Loans for Women - A Complete Guide

In India, more than 15 million businesses are run by women, contributing significantly to the economy. Yet, one of the biggest challenges women entrepreneurs and professionals face is access to affordable credit.

To encourage financial independence and entrepreneurship, the government, banks, and NBFCs have introduced several special loan schemes for women. These loans come with lower interest rates, Collateral-free options, and easier repayment terms. This guide explains the best loan schemes available for women in India — including government programmes, private Bank products, eligibility, and the application process.

Why Special Loans for Women?

- To promote women-led entrepreneurship in small and medium enterprises (SMEs).

- To reduce financial inequality and support weaker sections.

- To encourage participation of women in manufacturing, services, and agriculture.

- To support women in education, housing, and self-employment.

Major Government Loan Schemes for Women

Popular Loan Schemes for Women

Here’s a quick comparison table of major women-focused loan schemes:

| Scheme | Loan Amount | Key Benefits for Women |

|---|---|---|

| Mudra Yojana Scheme | ₹50,000 – ₹10 lakh | Collateral-free, small businesses, widely accessible |

| Mahila Udyam Nidhi Scheme (SIDBI) | Up to ₹10 lakh | Supports small-scale ventures, repayment up to 10 yrs |

| Stree Shakti Package (SBI) | ₹50,000 – ₹25 lakh | Interest concession 0.05%, no collateral up to ₹5 lakh |

| Dena Shakti Scheme | Up to ₹20 lakh | Women in agriculture, retail, education |

| Bharatiya Mahila Bank Business Loan | Up to ₹20 crore | Large women-led enterprises, manufacturing & services |

| Annapurna Scheme | Up to ₹50,000 | For food catering businesses, equipment purchase |

| Cent Kalyani Scheme | Up to ₹1 crore | Collateral-free, MSMEs, working capital & term loan |

| Udyogini Scheme | Up to ₹1 lakh | Rural women, concessional rates for SC/ST categories |

| SBI Asmita Loan (NEW) | Up to ₹2 lakh | For women SHGs and rural entrepreneurship |

| KBL Mahila Udyog Loan (NEW) | Up to ₹10 crore | Covers working capital & term loan, interest concessions |

| Loan for Women Entrepreneurs by NEDFi (NEW) | Up to ₹10 lakh | Supports women in North-East, micro & small enterprises |

| Swarnima Scheme (NEW) | Up to ₹2 lakh | For backward class women entrepreneurs, concessional rate |

Talk to our investment specialist

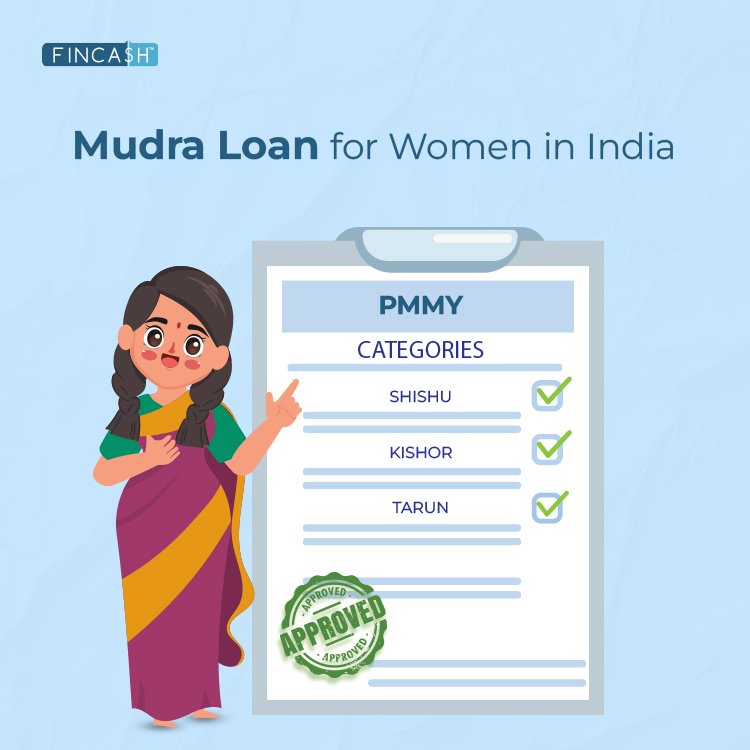

1. Pradhan Mantri Mudra Yojana (PMMY)

- Loans up to ₹10 lakh for small businesses

- Three categories: Shishu (up to ₹50,000), Kishore (₹50,000–₹5 lakh), Tarun (₹5–10 lakh)

- Collateral-free loans, available through banks, NBFCs, and MFIs

- Widely used by women running small shops, tailoring units, beauty parlours, catering, and more

2. Stand-Up India Scheme

- Launched in 2016 to encourage women and SC/ST entrepreneurs

- Loans between ₹10 lakh to ₹1 crore for greenfield enterprises

- At least one woman borrower per bank branch is encouraged

- Covers manufacturing, trading, and services sectors

3. Stree Shakti Package for Women Entrepreneurs (SBI)

- Available to women with 51% ownership in small businesses

- Interest rate concession of 0.05% on loans above ₹2 lakh

- No collateral for loans up to ₹5 lakh (in some cases)

- Offered exclusively through State Bank of India branches

4. Mahila Udyam Nidhi Scheme (SIDBI)

- Provides financial assistance up to ₹10 lakh to women entrepreneurs

- Repayment period of up to 10 years with a moratorium of 5 years

- Designed to promote small-scale ventures such as beauty parlours, day-care centres, and service units

- Implemented through SIDBI and select banks

5. Annapurna Scheme

- Specially designed for women in the food catering industry

- Loan up to ₹50,000 to buy utensils, kitchen equipment, and working capital

- Repayment period: up to 3 years

- Offered mainly by State Bank of Mysore (now SBI) and a few other banks.

6. SBI Asmita Loan

- Loan scheme targeted at women SHGs (Self Help Groups)

- Provides financial support for small income-generating activities

- Promotes rural entrepreneurship among women

7. KBL Mahila Udyog Loan (Karnataka Bank)

- Offers loans up to ₹10 crore for women-owned businesses

- Interest rate concession for eligible borrowers

- Covers working capital and term loan needs

8. Loan for Women Entrepreneurs by NEDFi (North East Development Finance Corporation Ltd.)

- Supports women entrepreneurs in the North-East region

- Loan up to ₹10 lakh for micro and small enterprises

- Helps promote regional development and self-reliance

9. New Swarnima Scheme (Women’s Development Corporation)

- Provides loans up to ₹2 lakh at concessional rates

- Specifically for women entrepreneurs from backward classes

- Encourages self-employment and small-scale ventures

Private Bank and NBFC Products for Women Loan

Along with government-backed schemes, many private banks and NBFCs have introduced special loan offerings for women:

- HDFC Bank: Personal & Business loans with flexible EMIs

- ICICI Bank: Collateral-free loans for self-employed women

- Axis Bank: Special processing fee discounts for women applicants

- Bajaj Finserv: Quick business loans with minimal documentation

Marriage Loan for Women

Marriage is one of the biggest financial milestones in India. Many banks and NBFCs offer personal loans for weddings, often marketed as marriage loans. Some of the key features are-

- Loan amounts range from ₹50,000 to ₹25 lakh, depending on income and repayment capacity

- Tenure usually between 12–72 months

- No collateral required (unsecured loans)

- Quick processing with minimal documentation

Benefits for Women Borrowers

- Some banks provide preferential interest rates for women applicants

- Women with a good credit score can negotiate for lower EMI burden

- Flexible usage — funds can be used for wedding expenses, honeymoon, or related costs

Instead of depending only on loans, financial planners advise women to plan ahead for weddings through investments like SIPs, to reduce loan dependency.

Home Loan Benefits for Women

Owning a home is a powerful step towards financial independence, and women in India enjoy several advantages when applying for a Home Loan:

Government Incentives

- Under Pradhan Mantri Awas Yojana (PMAY), women applicants/co-owners are mandatory for EWS and LIG categories, helping them avail credit-linked subsidies.

- Many state governments offer lower stamp duty (1–2% reduction) when the property is registered in a woman’s name.

Tax Benefits

- Women homeowners can claim deductions of up to ₹1.5 lakh under Section 80C and ₹2 lakh under Section 24(b) for housing loan repayment.

- If the property is jointly owned with a spouse, both can claim benefits separately.

Bank-Level Benefits

- Several banks (SBI, HDFC, ICICI, LIC Housing, Union Bank) offer 0.05%–0.1% lower interest rates for women borrowers.

- Joint loans with a woman co-applicant increase eligibility for a higher loan amount.

An Alternative to Loans – Invest in SIP!

While loans can help fulfil immediate needs like weddings or home purchases, they also come with EMIs, interest burden, and long tenure. A smarter way to prepare for these life goals is by Investing early through a Systematic Investment plan (SIP) in Mutual Funds.

Why SIPs Work Better for Long-Term Goals

Power of Compounding: Small monthly investments grow into a large corpus over years.

Goal-Based Planning: For weddings, home purchase, or even children’s education.

Flexibility: Start with as little as ₹500 per month.

Example - If you invest ₹5,000/month for 5 years at 12% annual return, you’ll accumulate around ₹4 lakh+, reducing the need for a loan.

Know Your SIP Returns

Final Thoughts

These schemes show how India is moving towards financial inclusion and women empowerment. Whether you’re a woman planning to start a home-based food business, set up a boutique, or scale a tech startup, there’s a loan scheme tailored to your needs. Before applying, compare eligibility, interest rates, and repayment terms across banks. Choosing the right scheme can make a huge difference in how smoothly your business grows.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.