Tax Rebate: Know How to Get Tax Rebate Under Sec 87A & Sec 80C

income tax can be a difficult subject to comprehend. Most people focus on looking at the tax slab rather than taking advantage of tax rebates to reduce the total tax outgo.

Tax rebate has the potential to reduce taxpayer’s tax liability. You just need to know the right options to use. If you are still confused about what this means, then this is the right article for you. Know how to get tax rebate under Sec 87A, Sec 80C and also on home loans.

What is Income Tax Rebate?

A tax rebate is a refund to the taxpayer when the liability is less than the tax paid. Taxpayers can avail a tax rebate on their income tax if the tax they owe is less than the total amount of the withholding taxes that they paid. Usually, tax refunds are paid after the end of the tax year.

As per section 237 to 245 of the income tax act, refund arises when the amount of tax paid by a person is greater than the taxed amount.

Section 87A

Section 87A of the income tax act, 1961 was launched to give relief to the taxpayers who fall under the 10 percent tax slab. If a person whose total net income does not cross INR 5 lakh can claim the tax rebate under section 87A of the income tax act.

The rebate under section 87A is available only for the individual assessee and not to members of Hindu Undivided Families, Association of Persons (AOP), Body of Individual (BOI), firm and company.

Note- The amount of rebate should not exceed the amount of the income tax calculated before the deduction on the total income of the individuals, which they will be charged for the assessment year.

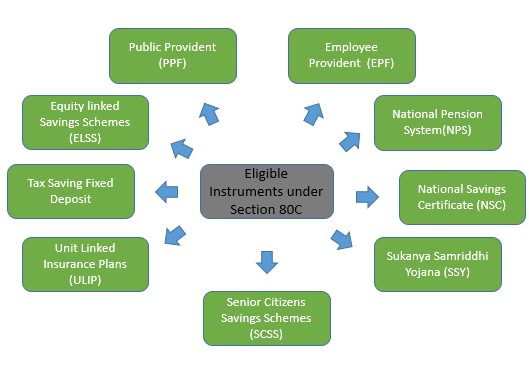

Section 80C

An individual can claim a deduction up to INR 1.5 lakh of the total income under Section 80C. Rebate under section 80C is only available for HUF and individuals.

Apart from 80C, there are other options available under the income tax act such as 80CCC, 80CCCD and 80CCE. You can save tax in any of these sections, however section 80C can be the best option to claim the tax deduction.

Talk to our investment specialist

Income Tax Rebate on Home Loan (2020-21)

As per the Union Budget 2020, taxpayers have the full freedom to either opt for the new tax slab or stick to the old tax regime.

However, if you go by the new tax slab 2020-21, then you will not be eligible to claim some of the tax benefits. But the good part is- you can claim tax break on interest paid on housing loan for rental property.

Homeowners can claim the deduction up to INR 2 lakh on their home interest if you or your family stay in the house. In case, if the house is vacant or rented out then the entire Home Loan interest is allowed as a deduction.

On the other hand, you can avail HRA rebate in income tax, but it is available for the salaried individuals whose HRA is the part of their salary structure. Those who are self-employed cannot avail the deduction.

How to Avail Income Tax Rebate in India?

An individual can get a refund of the tax paid/deducted at the time of the financial year by filing the Income Tax Return in the same FY. You can file your return either by uploading the filled excel/java utility form by providing the data in the online form.

The income tax department has started providing pre-filled ITR’s on the online platform. This ITR form contains information like- your salary income, interest income and other details.

In case you are filing ITR using excel utility then you can download an XML file to pre-fill your ITR.

Income Tax Slab for Senior Citizens & Super Senior Citizens

If you are a senior citizen then your tax liability will be calculated separately. The tax slabs are different for different assessee.

For the senior citizens (60-80 age), there are different tax rates and for super senior citizens (80+ age), the rates are different.

New Tax Regime for Senior Citizens FY 2020-21

The new union budget of 2020 has introduced an optional tax slab for taxpayers.

As per the new tax regime senior citizens can opt for either the old tax slab or the new one-

| New Tax Slab for FY 2020-21 | Tax Applicable |

|---|---|

| Up to INR 2.5 lakh | Exempt |

| Above INR 2.5-3 lakh | 5% |

| Above INR 3-Rs 5 lakh | 5% |

| Above INR 5-7.5 lakh | 10% |

| Above INR 7.5-10 lakh | 15% |

| Above INR 10-12.5 lakh | 20% |

| Above INR 12.5-15 lakh | 25% |

| Above INR 15 lakh | 30% |

Tax Slabs for Senior Citizens 2019-2020

Those who wish to opt the old tax regime can do so.

Here's the tax slab for senior citizen for FY 2019-20:

| Income | Tax Applicable |

|---|---|

| Up to INR 3,00,000 | Nil |

| INR 3,00,001 to INR 5,00,000 | 5%of the income exceeding INR 3,00,000 |

| INR 5,00,000 to INR 10,00,000 | 5%of the income exceeding INR 3,00,000 + 20% of the income INR 5,00,000 |

| INR 10,000,001 and above | 5% of the income exceeding INR 3,00,000 + 20% of the income exceeding INR 5,00,000 + 30% of the income exceeding INR 10,00,000 |

Tax Slab for Super Senior Citizen 2019-2020

The tax slab for super senior citizens are different from all slabs:

Check the tax slab for the year 2019-20:

| Income | Applicable Tax |

|---|---|

| Up to INR 5,00,000 | Nil |

| INR 5,00,001 to INR 10,00,000 | 20% of the income exceeding INR 5,00,000 |

| INR 10,00,001 and above | 20% of the income exceeding INR 5,00,000 + 30% of the income exceeding INR 10,00,000 |

Income Tax Rebate for Women 2019-2020

Income tax rebate for women is applicable, but it varies from the income and age.

Following are the tax slabs for women below 60 years of the age for the financial year 2019-20:

| Income Tax Slabs | Rate of Tax |

|---|---|

| Income up to INR 2.5 lakhs | Nil |

| Income range between INR 2,50,001 to 5 lakhs | 5% |

| Income range between INR 5,00,001 to 10 lakhs | INR 12,500 + 20% |

| Income above INR 10 lakhs | INR 1,12,500 + 30% |

Income Tax Slab for Women Senior Citizen 2019-20

For senior citizens tax slab always varies from the normal tax slab rates

The following table are the tax slabs for senior citizens above 60 years of the financial year 2019-20

| Income Tax Slabs | Tax Rate |

|---|---|

| Income up to INR 5,00,000 | Nil |

| Income range between INR 5 lakh - 10 lakh | 20% |

| Income above INR 10 lakh | INR 1,00,000 + 30% |

Surcharges

There will be an additional surcharge if the annual income is above INR 50 lakh.

The surcharge applicable are as follows:

| Taxable Income | Surcharge Tax Rate |

|---|---|

| Individual with income above INR 50 lakh - 1crore | 10% |

| Individual with income above INR 1 crore - 2crore | 15% |

| Individual with income above INR 2 crore - 5crore | 25% |

| Individual with income above INR 10 crore | 37% |

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.