How ₹5,000/month Can Turn Into ₹1 Crore: The Real Power of SIPs and Compounding

In a world full of Market noise and overnight success stories, it’s easy to feel overwhelmed or left behind. But wealth isn’t built in a flash — it's built one step, one month, one rupee at a time. And that’s where the quiet, consistent magic of Systematic Investment plan (SIPs) shines.

](https://d28wu8o6itv89t.cloudfront.net/images/HowmonthCanTurnIntoCroreTheRea-1746444147725.jpeg)

Let’s take a grounded, real-world look at how just ₹5,000 a month, invested diligently, can grow into over ₹1 crore — not through luck or hype, but through patience, discipline, and the unbeatable force of compounding.

Why ₹5,000/month Can Change Your Financial Future

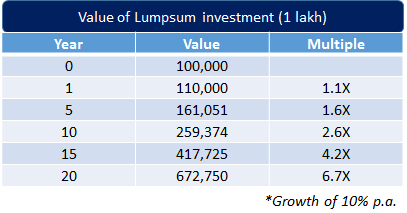

Imagine this: you set aside ₹5,000 every month — that’s less than what many spend on weekend outings. Over 20 years, this adds up to ₹12 lakh of your own money. Now, here’s where compounding steps in:

- At 10% annual return, it becomes ₹55 lakh

- At 12%, it becomes ₹75 lakh

- At 15%, it crosses ₹1.1 crore

The difference isn’t in the amount you invest — it’s in how long you stay invested and the rate at which your money compounds. Even a few percentage points make a huge difference over time.

My Journey: From Doubt to Discipline

A few years ago, I was like many others — overwhelmed by choices, uncertain where to begin, and convinced I needed a lot of money to start Investing. One day, while reviewing my monthly expenses, I realised I was spending more on food delivery, traveling, shopping, dining, etc. than I cared to admit. That’s when I decided: Why not invest just ₹5,000/month and forget about it for a while?

I picked a diversified Mutual Fund and set up a SIP. No market predictions — just quiet consistency.

In the first year, it barely made a difference. But by the third year, I saw something shift. The graph started bending upwards. Compounding was kicking in — slowly but surely. Today, that small decision has turned into one of the best financial moves of my life. And the peace of mind it brings? Priceless.

This isn’t about bragging. It’s about proving that you don’t need to be rich to start investing — you become financially strong because you started.

Talk to our investment specialist

The Real Reason SIPs Work (It’s Not Just the Maths)

1. No Need to Time the Market

Let’s face it — timing the market perfectly is nearly impossible. SIPs help you invest through the ups and downs, buying more units when prices are low and fewer when high. It smooths out Volatility and keeps you invested.

2. Compounding: Slow Start, Big Finish

In the first few years, returns might seem slow. But after 10+ years, growth accelerates. That’s how compounding works — like a snowball gathering mass. It’s boring at first, breathtaking later.

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Franklin Asian Equity Fund Growth ₹39.0197

↓ -0.01 ₹372 14.2 22.4 34.7 14.2 2.3 23.7 DSP Natural Resources and New Energy Fund Growth ₹107.583

↓ -0.23 ₹1,765 11.4 20.5 33.2 23.2 21.5 17.5 DSP US Flexible Equity Fund Growth ₹77.835

↑ 1.30 ₹1,119 8.9 15.9 27.3 22 16.7 33.8 Aditya Birla Sun Life Banking And Financial Services Fund Growth ₹64.83

↑ 0.21 ₹3,641 0.4 7.4 23.4 18 13 17.5 Franklin Build India Fund Growth ₹149.452

↑ 1.49 ₹3,003 2.3 5.3 21.1 28.1 23.9 3.7 Kotak Equity Opportunities Fund Growth ₹356.928

↑ 1.75 ₹29,991 0.7 4.4 17.9 19.9 17.3 5.6 Kotak Standard Multicap Fund Growth ₹87.925

↑ 0.42 ₹56,479 0 3.5 17.6 17.6 14.2 9.5 ICICI Prudential Banking and Financial Services Fund Growth ₹138.44

↑ 0.26 ₹10,951 -1.1 3.1 17.3 16.7 12.7 15.9 Invesco India Growth Opportunities Fund Growth ₹99.18

↑ 0.05 ₹8,959 -4.1 -4.3 16 24.4 17.5 4.7 Aditya Birla Sun Life Small Cap Fund Growth ₹84.9302

↑ 0.16 ₹4,778 -2.8 -0.7 15.8 18.3 15.6 -3.7 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 19 Feb 26 Research Highlights & Commentary of 10 Funds showcased

Commentary Franklin Asian Equity Fund DSP Natural Resources and New Energy Fund DSP US Flexible Equity Fund Aditya Birla Sun Life Banking And Financial Services Fund Franklin Build India Fund Kotak Equity Opportunities Fund Kotak Standard Multicap Fund ICICI Prudential Banking and Financial Services Fund Invesco India Growth Opportunities Fund Aditya Birla Sun Life Small Cap Fund Point 1 Bottom quartile AUM (₹372 Cr). Bottom quartile AUM (₹1,765 Cr). Bottom quartile AUM (₹1,119 Cr). Lower mid AUM (₹3,641 Cr). Lower mid AUM (₹3,003 Cr). Top quartile AUM (₹29,991 Cr). Highest AUM (₹56,479 Cr). Upper mid AUM (₹10,951 Cr). Upper mid AUM (₹8,959 Cr). Upper mid AUM (₹4,778 Cr). Point 2 Established history (18+ yrs). Established history (17+ yrs). Established history (13+ yrs). Established history (12+ yrs). Established history (16+ yrs). Oldest track record among peers (21 yrs). Established history (16+ yrs). Established history (17+ yrs). Established history (18+ yrs). Established history (18+ yrs). Point 3 Top rated. Rating: 5★ (top quartile). Rating: 5★ (upper mid). Rating: 5★ (upper mid). Rating: 5★ (upper mid). Rating: 5★ (lower mid). Rating: 5★ (lower mid). Rating: 5★ (bottom quartile). Rating: 5★ (bottom quartile). Rating: 5★ (bottom quartile). Point 4 Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 2.29% (bottom quartile). 5Y return: 21.51% (top quartile). 5Y return: 16.71% (upper mid). 5Y return: 12.99% (bottom quartile). 5Y return: 23.93% (top quartile). 5Y return: 17.27% (upper mid). 5Y return: 14.16% (lower mid). 5Y return: 12.73% (bottom quartile). 5Y return: 17.47% (upper mid). 5Y return: 15.59% (lower mid). Point 6 3Y return: 14.23% (bottom quartile). 3Y return: 23.16% (upper mid). 3Y return: 22.04% (upper mid). 3Y return: 18.03% (lower mid). 3Y return: 28.09% (top quartile). 3Y return: 19.87% (upper mid). 3Y return: 17.61% (bottom quartile). 3Y return: 16.74% (bottom quartile). 3Y return: 24.38% (top quartile). 3Y return: 18.26% (lower mid). Point 7 1Y return: 34.69% (top quartile). 1Y return: 33.22% (top quartile). 1Y return: 27.26% (upper mid). 1Y return: 23.37% (upper mid). 1Y return: 21.11% (upper mid). 1Y return: 17.92% (lower mid). 1Y return: 17.61% (lower mid). 1Y return: 17.33% (bottom quartile). 1Y return: 15.97% (bottom quartile). 1Y return: 15.77% (bottom quartile). Point 8 Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 2.18 (upper mid). Alpha: 0.61 (upper mid). Alpha: 0.00 (lower mid). Alpha: 2.61 (top quartile). Alpha: 3.74 (top quartile). Alpha: -2.00 (bottom quartile). Alpha: -0.94 (bottom quartile). Alpha: 0.00 (bottom quartile). Point 9 Sharpe: 2.24 (top quartile). Sharpe: 1.32 (top quartile). Sharpe: 1.15 (upper mid). Sharpe: 1.03 (upper mid). Sharpe: 0.21 (bottom quartile). Sharpe: 0.44 (lower mid). Sharpe: 0.46 (lower mid). Sharpe: 0.78 (upper mid). Sharpe: 0.19 (bottom quartile). Sharpe: 0.01 (bottom quartile). Point 10 Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: -0.16 (bottom quartile). Information ratio: 0.25 (top quartile). Information ratio: 0.00 (lower mid). Information ratio: 0.08 (upper mid). Information ratio: 0.19 (upper mid). Information ratio: -0.01 (bottom quartile). Information ratio: 0.56 (top quartile). Information ratio: 0.00 (bottom quartile). Franklin Asian Equity Fund

DSP Natural Resources and New Energy Fund

DSP US Flexible Equity Fund

Aditya Birla Sun Life Banking And Financial Services Fund

Franklin Build India Fund

Kotak Equity Opportunities Fund

Kotak Standard Multicap Fund

ICICI Prudential Banking and Financial Services Fund

Invesco India Growth Opportunities Fund

Aditya Birla Sun Life Small Cap Fund

3. Automation = Discipline

SIPs run on autopilot. This removes emotion — you don’t pause during a market dip or over-invest in a boom. The result? A cool-headed, consistent approach that beats 90% of panic-driven investors.

Let’s Talk Real Data: Axis Small Cap Fund Example

Say you invested ₹10,000 in Axis small cap Fund when it launched in 2013:

- Today, it would be worth over ₹1.12 lakh

- That’s a CAGR of 23.56% across 11 years

Now consider this: a SIP of just ₹1,000/month in the same fund for 10 years grew to nearly ₹5 lakh, even after weathering market corrections.

This isn’t theory — it’s what actually happened.

SIP vs Lump Sum: Which One’s Better?

| Feature | SIP | Lump Sum |

|---|---|---|

| Market Timing Needed? | No | Yes |

| Emotionally Easier? | Yes | No |

| Good for First-Time Investors? | Absolutely | Risky |

SIPs are made for real people: salaried, busy, and often unsure of when or how to invest. They remove friction from the process.

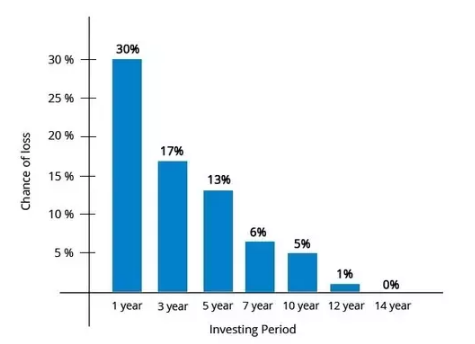

The Crucial Insight Most Miss

Here’s a hard truth: most people quit SIPs too soon. They pull out in fear after 3–5 years, right before compounding kicks into overdrive.

Stay invested. Because:

- Year 1–10 = slow, steady growth

- Year 11–20 = explosive acceleration

Don’t interrupt the magic. Let time do its thing.

Real Questions, Honest Answers

Q: What if I pause my SIP after 5 years?

A: You’ll still see gains, but you’ll miss the real growth curve. Long-term SIPs are where wealth multiplies.

Q: Can I expect 15% returns?

A: No fund can guarantee it — but historically, small-cap and flexi-cap funds have delivered this over long horizons. Choose wisely and stay the course.

Q: Is ₹5,000/month even enough?

A: Yes. It’s a great start. Combine with step-up SIPs as your Income grows.

Q: How do I pick a good fund?

A: Look for consistent long-term performance, low expense ratios, and experienced fund managers. Don't chase recent returns.

Final Takeaway: SIPs Are a Quiet Revolution

You won’t see SIP investors flaunting quick riches. But come back in 20 years, and you’ll find they’ve quietly built wealth, peace of mind, and freedom — without shouting about it.

Start small. Stay consistent. Let time and compounding do the rest.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.