Mediclaim Policy - Need of the Hour!

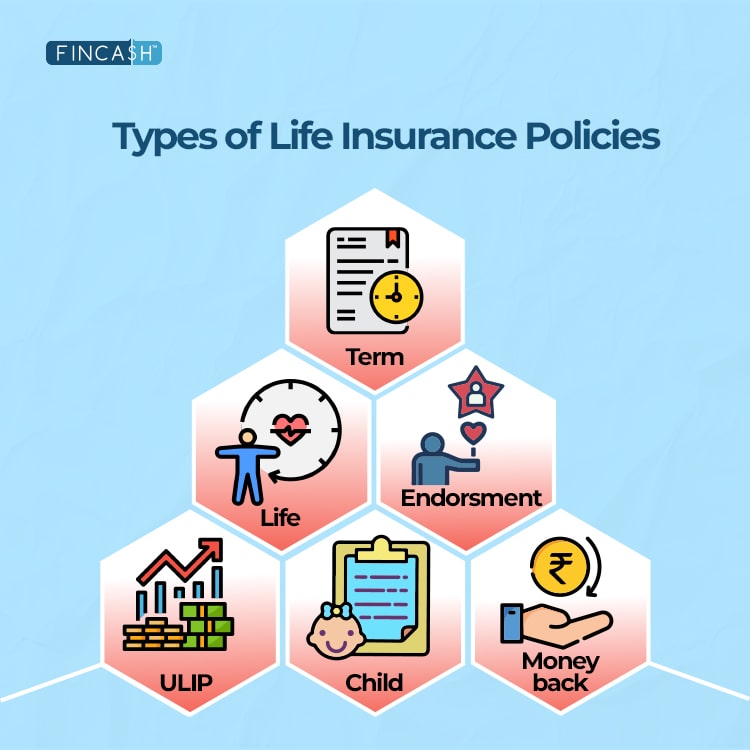

Mediclaim policy (also known as medical insurance) provides coverage for treatment and hospitalisation during a medical emergency. The insurance also provides coverage for the pre-hospitalisation expenses incurred few days before hospitalisation and post-hospitalisation. This policy is offered by both Life Insurance and health insurance companies in India.

You can buy mediclaim policy for family or individual (depending on your personal needs) to ensure protection during any medical emergencies. But before you buy, compare different policies and then choose the best mediclaim policy among them.

You can also buy cashless mediclaim policy online. Expenses incurred under certain situations are covered under the mediclaim insurance policy. These situations include-

- A sudden illness or surgery

- An accident

- Any surgery during the policy tenure

Types of Mediclaim Policies in India

Majorly, there are two types of mediclaim policies, such as:

1. Individual Mediclaim Policy

Here the coverage is provided to a single person. The mediclaim premium is decided on the basis of the age of the person getting health cover. When required, the individual covered under this policy can claim the entire sum assured amount.

2. Family Floater Mediclaim Policy

It is a medical policy providing coverage for the entire family. Usually, the plan include spouse, self and dependent children. However, some plans provide mediclaim for parents as well. The mediclaim premium depends on the oldest family member. Moreover, the entire sum assured amount can be used by both, an individual member or the entire family. So, people who wish to be tension-free from hospital bills and related expenses should buy a family floater mediclaim policy.

Talk to our investment specialist

Types of Claims under Mediclaim Policy

1. Cashless Mediclaim Policy

Cashless mediclaim is a mechanism in which a patient can easily get treated in the network hospital and then the insurer can either settle the entire claim or a part of it. This means a patient can get the treatment done without paying anything that time. To ensure a smooth claim process, follow all the procedures well.

2. Reimbursement option of the Mediclaim Insurance

With the reimbursement option of the mediclaim policy, it is mandatory to inform the insurance company regarding the hospitalisation that has happened or is likely to happen. Remember, you will have to submit your payment receipts, medicine bills and original discharge card to get your reimbursement.

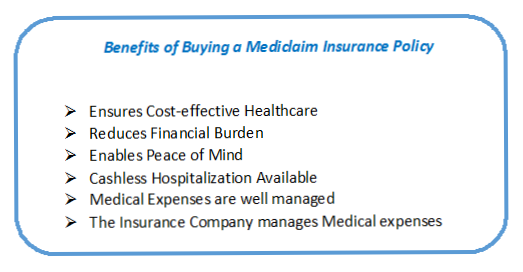

Benefits of Buying a Mediclaim Insurance Policy

Benefits of Mediclaim Policy, Ensures Cost-effective Healthcare, Reduces Financial Burden, Enables Peace of Mind, Cashless Hospitalization Available, Medical Expenses are well managed, The Insurance Company manages Medical expenses

What Should a Best Mediclaim Policy Cover?

Mediclaim insurance policy provides coverage for various kinds of expenses. But, it is important to choose a health plan that provides coverage suitable for your needs. How to choose one? We have mentioned some important things that a good medical policy should cover. Take a look!

Hospital Charges

A good medical plan should cover all the direct charges incurred during hospitalisation. These include charges of medicines, blood, oxygen, x-rays, organ transplants etc.

Day-care Treatment

Not only the direct charges, the policy should also cover technologically advanced treatments that do not require 24 hours hospitalisation.

Pre and Post Hospitalisation Expenses

One must consider a mediclaim insurance that provides coverage for pre and post hospitalisation expenses. An ideal policy is supposed to cover 30 days before and 60 days after hospitalisation. Moreover, you should try to include services like ambulance as well.

Medical professional’s fees

Look for a policy that also covers the fee that you pay to medical professionals like doctors, nurses and anaesthetist.

Accommodation Charges in Hospital

There are various cashless mediclaim policies that cover accommodation charges of the regular wards or ICUs. Consider buying those policies.

Broadly, while there are various covers offered by mediclaim policies, one should also look for the list of nearest hospitals that have tie-ups for cashless claims etc, during emergencies and otherwise this is beneficial. Also look for the sum assured being offered, today with high inflation the cost of medical care is ever increasing, protect yourself from being under-insured by going for a policy that suits your requirements.

Many a time those who have undergone the claims process cite that "you are never fully covered" till one goes through a procedure. Beyond this, some insurers offer benefits like dental coverage, coverage of pre-existing diseases with a limited cooling period (e.g. 1 year), OPD (out-patient department) coverage of doctor fees, one should look at the coverages, claims process, the list of tie-ups etc and then make a final decision.

Best Mediclaim Policy 2026

1. HDFC Ergo Health Insurance

HDFC health plans are designed keeping in mind the growing medical needs and rising inflation. The policy covers following medical expenses-

- Pre & Post hospitalization expenses

- ICU charges

- Ambulance cost

- Day care procedures

- AYUSH benefits

- Mental healthcare

- Home healthcare

- Sum insured rebound

- Organ donor expenses

- Free renewal health check-up

Some of the key features of the plan are as follows:

- Cashless claim service

- 10,000+ Network Hospitals

- 4.4 Customer Rating

- 1.5 Crore+ Happy Customers

2. New India Assurance Mediclaim

New India Mediclaim policy is available to persons between the age of 18 years and 65 years. Lifelong renewal is available provided the policy is renewed on time.

Key highlights of the policy:

- Health check-up for every 3 claim free years

- New born baby cover

- Ayurvedic / Homeopathic / Unani treatments covered

- Medical expenses for Organ transplant are payable

- Ambulance charges

- 139-day care procedures covered

3. Oriental Insurance Mediclaim

Oriental health insurance offers various health plans to offer you complete expectations. Here are the key features of the plan:

- Cashless treatment in the network hospitals

- No initial screening up to 55-years old individuals

- Daily cash allowance

- One of the highest available amount insured

- Attractive discounts on premium

- Quick claim settlement

- Lifelong renewability

- Portability option available

4. PNB Health Insurance

PNB MetLife Insurance and Care Health Insurance Limited have merged to help you in protecting and ensuring a secure financial future for you and your family. Through the alliance, it aims at fulfilling life without debt and fear of medical expenses during emergencies.

Key features of the policy:

- Life cover with inbuilt Terminal Illness Rider

- 7.5% discount on premiums

- Up to 150% increase in sum insured with NCB & NCB – Super

- Automatic recharge of sum insured

- Cashless hospitalization at over 7500+ network hospitals

5. Star Health Mediclaim

Star Health Insurance provides affordable policy plans with comprehensive protection for you, family, senior citizens and corporates. The insurer protects your savings from increasing medical costs by paying an affordable premium amount. Some of the key features are as follows:

- Offer 63% incurred claim ratio

- A massive of 9,900+ network of hospitals

- 2.95 LAKH+ agents helping its customers

- Customer base of over 16.9 Cr

- 90% cashless claims settled in less than 2 hours

- Free storage of medical records in electronic form for future needs

Compare & Buy Mediclaim Policy Online

With the advent of technology, the ease of buying a insurance policy is even more. You can easily compare mediclaim policies and buy a best medical insurance online. In my opinion, everyone should get a mediclaim policy, not only for themselves but for their entire family (with a family floater mediclaim policy). To ensure that you and your entire family remains safe during medical emergencies, buy a mediclaim policy now!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.