Headline Risk

What is Headline Risk?

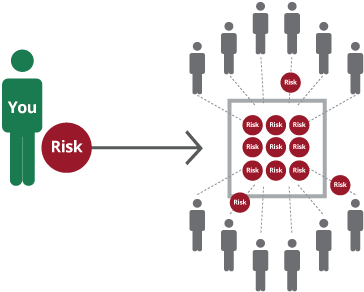

Many factors are responsible for influencing the value of the stocks. Headline risk is one such factor that can have a strong impact on the prices of a security. It refers to the phenomenon that imposes a great risk on the stock market and some specific securities due to news headlines.

The story portrayed by the media can affect a specific sector of the investment industry or the entire stock market. The best example of headline risk meaning is the 2018-19 headlines of a possible war between China and the United States.

Example

Let’s take another example-

Suppose a medical company launches a new drug and claims that it can reduce the cholesterol level of the patient drastically. The competitor conducts thorough research and finds that the drug does have a good impact on the patient’s cholesterol, but it comes with a few side effects that can cause damage to the liver. Though they are unable to obtain scientific proof concerning their study, they release this news to the media. This creates a headline.

The company that launched the drug for cholesterol must control these rumors and news or there is a good chance the company will experience a massive drop in the stock value. Even if the competitors couldn’t come up with scientific proof, people tend to believe media.

Talk to our investment specialist

Does Headline Affect Stock Market?

The headlines you get to read on social media sites, televisions, newspapers, and more can have a significant impact on the stock market. The headline fluctuates the stock prices. The surprising part is that it doesn’t matter whether the news is true or inaccurate. Even if the reporters publish misleading news, the investors will believe in it. As a result, the prices of the stocks will drop drastically. Headline risks occur when the prices of the stock fluctuate because of the news headline.

The headlines can also have a positive impact on the stock market. For example, if a specific drug gets FDA approval and the news gets published on social media and television, then the prices of the stock of the drug manufacturing company will increase. This means there can be a positive movement in the stock prices if the media mentions some positive news about the brand.

How to Control Headline Risk?

In order to control the headline risks, companies are supposed to enhance the public relations campaign. Brands need to focus on building a strong public relations campaign so that they can portray a positive image of the business to the target audience and investors. Not only will it compensate for the negative stories, but an effective press release campaign can help you control the headline risk.

For investors, it’s important to use only credible and reputable news sources to get real-time updates on the stock market. This will help them make an informed decision. Not all news channels and other sources offer a reliable and accurate story. So, don’t make a decision based on some random media stories.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.