Upside and Downside Capture Ratio: A Practical Guide for Indian Mutual Fund Investors

Upside and downside capture ratios help investors understand how a Mutual Fund behaves across different market phases. Rather than looking only at absolute returns, these ratios show whether a fund gains more or loses less than its benchmark during market rallies and corrections — and by how much.

Simply put, these ratios answer two very practical questions -

- When markets rise, does the fund rise more or less than the benchmark?

- When markets fall, does the fund fall more or less than the benchmark?

Because markets move in cycles, these ratios are especially useful for evaluating a fund’s consistency, risk control, and fund manager behaviour, not just headline returns.

Why Upside and Downside Capture Ratios Matter

Many investors evaluate funds based only on bull market performance. But strong long-term returns depend just as much on how a fund handles market downturns.

A fund that slightly underperforms during rallies but falls far less during corrections can often deliver better long-term outcomes than a highly aggressive fund that rises and falls sharply with the market.

Upside and downside capture ratios help investors-

- Assess a fund manager’s behaviour in different market conditions

- Understand whether returns come from skill or excessive risk-taking

- Compare funds within the same category more meaningfully

These ratios are particularly relevant for long-term SIP investors and those approaching Financial goals.

What Is Upside Capture Ratio?

The upside capture ratio measures how much a fund participates in positive market phases relative to its benchmark.

An upside capture ratio above 100 means the fund outperformed the benchmark during up markets

A ratio below 100 means the fund underperformed when markets were rising

Example -

If a benchmark delivers a return of 10% during a bull phase and the fund delivers 15%, the upside capture ratio is:

(15 ÷ 10) × 100 = 150

This means the fund gained 50% more than the benchmark during market upswings.

The upside capture ratio helps investors understand how aggressively a fund participates when markets are favourable.

Talk to our investment specialist

Formula for Upside Capture Ratio

Upside capture ratio is calculated by comparing the fund’s returns with benchmark returns during periods when the benchmark has generated positive returns.

Upside Capture Ratio = (Fund returns during up-market periods ÷ Benchmark returns during up-market periods) × 100

What is Downside Capture Ratio

The downside capture ratio measures how a fund performs during market declines.

- A downside capture ratio below 100 indicates the fund fell less than the benchmark

- A ratio above 100 means the fund lost more than the benchmark during corrections

This ratio is crucial for understanding a fund’s risk management and downside protection.

Example -

If the benchmark falls by -10% during a correction and the fund falls by -6%, the downside capture ratio is:

(-6 ÷ -10) × 100 = 60

This shows that the fund limited losses better than the benchmark.

Formula for Downside Capture Ratio

Downside capture ratio is calculated by comparing the fund’s returns with benchmark returns during periods when the benchmark has delivered negative returns.

Downside Capture Ratio = (Fund returns during down-market periods ÷ Benchmark returns during down-market periods) × 100

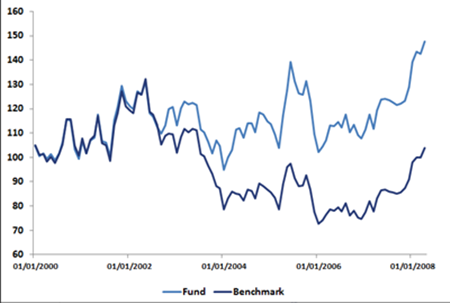

Upside and Downside Capture Ratio

Here's a view of returns from the fund and returns from the benchmark that fund managers tries to outperform.

A Critical Limitation Investors Should Know

The simple capture ratio formula works well only when both the fund and the benchmark move in the same direction.

Problems arise when they move in opposite directions.

Example

- Benchmark return: -5%

- Fund return: +2%

Using a direct division in such cases produces misleading or negative ratios, even though the fund has clearly outperformed the benchmark.

This is why professional data providers do not rely on single-period arithmetic calculations.

How Capture Ratios Are Calculated in Practice

In practice, capture ratios are calculated using periodic returns (usually monthly) and geometric averages, not simple arithmetic averages.

Why geometric averages are used

- Investment returns compound over time

- Geometric averages reflect the actual investor experience

- They handle Volatility and fluctuating returns more accurately

Simplified method

- Identify months where the benchmark return is positive (for upside capture)

- Calculate the fund’s geometric average return for those months

- Calculate the benchmark’s geometric average return for the same months

- Divide the fund return by the benchmark return and multiply by 100

The same process is repeated for months when the benchmark return is negative to calculate downside capture. This method ensures capture ratios remain meaningful across full market cycles.

India-Specific Mutual Fund Example

Consider an actively managed Large cap fund compared with the Nifty 50 over five years using monthly data.

Nifty 50

- Average return during positive months: +1.2%

- Average return during negative months: -0.8%

Large-cap fund

- Average return during positive months: +1.4%

- Average return during negative months: -0.5%

Upside Capture Ratio

(1.4 ÷ 1.2) × 100 = 117

The fund captured 17% more upside than the index during rallies.

Downside Capture Ratio

(-0.5 ÷ -0.8) × 100 = 62.5

The fund lost significantly less than the benchmark during market corrections.

This combination indicates measured participation in bull markets and strong downside protection, a desirable trait for long-term investors.

How to Interpret Upside and Downside Capture Together

Capture ratios should always be analysed together, not in isolation.

| Scenario | What It Indicates |

|---|---|

| High upside, high downside | Aggressive fund with higher volatility |

| Low upside, low downside | Defensive fund with capital protection |

| High upside, low downside | Strong fund manager skill (rare) |

| Low upside, high downside | Poor risk-return balance |

For long-term investors, downside control is often more important than maximum upside participation.

Who Should Use Capture Ratios?

Upside and downside capture ratios are useful for -

- Long-term SIP investors

- Investors comparing funds within the same category

- Investors nearing financial goals

- Evaluating active fund manager performance

They are less relevant for short-term traders focused purely on momentum.

Key Takeaways

- Upside capture shows how a fund performs in rising markets

- Downside capture shows how well it controls losses during corrections

- Ratios should be calculated using periodic returns and geometric averages

- A good fund does not need the highest upside capture

- Consistent downside protection plays a major role in long-term wealth creation

Understanding capture ratios helps investors move beyond return chasing and focus on risk-aware Investing, which is essential for sustainable long-term results.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

You Might Also Like