Top 10 Best Health Insurance Companies in India

One small accident or uncalled illness can make you realise the importance of medical insurance. But do you want to wait for it? Or rather safeguard your health by financial security. Being financially prepared to tackle the cost of sudden hospital expenses or surgery is of utmost importance. Having just a plan is not enough, signing this agreement with the ideal insurer is equally essential.

Only the best health Insurance companies will offer a wide medical coverage, such as doctor visits, hospitalisation expenses, surgery fees, medicinal cost, nursing allowance, hospital room rent, cashless treatment, maternity plan, etc. Here is an in-depth look at the top health insurers in India who can give you a sigh of relief in your difficulties.

Tips for Buying Best Medical Insurance

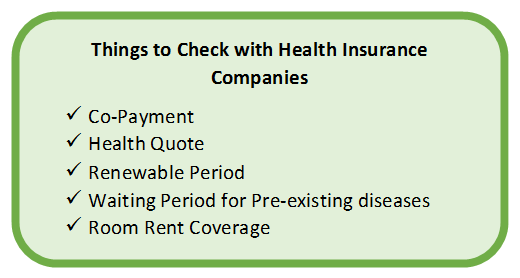

There are various types of health insurance policies available in the market. For each one of them the health quote, co-payment, limits of coverage and illnesses covered varies. While choosing a medical plan, it is advised to consider the health insurance companies list.

Top 10 Best Health Insurance Companies in India

Some of the best health insurance companies in India are listed below:

- HDFC ERGO Health Insurance (Formerly Apollo Munich Health Insurance)

- Star Health & Allied Insurance Company Limited

- Niva Bupa Health Insurance (Formerly Max Bupa Health Insurance)

- ICICI Lombard Health Insurance Company Limited

- Care Health Insurance (Formerly Religare Health Insurance)

- Manipal Cigna Health Insurance Company Limited

- Bajaj Allianz Health Insurance Company Limited

- New India Assurance Company Limited

- Oriental Insurance Company Limited

- National Insurance Company Limited

Talk to our investment specialist

1. HDFC ERGO Health Insurance (Formerly Apollo Munich Health Insurance)

Apollo Munich, which is now HDFC ERGO Health Insurance is one of the most trusted brands with happy customers of 1.5+ crores. The company has an exceptional record of an 86.52% claim settlement ratio. The plan covers medical expenses, cost of hospitalization, ICU charges, ambulance cost, daycare procedures, Ayush benefits, etc. HDFC ERGO has 13,000+ networks of hospitals across India. The insurer also offers lifelong renewability and portability options in the insurance plans.

Health Insurance Plans by HDFC ERGO

- Optima Secure Health Insurance Policy

- My:Health Suraksha Insurance Plan

- My:Health Koti Suraksha Insurance Plan

- My: Health Women Suraksha Plan

- My: Health Medisure Super Top-Up Plan

- Critical Health Insurance Policy

- Ican Cancer Insurance

2. Star Health Health Insurance

Started in 2006, Star Health is India’s first standalone health insurance provider. The company has an excellent service with innovative products, which caters for individuals, families and corporates. It provides sterling services in personal accident and overseas Travel Insurance. Star Health is predominantly into Bancassurance and has a well-established relationship with various banks. The insurer has an incurred claim ratio of 90%. Currently, the company has 11000+ cash hospitals and 640+ branches across the country.

Popular Star Health Insurance Plans

- Star Novel Coronavirus

- Young Star Insurance Policy

- Star Care Micro Insurance

- Family Delite

- Arogya Sanjeevani Policy

- Corona Kavach Policy

- Corona Rakshak Policy

- Outpatient Care Insurance Policy

- Star Micro Rural And Farmers Care Policy

- Criticare Plus

- Star Comprehensive

- Min: 3 Months; Max: 65 Years

- Red Carpet

- Diabetes Safe

- Cardiac Care

- Medi Classic Insurance Policy

- Cancer Care Gold

- Star Health Gain

- Special Care

- Family Health Optima

3. Niva Bupa Health Insurance (Formerly Max Bupa Health Insurance)

Max Bupa, now Niva Bupa Health Insurance is a joint venture between True North, an Indian private equity firm, and Bupa, a UK’s healthcare service-based organisation. It offers wide coverage for the entire family, including newborn babies and senior citizens. Niva Bupa has 7600+ networks of hospitals, along with a claim settlement ratio of 89.46%. The company offers lifetime renewal options. It covers expenses like pre and posts hospitalization, hospital room rent, OPD expense cover, organ donation, daycare, along with regular health check-ups once or twice annually.

Health Plans by Niva Bupa

- Health Insurance Plans

- family health insurance Plans

- Individual health insurance plan

- Critical illness insurance Plan

- personal accident insurance Plan

- Senior Citizen Plan

4. ICICI Lombard Health Insurance

ICICI Lombard General Insurance came into limelight after its joint venture with ICICI Bank and Fairfax Financial Holdings Limited (Canada). The company offers comprehensive health insurance that covers daycare procedures, hospital expenses, ambulance charges, and domiciliary hospitalization. In 2021, Bharti AXA Health Insurance merged with ICICI Lombard general insurance.This merger has opened the opportunity for customers to access a wider distribution network.

Health Plans by ICICI Lombard

- Complete Health Insurance Plan

- Health Booster

- Personal Protect

- Arogya Sanjeevani Policy

- Corona Kavach Policy

- Saral Suraksha Bima

5. Care Health Insurance (Formerly Religare Health Insurance)

The Care health insurance offers features like cashless hospitalisation, cover against critical illnesses like cancer, kidney & heart issues, etc. The health plan helps you cover a number of costs by providing a number of benefits like - ambulance and room rent, cashless feature, pre- and post-hospitalisation costs, no claim bonus, tax benefits periodic medical checkups, etc. Care Health insurance has a hospital network of 7400+ and a claim settlement ratio of 95%.

Best Care Health Plans

- Personal Health Insurance plan

- Family Health Insurance Plan

- Critical Illness Health Insurance Plan

- Senior Citizen Health Insurance Plan

- Maternity Health Insurance Plan

- Accident Health Insurance Plan

6. Manipal Cigna Health Insurance

Manipal Cigna (previously known as Cigna TTK Health Insurance) has a wide network of cashless treatment at 6500+ hospitals and a claim settlement ratio of 85.72%. The company offers customized plans as per the changing life stages. Manipal Cigna focuses to improve the health, well-being and peace of mind of every customer. It makes health more affordable by partnering with providers that offer quality and cost-effective care.

Manipal Cigna Health Plans

- Lifetime Health

- ProHealth Insurance

- ProHealth Select

- Super Top Up

- Arogya Sanjeevani Policy

- Corona Kavach Policy

- Corona Rakshak Policy

- Saral Suraksha Bima

- Lifestyle Protection Critical Care

- ProHealth Cash

- ProHealth Group Insurance Policy

- Global Health Group Policy

- Lifestyle Protection Group Policy

- Group Overseas Travel Insurance

- FlexiCare Group Insurance Policy

7. Bajaj Allianz Health Insurance

Bajaj Allianz Health insurance comes with family discount and lifetime reliability options.It makes a cashless claim settlement facility in 6500+ hospitals. It has an also incurred claim ratio of 77.61%. You get maximum coverage at affordable rates, which are easy to buy/renew online. Bajaj Allianz offers a number of benefits like cashless treatment, tax benefits, daily hospital cash, cumulative bonus, free health checkups, ambulance charges, day care procedures, daily cash benefits, etc.

Best Health Plans by Bajaj Allianz

- Bajaj Allianz Silver Health Insurance Plan

- Bajaj Allianz Health Infinity Plan

- Bajaj Allianz Critical Illness Plan

- Arogya Sanjeevani Policy

- Bajaj Allianz Critical Illness Plan

- Bajaj Allianz Personal Guard

- Bajaj Allianz Personal Guard

- Bajaj Allianz M Care Health Insurance Plan

8. New India Health Insurance

New India Assurance Company Limited is a multinational general insurance company owned by the Government of India. It offers a unique feature for the health insurance policy and is famous for its mediclaim policy. The company is operating in 28 countries and deals with non-life businesses. It has 1200+ cashless hospitals with an incurred claim ratio of 103.74%. The health plan covers up to 6 family members. It offers a pre- and post- hospitalisation cover and a lifetime renewal benefit. New India Health Insurance also offers the facility of online renewal of the plans.

New India Assurance Health Insurance Plans

- Mediclaim 2007 Policy

- New India Top Up Mediclaim

- New India Assurance - Mediclaim 2012 Policy

- New India's Senior Citizen Mediclaim Policy

- New India Health Insurance Janata Mediclaim Policy

- New India Assurance Personal Accident Policy

- New India Asha Kiran Policy

- Rasta Apatti Kavach (Road Safety Insurance)

- Union Health Care Policy

- New India family floater Mediclaim Policy

9. Oriental Insurance Company Limited

It is a government-owned general insurance company offering health insurance products with a number of benefits to the customer. Anyone above the age of 60 years doesn’t have to provide a medical test. The company has a network of 4300+ hospitals that offers cashless treatment. It has an incurred claim ratio of 85.39%. Oriental Health Insurance offers plans that let you cover up to 7 family members, along with a lifelong renewal benefit.

Top Health Plans by Oriental

- Happy Family Floater Policy

- Mediclaim Insurance Policy (Individual)

- Oriental Happy Cash-Nischint Rahein!

- Oriental Super Health Top-up

- Pravasi Bharatiya Bima Yojana

- Arogya Sanjeevani Policy

- Group Mediclaim Policy

- Overseas Mediclaim Policy (E&S)

- Jan Arogya Bima Policy

- Oriental Dengue Kavach

- Overseas Mediclaim Policy- Business and Holiday

- Oriental Critical Illness Policy

- Corona Kavach and Group Corona Kavach

- Oriental Insurance Bank Saathi Policy - Group

- Oriental Cancer Protect

10. National Health Insurance

National Insurance Company is a government entity serving for more than 100 years. It offers free health check-up benefit up to 1% of the sum insured after the completion of four claim years. The company has 6000+ networks of hospitals and incurred a claims ratio of 114.24%. The health plans come with add-on covers, cashless claims, and a number of benefits like free health check-ups, cashless benefits, coverage for in-patient treatment, daycare treatments, pre-hospitalisation and post-hospitalisation, ambulance, etc.

Top Health Plans of National Insurance

- National Mediclaim Plus Policy

- National Mediclaim Policy

- Overseas Mediclaim Business and Holiday

- Overseas Mediclaim Employment and Studies

- Parivar Mediclaim Policy for Family

- Arogya Sanjeevani Policy

- Corona Kavach Policy

- National Parivar Mediclaim

Conclusion

Usually, the medical insurance companies offer various policies with different terms and conditions. It is advised to choose the plan that is best suited for you and your family (consider Family Floater Plans if buying for family). Therefore, don’t wait for any misfortune to happen. Compare health insurance plans, choose the best-suited plan from a reputed health insurance company and live insured!

FAQs

1. Why should you purchase a health insurance plan?

A: A health insurance plan is a protective measure that prevents you from using your savings in a medical emergency. When faced with a medical emergency, you will have to use your funds from your savings to cover the expenses, unless you are insured. However, with a health insurance policy, you can claim coverage up to the sum insured.

2. Do different companies offer different insurance policies?

A: Yes, they do. Some of the policies are designed to provide individual coverage, while others are family health insurance policies. Similarly, depending upon the premium paid, the health condition of the person or persons being insured, the policy will differ. Thus, depending on the type of policy you are purchasing and the insurance company you are purchasing from, you will be provided a particular healthcare policy.

3. What are the parameters to purchase a health insurance?

A: When you purchase a health insurance policy, you should check the coverage, i.e., whether the insurance policy covers medical bills, hospitalization expenses, ambulance charges, medical expenses due to severe illnesses, and domiciliary hospitalization charges. Similarly, the insurance company you are purchasing the policy should be associated with the leading hospitals in your area. Other than that, it should also have a network of hospitals across the country. This will assure you that the policy you purchase is acceptable anywhere in India.

4. Should claims be a factor while comparing health policies?

A: Yes, you should check the claims records of the insurance company when purchasing a health insurance policy. For example, Star Health Insurance has incurred a claim ratio of 63%. Apollo Munich Health Insurance, a joint venture of HDFC Limited and ERGO International AG, has posted a claim ratio of 62%. Both of these are higher than Care Health Insurance, which has incurred a claim ratio of 55%. Hence, if you are thinking of purchasing health insurance from a company with a higher ratio of claim settlement, you must compare well.

5. Why should you purchase health insurance from Oriental Insurance Company Limited?

A: Oriental Insurance Company Limited has numerous insurance-related products. It has been providing clients with numerous healthcare policies for many years. Additionally, people above the age of sixty do not have to undergo a rigorous medical check-up to purchase an insurance policy. The company also has a network with more than 4300 hospitals across the country. It has incurred a claim ratio of 85.39%.

6. What are the benefits of purchasing a healthcare policy from National Insurance Company Limited?

A: National Insurance Company Limited has been providing clients with various types of insurance policies for nearly one hundred years. If you think of purchasing a health insurance policy from a reputed firm, you should consider National Health Insurance. It also offers free health check-up and has recorded a claim ratio of 114.24%.

7. What is a cashless benefit?

A: Some insurance companies allow the insured to enjoy cashless hospitalization. Here the insurance company will settle the hospitalization expenses directly, and you will not have to make any upfront payments. As a policyholder, you will not have to make any payment during the hospitalization.

8. Is there any government-run insurance company?

A: Yes, New India Assurance Company is a multinational general insurance company owned by the government. The company was the first to offer what is known as the Mediclaim policy. It has a strong presence in India but twenty-eight other countries across the world and has recorded a claim ratio of 103.74%.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Good information - it is very useful. I need15 lakh health insurance.

Nice information

Great Knowledge Towards Customers