बेस्ट बॅलन्स्ड म्युच्युअल फंड 2022

शीर्षस्थानीसंतुलित निधी आहेतम्युच्युअल फंड जे त्यांच्या मालमत्तेची गुंतवणूक इक्विटी आणि डेट इन्स्ट्रुमेंट या दोन्हीमध्ये चांगले एकूण परतावा देण्यासाठी करतात. बॅलन्स्ड म्युच्युअल फंड हे गुंतवणूकदारांसाठी फायदेशीर आहेत जे ए घेण्यास इच्छुक आहेतबाजार तसेच काही निश्चित परतावा शोधत असताना जोखीम.

इक्विटी आणि स्टॉक्समध्ये गुंतवलेली मालमत्ता बाजाराशी संबंधित परतावा देते तर कर्ज साधनांमध्ये गुंतवलेली मालमत्ता निश्चित परतावा देते. इक्विटी आणि डेट या दोन्हींचे मिश्रण असल्याने, गुंतवणूकदारांनी खूप सावधगिरी बाळगली पाहिजेगुंतवणूक या निधीमध्ये. बॅलन्स्ड म्युच्युअल फंडामध्ये गुंतवणूक करण्यापूर्वी गुंतवणूकदारांना टॉप बॅलन्स्ड फंड शोधण्याचा सल्ला दिला जातो. आम्ही खाली शीर्ष संतुलित म्युच्युअल फंड सूचीबद्ध केले आहेत.

बॅलन्स्ड म्युच्युअल फंडात गुंतवणूक का करावी?

साधारणपणे, गुंतवणूकदार कमी जोखमीसह कमी कालावधीत त्यांच्या गुंतवणुकीत विविधता आणण्याचे मार्ग शोधतात. इक्विटी आणि डेट या दोन्ही साधनांचे संयोजन असल्याने, संतुलित म्युच्युअल फंड या दोन्ही जगातील सर्वोत्तम ऑफर देतात. त्यामुळे, हे फंड कर्जाच्या एक्सपोजरमुळे काही मूलभूत परताव्याचे व्यवस्थापन करताना सतत बदलत्या बाजार परिस्थितीमुळे पडझडीचा धोका कमी करतात. 100% गुंतवणुकीपेक्षा किंचित कमी जोखमीसह परतावा मिळविण्याचा मध्यम मार्ग शोधणाऱ्या गुंतवणूकदारांसाठी हे संतुलित फंड हा अत्यंत योग्य गुंतवणूक पर्याय बनवतो.इक्विटी फंड.

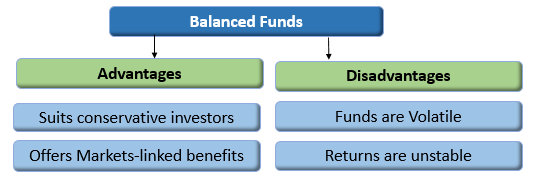

टॉप बॅलन्स्ड फंडांचे फायदे आणि तोटे

फायदे

- 35-40% मालमत्तेची स्थिर गुंतवणूक करून स्थिर परतावा देतेउत्पन्न पर्याय

- इक्विटीमध्ये 60-65% मालमत्ता गुंतवून बाजाराशी संबंधित परतावा देतात

- मध्यम जोखीम घेण्यास इच्छुक असलेल्या पुराणमतवादी गुंतवणूकदारांसाठी योग्य

तोटे

- इक्विटीमध्ये गुंतवलेले फंड अस्थिर असतात आणि त्यात उच्च-जोखीम असतेघटक

- एकत्रित परतावा (डेट आणि इक्विटी म्युच्युअल फंड या दोन्हींचा परतावा) दीर्घकाळात फार चांगला परतावा देऊ शकत नाही.

Talk to our investment specialist

आर्थिक वर्ष 22 - 23 मध्ये गुंतवणुकीसाठी सर्वोत्तम कामगिरी करणारे बॅलन्स्ड फंड किंवा हायब्रिड फंड

टॉप परफॉर्मिंग अग्रेसिव्ह हायब्रिड फंड

हा फंड त्याच्या एकूण मालमत्तेपैकी सुमारे 65 ते 85 टक्के इक्विटी-संबंधित साधनांमध्ये आणि सुमारे 20 ते 35 टक्के मालमत्ता कर्ज साधनांमध्ये गुंतवेल.म्युच्युअल फंड घरे एकतर संतुलित संकरित किंवा आक्रमक संकरित फंड देऊ शकतो, दोन्ही नाही.

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) ICICI Prudential Equity and Debt Fund Growth ₹414.8

↑ 3.14 ₹49,223 3.9 5.3 12.4 19.5 22.1 13.3 BOI AXA Mid and Small Cap Equity and Debt Fund Growth ₹38.86

↑ 0.25 ₹1,321 2.9 0.3 -1.6 18.5 19.6 -0.9 JM Equity Hybrid Fund Growth ₹120.511

↑ 0.88 ₹811 0.8 -1.9 -3.5 17.9 17 -3.1 UTI Hybrid Equity Fund Growth ₹422.167

↑ 2.30 ₹6,718 5.5 3.3 5.7 17 17.2 6.4 Bandhan Hybrid Equity Fund Growth ₹27.237

↑ 0.20 ₹1,486 4.4 5.6 7.2 16.4 15.3 7.7 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 2 Jan 26 Research Highlights & Commentary of 5 Funds showcased

Commentary ICICI Prudential Equity and Debt Fund BOI AXA Mid and Small Cap Equity and Debt Fund JM Equity Hybrid Fund UTI Hybrid Equity Fund Bandhan Hybrid Equity Fund Point 1 Highest AUM (₹49,223 Cr). Bottom quartile AUM (₹1,321 Cr). Bottom quartile AUM (₹811 Cr). Upper mid AUM (₹6,718 Cr). Lower mid AUM (₹1,486 Cr). Point 2 Established history (26+ yrs). Established history (9+ yrs). Established history (30+ yrs). Oldest track record among peers (31 yrs). Established history (9+ yrs). Point 3 Top rated. Not Rated. Rating: 1★ (lower mid). Rating: 3★ (upper mid). Not Rated. Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 22.07% (top quartile). 5Y return: 19.65% (upper mid). 5Y return: 16.96% (bottom quartile). 5Y return: 17.15% (lower mid). 5Y return: 15.28% (bottom quartile). Point 6 3Y return: 19.50% (top quartile). 3Y return: 18.45% (upper mid). 3Y return: 17.94% (lower mid). 3Y return: 16.97% (bottom quartile). 3Y return: 16.41% (bottom quartile). Point 7 1Y return: 12.42% (top quartile). 1Y return: -1.62% (bottom quartile). 1Y return: -3.50% (bottom quartile). 1Y return: 5.68% (lower mid). 1Y return: 7.16% (upper mid). Point 8 1M return: 0.64% (bottom quartile). 1M return: 2.29% (top quartile). 1M return: -1.04% (bottom quartile). 1M return: 1.31% (upper mid). 1M return: 0.95% (lower mid). Point 9 Alpha: 4.08 (top quartile). Alpha: 0.00 (lower mid). Alpha: -9.12 (bottom quartile). Alpha: -1.95 (bottom quartile). Alpha: 1.21 (upper mid). Point 10 Sharpe: 0.65 (top quartile). Sharpe: -0.30 (bottom quartile). Sharpe: -0.55 (bottom quartile). Sharpe: 0.00 (lower mid). Sharpe: 0.26 (upper mid). ICICI Prudential Equity and Debt Fund

BOI AXA Mid and Small Cap Equity and Debt Fund

JM Equity Hybrid Fund

UTI Hybrid Equity Fund

Bandhan Hybrid Equity Fund

टॉप परफॉर्मिंग कंझर्वेटिव्ह हायब्रिड फंड

ही योजना मुख्यत्वे कर्ज साधनांमध्ये गुंतवणूक करेल. त्यांच्या एकूण मालमत्तेपैकी सुमारे 75 ते 90 टक्के कर्ज साधनांमध्ये आणि सुमारे 10 ते 25 टक्के इक्विटी-संबंधित साधनांमध्ये गुंतवणूक केली जाईल. या योजनेला कंझर्व्हेटिव्ह असे नाव देण्यात आले आहे कारण ती जोखीम-प्रतिरोधी लोकांसाठी आहे. ज्या गुंतवणूकदारांना त्यांच्या गुंतवणुकीत जास्त धोका पत्करायचा नाही ते या योजनेत गुंतवणूक करण्यास प्राधान्य देऊ शकतात.

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) ICICI Prudential MIP 25 Growth ₹78.0979

↑ 0.19 ₹3,370 1.7 3.1 7.7 10.2 9.2 7.9 Kotak Debt Hybrid Fund Growth ₹59.7857

↑ 0.13 ₹3,103 1.9 1.9 5.1 10.2 9.6 5.3 DSP Regular Savings Fund Growth ₹60.2097

↑ 0.10 ₹180 2.1 2.3 6.8 10 8.3 7.2 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 2 Jan 26 Research Highlights & Commentary of 3 Funds showcased

Commentary ICICI Prudential MIP 25 Kotak Debt Hybrid Fund DSP Regular Savings Fund Point 1 Highest AUM (₹3,370 Cr). Lower mid AUM (₹3,103 Cr). Bottom quartile AUM (₹180 Cr). Point 2 Established history (21+ yrs). Oldest track record among peers (22 yrs). Established history (21+ yrs). Point 3 Top rated. Rating: 4★ (lower mid). Rating: 3★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderate. Risk profile: Moderately High. Point 5 5Y return: 9.16% (lower mid). 5Y return: 9.56% (upper mid). 5Y return: 8.25% (bottom quartile). Point 6 3Y return: 10.24% (upper mid). 3Y return: 10.15% (lower mid). 3Y return: 10.05% (bottom quartile). Point 7 1Y return: 7.75% (upper mid). 1Y return: 5.11% (bottom quartile). 1Y return: 6.84% (lower mid). Point 8 1M return: 0.28% (bottom quartile). 1M return: 0.77% (upper mid). 1M return: 0.60% (lower mid). Point 9 Alpha: 0.00 (upper mid). Alpha: -2.79 (bottom quartile). Alpha: -0.35 (lower mid). Point 10 Sharpe: 0.61 (upper mid). Sharpe: -0.21 (bottom quartile). Sharpe: 0.20 (lower mid). ICICI Prudential MIP 25

Kotak Debt Hybrid Fund

DSP Regular Savings Fund

टॉप परफॉर्मिंग आर्बिट्रेज फंड

हा फंड आर्बिट्राज धोरणाचा अवलंब करेल आणि त्याच्या मालमत्तेपैकी किमान ६५ टक्के इक्विटी-संबंधित साधनांमध्ये गुंतवेल. आर्बिट्रेज फंड हे म्युच्युअल फंड आहेत जे म्युच्युअल फंड परतावा व्युत्पन्न करण्यासाठी रोख बाजार आणि डेरिव्हेटिव्ह मार्केटमधील फरक किंमतीचा फायदा घेतात. आर्बिट्राज फंडांद्वारे मिळणारा परतावा शेअर बाजाराच्या अस्थिरतेवर अवलंबून असतो. आर्बिट्रेज म्युच्युअल फंड हे संकरित स्वरूपाचे असतात आणि उच्च किंवा सततच्या अस्थिरतेच्या काळात हे फंड गुंतवणूकदारांना तुलनेने जोखीममुक्त परतावा देतात.

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) UTI Arbitrage Fund Growth ₹36.0869

↑ 0.02 ₹10,720 1.6 2.9 6.5 7.1 5.9 6.5 SBI Arbitrage Opportunities Fund Growth ₹34.8036

↑ 0.01 ₹41,083 1.6 2.9 6.5 7.2 6 6.5 Invesco India Arbitrage Fund Growth ₹32.8545

↑ 0.01 ₹27,562 1.6 2.9 6.4 7.1 6 6.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 2 Jan 26 Research Highlights & Commentary of 3 Funds showcased

Commentary UTI Arbitrage Fund SBI Arbitrage Opportunities Fund Invesco India Arbitrage Fund Point 1 Bottom quartile AUM (₹10,720 Cr). Highest AUM (₹41,083 Cr). Lower mid AUM (₹27,562 Cr). Point 2 Oldest track record among peers (19 yrs). Established history (19+ yrs). Established history (18+ yrs). Point 3 Top rated. Rating: 2★ (bottom quartile). Rating: 3★ (lower mid). Point 4 Risk profile: Moderately Low. Risk profile: Moderately Low. Risk profile: Moderately Low. Point 5 5Y return: 5.87% (bottom quartile). 5Y return: 6.02% (upper mid). 5Y return: 6.01% (lower mid). Point 6 3Y return: 7.14% (lower mid). 3Y return: 7.16% (upper mid). 3Y return: 7.13% (bottom quartile). Point 7 1Y return: 6.51% (upper mid). 1Y return: 6.47% (lower mid). 1Y return: 6.43% (bottom quartile). Point 8 1M return: 0.59% (upper mid). 1M return: 0.55% (bottom quartile). 1M return: 0.56% (lower mid). Point 9 Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 0.00 (bottom quartile). Point 10 Sharpe: 1.22 (lower mid). Sharpe: 1.23 (upper mid). Sharpe: 1.03 (bottom quartile). UTI Arbitrage Fund

SBI Arbitrage Opportunities Fund

Invesco India Arbitrage Fund

टॉप परफॉर्मिंग डायनॅमिक अॅसेट अॅलोकेशन फंड

ही योजना इक्विटी आणि कर्ज साधनांमधील त्यांची गुंतवणूक गतिशीलपणे व्यवस्थापित करेल. हे फंड कर्जाचे वाटप वाढवतात आणि बाजार महाग झाल्यावर इक्विटीचे वेटेज कमी करतात. तसेच, हे फंड कमी जोखमीवर स्थिरता प्रदान करण्यावर भर देतात.Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Axis Dynamic Equity Fund Growth ₹21.8

↑ 0.11 ₹3,810 4.5 3.4 6.3 14.8 11.8 7 ICICI Prudential Balanced Advantage Fund Growth ₹78.21

↑ 0.40 ₹69,868 4.2 5.5 11.7 13.8 12.9 12.2 Aditya Birla Sun Life Balanced Advantage Fund Growth ₹110.65

↑ 0.40 ₹8,800 4.3 3.1 9.8 13.3 11.5 10.1 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 2 Jan 26 Research Highlights & Commentary of 3 Funds showcased

Commentary Axis Dynamic Equity Fund ICICI Prudential Balanced Advantage Fund Aditya Birla Sun Life Balanced Advantage Fund Point 1 Bottom quartile AUM (₹3,810 Cr). Highest AUM (₹69,868 Cr). Lower mid AUM (₹8,800 Cr). Point 2 Established history (8+ yrs). Established history (19+ yrs). Oldest track record among peers (25 yrs). Point 3 Not Rated. Top rated. Rating: 3★ (lower mid). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 11.78% (lower mid). 5Y return: 12.93% (upper mid). 5Y return: 11.50% (bottom quartile). Point 6 3Y return: 14.80% (upper mid). 3Y return: 13.85% (lower mid). 3Y return: 13.29% (bottom quartile). Point 7 1Y return: 6.29% (bottom quartile). 1Y return: 11.66% (upper mid). 1Y return: 9.76% (lower mid). Point 8 1M return: 0.83% (bottom quartile). 1M return: 0.98% (upper mid). 1M return: 0.97% (lower mid). Point 9 Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 0.00 (bottom quartile). Point 10 Sharpe: 0.07 (bottom quartile). Sharpe: 0.82 (upper mid). Sharpe: 0.34 (lower mid). Axis Dynamic Equity Fund

ICICI Prudential Balanced Advantage Fund

Aditya Birla Sun Life Balanced Advantage Fund

टॉप परफॉर्मिंग इक्विटी सेव्हिंग्स फंड

ही योजना इक्विटी, आर्बिट्रेज आणि डेटमध्ये गुंतवणूक करेल. इक्विटी बचत एकूण मालमत्तेपैकी किमान 65 टक्के शेअर्समध्ये आणि किमान 10 टक्के कर्जामध्ये गुंतवेल. योजना माहिती दस्तऐवजात किमान हेज्ड आणि हेज्ड गुंतवणुकीचे वर्णन करेल.Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Kotak Equity Savings Fund Growth ₹27.3432

↑ 0.04 ₹9,422 2.6 4.7 7.5 11.7 10.7 7.9 SBI Equity Savings Fund Growth ₹24.457

↑ 0.03 ₹5,997 2.2 1.4 4.9 11.4 9.7 5 Edelweiss Equity Savings Fund Growth ₹26.1869

↑ 0.06 ₹1,106 2.3 3.7 7.6 11.4 9.8 8 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 2 Jan 26 Research Highlights & Commentary of 3 Funds showcased

Commentary Kotak Equity Savings Fund SBI Equity Savings Fund Edelweiss Equity Savings Fund Point 1 Highest AUM (₹9,422 Cr). Lower mid AUM (₹5,997 Cr). Bottom quartile AUM (₹1,106 Cr). Point 2 Oldest track record among peers (11 yrs). Established history (10+ yrs). Established history (11+ yrs). Point 3 Not Rated. Not Rated. Not Rated. Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 10.65% (upper mid). 5Y return: 9.72% (bottom quartile). 5Y return: 9.82% (lower mid). Point 6 3Y return: 11.73% (upper mid). 3Y return: 11.42% (lower mid). 3Y return: 11.41% (bottom quartile). Point 7 1Y return: 7.51% (lower mid). 1Y return: 4.86% (bottom quartile). 1Y return: 7.60% (upper mid). Point 8 1M return: 0.45% (lower mid). 1M return: 0.08% (bottom quartile). 1M return: 0.91% (upper mid). Point 9 Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 0.00 (bottom quartile). Point 10 Sharpe: 0.17 (lower mid). Sharpe: -0.05 (bottom quartile). Sharpe: 0.72 (upper mid). Kotak Equity Savings Fund

SBI Equity Savings Fund

Edelweiss Equity Savings Fund

टॉप परफॉर्मिंग मल्टी अॅसेट अलोकेशन फंड

ही योजना तीन मालमत्ता वर्गांमध्ये गुंतवणूक करू शकते, याचा अर्थ ते इक्विटी आणि कर्ज व्यतिरिक्त अतिरिक्त मालमत्ता वर्गात गुंतवणूक करू शकतात. फंडाने प्रत्येक मालमत्ता वर्गात किमान 10 टक्के गुंतवणूक करावी. परदेशी सिक्युरिटीजला स्वतंत्र मालमत्ता वर्ग मानले जाणार नाही. (Erstwhile UTI Wealth Builder Fund) The objective of the Scheme is to achieve long term capital appreciation by investing predominantly in a diversified portfolio of equity and equity related instruments along with investments in Gold ETFs and Debt and Money Market Instruments. However, there can be no assurance that the investment objective of the Scheme will be achieved. Below is the key information for UTI Multi Asset Fund Returns up to 1 year are on (Erstwhile ICICI Prudential Dynamic Plan) To generate capital appreciation by actively investing in equity and equity related securities. For defensive considerations, the Scheme may invest in debt, money market instruments and derivatives. The investment manager will have the discretion to take aggressive asset calls i.e. by staying 100% invested in equity market/equity related instruments at a given point of time and 0% at another, in which case, the fund may be invested in debt related instruments at its discretion. The AMC may choose to churn the portfolio of the Scheme in order to achieve the investment objective. The Scheme is suitable for investors seeking high returns and for those who are willing to take commensurate risks. Research Highlights for ICICI Prudential Multi-Asset Fund Below is the key information for ICICI Prudential Multi-Asset Fund Returns up to 1 year are on (Erstwhile ICICI Prudential Balanced Fund) To generate long term capital appreciation and current income from a portfolio

that is invested in equity and equity related securities as well as in fixed income

securities. Research Highlights for ICICI Prudential Equity and Debt Fund Below is the key information for ICICI Prudential Equity and Debt Fund Returns up to 1 year are on (Erstwhile BOI AXA Mid Cap Equity And Debt Fund) The scheme's objective is to provide capital appreciation and income distribution to investors from a portfolio constituting of mid cap equity and equity related securities as well as fixed income securities.However there can be no assurance that the investment objectives of the Scheme will be realized Research Highlights for BOI AXA Mid and Small Cap Equity and Debt Fund Below is the key information for BOI AXA Mid and Small Cap Equity and Debt Fund Returns up to 1 year are on (Erstwhile SBI Magnum Monthly Income Plan Floater) To provide regular income, liquidity and attractive returns to investors in addition

to mitigating the impact of interest rate risk through an actively managed

portfolio of floating rate and fixed rate debt instruments, equity, money market

instruments and derivatives. Research Highlights for SBI Multi Asset Allocation Fund Below is the key information for SBI Multi Asset Allocation Fund Returns up to 1 year are on (Erstwhile JM Balanced Fund) To provide steady current income as well as long term growth of capital. Research Highlights for JM Equity Hybrid Fund Below is the key information for JM Equity Hybrid Fund Returns up to 1 year are on (Erstwhile Edelweiss Prudent Advantage Fund) The objective of the Scheme is to generate returns through capital appreciation by investing in diversified portfolio of equity and equity-related securities, fixed income instruments and Gold Exchange Traded Funds.

However, there is no assurance that the investment objective of the Scheme will be realized. Research Highlights for Edelweiss Multi Asset Allocation Fund Below is the key information for Edelweiss Multi Asset Allocation Fund Returns up to 1 year are on (Erstwhile UTI Balanced Fund) The scheme aims to invest in a portfolio of equity/equity related securities and fixed income securities (debt and money market securities) with a view to generating regular income together with capital appreciation. Research Highlights for UTI Hybrid Equity Fund Below is the key information for UTI Hybrid Equity Fund Returns up to 1 year are on (Erstwhile IDFC Balanced Fund) The Fund seeks to generate long term capital appreciation along with current income by investing in a mix of equity and equity related securities, debt securities and money market instruments. There is no assurance or guarantee that the objectives of the scheme will be realised. Research Highlights for Bandhan Hybrid Equity Fund Below is the key information for Bandhan Hybrid Equity Fund Returns up to 1 year are on Seeks to generate long term capital appreciation and current income from a portfolio constituted of equity and equity related securities as well as fixed income securities. Research Highlights for DSP Equity and Bond Fund Below is the key information for DSP Equity and Bond Fund Returns up to 1 year are on (Erstwhile Sundaram Balanced Fund) The scheme seeks to generate capital appreciation and current income through a judicious mix of investments in equities and fixed income securities. Research Highlights for Sundaram Equity Hybrid Fund Below is the key information for Sundaram Equity Hybrid Fund Returns up to 1 year are on Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) UTI Multi Asset Fund Growth ₹79.6601

↑ 0.48 ₹6,551 6.3 6.4 9.7 20.1 15.1 11.1 ICICI Prudential Multi-Asset Fund Growth ₹819.803

↓ -0.78 ₹75,067 5.1 7.7 18 19.5 21.8 18.6 SBI Multi Asset Allocation Fund Growth ₹65.7702

↑ 0.32 ₹12,466 7.4 10 18.2 18.4 14.8 18.6 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 2 Jan 26 Research Highlights & Commentary of 3 Funds showcased

Commentary UTI Multi Asset Fund ICICI Prudential Multi-Asset Fund SBI Multi Asset Allocation Fund Point 1 Bottom quartile AUM (₹6,551 Cr). Highest AUM (₹75,067 Cr). Lower mid AUM (₹12,466 Cr). Point 2 Established history (17+ yrs). Oldest track record among peers (23 yrs). Established history (20+ yrs). Point 3 Rating: 1★ (bottom quartile). Rating: 2★ (lower mid). Top rated. Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderate. Point 5 5Y return: 15.11% (lower mid). 5Y return: 21.79% (upper mid). 5Y return: 14.80% (bottom quartile). Point 6 3Y return: 20.06% (upper mid). 3Y return: 19.55% (lower mid). 3Y return: 18.44% (bottom quartile). Point 7 1Y return: 9.73% (bottom quartile). 1Y return: 18.04% (lower mid). 1Y return: 18.25% (upper mid). Point 8 1M return: 0.81% (bottom quartile). 1M return: 0.85% (lower mid). 1M return: 2.41% (upper mid). Point 9 Alpha: 0.00 (upper mid). Alpha: 0.00 (lower mid). Alpha: 0.00 (bottom quartile). Point 10 Sharpe: 0.48 (bottom quartile). Sharpe: 1.32 (upper mid). Sharpe: 1.17 (lower mid). UTI Multi Asset Fund

ICICI Prudential Multi-Asset Fund

SBI Multi Asset Allocation Fund

AUM >= 200 कोटी & क्रमवारी लावली3 वर्षCAGR परत.1. UTI Multi Asset Fund

UTI Multi Asset Fund

Growth Launch Date 21 Oct 08 NAV (02 Jan 26) ₹79.6601 ↑ 0.48 (0.61 %) Net Assets (Cr) ₹6,551 on 30 Nov 25 Category Hybrid - Multi Asset AMC UTI Asset Management Company Ltd Rating ☆ Risk Moderately High Expense Ratio 1.79 Sharpe Ratio 0.48 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Dec 20 ₹10,000 31 Dec 21 ₹11,180 31 Dec 22 ₹11,673 31 Dec 23 ₹15,076 31 Dec 24 ₹18,198 31 Dec 25 ₹20,215 Returns for UTI Multi Asset Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 2 Jan 26 Duration Returns 1 Month 0.8% 3 Month 6.3% 6 Month 6.4% 1 Year 9.7% 3 Year 20.1% 5 Year 15.1% 10 Year 15 Year Since launch 12.8% Historical performance (Yearly) on absolute basis

Year Returns 2024 11.1% 2023 20.7% 2022 29.1% 2021 4.4% 2020 11.8% 2019 13.1% 2018 3.9% 2017 -0.5% 2016 17.1% 2015 7.3% Fund Manager information for UTI Multi Asset Fund

Name Since Tenure Sharwan Kumar Goyal 12 Nov 21 4.05 Yr. Jaydeep Bhowal 1 Oct 24 1.17 Yr. Data below for UTI Multi Asset Fund as on 30 Nov 25

Asset Allocation

Asset Class Value Cash 7.73% Equity 68.27% Debt 11.82% Other 12.18% Equity Sector Allocation

Sector Value Financial Services 16.04% Technology 11.92% Consumer Defensive 9.37% Consumer Cyclical 7.68% Basic Materials 6.16% Industrials 5.61% Health Care 4.33% Energy 3.13% Communication Services 3.08% Real Estate 3% Debt Sector Allocation

Sector Value Government 9.04% Cash Equivalent 7.72% Corporate 2.79% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity UTI Gold ETF

- | -12% ₹805 Cr 76,018,936 Infosys Ltd (Technology)

Equity, Since 31 Mar 24 | INFY3% ₹177 Cr 1,132,192

↑ 115,255 ITC Ltd (Consumer Defensive)

Equity, Since 31 Oct 22 | ITC3% ₹172 Cr 4,253,690

↑ 83,865 Asian Paints Ltd (Basic Materials)

Equity, Since 31 Oct 24 | ASIANPAINT2% ₹151 Cr 524,991

↑ 28,672 State Bank of India (Financial Services)

Equity, Since 31 Oct 25 | SBIN2% ₹149 Cr 1,519,927

↑ 157,362 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Apr 24 | BHARTIARTL2% ₹142 Cr 677,566

↓ -10,759 Nestle India Ltd (Consumer Defensive)

Equity, Since 29 Feb 24 | NESTLEIND2% ₹141 Cr 1,119,520

↑ 73,323 HDFC Bank Ltd (Financial Services)

Equity, Since 30 Apr 25 | HDFCBANK2% ₹137 Cr 1,364,459

↓ -4,163 Tata Consultancy Services Ltd (Technology)

Equity, Since 29 Feb 24 | TCS2% ₹135 Cr 431,841 Coal India Ltd (Energy)

Equity, Since 31 Oct 22 | COALINDIA2% ₹126 Cr 3,341,545

↑ 606,406 2. ICICI Prudential Multi-Asset Fund

ICICI Prudential Multi-Asset Fund

Growth Launch Date 31 Oct 02 NAV (01 Jan 26) ₹819.803 ↓ -0.78 (-0.09 %) Net Assets (Cr) ₹75,067 on 30 Nov 25 Category Hybrid - Multi Asset AMC ICICI Prudential Asset Management Company Limited Rating ☆☆ Risk Moderately High Expense Ratio 1.47 Sharpe Ratio 1.32 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Dec 20 ₹10,000 31 Dec 21 ₹13,472 31 Dec 22 ₹15,742 31 Dec 23 ₹19,543 31 Dec 24 ₹22,698 31 Dec 25 ₹26,920 Returns for ICICI Prudential Multi-Asset Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 2 Jan 26 Duration Returns 1 Month 0.9% 3 Month 5.1% 6 Month 7.7% 1 Year 18% 3 Year 19.5% 5 Year 21.8% 10 Year 15 Year Since launch 20.9% Historical performance (Yearly) on absolute basis

Year Returns 2024 18.6% 2023 16.1% 2022 24.1% 2021 16.8% 2020 34.7% 2019 9.9% 2018 7.7% 2017 -2.2% 2016 28.2% 2015 12.5% Fund Manager information for ICICI Prudential Multi-Asset Fund

Name Since Tenure Sankaran Naren 1 Feb 12 13.84 Yr. Manish Banthia 22 Jan 24 1.86 Yr. Ihab Dalwai 3 Jun 17 8.5 Yr. Akhil Kakkar 22 Jan 24 1.86 Yr. Sri Sharma 30 Apr 21 4.59 Yr. Gaurav Chikane 2 Aug 21 4.33 Yr. Sharmila D'Silva 31 Jul 22 3.34 Yr. Masoomi Jhurmarvala 4 Nov 24 1.07 Yr. Data below for ICICI Prudential Multi-Asset Fund as on 30 Nov 25

Asset Allocation

Asset Class Value Cash 19.54% Equity 63.86% Debt 6.49% Other 10.1% Equity Sector Allocation

Sector Value Financial Services 21.31% Consumer Cyclical 10.79% Basic Materials 6.83% Technology 6.16% Industrials 6.01% Consumer Defensive 5.83% Energy 5.05% Health Care 4.34% Communication Services 2.3% Utility 2.04% Real Estate 1.55% Debt Sector Allocation

Sector Value Cash Equivalent 15.4% Government 5.5% Corporate 5.14% Credit Quality

Rating Value A 0.92% AA 12.4% AAA 63.58% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Pru Gold ETF

- | -4% ₹3,375 Cr 312,260,882

↑ 87,670,000 ICICI Bank Ltd (Financial Services)

Equity, Since 31 May 06 | ICICIBANK4% ₹3,232 Cr 23,271,875

↑ 4,678,970 Future on Gold

- | -3% ₹2,499 Cr 1,930

↑ 1,930 Reliance Industries Ltd (Energy)

Equity, Since 31 Dec 20 | RELIANCE3% ₹2,406 Cr 15,349,805

↓ -463,500 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jan 22 | HDFCBANK3% ₹2,337 Cr 23,194,083

↑ 4,691,719 Axis Bank Ltd (Financial Services)

Equity, Since 31 Dec 20 | AXISBANK3% ₹2,262 Cr 17,676,017

↓ -176,250 Infosys Ltd (Technology)

Equity, Since 31 Oct 19 | INFY3% ₹1,915 Cr 12,274,873

↑ 265,660 Maruti Suzuki India Ltd (Consumer Cyclical)

Equity, Since 31 Aug 21 | MARUTI2% ₹1,618 Cr 1,017,654

↑ 64,924 SBI Cards and Payment Services Ltd Ordinary Shares (Financial Services)

Equity, Since 30 Nov 22 | SBICARD2% ₹1,548 Cr 17,583,581

↑ 2,254,215 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 19 | LT2% ₹1,404 Cr 3,450,617 3. ICICI Prudential Equity and Debt Fund

ICICI Prudential Equity and Debt Fund

Growth Launch Date 3 Nov 99 NAV (02 Jan 26) ₹414.8 ↑ 3.14 (0.76 %) Net Assets (Cr) ₹49,223 on 30 Nov 25 Category Hybrid - Hybrid Equity AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.6 Sharpe Ratio 0.65 Information Ratio 1.95 Alpha Ratio 4.08 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Dec 20 ₹10,000 31 Dec 21 ₹14,170 31 Dec 22 ₹15,828 31 Dec 23 ₹20,298 31 Dec 24 ₹23,784 31 Dec 25 ₹26,951 Returns for ICICI Prudential Equity and Debt Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 2 Jan 26 Duration Returns 1 Month 0.6% 3 Month 3.9% 6 Month 5.3% 1 Year 12.4% 3 Year 19.5% 5 Year 22.1% 10 Year 15 Year Since launch 15.3% Historical performance (Yearly) on absolute basis

Year Returns 2024 13.3% 2023 17.2% 2022 28.2% 2021 11.7% 2020 41.7% 2019 9% 2018 9.3% 2017 -1.9% 2016 24.8% 2015 13.7% Fund Manager information for ICICI Prudential Equity and Debt Fund

Name Since Tenure Sankaran Naren 7 Dec 15 9.99 Yr. Manish Banthia 19 Sep 13 12.21 Yr. Mittul Kalawadia 29 Dec 20 4.93 Yr. Akhil Kakkar 22 Jan 24 1.86 Yr. Sri Sharma 30 Apr 21 4.59 Yr. Sharmila D'Silva 31 Jul 22 3.34 Yr. Nitya Mishra 4 Nov 24 1.07 Yr. Data below for ICICI Prudential Equity and Debt Fund as on 30 Nov 25

Asset Allocation

Asset Class Value Cash 10.3% Equity 77.07% Debt 12.59% Equity Sector Allocation

Sector Value Financial Services 19.31% Consumer Cyclical 11.35% Energy 8.18% Health Care 7.17% Technology 6.03% Industrials 5.98% Consumer Defensive 5.8% Utility 5.35% Real Estate 2.89% Basic Materials 2.53% Communication Services 2.23% Debt Sector Allocation

Sector Value Corporate 8.78% Cash Equivalent 7.26% Government 6.89% Credit Quality

Rating Value A 1.15% AA 12.4% AAA 54.29% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Bank Ltd (Financial Services)

Equity, Since 31 Jul 12 | ICICIBANK6% ₹3,189 Cr 22,962,853 Reliance Industries Ltd (Energy)

Equity, Since 30 Jun 22 | RELIANCE6% ₹2,907 Cr 18,543,909 NTPC Ltd (Utilities)

Equity, Since 28 Feb 17 | NTPC5% ₹2,493 Cr 76,360,769

↑ 285,854 Sun Pharmaceuticals Industries Ltd (Healthcare)

Equity, Since 31 May 16 | SUNPHARMA5% ₹2,468 Cr 13,476,970 HDFC Bank Ltd (Financial Services)

Equity, Since 30 Apr 21 | HDFCBANK4% ₹2,189 Cr 21,722,693 Axis Bank Ltd (Financial Services)

Equity, Since 31 Mar 21 | AXISBANK3% ₹1,466 Cr 11,459,322 TVS Motor Co Ltd (Consumer Cyclical)

Equity, Since 28 Feb 18 | TVSMOTOR3% ₹1,417 Cr 4,012,393 Maruti Suzuki India Ltd (Consumer Cyclical)

Equity, Since 31 Jul 21 | MARUTI3% ₹1,339 Cr 842,167 Infosys Ltd (Technology)

Equity, Since 30 Jun 16 | INFY3% ₹1,270 Cr 8,138,013 Avenue Supermarts Ltd (Consumer Defensive)

Equity, Since 31 Jan 23 | DMART3% ₹1,267 Cr 3,170,463

↑ 207,683 4. BOI AXA Mid and Small Cap Equity and Debt Fund

BOI AXA Mid and Small Cap Equity and Debt Fund

Growth Launch Date 20 Jul 16 NAV (02 Jan 26) ₹38.86 ↑ 0.25 (0.65 %) Net Assets (Cr) ₹1,321 on 30 Nov 25 Category Hybrid - Hybrid Equity AMC BOI AXA Investment Mngrs Private Ltd Rating Risk Moderately High Expense Ratio 2.27 Sharpe Ratio -0.3 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Dec 20 ₹10,000 31 Dec 21 ₹15,448 31 Dec 22 ₹14,711 31 Dec 23 ₹19,670 31 Dec 24 ₹24,743 31 Dec 25 ₹24,514 Returns for BOI AXA Mid and Small Cap Equity and Debt Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 2 Jan 26 Duration Returns 1 Month 2.3% 3 Month 2.9% 6 Month 0.3% 1 Year -1.6% 3 Year 18.5% 5 Year 19.6% 10 Year 15 Year Since launch 15.4% Historical performance (Yearly) on absolute basis

Year Returns 2024 -0.9% 2023 25.8% 2022 33.7% 2021 -4.8% 2020 54.5% 2019 31.1% 2018 -4.7% 2017 -14.2% 2016 47.1% 2015 Fund Manager information for BOI AXA Mid and Small Cap Equity and Debt Fund

Name Since Tenure Alok Singh 16 Feb 17 8.79 Yr. Data below for BOI AXA Mid and Small Cap Equity and Debt Fund as on 30 Nov 25

Asset Allocation

Asset Class Value Cash 12.44% Equity 74.27% Debt 13.3% Equity Sector Allocation

Sector Value Financial Services 16.12% Basic Materials 15.86% Industrials 13.49% Consumer Cyclical 9.03% Health Care 8.2% Technology 5.66% Consumer Defensive 3.9% Utility 0.9% Real Estate 0.62% Energy 0.5% Debt Sector Allocation

Sector Value Government 10.43% Cash Equivalent 8.36% Corporate 6.94% Credit Quality

Rating Value AA 1.44% AAA 98.56% Top Securities Holdings / Portfolio

Name Holding Value Quantity Indian Bank (Financial Services)

Equity, Since 31 Aug 23 | INDIANB3% ₹44 Cr 505,000 Jindal Stainless Ltd (Basic Materials)

Equity, Since 30 Sep 21 | JSL3% ₹44 Cr 566,000 UNO Minda Ltd (Consumer Cyclical)

Equity, Since 31 Jul 19 | UNOMINDA3% ₹41 Cr 314,000 Housing & Urban Development Corp Ltd (Financial Services)

Equity, Since 31 May 24 | HUDCO3% ₹38 Cr 1,580,000 Hindustan Copper Ltd (Basic Materials)

Equity, Since 31 Oct 24 | 5135993% ₹34 Cr 1,050,000 PB Fintech Ltd (Financial Services)

Equity, Since 29 Feb 24 | 5433902% ₹33 Cr 180,000 Eris Lifesciences Ltd Registered Shs (Healthcare)

Equity, Since 31 Jul 23 | ERIS2% ₹32 Cr 202,783

↑ 7,783 Bharat Dynamics Ltd Ordinary Shares (Industrials)

Equity, Since 31 Jul 24 | BDL2% ₹30 Cr 196,000 TD Power Systems Ltd (Industrials)

Equity, Since 31 Jul 24 | TDPOWERSYS2% ₹30 Cr 380,000 Glenmark Pharmaceuticals Ltd (Healthcare)

Equity, Since 31 Jul 25 | GLENMARK2% ₹29 Cr 150,000 5. SBI Multi Asset Allocation Fund

SBI Multi Asset Allocation Fund

Growth Launch Date 21 Dec 05 NAV (02 Jan 26) ₹65.7702 ↑ 0.32 (0.49 %) Net Assets (Cr) ₹12,466 on 15 Dec 25 Category Hybrid - Multi Asset AMC SBI Funds Management Private Limited Rating ☆☆☆☆ Risk Moderate Expense Ratio 1.46 Sharpe Ratio 1.17 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Dec 20 ₹10,000 31 Dec 21 ₹11,302 31 Dec 22 ₹11,977 31 Dec 23 ₹14,897 31 Dec 24 ₹16,803 31 Dec 25 ₹19,924 Returns for SBI Multi Asset Allocation Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 2 Jan 26 Duration Returns 1 Month 2.4% 3 Month 7.4% 6 Month 10% 1 Year 18.2% 3 Year 18.4% 5 Year 14.8% 10 Year 15 Year Since launch 9.9% Historical performance (Yearly) on absolute basis

Year Returns 2024 18.6% 2023 12.8% 2022 24.4% 2021 6% 2020 13% 2019 14.2% 2018 10.6% 2017 0.4% 2016 10.9% 2015 8.7% Fund Manager information for SBI Multi Asset Allocation Fund

Name Since Tenure Dinesh Balachandran 31 Oct 21 4.09 Yr. Mansi Sajeja 1 Dec 23 2 Yr. Vandna Soni 1 Jan 24 1.92 Yr. Data below for SBI Multi Asset Allocation Fund as on 15 Dec 25

Asset Allocation

Asset Class Value Cash 10.3% Equity 46.93% Debt 32.36% Other 10.41% Equity Sector Allocation

Sector Value Financial Services 14.22% Real Estate 6.48% Consumer Cyclical 5.9% Energy 3.97% Technology 3.83% Basic Materials 3.74% Consumer Defensive 3.35% Industrials 2.32% Utility 1.69% Health Care 1.11% Communication Services 0.33% Debt Sector Allocation

Sector Value Corporate 24.41% Cash Equivalent 9.53% Government 8.72% Credit Quality

Rating Value A 2.23% AA 51.08% AAA 46.69% Top Securities Holdings / Portfolio

Name Holding Value Quantity SBI Silver ETF

- | -7% ₹840 Cr 44,296,178

↓ -4,000,000 Brookfield India Real Estate Trust (Real Estate)

-, Since 30 Apr 25 | 5432614% ₹498 Cr 15,164,234

↑ 7,500,000 SBI Gold ETF

- | -3% ₹426 Cr 37,241,000 6.68% Govt Stock 2040

Sovereign Bonds | -3% ₹339 Cr 35,000,000 6.48% Govt Stock 2035

Sovereign Bonds | -2% ₹298 Cr 30,000,000

↑ 30,000,000 Reliance Industries Ltd (Energy)

Equity, Since 15 Sep 24 | RELIANCE2% ₹268 Cr 1,720,000 HDFC Bank Ltd (Financial Services)

Equity, Since 30 Nov 22 | HDFCBANK2% ₹265 Cr 2,662,000 Jtpm Metal TRaders Limited

Debentures | -2% ₹257 Cr 25,000 PB Fintech Ltd (Financial Services)

Equity, Since 31 Jul 25 | 5433902% ₹236 Cr 1,222,500 Embassy Office Parks REIT (Real Estate)

-, Since 30 Apr 25 | 5426022% ₹216 Cr 4,900,000 6. JM Equity Hybrid Fund

JM Equity Hybrid Fund

Growth Launch Date 1 Apr 95 NAV (02 Jan 26) ₹120.511 ↑ 0.88 (0.73 %) Net Assets (Cr) ₹811 on 30 Nov 25 Category Hybrid - Hybrid Equity AMC JM Financial Asset Management Limited Rating ☆ Risk Moderately High Expense Ratio 2.3 Sharpe Ratio -0.55 Information Ratio 0.79 Alpha Ratio -9.12 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-60 Days (1%),60 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Dec 20 ₹10,000 31 Dec 21 ₹12,294 31 Dec 22 ₹13,284 31 Dec 23 ₹17,781 31 Dec 24 ₹22,579 31 Dec 25 ₹21,874 Returns for JM Equity Hybrid Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 2 Jan 26 Duration Returns 1 Month -1% 3 Month 0.8% 6 Month -1.9% 1 Year -3.5% 3 Year 17.9% 5 Year 17% 10 Year 15 Year Since launch 12.3% Historical performance (Yearly) on absolute basis

Year Returns 2024 -3.1% 2023 27% 2022 33.8% 2021 8.1% 2020 22.9% 2019 30.5% 2018 -8.1% 2017 1.7% 2016 18.5% 2015 3% Fund Manager information for JM Equity Hybrid Fund

Name Since Tenure Satish Ramanathan 1 Oct 24 1.17 Yr. Asit Bhandarkar 31 Dec 21 3.92 Yr. Ruchi Fozdar 4 Oct 24 1.16 Yr. Deepak Gupta 11 Apr 25 0.64 Yr. Data below for JM Equity Hybrid Fund as on 30 Nov 25

Asset Allocation

Asset Class Value Cash 0.64% Equity 76.46% Debt 22.89% Equity Sector Allocation

Sector Value Financial Services 24.23% Technology 15.93% Industrials 14.08% Consumer Cyclical 8.66% Basic Materials 5.56% Communication Services 3.76% Health Care 3.14% Consumer Defensive 1.1% Debt Sector Allocation

Sector Value Corporate 12.59% Government 10.31% Cash Equivalent 0.64% Credit Quality

Rating Value AA 8.7% AAA 91.3% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 30 Jun 24 | HDFCBANK4% ₹35 Cr 350,000 Ujjivan Small Finance Bank Ltd Ordinary Shares (Financial Services)

Equity, Since 31 Jan 25 | UJJIVANSFB4% ₹33 Cr 5,974,365

↑ 23,500 Larsen & Toubro Ltd (Industrials)

Equity, Since 31 May 21 | LT4% ₹32 Cr 78,000

↑ 10,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Oct 24 | BHARTIARTL4% ₹31 Cr 145,246 Multi Commodity Exchange of India Ltd (Financial Services)

Equity, Since 31 May 25 | MCX4% ₹30 Cr 29,676

↓ -1,000 Coforge Ltd (Technology)

Equity, Since 31 May 25 | COFORGE4% ₹28 Cr 149,000

↑ 44,000 Bajaj Finance Ltd (Financial Services)

Equity, Since 31 Jan 25 | BAJFINANCE3% ₹27 Cr 265,040

↓ -10,000 Waaree Energies Ltd (Technology)

Equity, Since 31 May 25 | 5442773% ₹24 Cr 77,000 6.48% Govt Stock 2035

Sovereign Bonds | -3% ₹23 Cr 2,275,000

↑ 200,000 One97 Communications Ltd (Technology)

Equity, Since 30 Jun 25 | 5433963% ₹22 Cr 170,000 7. Edelweiss Multi Asset Allocation Fund

Edelweiss Multi Asset Allocation Fund

Growth Launch Date 12 Aug 09 NAV (02 Jan 26) ₹65.48 ↑ 0.41 (0.63 %) Net Assets (Cr) ₹3,413 on 30 Nov 25 Category Hybrid - Multi Asset AMC Edelweiss Asset Management Limited Rating ☆ Risk Moderately High Expense Ratio 1.98 Sharpe Ratio 0.15 Information Ratio 1.33 Alpha Ratio -0.39 Min Investment 5,000 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 31 Dec 20 ₹10,000 31 Dec 21 ₹12,709 31 Dec 22 ₹13,386 31 Dec 23 ₹16,788 31 Dec 24 ₹20,174 31 Dec 25 ₹21,377 Returns for Edelweiss Multi Asset Allocation Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 2 Jan 26 Duration Returns 1 Month 1% 3 Month 3.1% 6 Month 1.8% 1 Year 5% 3 Year 17% 5 Year 16.5% 10 Year 15 Year Since launch Historical performance (Yearly) on absolute basis

Year Returns 2024 6% 2023 20.2% 2022 25.4% 2021 5.3% 2020 27.1% 2019 12.7% 2018 10.4% 2017 -0.1% 2016 26.1% 2015 0.2% Fund Manager information for Edelweiss Multi Asset Allocation Fund

Name Since Tenure Dhawal Dalal 22 Sep 25 0.19 Yr. Bhavesh Jain 14 Oct 15 10.14 Yr. Bharat Lahoti 1 Oct 21 4.17 Yr. Rahul Dedhia 1 Jul 24 1.42 Yr. Pranavi Kulkarni 1 Aug 24 1.33 Yr. Data below for Edelweiss Multi Asset Allocation Fund as on 30 Nov 25

Asset Allocation

Asset Class Value Cash 13.65% Equity 78.09% Debt 8.25% Equity Sector Allocation

Sector Value Financial Services 25.2% Consumer Cyclical 10.45% Health Care 7.7% Technology 6.28% Industrials 5.7% Basic Materials 5.6% Communication Services 4.59% Energy 4.16% Consumer Defensive 3.57% Utility 2.75% Real Estate 0.89% Debt Sector Allocation

Sector Value Cash Equivalent 13.65% Corporate 7.63% Government 0.63% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Bank Ltd (Financial Services)

Equity, Since 31 Mar 15 | ICICIBANK6% ₹191 Cr 1,373,985 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Oct 15 | HDFCBANK5% ₹158 Cr 1,569,936 National Bank For Agriculture And Rural Development

Debentures | -4% ₹140 Cr 14,000,000

↓ -5,000,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Oct 19 | BHARTIARTL4% ₹123 Cr 583,607

↑ 87,753 State Bank of India (Financial Services)

Equity, Since 30 Jun 15 | SBIN3% ₹109 Cr 1,116,240

↑ 262,526 Infosys Ltd (Technology)

Equity, Since 31 May 15 | INFY3% ₹96 Cr 616,103 Reliance Industries Ltd (Energy)

Equity, Since 31 Aug 20 | RELIANCE3% ₹94 Cr 601,184

↑ 122,156 NTPC Ltd (Utilities)

Equity, Since 30 Nov 21 | NTPC2% ₹82 Cr 2,497,975

↑ 544,402 Aditya Birla Capital Limited

Debentures | -2% ₹76 Cr 7,500,000 Hdb Financial Services Limited

Debentures | -2% ₹76 Cr 7,500,000 8. UTI Hybrid Equity Fund

UTI Hybrid Equity Fund

Growth Launch Date 2 Jan 95 NAV (02 Jan 26) ₹422.167 ↑ 2.30 (0.55 %) Net Assets (Cr) ₹6,718 on 30 Nov 25 Category Hybrid - Hybrid Equity AMC UTI Asset Management Company Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 1.88 Sharpe Ratio 0 Information Ratio 1.42 Alpha Ratio -1.95 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Dec 20 ₹10,000 31 Dec 21 ₹13,047 31 Dec 22 ₹13,783 31 Dec 23 ₹17,291 31 Dec 24 ₹20,696 31 Dec 25 ₹22,025 Returns for UTI Hybrid Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 2 Jan 26 Duration Returns 1 Month 1.3% 3 Month 5.5% 6 Month 3.3% 1 Year 5.7% 3 Year 17% 5 Year 17.2% 10 Year 15 Year Since launch 15% Historical performance (Yearly) on absolute basis

Year Returns 2024 6.4% 2023 19.7% 2022 25.5% 2021 5.6% 2020 30.5% 2019 13.2% 2018 2.5% 2017 -5.6% 2016 25.7% 2015 8.8% Fund Manager information for UTI Hybrid Equity Fund

Name Since Tenure V Srivatsa 24 Sep 09 16.2 Yr. Sunil Patil 5 Feb 18 7.82 Yr. Jaydeep Bhowal 3 Nov 25 0.08 Yr. Data below for UTI Hybrid Equity Fund as on 30 Nov 25

Asset Allocation

Asset Class Value Cash 1.73% Equity 72.96% Debt 25.31% Equity Sector Allocation

Sector Value Financial Services 21.59% Technology 8.04% Consumer Cyclical 7.64% Industrials 6.73% Energy 6.16% Consumer Defensive 5.07% Basic Materials 4.97% Communication Services 4.33% Health Care 4.25% Real Estate 2.71% Utility 1.46% Debt Sector Allocation

Sector Value Government 18.68% Corporate 6.4% Cash Equivalent 1.96% Credit Quality

Rating Value AA 0.47% AAA 99.53% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 29 Feb 20 | HDFCBANK6% ₹406 Cr 4,027,946 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Mar 10 | ICICIBANK5% ₹308 Cr 2,218,644

↓ -40,000 Infosys Ltd (Technology)

Equity, Since 31 Mar 06 | INFY4% ₹270 Cr 1,729,346

↑ 30,000 Reliance Industries Ltd (Energy)

Equity, Since 31 Dec 19 | RELIANCE3% ₹222 Cr 1,418,588 ITC Ltd (Consumer Defensive)

Equity, Since 31 Aug 06 | ITC3% ₹198 Cr 4,904,969 Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Mar 12 | LT2% ₹152 Cr 374,309 Vedanta Ltd (Basic Materials)

Equity, Since 30 Apr 24 | VEDL2% ₹141 Cr 2,675,574

↓ -145,000 Wipro Ltd (Technology)

Equity, Since 30 Jun 24 | WIPRO2% ₹136 Cr 5,440,657 7.32% Govt Stock 2030

Sovereign Bonds | -2% ₹125 Cr 1,200,000,000 7.24% Govt Stock 2055

Sovereign Bonds | -2% ₹124 Cr 1,250,000,000

↑ 250,000,000 9. Bandhan Hybrid Equity Fund

Bandhan Hybrid Equity Fund

Growth Launch Date 30 Dec 16 NAV (02 Jan 26) ₹27.237 ↑ 0.20 (0.75 %) Net Assets (Cr) ₹1,486 on 30 Nov 25 Category Hybrid - Hybrid Equity AMC IDFC Asset Management Company Limited Rating Risk Moderately High Expense Ratio 2.35 Sharpe Ratio 0.26 Information Ratio 0.59 Alpha Ratio 1.21 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Dec 20 ₹10,000 31 Dec 21 ₹13,080 31 Dec 22 ₹12,940 31 Dec 23 ₹15,579 31 Dec 24 ₹18,846 31 Dec 25 ₹20,290 Returns for Bandhan Hybrid Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 2 Jan 26 Duration Returns 1 Month 1% 3 Month 4.4% 6 Month 5.6% 1 Year 7.2% 3 Year 16.4% 5 Year 15.3% 10 Year 15 Year Since launch 11.8% Historical performance (Yearly) on absolute basis

Year Returns 2024 7.7% 2023 21% 2022 20.4% 2021 -1.1% 2020 30.8% 2019 13.9% 2018 4.7% 2017 -3.8% 2016 16.2% 2015 Fund Manager information for Bandhan Hybrid Equity Fund

Name Since Tenure Harshal Joshi 28 Jul 21 4.35 Yr. Brijesh Shah 10 Jun 24 1.48 Yr. Prateek Poddar 7 Jun 24 1.48 Yr. Ritika Behera 7 Oct 23 2.15 Yr. Gaurav Satra 7 Jun 24 1.48 Yr. Data below for Bandhan Hybrid Equity Fund as on 30 Nov 25

Asset Allocation

Asset Class Value Cash 4.71% Equity 78.73% Debt 16.56% Equity Sector Allocation

Sector Value Financial Services 21.31% Consumer Cyclical 11.34% Technology 8.73% Health Care 6.96% Industrials 6.9% Basic Materials 4.93% Energy 4.76% Consumer Defensive 4.53% Utility 3.35% Communication Services 3.14% Real Estate 2.08% Debt Sector Allocation

Sector Value Corporate 10.05% Government 6.51% Cash Equivalent 4.71% Credit Quality

Rating Value AA 6.29% AAA 93.71% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 30 Jun 24 | HDFCBANK6% ₹91 Cr 904,525

↑ 193,865 Reliance Industries Ltd (Energy)

Equity, Since 30 Apr 20 | RELIANCE5% ₹71 Cr 450,846

↑ 55,780 Bajaj Housing Finance Limited

Debentures | -4% ₹60 Cr 6,000,000 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Jul 24 | ICICIBANK4% ₹56 Cr 405,397

↑ 20,571 Tata Capital Limited

Debentures | -3% ₹51 Cr 5,000,000 7.3% Govt Stock 2053

Sovereign Bonds | -3% ₹50 Cr 5,000,000 Eternal Ltd (Consumer Cyclical)

Equity, Since 31 May 24 | 5433203% ₹39 Cr 1,292,674

↑ 180,619 State Bank of India (Financial Services)

Equity, Since 28 Feb 21 | SBIN3% ₹38 Cr 389,422

↑ 21,555 One97 Communications Ltd (Technology)

Equity, Since 31 Oct 24 | 5433962% ₹36 Cr 276,183

↑ 18,477 Axis Bank Ltd (Financial Services)

Equity, Since 31 Jan 17 | AXISBANK2% ₹35 Cr 271,430

↑ 28,744 10. DSP Equity and Bond Fund

DSP Equity and Bond Fund

Growth Launch Date 27 May 99 NAV (02 Jan 26) ₹365.682 ↑ 1.41 (0.39 %) Net Assets (Cr) ₹12,105 on 30 Nov 25 Category Hybrid - Hybrid Equity AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.76 Sharpe Ratio 0 Information Ratio 0.89 Alpha Ratio -1.73 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Dec 20 ₹10,000 31 Dec 21 ₹12,422 31 Dec 22 ₹12,084 31 Dec 23 ₹15,144 31 Dec 24 ₹17,818 31 Dec 25 ₹19,024 Returns for DSP Equity and Bond Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 2 Jan 26 Duration Returns 1 Month 0.6% 3 Month 2.8% 6 Month 1.5% 1 Year 5.3% 3 Year 16.3% 5 Year 13.7% 10 Year 15 Year Since launch 14.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 6.8% 2023 17.7% 2022 25.3% 2021 -2.7% 2020 24.2% 2019 17% 2018 14.2% 2017 -5.1% 2016 27.6% 2015 8.3% Fund Manager information for DSP Equity and Bond Fund

Name Since Tenure Abhishek Singh 1 Mar 24 1.75 Yr. Shantanu Godambe 1 Aug 24 1.33 Yr. Data below for DSP Equity and Bond Fund as on 30 Nov 25

Asset Allocation

Asset Class Value Cash 5.78% Equity 68.86% Debt 25.35% Other 0.01% Equity Sector Allocation

Sector Value Financial Services 29.55% Health Care 8.8% Consumer Cyclical 8.76% Consumer Defensive 5.83% Technology 5.57% Utility 4.18% Basic Materials 2.66% Communication Services 1.37% Energy 1.35% Industrials 0.78% Debt Sector Allocation

Sector Value Government 18.68% Corporate 7.5% Cash Equivalent 4.96% Credit Quality

Rating Value AA 6.84% AAA 93.16% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jan 14 | HDFCBANK7% ₹861 Cr 8,541,164 6.9% Govt Stock 2065

Sovereign Bonds | -6% ₹686 Cr 72,500,000

↑ 8,500,000 ICICI Bank Ltd (Financial Services)

Equity, Since 30 Nov 15 | ICICIBANK5% ₹633 Cr 4,555,949

↑ 673,088 Mahindra & Mahindra Ltd (Consumer Cyclical)

Equity, Since 31 Mar 24 | M&M4% ₹495 Cr 1,317,286 Axis Bank Ltd (Financial Services)

Equity, Since 30 Sep 18 | AXISBANK4% ₹491 Cr 3,838,487 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 31 Jul 24 | KOTAKBANK4% ₹456 Cr 2,148,818 Infosys Ltd (Technology)

Equity, Since 30 Jun 20 | INFY4% ₹424 Cr 2,719,040

↑ 402,812 Samvardhana Motherson International Ltd (Consumer Cyclical)

Equity, Since 31 Mar 21 | MOTHERSON3% ₹370 Cr 31,801,866 ITC Ltd (Consumer Defensive)

Equity, Since 31 Mar 24 | ITC3% ₹348 Cr 8,602,900 NTPC Ltd (Utilities)

Equity, Since 30 Jun 25 | NTPC3% ₹334 Cr 10,222,039

↑ 685,917 11. Sundaram Equity Hybrid Fund

Sundaram Equity Hybrid Fund

Growth Launch Date 23 Jun 00 NAV (31 Dec 21) ₹135.137 ↑ 0.78 (0.58 %) Net Assets (Cr) ₹1,954 on 30 Nov 21 Category Hybrid - Hybrid Equity AMC Sundaram Asset Management Company Ltd Rating ☆☆ Risk Moderately High Expense Ratio 2.18 Sharpe Ratio 2.64 Information Ratio -0.12 Alpha Ratio 5.81 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Dec 20 ₹10,000 Returns for Sundaram Equity Hybrid Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 2 Jan 26 Duration Returns 1 Month 1.8% 3 Month 0.5% 6 Month 10.5% 1 Year 27.1% 3 Year 16% 5 Year 14.2% 10 Year 15 Year Since launch 12.8% Historical performance (Yearly) on absolute basis

Year Returns 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 Fund Manager information for Sundaram Equity Hybrid Fund

Name Since Tenure Data below for Sundaram Equity Hybrid Fund as on 30 Nov 21

Asset Allocation

Asset Class Value Equity Sector Allocation

Sector Value Debt Sector Allocation

Sector Value Credit Quality

Rating Value Top Securities Holdings / Portfolio

Name Holding Value Quantity

बॅलन्स्ड म्युच्युअल फंडामध्ये ऑनलाइन गुंतवणूक कशी करावी?

Fincash.com वर आजीवन मोफत गुंतवणूक खाते उघडा.

तुमची नोंदणी आणि KYC प्रक्रिया पूर्ण करा

दस्तऐवज अपलोड करा (PAN, आधार इ.).आणि, तुम्ही गुंतवणूक करण्यास तयार आहात!

येथे प्रदान केलेली माहिती अचूक असल्याची खात्री करण्यासाठी सर्व प्रयत्न केले गेले आहेत. तथापि, डेटाच्या अचूकतेबद्दल कोणतीही हमी दिली जात नाही. कृपया कोणतीही गुंतवणूक करण्यापूर्वी योजना माहिती दस्तऐवजासह सत्यापित करा.

Research Highlights for UTI Multi Asset Fund