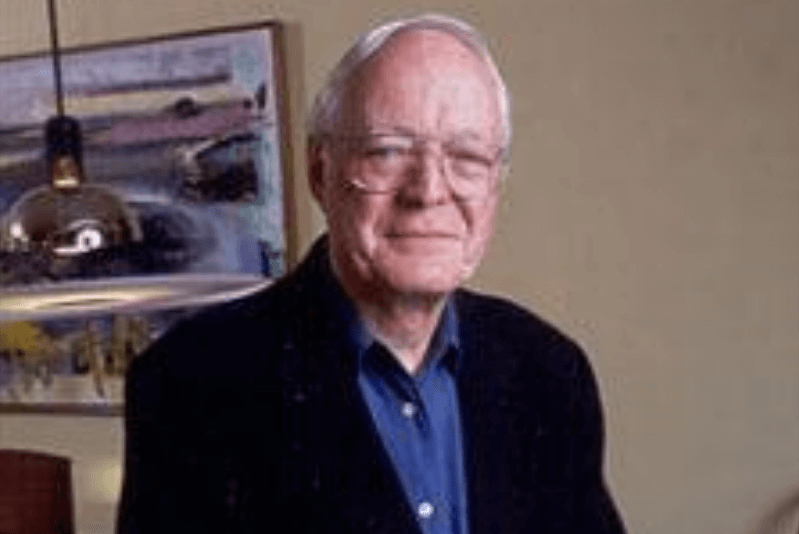

Top Investing Tips from Low P/E Investor John Neff

John B. Neff was an American Investor, Mutual Fund Manager and a philanthropist. He was well- known for his Value investing styles and his heading of Vanguard’s Windsor Fund. Notably, under his headship, Windsor fund became the and largest mutual fund with highest returns in existence. However, it was closed to new investors in the 1980s. Neff retired from Vanguard in 1995. In this three-decade-long career at Windsor fund, the return increased from 13.7% annually.

People describe him as the ‘value investor’ or ‘contrarian’ but he preferred to call himself the ‘low price-earnings investor’.

| Particulars | Description |

|---|---|

| Name | John B. Neff |

| Birth Date | September 19, 1931 |

| Birth Place | Wauseon, Ohio, U.S. |

| Died | June 4, 2019 (aged 87) |

| Nationality | United States |

| Other names | "The Professional's Professional" |

| Alma mater | University of Toledo, Case Western Reserve University |

| Occupation | Investor, mutual fund manager, and philanthropist |

| Known for | Managing the Vanguard Windsor Fund |

John Neff graduated from the University of Toledo in 1955. He worked at the National City Bank of Cleveland before joining the Case Western University and getting a business degree in 1958. He passed away on June 4, 2019

John Neff’s Investing Tips

1. Be Disciplined

John Neff once said self-discipline and a curious mind is important for success. Even when it comes to the stock market, discipline is extremely important. Lack of discipline can lead to high failure in trading. Discipline in the stock market involves the will and dedication to stay focused and hard-working along with the discipline to stick to your trading plan.

When it comes to stock market investment, you get the opportunity to be your own boss. You decide how to invest and where to invest. In order to keep yourself aligned to get the best returns, high-level of self-discipline is important.

Talk to our investment specialist

2. Take Risks

John Neff was a successful investor with a contrarian nature. He once said that he has argued with the stock market his whole career. It is important to keep your mind open and take the risk as and when required. Not taking risks for profitable returns could cause loss as well. It is important to note that the risk you are taking should not be out of the emotional and irrational decision. Do your research and calculate the risk before delving any forward. Even if the view is unpopular, do your research about it and have the willingness to step outside of your comfort zone.

3. Find Value

John Neff found value in beaten-down or unloved stocks. When none saw value in a stock, Neff did. Soon enough the market would catch on to his find and automatically the stock prices would increase. He firmly believed in low P/E (low Price Earnings Ratio) Investing. He attributes the Windsor fund’s success to low P/E investing. In his 31-year tenure with Windsor, he beat the market 22 times with this investing method. John attributed says low P/E as the most reliable investment method. If you own a stock, you are bound to get some negative news but the good news comes as a surprise and it could also bring along huge benefits.

Low P/E stocks usually get less attention and people expect less from it. But investment in low P/E stocks brings the benefit of no penalty. You can improve your financial performance with these stocks. The crowd usually falls for the trending news and gives up on investing in low P/E stocks. But that is unwise to do. He always placed focus on beaten down or unloved stocks.

4. Study the Industry

John Neff once said that a wise investor always studies the industry, it’s products and its economic structure. Wise investors are active and always look for opportunities that help them get the best deal with high returns. The ones who snooze are bound to lose. Don’t follow the crowd or be fooled by the market slips. Make sure to always stay on foot to be able to make the right investments.

Conclusion

John Neff’s style of investing was a low P/E methodology. He was considered a wise and tactical contrarian investor who always placed a great deal of attention on low-tech security analysis. If there is one thing you could take back from John Neff’s style of investing, it would be to study the market very well and not underestimate the power of investing methodology as low P/E.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.