Royal Sundaram General Insurance Company Limited

Royal Sundaram general insurance Company Limited is India's first private general insurance company, licensed in October 2000 by India's Insurance Regulatory and Development Authority (IRDA). Royal Sundaram, formerly known as Royal Sundaram Alliance Insurance Company Limited, is a subsidiary of Sundaram Finance (non-banking finance sector).

Royal Sundaram General Insurance was initially promoted as a joint venture between Sundaram Finance and Royal Sundaram Insurance plc, one of the UK's oldest general insurers. In July 2015, Sundaram Finance acquired a 26% equity holding from Royal and SunAlliance Insurance plc. But today, Sundaram Finance holds 75.90% of the equity, and Indian shareholders hold the remaining 24.10%.

Royal Sundaram General Insurance offers a wide range of plans, including motor, health, home, travel, and personal accident insurance. Also, the company offers specially designed products to small & medium enterprises(SMEs) and individual customers.

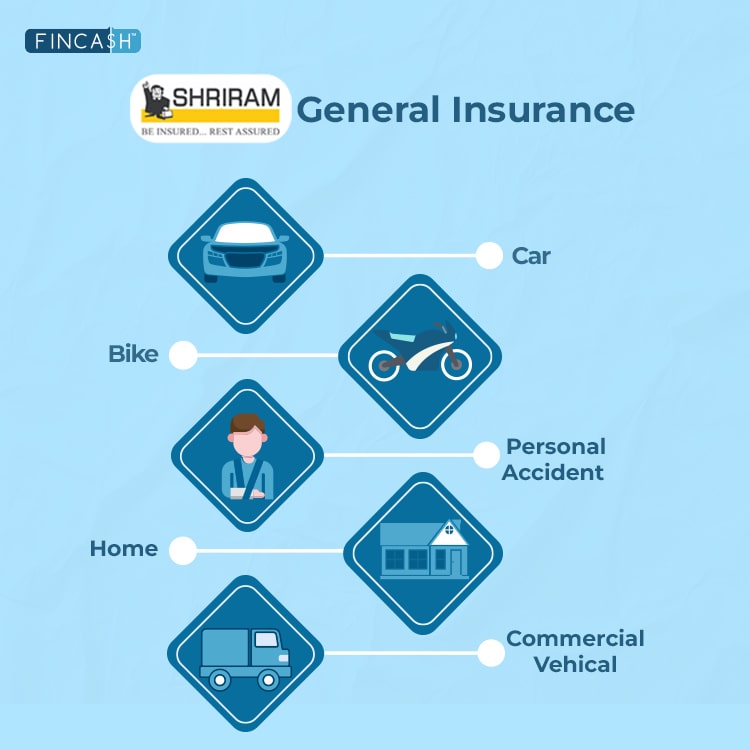

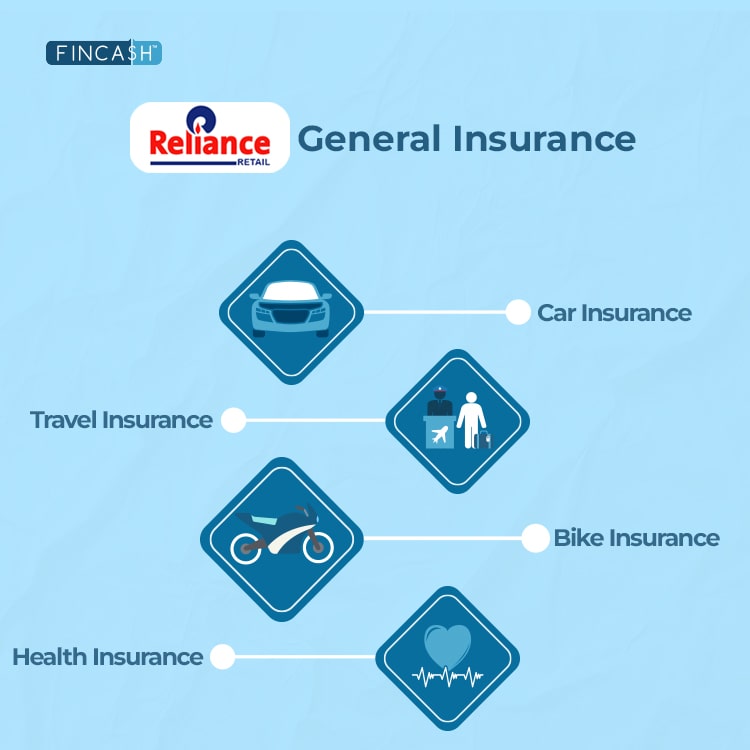

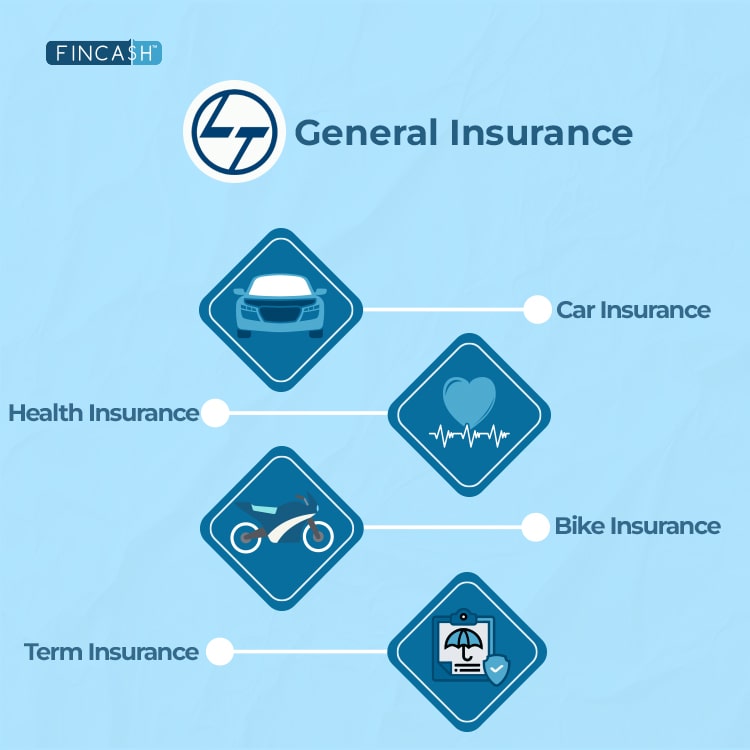

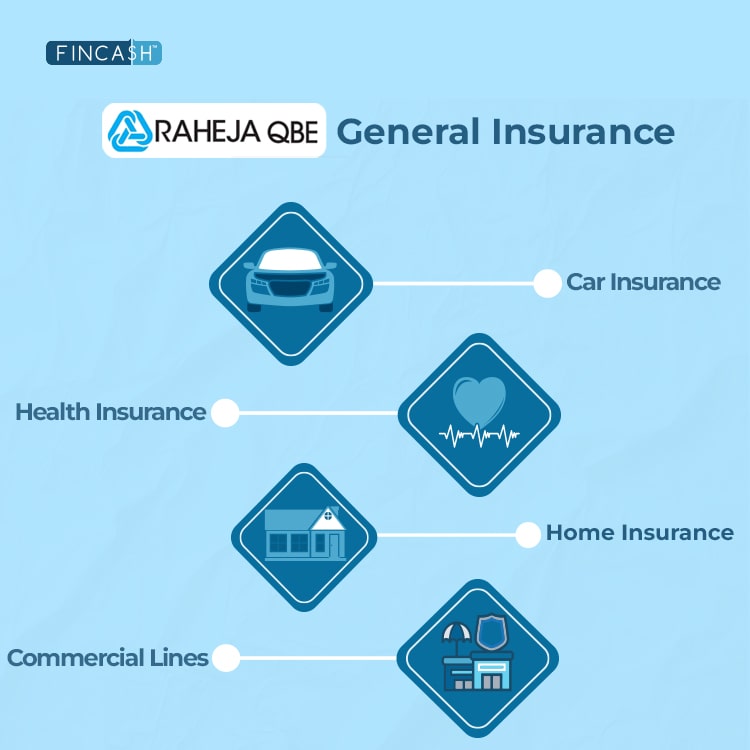

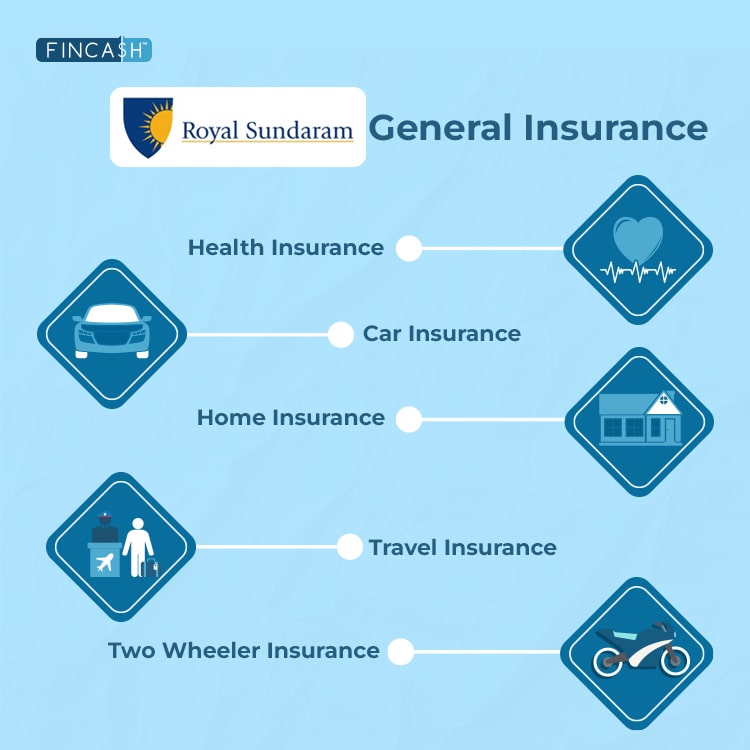

Royal Sundaram General Insurance Product Portfolio

Below is the list of products that you can find under the Portfolio of Royal Sundaram General Insurance Company:

1. Royal Sundaram Health Insurance

A health insurance plan covers hospitalisation expenses and various medical treatments for you and/or your family, whether planned or unexpected. In the current era, the costs associated with emergency and scheduled medical procedures can be exorbitant. Protect your hard-earned savings and let a comprehensive health insurance plan handle the financial strain of hospitalisation and medical care.

Under this category, you can find the following plans:

- Royal Sundaram Lifeline Classic Health Insurance Plan

- Royal Sundaram Lifeline Supreme Health Insurance Plan

- Royal Sundaram Lifeline Elite Health Insurance Plan

Inclusions of Royal Sundaram Health Insurance

Below mentioned are the factors covered in these plans:

- Coverage for medical expenses incurred before hospitalisation, typically up to 30 days prior

- Coverage for medical expenses incurred after discharge from the hospital, typically up to 60 days

- Coverage for the medical expenses of an organ donor during the organ transplant procedure

- Expenses for transportation to the nearest hospital in an emergency

- A daily cash allowance for up to 30 days during hospitalisation to cover incidental expenses

- Coverage for medical expenses related to childbirth, including pre-natal and post-natal care

- Coverage for the medical expenses of a newborn baby from birth until a specified period

- Coverage for vaccinations for the insured and their family members as specified in the policy

- Coverage for medical expenses when the insured is admitted to the hospital for more than 24 hours

Exclusions of Royal Sundaram Health Insurance

Below mentioned are the factors that are not covered in these plans:

- Any illness or condition that the insured was aware of and had been diagnosed with before the commencement of the policy unless specified otherwise in the policy terms

- Any diseases or illnesses contracted within the first 30 days of the policy period are not covered

- Certain specified illnesses and treatments have a waiting period of 24 months before coverage begins

a. Royal Sundaram Family Plus

Family Plus, is a unique health insurance plan for a young couple planning to start a family It is a unique combination of an Individual + Floater Sum Insured in the same health insurance policy. The floater plan is designed especially for large families and it covers up to 19 relationships.

Some of the key benefits offered by Family Plus:

- Inpatient hospitalisation expenses

- Pre and post-hospitalisation expenses

- All day-care procedures

- Coverage for the treatment of organ donor

- Ambulance cover

- No-claim bonus (NCB)

- Vaccination in case of animal bite

- AYUSH Treatment

- Domiciliary hospitalisation expenses

- Emergency domestic evacuation

b. Royal Sundaram Lifeline

Lifeline is a holistic indemnity plan that covers the health insurance needs of you and your family. It is offered as an Individual plan and as a family floater plan for yourself, your spouse and children.

Some of the key features offered in the Lifeline plan are:

- Inpatient hospitalisation expenses

- Pre and post-hospitalization expenses

- Coverage of all daycare procedures

- Ambulance cover

- Expenses for treatment of organ donor

- Domiciliary hospitalisation

- No-claim bonus (NCB)

- AYUSH Treatment

- Covers vaccination in case of animal bite

- Provision of complete health check-up

- Preventive healthcare and wellness

Talk to our investment specialist

2. Royal Sundaram Car Insurance

With minimal documentation and quick claim settlement, Royal Sundaram offers car policy for you to be prepared for the unforeseen circumstances in life. You are covered by a Personal Accident Cover for a minimum of Rs.15 lakh. In case you are in an accident involving a third party, the policy covers your financial liability for damage to their property.

The policy also protects against loss or damage due to theft or accident. Additional coverages also includes:

- Personal accident cover for all passengers and paid driver up to a maximum of Rs. 50 lakh per person

- Legal liability to your employees who might be driving or travelling in the car

- Legal liability for your paid driver

- Comprehensive cover for electrical/electronic/ non-electrical fittings

- Cover for CNG Kit and Bi-Fuel System as mentioned in the Registration Copy (RC) book

3. Royal Sundaram Travel Secure Plan

Travel Secure is a very comprehensive policy covering all segments of travel abroad. Here are the plans offered:

Leisure Trip - It is a comprehensive plan for a holiday abroad, with SI starting from 50,000 USD up to 10 lac USD

Multi Trip - If you are a frequent business traveller who takes multiple trips in a year, then you can get a customised annual plan

Senior Citizen - A tailor made plan for members aged 71 and above

Asia - An affordable plan exclusively for travel within Asia

Student - A very useful annual plan for all students going abroad for studies, the duration of which can be from 1 to 7 years

4. Royal Sundaram Home Insurance

The deep sentimental value of your home and its possessions is understandable. Thus, the Home insurance plans by Royal Sundaram are designed to protect your building and its contents. With these policies, you can rest assured knowing that your home's and its belongings' safety is in reliable hands.

Under this category, you can find the following plans:

- Home Building Insurance

Home Building Insurance offers you cover for your residential home and shelters you from unforeseen expenses due to natural and manmade damage

It compensates for the breakage or loss of your personal treasures and essentials to ensure your peace of mind

- Home Building and Contents Insurance

This offers you comprehensive cover for your residential home from expenses due to natural and manmade damage and also compensates for the breakage or loss of your personal treasures

Inclusions of Royal Sundaram Home Insurance

Below mentioned are the factors covered in these plans:

- Protects the structure of your home against risks such as fire, storms, and other natural disasters

- Covers the contents of your home, including furniture, appliances, and personal belongings against theft, fire, and other perils

Exclusions of Royal Sundaram Home Insurance

Below mentioned are the factors that are not covered in these plans:

- Any damage caused due to war, nuclear risks, or related perils is not covered

- Normal wear and tear, gradual deterioration, or mechanical or electrical breakdowns are excluded

- Damage or loss caused by illegal activities or criminal acts

- Any damage caused intentionally by the policyholder or residents

- Damage due to pollution or contamination

- Damage or loss occurring when the home has been unoccupied for a specified period

- Any indirect or consequential losses arising from the damage or loss of insured property

5. Royal Sundaram Personal Accident Plan

You can always stay ahead of unseen circumstances such as accidents by making sure that you and your family are always backed by insurance. The benefit of having a personal accident plan is that you are protected against loss of income.

- 24x7 global coverage

- Family cover

- Protection that grows annually

- Instant cover

- No medical test or income proof

- Free look period

Inclusions of Royal Sundaram Personal Accident Insurance

Below mentioned are the factors covered in these plans:

- Provides a lump sum payment to the nominee in case of the insured's accidental death

- Offers compensation if the insured suffers a permanent and total disability due to an accident, rendering them unable to work for life

- Covers financial compensation for permanent partial disabilities resulting from an accident, such as the loss of a limb or eyesight

- Provides compensation if the insured is temporarily unable to work due to an accident-related injury

- Covers the medical expenses incurred for hospitalisation due to an accident, including costs for surgery, doctor consultations, and other related treatments

- Provides a lump sum amount towards the education of the insured's dependent children in the event of the insured's accidental death or permanent total disablement

Exclusions of Royal Sundaram Personal Accident Insurance

Below mentioned are the factors that are not covered in these plans:

- Coverage is not provided for self-inflicted injuries or intentionally caused by the insured

- Any claims resulting from suicide or attempted suicide are excluded from the policy

- Injuries or incidents occurring while the insured is under the influence of alcohol or drugs are not covered

- Accidents that occur while participating in activities such as aviation, ballooning, or other dangerous sports are excluded

6. Commercial Vehicle Insurance

The plan covers goods carrying vehicles, passenger-carrying vehicles, taxies, miscellaneous class of vehicles such as cranes and trailers, tractors, trade road risk policy, trade road transit policy and trade internal risk policy

Some of the key benefits offered under this plan are as follows:

- Loss or damage protection

- Unlimited liability

- Indemnity for third party property

- Personal accident cover

- Cashless claim

- Assured service

Inclusions of Royal Sundaram Commercial Vehicle Insurance

Below mentioned are the factors covered in these plans:

- Covers damages to commercial vehicles caused by accidents

- Provides coverage if the insured vehicle is stolen

- Includes protection against damages due to fire and explosions

- Covers damages caused by natural disasters like floods, earthquakes, storms, etc

- Protects against damages from riots, strikes, and acts of terrorism

- Covers legal liabilities arising from damages caused to a third party's property or bodily injuries/death in an accident involving the insured vehicle

- Provides compensation in case of accidental death or permanent disability of the owner-driver

- Covers expenses related to towing the insured vehicle to the nearest repair shop following an accident

Exclusions of Royal Sundaram Commercial Vehicle Insurance

Below are the factors that are not covered in these plans:

- Losses due to depreciation of the vehicle's value over time are not covered

- Damages caused by mechanical or electrical failures are excluded

- Claims arising from driving without a valid license, under the influence of alcohol/drugs, or engaging in illegal activities are not covered

- Normal wear and tear and ageing of the vehicle are not included

- Excludes damages caused by war, invasions, hostilities, civil war, and related events

- Indirect losses or damages resulting from an accident, like loss of income due to vehicle downtime, are not covered

- Claims will not be entertained if the vehicle is used for purposes other than those stated in the insurance policy

- Damages incurred while driving outside the geographical area specified in the policy are not covered

- Any damages or issues before the policy's inception are excluded from coverage

7. Royal Sundaram Business Insurance

These business insurance solutions are designed to safeguard your business against various risks. These solutions cover a wide range of risks and include expert advice on Risk Management and Loss Prevention to help minimise potential losses and enhance your business's resilience.

Royal Sundaram offers extensive business insurance solutions like:

- Marine Insurance

- Office Insurance

- Engineering Insurance

- Industrial Insurance

- Employee Solutions

Inclusions of Royal Sundaram Business Insurance

Below mentioned are the factors covered in these plans:

- Coverage for physical damage to buildings, machinery, and other assets caused by fire, theft, natural disasters, and accidental damage

- Compensation for loss of income due to an interruption in business operations caused by insured perils

- Protection for goods in transit, covering loss or damage during transportation via sea, air, or land

- Coverage for office contents and premises against risks such as fire, theft, and accidental damage

- Insurance for machinery breakdown, contractor's plant and equipment, and construction projects

- Comprehensive protection for industrial operations, including machinery, plant, and stock coverage against fire, theft, and accidental damage

- Protection against legal liabilities arising from third-party bodily injury or property damage due to business operations

- Expert advice and services aimed at reducing potential risks and minimising losses

Exclusions of Royal Sundaram Commercial Vehicle Insurance

Below mentioned are the factors that are not covered in these plans:

- Any damage or loss that occurred before the policy was in effect

- Losses or damages caused intentionally by the insured or their representatives

- Damages resulting from war, invasion, acts of foreign enemies, hostilities, civil war, rebellion, revolution, insurrection, military or usurped power, and terrorism

- Losses or damages caused by ionising radiation or contamination by radioactivity from any nuclear fuel or nuclear waste

- Natural wear and tear, depreciation, and gradual deterioration of insured items

- Damages or losses arising from pollution or contamination unless caused by an insured peril

- Mechanical or electrical breakdowns not caused by an insured peril

- Losses or damages occurring during illegal activities or due to illegal use of insured property

- Liabilities assumed under any contract or agreement unless the liability would have existed in the absence of such contract or agreement

- Risks not reported to the insurance provider or not covered within the scope of the policy

Conclusion

Royal Sundaram General Insurance has been providing innovative general solutions to individuals, families and business directly as well as through its intermediaries and affinity partners. Royal Sundaram's Accident and Health claims process received ISO 9001-2008 certification for effective customer service delivery. Likewise, the company has won many awards based on customer satisfaction.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.