Marriage Planning Calculator

Marriage is one of the most awaited life events and something that every parent looks forward to. However, with marriages turning lavish day by day and the increasing rate of inflation, you can land into a tight spot if you don’t pre-plan your expenses. Therefore, marriage planning calculator helps you plan and invest your money for the big day in advance.

What is a Wedding Planning Calculator?

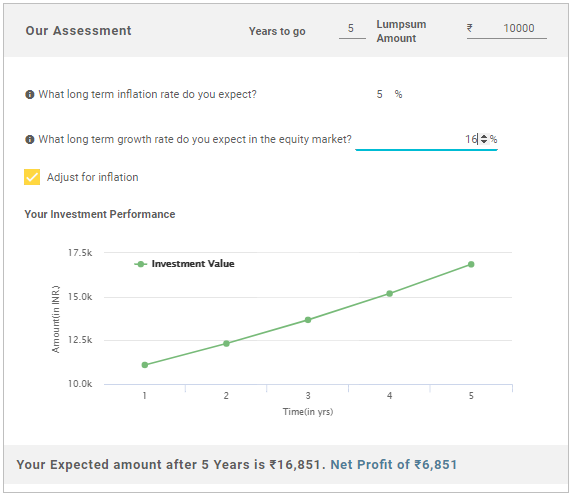

The calculator gives you an estimate of how much returns can you expect from your investment for the wedding.

Know Your Monthly SIP Amount

How does the Calculator Work?

The working of the calculator is pretty simple. All you have to do is enter the details of your child’s age, his/her approximate age of marriage, amount you would require for marriage and the interest rate. The calculator will quickly generate results based on the values entered and you will get an idea of how much you need to save monthly to reach the goal.

Benefits of Marriage Calculator

- Calculation can be done online for free in minutes

- The calculator considers all factors that can affect your finances and gives a realistic estimate

- Based on the results generated you can select the most appropriate investment

Note/ Disclaimer: The calculations are generated assuming an inflation rate of 6% and the values are illustrative. The actual cost incurred would depend on the future performance of your investment and is subject to market conditions

Talk to our investment specialist

Why Should you Plan your Child’s Marriage in Advance?

- Advance planning helps handle hidden costs associated with marriage

- Timely investments help counter the impact of rising inflation rates

- Early Investing will keep your financial life disciplined

- You will not have to disturb your retirement fund incase extra money is needed

- Building a steady corpus by keeping a set amount each month will help relieve financial stress

Fund Selection Methodology used to find 2 funds

Top Funds for 2026

*Best funds based on 3 year performance.

"The primary investment objective of the Scheme is to seek capital appreciation by investing predominantly in units of MLIIF - WGF. The Scheme may, at the discretion of the Investment Manager, also invest in the units of other similar overseas mutual fund schemes, which may constitute a significant part of its corpus. The Scheme may also invest a certain portion of its corpus in money market securities and/or units of money market/liquid schemes of DSP Merrill Lynch Mutual Fund, in order to meet liquidity requirements from time to time. However, there is no assurance that the investment objective of the Scheme will be realized." Below is the key information for DSP World Gold Fund Returns up to 1 year are on To generate capital appreciation by investing in Equity and Equity Related Instruments of companies where the Central / State Government(s) has majority shareholding or management control or has powers to appoint majority of directors. However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved. The Scheme does not assure or guarantee any returns. Research Highlights for Invesco India PSU Equity Fund Below is the key information for Invesco India PSU Equity Fund Returns up to 1 year are on 1. DSP World Gold Fund

DSP World Gold Fund

Growth Launch Date 14 Sep 07 NAV (26 Feb 26) ₹67.9493 ↓ -0.10 (-0.14 %) Net Assets (Cr) ₹1,975 on 31 Jan 26 Category Equity - Global AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆ Risk High Expense Ratio 1.41 Sharpe Ratio 3.41 Information Ratio -0.47 Alpha Ratio 2.12 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹8,807 31 Jan 23 ₹9,422 31 Jan 24 ₹8,517 31 Jan 25 ₹12,548 31 Jan 26 ₹33,170 Returns for DSP World Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 26 Feb 26 Duration Returns 1 Month 3.7% 3 Month 42.1% 6 Month 90.1% 1 Year 185.1% 3 Year 64.8% 5 Year 32.4% 10 Year 15 Year Since launch 10.9% Historical performance (Yearly) on absolute basis

Year Returns 2024 167.1% 2023 15.9% 2022 7% 2021 -7.7% 2020 -9% 2019 31.4% 2018 35.1% 2017 -10.7% 2016 -4% 2015 52.7% Fund Manager information for DSP World Gold Fund

Name Since Tenure Jay Kothari 1 Mar 13 12.93 Yr. Data below for DSP World Gold Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Basic Materials 95.89% Asset Allocation

Asset Class Value Cash 1.55% Equity 95.89% Debt 0.01% Other 2.56% Top Securities Holdings / Portfolio

Name Holding Value Quantity BGF World Gold I2

Investment Fund | -74% ₹1,458 Cr 1,177,658

↓ -41,596 VanEck Gold Miners ETF

- | GDX25% ₹497 Cr 573,719 Treps / Reverse Repo Investments

CBLO/Reverse Repo | -2% ₹35 Cr Net Receivables/Payables

Net Current Assets | -1% -₹15 Cr 2. Invesco India PSU Equity Fund

Invesco India PSU Equity Fund

Growth Launch Date 18 Nov 09 NAV (27 Feb 26) ₹68.32 ↓ -0.70 (-1.01 %) Net Assets (Cr) ₹1,492 on 31 Jan 26 Category Equity - Sectoral AMC Invesco Asset Management (India) Private Ltd Rating ☆☆☆ Risk High Expense Ratio 2.14 Sharpe Ratio 0.53 Information Ratio -0.5 Alpha Ratio -2.7 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹13,872 31 Jan 23 ₹15,622 31 Jan 24 ₹26,577 31 Jan 25 ₹29,948 31 Jan 26 ₹35,297 Returns for Invesco India PSU Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 26 Feb 26 Duration Returns 1 Month 3.8% 3 Month 4.2% 6 Month 13.1% 1 Year 34.5% 3 Year 32.5% 5 Year 25.8% 10 Year 15 Year Since launch 12.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 10.3% 2023 25.6% 2022 54.5% 2021 20.5% 2020 31.1% 2019 6.1% 2018 10.1% 2017 -16.9% 2016 24.3% 2015 17.9% Fund Manager information for Invesco India PSU Equity Fund

Name Since Tenure Hiten Jain 1 Jul 25 0.59 Yr. Sagar Gandhi 1 Jul 25 0.59 Yr. Data below for Invesco India PSU Equity Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Industrials 31.92% Financial Services 29.89% Utility 18.15% Energy 12.64% Basic Materials 4.19% Consumer Cyclical 1.08% Asset Allocation

Asset Class Value Cash 2.14% Equity 97.86% Top Securities Holdings / Portfolio

Name Holding Value Quantity State Bank of India (Financial Services)

Equity, Since 28 Feb 21 | SBIN9% ₹139 Cr 1,294,989

↓ -92,628 Bharat Electronics Ltd (Industrials)

Equity, Since 31 Mar 17 | BEL9% ₹135 Cr 2,997,692 Indian Bank (Financial Services)

Equity, Since 30 Jun 21 | INDIANB7% ₹106 Cr 1,157,444 Bharat Petroleum Corp Ltd (Energy)

Equity, Since 30 Sep 18 | BPCL7% ₹99 Cr 2,717,009 Hindustan Aeronautics Ltd Ordinary Shares (Industrials)

Equity, Since 31 May 22 | HAL6% ₹87 Cr 187,643

↓ -8,515 NTPC Green Energy Ltd (Utilities)

Equity, Since 30 Nov 24 | NTPCGREEN5% ₹79 Cr 9,129,820 Dredging Corp of India Ltd (Industrials)

Equity, Since 31 Jul 25 | DREDGECORP5% ₹73 Cr 646,300 Bharat Dynamics Ltd Ordinary Shares (Industrials)

Equity, Since 31 May 22 | BDL5% ₹69 Cr 445,685 Bank of Baroda (Financial Services)

Equity, Since 30 Jun 21 | BANKBARODA5% ₹67 Cr 2,244,222 NTPC Ltd (Utilities)

Equity, Since 31 May 19 | NTPC4% ₹64 Cr 1,801,543

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Research Highlights for DSP World Gold Fund