14% Equity 97.86% Top Securities Holdings / Portfolio

Name Holding Value Quantity State Bank of India (Financial Services)

Equity, Since 28 Feb 21 | SBIN9% ₹139 Cr 1,294,989

↓ -92,628 Bharat Electronics Ltd (Industrials)

Equity, Since 31 Mar 17 | BEL9% ₹135 Cr 2,997,692 Indian Bank (Financial Services)

Equity, Since 30 Jun 21 | INDIANB7% ₹106 Cr 1,157,444 Bharat Petroleum Corp Ltd (Energy)

Equity, Since 30 Sep 18 | BPCL7% ₹99 Cr 2,717,009 Hindustan Aeronautics Ltd Ordinary Shares (Industrials)

Equity, Since 31 May 22 | HAL6% ₹87 Cr 187,643

↓ -8,515 NTPC Green Energy Ltd (Utilities)

Equity, Since 30 Nov 24 | NTPCGREEN5% ₹79 Cr 9,129,820 Dredging Corp of India Ltd (Industrials)

Equity, Since 31 Jul 25 | DREDGECORP5% ₹73 Cr 646,300 Bharat Dynamics Ltd Ordinary Shares (Industrials)

Equity, Since 31 May 22 | BDL5% ₹69 Cr 445,685 Bank of Baroda (Financial Services)

Equity, Since 30 Jun 21 | BANKBARODA5% ₹67 Cr 2,244,222 NTPC Ltd (Utilities)

Equity, Since 31 May 19 | NTPC4% ₹64 Cr 1,801,543 5. DSP India T.I.G.E.R Fund

DSP India T.I.G.E.R Fund

Growth Launch Date 11 Jun 04 NAV (27 Feb 26) ₹327.007 ↓ -1.79 (-0.54 %) Net Assets (Cr) ₹5,184 on 31 Jan 26 Category Equity - Sectoral AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆☆ Risk High Expense Ratio 1.89 Sharpe Ratio 0.08 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹15,028 31 Jan 23 ₹16,816 31 Jan 24 ₹26,495 31 Jan 25 ₹30,221 31 Jan 26 ₹31,981 Returns for DSP India T.I.G.E.R Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 26 Feb 26 Duration Returns 1 Month 9.7% 3 Month 2.9% 6 Month 6% 1 Year 24.5% 3 Year 27.2% 5 Year 24.7% 10 Year 15 Year Since launch 17.4% Historical performance (Yearly) on absolute basis

Year Returns 2024 -2.5% 2023 32.4% 2022 49% 2021 13.9% 2020 51.6% 2019 2.7% 2018 6.7% 2017 -17.2% 2016 47% 2015 4.1% Fund Manager information for DSP India T.I.G.E.R Fund

Name Since Tenure Rohit Singhania 21 Jun 10 15.63 Yr. Data below for DSP India T.I.G.E.R Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Industrials 30.23% Basic Materials 14.52% Financial Services 12.4% Utility 11.04% Energy 8.15% Consumer Cyclical 8.07% Health Care 5.75% Communication Services 3.2% Technology 1.66% Real Estate 1.57% Consumer Defensive 1.34% Asset Allocation

Asset Class Value Cash 2.08% Equity 97.92% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Jun 04 | LT5% ₹267 Cr 678,645

↓ -15,823 NTPC Ltd (Utilities)

Equity, Since 30 Nov 17 | NTPC5% ₹254 Cr 7,145,883 Apollo Hospitals Enterprise Ltd (Healthcare)

Equity, Since 31 Dec 24 | APOLLOHOSP4% ₹197 Cr 283,144

↑ 37,216 Multi Commodity Exchange of India Ltd (Financial Services)

Equity, Since 31 May 25 | MCX3% ₹172 Cr 680,825 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Oct 18 | BHARTIARTL3% ₹160 Cr 812,745 Oil & Natural Gas Corp Ltd (Energy)

Equity, Since 31 Mar 24 | ONGC3% ₹153 Cr 5,686,486

↑ 1,321,459 Power Grid Corp Of India Ltd (Utilities)

Equity, Since 31 Jan 25 | POWERGRID3% ₹143 Cr 5,567,574 Hindustan Aeronautics Ltd Ordinary Shares (Industrials)

Equity, Since 31 Oct 25 | HAL3% ₹141 Cr 305,098 Kirloskar Oil Engines Ltd (Industrials)

Equity, Since 31 Mar 23 | KIRLOSENG3% ₹136 Cr 1,154,264 Coal India Ltd (Energy)

Equity, Since 31 Dec 23 | COALINDIA2% ₹119 Cr 2,705,180

↓ -616,273 6. Franklin Build India Fund

Franklin Build India Fund

Growth Launch Date 4 Sep 09 NAV (27 Feb 26) ₹148.681 ↓ -1.28 (-0.86 %) Net Assets (Cr) ₹3,003 on 31 Jan 26 Category Equity - Sectoral AMC Franklin Templeton Asst Mgmt(IND)Pvt Ltd Rating ☆☆☆☆☆ Risk High Expense Ratio 2.01 Sharpe Ratio 0.21 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹14,734 31 Jan 23 ₹15,797 31 Jan 24 ₹25,867 31 Jan 25 ₹29,250 31 Jan 26 ₹31,672 Returns for Franklin Build India Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 26 Feb 26 Duration Returns 1 Month 8.1% 3 Month 2.1% 6 Month 6.6% 1 Year 24.2% 3 Year 28.6% 5 Year 24% 10 Year 15 Year Since launch 17.8% Historical performance (Yearly) on absolute basis

Year Returns 2024 3.7% 2023 27.8% 2022 51.1% 2021 11.2% 2020 45.9% 2019 5.4% 2018 6% 2017 -10.7% 2016 43.3% 2015 8.4% Fund Manager information for Franklin Build India Fund

Name Since Tenure Ajay Argal 18 Oct 21 4.29 Yr. Kiran Sebastian 7 Feb 22 3.99 Yr. Sandeep Manam 18 Oct 21 4.29 Yr. Data below for Franklin Build India Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Industrials 33.81% Financial Services 16.07% Utility 14.48% Energy 13.67% Communication Services 8.08% Basic Materials 5.58% Real Estate 2.64% Consumer Cyclical 1.25% Technology 1.16% Asset Allocation

Asset Class Value Cash 3.26% Equity 96.74% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 29 Feb 20 | LT9% ₹261 Cr 665,000 Oil & Natural Gas Corp Ltd (Energy)

Equity, Since 30 Jun 19 | ONGC6% ₹184 Cr 6,825,000 Reliance Industries Ltd (Energy)

Equity, Since 31 Oct 21 | RELIANCE6% ₹176 Cr 1,260,000

↑ 60,000 InterGlobe Aviation Ltd (Industrials)

Equity, Since 29 Feb 20 | INDIGO5% ₹161 Cr 350,000

↑ 24,659 NTPC Ltd (Utilities)

Equity, Since 30 Nov 16 | NTPC5% ₹142 Cr 3,978,727

↓ -371,273 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Sep 09 | BHARTIARTL5% ₹140 Cr 710,000 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Oct 25 | HDFCBANK5% ₹139 Cr 1,500,000 Axis Bank Ltd (Financial Services)

Equity, Since 31 Mar 12 | AXISBANK5% ₹137 Cr 1,000,000 State Bank of India (Financial Services)

Equity, Since 31 Jul 14 | SBIN4% ₹108 Cr 1,000,000 REC Ltd (Financial Services)

Equity, Since 30 Sep 25 | RECLTD3% ₹98 Cr 2,700,000

↑ 400,000 7. LIC MF Infrastructure Fund

LIC MF Infrastructure Fund

Growth Launch Date 29 Feb 08 NAV (27 Feb 26) ₹50.5051 ↓ -0.33 (-0.66 %) Net Assets (Cr) ₹946 on 31 Jan 26 Category Equity - Sectoral AMC LIC Mutual Fund Asset Mgmt Co Ltd Rating Risk High Expense Ratio 2.21 Sharpe Ratio 0.03 Information Ratio 0.29 Alpha Ratio -6.08 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹15,011 31 Jan 23 ₹15,567 31 Jan 24 ₹24,683 31 Jan 25 ₹30,671 31 Jan 26 ₹31,739 Returns for LIC MF Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 26 Feb 26 Duration Returns 1 Month 10.5% 3 Month 1.6% 6 Month 5.4% 1 Year 26.6% 3 Year 29.6% 5 Year 24% 10 Year 15 Year Since launch 9.4% Historical performance (Yearly) on absolute basis

Year Returns 2024 -3.7% 2023 47.8% 2022 44.4% 2021 7.9% 2020 46.6% 2019 -0.1% 2018 13.3% 2017 -14.6% 2016 42.2% 2015 -2.2% Fund Manager information for LIC MF Infrastructure Fund

Name Since Tenure Yogesh Patil 18 Sep 20 5.38 Yr. Mahesh Bendre 1 Jul 24 1.59 Yr. Data below for LIC MF Infrastructure Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Industrials 48.01% Consumer Cyclical 14.5% Basic Materials 9.34% Financial Services 6.56% Utility 6.33% Technology 3.72% Real Estate 3.47% Health Care 3.21% Communication Services 2.91% Asset Allocation

Asset Class Value Cash 1.95% Equity 98.05% Top Securities Holdings / Portfolio

Name Holding Value Quantity Tata Motors Ltd (Consumer Cyclical)

Equity, Since 31 Oct 25 | TMCV5% ₹48 Cr 1,051,964

↓ -36,431 Shakti Pumps (India) Ltd (Industrials)

Equity, Since 31 Mar 24 | SHAKTIPUMP5% ₹43 Cr 686,379 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Apr 09 | LT5% ₹43 Cr 108,403 REC Ltd (Financial Services)

Equity, Since 31 Jul 23 | RECLTD3% ₹33 Cr 901,191 Apollo Hospitals Enterprise Ltd (Healthcare)

Equity, Since 30 Jun 25 | APOLLOHOSP3% ₹30 Cr 43,674 Garware Hi-Tech Films Ltd (Basic Materials)

Equity, Since 31 Aug 23 | 5006553% ₹28 Cr 93,271 Schneider Electric Infrastructure Ltd (Industrials)

Equity, Since 31 Dec 23 | SCHNEIDER3% ₹26 Cr 377,034

↑ 61,173 Bharat Bijlee Ltd (Industrials)

Equity, Since 31 Jul 22 | BBL3% ₹26 Cr 92,624 Avalon Technologies Ltd (Technology)

Equity, Since 31 Jul 23 | AVALON3% ₹25 Cr 289,118 Mahindra Lifespace Developers Ltd (Real Estate)

Equity, Since 30 Jun 24 | MAHLIFE3% ₹24 Cr 659,065

financial planning is the key to managing your income and expenditures. So, what is your financial goal? Analyse and invest wisely!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Great Read. Clarified my doubts.