Best Liquid Mutual Funds in 2026 - A Complete Investor Guide

Every investor has “temporary money” — money waiting to be invested, spent, or moved.

Bonuses, business inflows, sale proceeds, emergency buffers — these amounts often sit in savings accounts simply because it feels convenient. But convenience comes at a cost.

Liquid Mutual Funds exist for exactly this situation. They are designed to handle money that is not meant to stay idle, yet should not be exposed to market Volatility.

In this article, we break down liquid mutual funds in a practical, investor-first manner — how they work, why experienced investors use them, and how you can use them effectively as part of a disciplined Financial plan.

What are Liquid Funds?

Liquid mutual funds are a category of debt mutual funds that invest in very short-term money market instruments such as:

- Treasury Bills (T-Bills)

- Certificates of Deposit (CDs)

- Commercial Papers (CPs)

- Short-term government securities

The defining feature of Liquid Funds is that the maturity of each instrument does not exceed 91 days. Because of this ultra-short maturity, liquid funds carry low interest-rate risk and relatively low credit risk compared to other debt funds.

In simple terms, liquid funds are designed to park money safely for a few days to a few months, while earning returns that are typically higher than a savings Bank account.

How Do Liquid Funds Work?

When you invest in a liquid fund, your money is pooled with other investors’ money and invested in short-term debt instruments issued by governments, banks, and high-quality corporates.

Because these instruments mature quickly -

- The fund manager can easily meet redemption requests

- NAV fluctuations remain minimal

- The fund continuously reinvests matured instruments at prevailing market rates

This makes liquid funds highly suitable for managing temporary surplus cash.

Talk to our investment specialist

Why Invest in Liquid Funds?

Liquid funds are not return-maximising products. They are efficiency products—designed to optimise idle money.

Key Benefits -

- No lock-in period - You can withdraw money anytime

- High liquidity - Most liquid funds offer T+1 redemption

- Low risk - Minimal volatility due to short maturity

- Better than idle cash - Typically earn more than savings accounts

- Ideal for short duration - From 1 day to a few months

Liquid funds are often used as a temporary parking solution, not a long-term investment.

Liquid Funds vs Savings Bank Account

Savings accounts are familiar and perceived as safe, but they are not efficient for surplus cash.

| Feature | Savings Account | Liquid Mutual Fund |

|---|---|---|

| Returns | Low | Relatively higher |

| Liquidity | Instant | T+1 redemption |

| Risk | Nil | Low |

| Flexibility | Limited | High |

While savings accounts offer convenience, liquid funds are often preferred when money is not required immediately and can be parked even for a short period.

Example: If you receive a bonus, business inflow, or sale proceeds and do not need the money immediately, a liquid fund allows your money to work instead of remaining idle.

Who Should Invest in Liquid Funds?

Liquid funds are suitable for:

- Salaried individuals waiting to deploy money into SIPs

- Business owners managing working capital

- Investors waiting for market opportunities

- Individuals parking emergency funds temporarily

- Corporates managing short-term cash flows

They are not meant for long-term wealth creation, but for capital preservation with efficiency.

Fund Selection Methodology used to find 6 funds

6 Best Liquid Funds India FY 26 - 27

Fund NAV Net Assets (Cr) 1 MO (%) 3 MO (%) 6 MO (%) 1 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity Axis Liquid Fund Growth ₹3,014.04

↑ 0.70 ₹35,653 0.5 1.5 3 6.4 6.6 6.06% 1M 28D 2M 2D Edelweiss Liquid Fund Growth ₹3,461.51

↑ 0.69 ₹10,414 0.5 1.5 3 6.4 6.5 6.03% 2M 1D 2M 1D UTI Liquid Cash Plan Growth ₹4,440.25

↑ 0.97 ₹23,480 0.5 1.5 3 6.4 6.5 6.04% 1M 26D 1M 26D Tata Liquid Fund Growth ₹4,262.49

↑ 1.01 ₹18,946 0.5 1.5 2.9 6.4 6.5 6.08% 1M 28D 1M 28D DSP Liquidity Fund Growth ₹3,864.35

↑ 0.87 ₹17,777 0.5 1.5 3 6.4 6.5 5.98% 1M 2D 1M 6D Aditya Birla Sun Life Liquid Fund Growth ₹436.097

↑ 0.10 ₹47,273 0.5 1.5 2.9 6.4 6.5 6.19% 2M 1D 2M 1D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 13 Feb 26 Research Highlights & Commentary of 6 Funds showcased

Commentary Axis Liquid Fund Edelweiss Liquid Fund UTI Liquid Cash Plan Tata Liquid Fund DSP Liquidity Fund Aditya Birla Sun Life Liquid Fund Point 1 Upper mid AUM (₹35,653 Cr). Bottom quartile AUM (₹10,414 Cr). Upper mid AUM (₹23,480 Cr). Lower mid AUM (₹18,946 Cr). Bottom quartile AUM (₹17,777 Cr). Highest AUM (₹47,273 Cr). Point 2 Established history (16+ yrs). Established history (18+ yrs). Oldest track record among peers (22 yrs). Established history (21+ yrs). Established history (20+ yrs). Established history (21+ yrs). Point 3 Top rated. Rating: 2★ (bottom quartile). Rating: 3★ (lower mid). Rating: 4★ (upper mid). Rating: 3★ (bottom quartile). Rating: 4★ (upper mid). Point 4 Risk profile: Low. Risk profile: Low. Risk profile: Low. Risk profile: Low. Risk profile: Low. Risk profile: Low. Point 5 1Y return: 6.40% (top quartile). 1Y return: 6.38% (upper mid). 1Y return: 6.38% (upper mid). 1Y return: 6.37% (bottom quartile). 1Y return: 6.37% (lower mid). 1Y return: 6.37% (bottom quartile). Point 6 1M return: 0.54% (top quartile). 1M return: 0.53% (lower mid). 1M return: 0.53% (upper mid). 1M return: 0.53% (bottom quartile). 1M return: 0.54% (upper mid). 1M return: 0.53% (bottom quartile). Point 7 Sharpe: 3.47 (upper mid). Sharpe: 3.82 (top quartile). Sharpe: 3.28 (lower mid). Sharpe: 3.23 (bottom quartile). Sharpe: 3.55 (upper mid). Sharpe: 3.21 (bottom quartile). Point 8 Information ratio: 0.00 (top quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: 0.00 (bottom quartile). Information ratio: 0.00 (bottom quartile). Point 9 Yield to maturity (debt): 6.06% (upper mid). Yield to maturity (debt): 6.03% (bottom quartile). Yield to maturity (debt): 6.04% (lower mid). Yield to maturity (debt): 6.08% (upper mid). Yield to maturity (debt): 5.98% (bottom quartile). Yield to maturity (debt): 6.19% (top quartile). Point 10 Modified duration: 0.16 yrs (upper mid). Modified duration: 0.17 yrs (bottom quartile). Modified duration: 0.16 yrs (upper mid). Modified duration: 0.16 yrs (lower mid). Modified duration: 0.09 yrs (top quartile). Modified duration: 0.17 yrs (bottom quartile). Axis Liquid Fund

Edelweiss Liquid Fund

UTI Liquid Cash Plan

Tata Liquid Fund

DSP Liquidity Fund

Aditya Birla Sun Life Liquid Fund

All the funds mentioned above are ideal, we are giving you detailed analysis of 3 funds.

To provide a high level of liquidity with reasonable returns commensurating with low risk through a portfolio of money market and debt securities. However there can be no assurance that the investment objective of the scheme will be achieved. Research Highlights for Axis Liquid Fund Below is the key information for Axis Liquid Fund Returns up to 1 year are on The investment objective of the Scheme is to provide reasonable returns, commensurate with low risk while providing a high level of liquidity, through a portfolio of money market and debt securities. However, there can be no assurance that the investment objectives of the Scheme will be realized. Research Highlights for Edelweiss Liquid Fund Below is the key information for Edelweiss Liquid Fund Returns up to 1 year are on The investment objective of the scheme is to generate steady and reasonable income, with low risk and high level of liquidity from a portfolio of money market securities and high quality debt. Research Highlights for UTI Liquid Cash Plan Below is the key information for UTI Liquid Cash Plan Returns up to 1 year are on 1. Axis Liquid Fund

Axis Liquid Fund

Growth Launch Date 9 Oct 09 NAV (13 Feb 26) ₹3,014.04 ↑ 0.70 (0.02 %) Net Assets (Cr) ₹35,653 on 31 Dec 25 Category Debt - Liquid Fund AMC Axis Asset Management Company Limited Rating ☆☆☆☆ Risk Low Expense Ratio 0.23 Sharpe Ratio 3.47 Information Ratio 0 Alpha Ratio 0 Min Investment 500 Min SIP Investment 1,000 Exit Load NIL Yield to Maturity 6.06% Effective Maturity 2 Months 2 Days Modified Duration 1 Month 28 Days Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹10,333 31 Jan 23 ₹10,864 31 Jan 24 ₹11,639 31 Jan 25 ₹12,497 31 Jan 26 ₹13,296 Returns for Axis Liquid Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 13 Feb 26 Duration Returns 1 Month 0.5% 3 Month 1.5% 6 Month 3% 1 Year 6.4% 3 Year 7% 5 Year 5.9% 10 Year 15 Year Since launch 7% Historical performance (Yearly) on absolute basis

Year Returns 2024 6.6% 2023 7.4% 2022 7.1% 2021 4.9% 2020 3.3% 2019 4.3% 2018 6.6% 2017 7.5% 2016 6.7% 2015 7.6% Fund Manager information for Axis Liquid Fund

Name Since Tenure Devang Shah 5 Nov 12 13.16 Yr. Aditya Pagaria 13 Aug 16 9.39 Yr. Sachin Jain 3 Jul 23 2.5 Yr. Data below for Axis Liquid Fund as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 99.74% Other 0.26% Debt Sector Allocation

Sector Value Cash Equivalent 57.87% Corporate 34.53% Government 7.34% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity Net Receivables / (Payables)

CBLO | -10% -₹3,660 Cr Tbill

Sovereign Bonds | -6% ₹1,976 Cr 200,000,000

↑ 200,000,000 Tbill

Sovereign Bonds | -4% ₹1,299 Cr 130,807,200 HDFC Bank Limited

Certificate of Deposit | -4% ₹1,260 Cr 25,500

↑ 25,500 Small Industries Dev Bank Of India

Commercial Paper | -3% ₹993 Cr 20,000 Export Import Bank Of India

Commercial Paper | -3% ₹993 Cr 20,000 Indian Bank (25/02/2026) **

Certificate of Deposit | -3% ₹991 Cr 20,000

↑ 20,000 Small Industries Dev Bank Of India

Commercial Paper | -3% ₹991 Cr 20,000 HDFC Bank Ltd.

Debentures | -3% ₹963 Cr 19,500

↑ 19,500 India (Republic of)

- | -3% ₹946 Cr 95,000,000 2. Edelweiss Liquid Fund

Edelweiss Liquid Fund

Growth Launch Date 21 Sep 07 NAV (13 Feb 26) ₹3,461.51 ↑ 0.69 (0.02 %) Net Assets (Cr) ₹10,414 on 31 Dec 25 Category Debt - Liquid Fund AMC Edelweiss Asset Management Limited Rating ☆☆ Risk Low Expense Ratio 0.23 Sharpe Ratio 3.82 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load NIL Yield to Maturity 6.03% Effective Maturity 2 Months 1 Day Modified Duration 2 Months 1 Day Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹10,326 31 Jan 23 ₹10,833 31 Jan 24 ₹11,585 31 Jan 25 ₹12,435 31 Jan 26 ₹13,228 Returns for Edelweiss Liquid Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 13 Feb 26 Duration Returns 1 Month 0.5% 3 Month 1.5% 6 Month 3% 1 Year 6.4% 3 Year 6.9% 5 Year 5.8% 10 Year 15 Year Since launch 7% Historical performance (Yearly) on absolute basis

Year Returns 2024 6.5% 2023 7.3% 2022 6.9% 2021 4.7% 2020 3.2% 2019 4.1% 2018 6.6% 2017 7.4% 2016 6.6% 2015 6.8% Fund Manager information for Edelweiss Liquid Fund

Name Since Tenure Rahul Dedhia 11 Dec 17 8.06 Yr. Hetul Raval 22 Sep 25 0.27 Yr. Data below for Edelweiss Liquid Fund as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 99.79% Other 0.21% Debt Sector Allocation

Sector Value Cash Equivalent 66.05% Corporate 24.73% Government 9.02% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity Net Receivables/(Payables)

CBLO | -6% -₹643 Cr Tbill

Sovereign Bonds | -6% ₹593 Cr 60,000,000

↑ 60,000,000 Axis Bank Limited

Certificate of Deposit | -5% ₹544 Cr 55,000,000 HDFC Bank Ltd.

Debentures | -4% ₹444 Cr 45,000,000

↑ 45,000,000 India (Republic of)

- | -3% ₹349 Cr 35,000,000 Bank Of Baroda

Certificate of Deposit | -3% ₹346 Cr 35,000,000 Small Industries Development Bank Of India

Debentures | -3% ₹300 Cr 30,000,000 Punjab National Bank Cd 09-03-26#**

Certificate of Deposit | -3% ₹297 Cr 30,000,000

↑ 30,000,000 Small Industries Dev Bank Of India

Commercial Paper | -3% ₹296 Cr 30,000,000

↑ 30,000,000 Axis Bank Limited

Certificate of Deposit | -2% ₹248 Cr 25,000,000 3. UTI Liquid Cash Plan

UTI Liquid Cash Plan

Growth Launch Date 11 Dec 03 NAV (13 Feb 26) ₹4,440.25 ↑ 0.97 (0.02 %) Net Assets (Cr) ₹23,480 on 31 Dec 25 Category Debt - Liquid Fund AMC UTI Asset Management Company Ltd Rating ☆☆☆ Risk Low Expense Ratio 0.25 Sharpe Ratio 3.28 Information Ratio 0 Alpha Ratio 0 Min Investment 500 Min SIP Investment 1,500 Exit Load NIL Yield to Maturity 6.04% Effective Maturity 1 Month 26 Days Modified Duration 1 Month 26 Days Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹10,333 31 Jan 23 ₹10,859 31 Jan 24 ₹11,630 31 Jan 25 ₹12,481 31 Jan 26 ₹13,277 Returns for UTI Liquid Cash Plan

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 13 Feb 26 Duration Returns 1 Month 0.5% 3 Month 1.5% 6 Month 3% 1 Year 6.4% 3 Year 6.9% 5 Year 5.9% 10 Year 15 Year Since launch 6.8% Historical performance (Yearly) on absolute basis

Year Returns 2024 6.5% 2023 7.3% 2022 7% 2021 4.8% 2020 3.3% 2019 4.2% 2018 6.6% 2017 7.4% 2016 6.7% 2015 7.7% Fund Manager information for UTI Liquid Cash Plan

Name Since Tenure Amit Sharma 7 Jul 17 8.49 Yr. Data below for UTI Liquid Cash Plan as on 31 Dec 25

Asset Allocation

Asset Class Value Cash 99.71% Other 0.29% Debt Sector Allocation

Sector Value Cash Equivalent 66.4% Corporate 30.34% Government 2.98% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity Tbill

Sovereign Bonds | -5% ₹1,236 Cr 12,500,000,000

↑ 12,500,000,000 HDFC Bank Limited

Certificate of Deposit | -4% ₹992 Cr 10,000,000,000

↑ 10,000,000,000 Net Current Assets

Net Current Assets | -4% -₹915 Cr Tbill

Sovereign Bonds | -3% ₹790 Cr 8,000,000,000

↑ 8,000,000,000 Small Industries Dev Bank Of India

Commercial Paper | -3% ₹741 Cr 7,500,000,000

↑ 7,500,000,000 Indian Overseas Bank

Debentures | -3% ₹691 Cr 7,000,000,000

↑ 7,000,000,000 Kotak Mahindra Bank Limited

Certificate of Deposit | -3% ₹594 Cr 5,950,000,000

↑ 3,000,000,000 Punjab & Sind Bank

Debentures | -2% ₹543 Cr 5,500,000,000

↑ 5,500,000,000 HDFC Bank Ltd.

Debentures | -2% ₹498 Cr 5,000,000,000

↑ 5,000,000,000 Tata Capital Housing Finance Limited

Commercial Paper | -2% ₹497 Cr 5,000,000,000

How to Evaluate Liquid Mutual Funds?

Choosing a liquid fund should not be based on returns alone. Since return differences are marginal, risk management and structure matter more.

1. Credit Quality of Portfolio

A good liquid fund primarily invests in:

- Government securities

- PSU-issued instruments

- Highly rated corporate papers

Funds that take excessive credit risk to boost short-term returns should be avoided.

2. Expense Ratio

Expense ratio plays a crucial role in short-term investments.

- Lower expense ratio = higher take-home return

- Liquid funds generally maintain lower expense ratios compared to other debt funds

Even a small difference in expense ratio can materially impact returns over short holding periods.

3. Fund Size and Track Record

- Larger AUM indicates higher market trust

- A longer track record helps assess consistency and risk management

Avoid very small or newly launched liquid funds unless backed by a strong AMC pedigree.

4. Investment Horizon

Liquid funds are suitable for very short durations.

- Up to 1 day to a few weeks: Ideal use case

- Up to 3 months: Still suitable

Beyond that: Other debt funds may be more appropriate

For longer horizons, investors may consider ultra short duration or short duration funds.

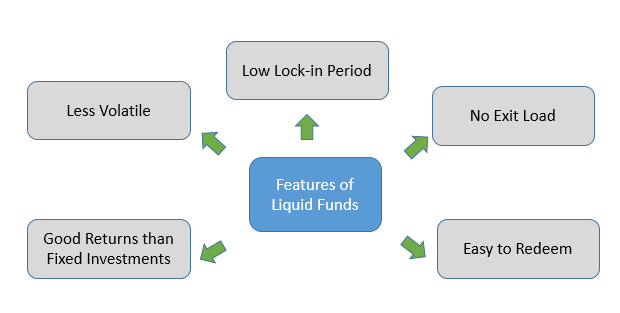

Features of Liquid Mutual Funds

1. Exit Load

Most liquid funds do not charge exit load. If applicable, it is usually minimal and limited to very early redemptions.

2. Volatility

Due to ultra-short maturity, liquid funds exhibit very low NAV volatility. However, like all market-linked products, they are not entirely risk-free.

3. Lock-in Period

Liquid funds do not have a lock-in period. You can redeem your investment at any time based on liquidity needs.

4. Returns

Liquid fund returns are influenced by:

- Prevailing short-term interest rates

- Money market liquidity

- Credit quality of instruments

Returns may fluctuate over time but generally remain more stable compared to longer-duration debt funds

5. Liquid Funds Taxation

Liquid fund taxation depends on how you invest -

- Capital Gains: Taxed as per applicable income tax slab

- Dividends: Taxed in the hands of the investor

Tax treatment may differ based on individual circumstances. Investors should consider post-tax returns when comparing liquid funds with other short-term options.

Liquid Funds vs Other Short-Term Options

| Option | Liquidity | Risk | Return Potential |

|---|---|---|---|

| Savings Account | Instant | None | Low |

| Fixed Deposit | Locked | Low | Moderate |

| Overnight Fund | Very High | Very Low | Low–Moderate |

| Liquid Fund | High | Low | Moderate |

Liquid funds often strike a balance between liquidity and efficiency.

Common Misconceptions About Liquid Funds

- “Liquid funds are risky” – Risk is low, but not zero

- “Returns are guaranteed” – Returns are market-linked

- “Only big investors use them” – Suitable for retail investors too

Understanding the purpose of liquid funds helps avoid misuse.

How to Invest in Liquid Funds Online?

Open Free Investment Account for Lifetime at Fincash.com

Complete your Registration and KYC Process

Upload Documents (PAN, Aadhaar, etc.). And, You are Ready to Invest!

Due to the lack of awareness about liquid funds, people don’t invest in them and instead keep huge sums in a savings account. But, it’s never too late to begin something good. So, invest in Best Liquid Funds today!

Final Thoughts

Liquid mutual funds play a crucial role in a well-structured financial plan. They help ensure that surplus money is never idle, while still maintaining liquidity and safety.

Instead of letting short-term funds lose value in savings accounts, liquid funds offer a smarter alternative—provided investors understand their role and limitations.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Good knowledgeable information, you should have to give an example