Top 7 Best Uses of PAN Card for Indians

Issued by the income tax Department, a PAN Card is the most valuable identification document for Indians. Citizens, residents, non-residents of India, and every individual who falls into the category of the IT Act of 1961 can apply for the PAN card. Even minors can apply, but they must update it later after turning 18.

Whether you are looking for currency conversion or stock Market investment, a PAN card is mandatory for investment, interest Earnings, etc. It was initially issued for preventing the underpayment or non-payment of tax. Simply put, PAN was considered a means to ensure that every entity pays the Income tax in a timely fashion. But, it is now used for investments and other purposes.

PAN card is linked to your financial accounts, thus making it easier for the IT Department to track your income from property, investments, salaries & wages, and other income sources.

While the primary purpose of a PAN card is to help the Income Tax officers keep a tab on your income and tax payments, the uses of this identification document can go beyond.

Every individual who intends to make an investment in financial security, Real Estate, and other investment instruments that require a PAN validation must get a PAN card. Plus, whoever runs a business or an entity with an annual turnover exceeding INR 5 Lakh must have a PAN.

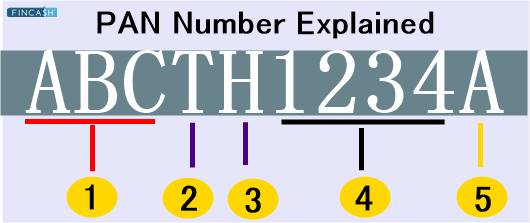

Example of PAN Card Number

A PAN card features a 10-digital number that is unique for every individual. The first four characters are a series of numbers, followed by an alphabet. The combination of these numbers and alphabets gives a unique PAN number.

ABCTH1234A

The first three characters are the alphabetic series, such as ABC

The fourth character represents the status of the holder. Each holder type is uniquely defined by a letter from the list below:

- A — Association of persons (AOP)

- B — Body of individuals (BOI)

- C — Company

- F — Firm

- G — Government

- H — HUF (hindu undivided family)

- L — Local authority

- J — Artificial juridical person

- P — Person (Individual)

- T — Trust (AOP)

The fifth character represents the first character of your surname, i.e. if you are an individual.

Next four characters are sequential numbers running from 0001 to 9999

Last character, i.e., the tenth character is always an alphabetic check digit

Understanding the logic behind the sequencing in PAN characters will always help you memorise your PAN number easily.

Talk to our investment specialist

Uses of PAN Card

PAN card has many applications - ranging from income tax payments to making an investment. Let’s check out the top uses of PAN card.

1. Investments

Making an investment in equities and Debentures is a sure way to build your wealth over time. But, the only way to have a successful transaction is by getting a PAN card issued. Investments above INR 50,000 needs the support of a PAN card for completing the transaction.

2. Tax Returns

The main purpose is to help you with the tax formalities. For any resident or non-resident of India who is eligible for tax payments, a PAN card is required when filing the tax returns. Plus, quoting your PAN number can result in tax reductions. To enjoy these perks, you must have a PAN card linked to your Bank account.

3. Opening a Bank Account

A PAN card has become mandatory for each resident planning to open a bank account - whether you open an account at a private or a public bank.

4. Buying or Selling

For any large transaction that costs you INR 5,00,000 or higher, a PAN card is required. It can be a house, a vehicle, expensive jewelry, and other such

luxury products.

5. Identity Proof

You can use a PAN card as identity proof for verification or authentication purposes. It can be used for passports, visas, driving licenses, and other applications. It is also used as age or address proof.

6. Currency Conversion

The Credit Bureaus and foreign exchange markets will ask you to submit the PAN number to complete your currency conversion request.

7. Loan

At the time of the loan application, the user is supposed to send a copy of their PAN card to the banker. Whether you take out the loan from a bank or a credit union, a PAN card is mandatory to get your loan application passed.

PAN identification has many uses and depending on your investment, it is often mandatory for an investor to submit it.

How to get your PAN Card?

You can make a request for the issuance or re-issuance of the PAN card. Further requests concerning corrections in the card can also be made online on the official website of the NSDL.

Fill out the form for the PAN card application on the website, make the payment through debit/credit card or net banking, and submit the application form to the NSDL.

Keep the following documents handy when submitting an application for the PAN card:

- aadhaar card

- Voter ID card

- Birth certificate

- Passport

- Driving license

Other documents might be required depending on your age, address, and residency status. Foreigners might be asked to submit a set of additional documents, including the ration card, certificate of domicile, and Post Office passbook. You can also visit the NSDL center to fill and submit the application form for a PAN card in person. It might take the NSDL 15-30 days to respond.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.