Top Dynamic Bond Funds Rated by FINCASH for 2025 - 2026

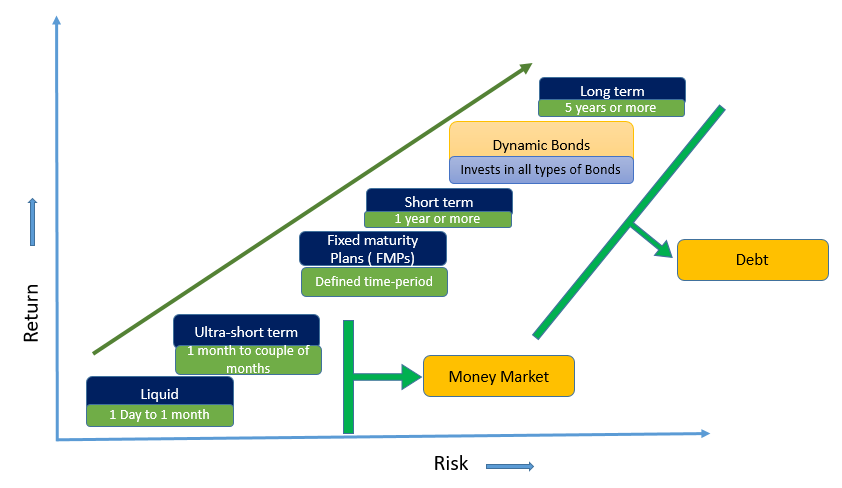

Dynamic bond Funds can be considered as an investment option for mid or long-term plan. This Mutual Fund scheme invests its corpus in fixed Income securities consisting of varying maturity periods. In this fund, the fund managers decide on which funds they need to invest based on their perception of the interest rate scenario and future interest rate movements.

Investors who feel puzzled about the interest rate scenario can prefer Investing in Dynamic Bond Funds. You can rely on the view of the fund managers to earn profits through this fund. Some of the best performing dynamic bond funds to invest in are as follows:

Talk to our investment specialist

Top Rated Dynamic Bond Funds

Fund NAV Net Assets (Cr) Rating 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity Exit Load Aditya Birla Sun Life Medium Term Plan Growth ₹42.3295

↑ 0.03 ₹2,982 ☆☆☆☆ 2.9 5.2 10.2 10.1 7.78% 3Y 4M 24D 4Y 6M 7D 0-365 Days (1%),365 Days and above(NIL) Axis Strategic Bond Fund Growth ₹29.2078

↑ 0.02 ₹2,044 ☆☆☆☆ 1.3 3.4 8.1 8.2 8.16% 3Y 2M 19D 4Y 4M 6D 0-12 Months (1%),12 Months and above(NIL) Nippon India Strategic Debt Fund Growth ₹16.379

↑ 0.00 ₹136 ☆☆☆☆ 1.1 3.1 9.4 8.5 7.1% 3Y 6M 29D 4Y 8M 8D 0-12 Months (1%),12 Months and above(NIL) Kotak Medium Term Fund Growth ₹23.8344

↑ 0.02 ₹1,987 ☆☆☆ 1.2 4 8.7 8.3 8.24% 3Y 29D 4Y 4M 10D 0-18 Months (2%),18 Months and above(NIL) Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 25 Feb 26 Research Highlights & Commentary of 4 Funds showcased

Commentary Aditya Birla Sun Life Medium Term Plan Axis Strategic Bond Fund Nippon India Strategic Debt Fund Kotak Medium Term Fund Point 1 Highest AUM (₹2,982 Cr). Upper mid AUM (₹2,044 Cr). Bottom quartile AUM (₹136 Cr). Lower mid AUM (₹1,987 Cr). Point 2 Oldest track record among peers (16 yrs). Established history (13+ yrs). Established history (11+ yrs). Established history (11+ yrs). Point 3 Top rated. Rating: 4★ (upper mid). Rating: 4★ (lower mid). Rating: 3★ (bottom quartile). Point 4 Risk profile: Moderate. Risk profile: Moderate. Risk profile: Moderate. Risk profile: Moderate. Point 5 1Y return: 10.21% (top quartile). 1Y return: 8.11% (bottom quartile). 1Y return: 9.44% (upper mid). 1Y return: 8.69% (lower mid). Point 6 1M return: 0.93% (lower mid). 1M return: 0.96% (upper mid). 1M return: 0.91% (bottom quartile). 1M return: 0.97% (top quartile). Point 7 Sharpe: 2.33 (top quartile). Sharpe: 1.06 (lower mid). Sharpe: 1.03 (bottom quartile). Sharpe: 1.32 (upper mid). Point 8 Information ratio: 0.00 (top quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: 0.00 (bottom quartile). Point 9 Yield to maturity (debt): 7.78% (lower mid). Yield to maturity (debt): 8.16% (upper mid). Yield to maturity (debt): 7.10% (bottom quartile). Yield to maturity (debt): 8.24% (top quartile). Point 10 Modified duration: 3.40 yrs (lower mid). Modified duration: 3.22 yrs (upper mid). Modified duration: 3.58 yrs (bottom quartile). Modified duration: 3.08 yrs (top quartile). Aditya Birla Sun Life Medium Term Plan

Axis Strategic Bond Fund

Nippon India Strategic Debt Fund

Kotak Medium Term Fund

Why Are These Top Performers?

Fincash has employed the following parameters for shortlisting the top performing funds:

Past Returns: Return analysis of last 3 years.

Parameters & Weights: Information ratio with some modifications for our ratings and rankings.

Qualitative & Quantitative Analysis: Quantitative measures like Average Maturity, Credit Quality, Expense Ratio, Sharpe Ratio, Sortino Ratio, Alpa, including fund age and the size of the fund has been considered. Qualitative analysis like the reputation of the fund along with the fund manager is one of the important parameters that you would see in the listed funds.

Asset Size: The minimum AUM criteria for debt mutual fund are INR 100 Crores with some exceptions at times for new funds that are doing well in the Market.

Performance with Respect to Benchmark: Peer average.

Smart Tips to Invest in Dynamic Bond Funds

Some of the important tips to consider while investing in dynamic bond funds are:

Investment Tenure: Investors planning to invest in dynamic bond funds should stay invested for minimum three years.

Invest via a SIP: SIP or Systematic Investment plan is the most efficient way to invest in a Mutual Fund. They not only provide a systematic way of investing, but also ensures regular investment growth. You can invest in a SIP with an amount as low as INR 500.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.