Top 6 Best Government Investment Schemes in India

Many investors wish to ensure investments with skyrocketing returns as early as possible without having the risk of obtaining losses to the principal amount. They look for Investment plan for doubling the overall investment with minimal or no risk.

However, unfortunately, a low-risk and high-return combination is not possible in a real life scenario. On grounds of reality, returns and risks tend to be directly proportional to each other –going hand in hand. This implies that higher the returns, the higher is going to be the overall risk, and vice versa.

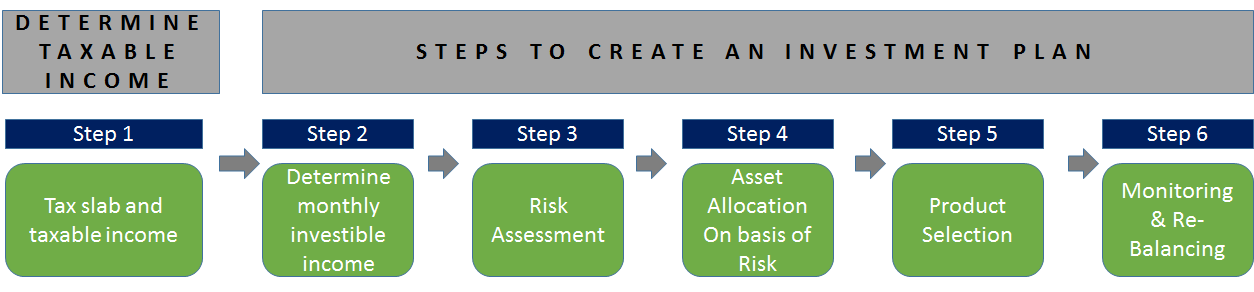

When you are selecting investment avenue, you are required to match your own risk with the risks involved in the given product before you make the investment. You can come across some investments featuring higher risks. However, these also reveal the potential to yield higher returns that are inflation-adjusted in comparison to other asset class on a long-term basis.

Best Indian Government Schemes

If you are looking forward to Investing in some lucrative government-based scheme for investment, here are some of the top options to explore.

1. Sukanya Samriddhi Yojana (SSY)

Sukanya Samriddhi Yojana Scheme was launched with an aim to encourage the parents to secure the future for their daughters. It was launched in the year 2015 by the Prime Minister of India Narendra Modi under the ‘Beti Bachao, Beti Padhao’ campaign. This scheme is targeted towards the minor girl child. SSY account can be opened in the name of the girl from her birth to any time before she turns 10 years old.

The minimum investment amount for this scheme is INR 1,000 to a maximum of INR 1.5 lakh per year. Sukanya Samriddhi scheme is operative for 21 years from the date of opening.

2. National Pension Scheme (NPS)

National Pension Scheme or NPS is one of the famous schemes offered by the Government of India. It is a retirement saving scheme open to all the Indians, but mandatory for all the government employees. It aims to provide retirement income to the citizens of India. Indian citizens and NRIs in the age group of 18 to 60 can subscribe to this scheme.

Under NPS scheme, you can allocate your funds in equity, corporate Bonds and government securities. Investments made up to INR 50,000 are liable for deductions under section 80 CCD (1B). Additional investments upto INR 1,50,000 are tax deductible under Section 80C of the income tax Act.

Talk to our investment specialist

3. Public Provident Fund (PPF)

PPF is also one of the oldest retirement schemes launched by the Government of India. The amount invested, interest earned and the amount withdrawn are all exempt from tax. Thus, the Public Provident Fund is not only safe, but can help you save taxes at the same time. The current interest rate of the scheme (FY 2020-21) is 7.1% p.a. In PPF, one can claim tax deductions upto INR 1,50,000 under section 80C of Income Tax Act.

The fund holds a longer tenure of 15 years, the overall influence of compounding interest that is tax-free tends to be significant –especially during the later years. Moreover, as interest gets earned and the invested principal gets backed by the respective sovereign guarantee, it is known to make up for a safe investment. It is important to note that the overall rate of interest on PPF gets reviewed every quarter by the Indian Government.

4. National Savings Certificate (NSC)

National Saving Certificate is launched by the Government of India to promote the habit of savings amongst the Indians. The minimum investment amount for this scheme is INR 100 and there is no maximum investment amount. The interest rate of NSC changes every year. From 01.04.2020, the interest rate of NSC is 6.8% compounded annually, but payable at maturity. One can claim tax deduction of INR 1.5 lakh under Section 80C of the Income Tax Act. Only residents of India are eligible to invest in this scheme.

5. Atal Pension Yojana (APY)

Atal Pension Yojana or APY is a social security scheme launched by the Government of India for the workers in the unorganized sector. An Indian citizen in the age group of 18-40 years with a valid Bank account is eligible to apply of the scheme. It is launched to encourage individuals from the weaker section to opt for a pension, which would benefit them during their old age. The scheme can also be taken by anyone who is self-employed. One can enroll for APY with your bank or Post Office. However, the only condition in this scheme is that the contribution must be made until the age of 60.

6. Pradhan Mantri Jan Dhan Yojana (PMJDY)

Pradhan Mantri Jan Dhan Yojana was launched to provide basic banking services like a Savings Account, deposit account, insurance, pension and so on, to the Indians. The government of India aimed to provide easy access to financial services such as Savings and Deposit Accounts, Remittance, Insurance, Credit, Pension to the poor and needy section of our society. The minimum age limit in this scheme for a minor is 10 years. Otherwise, any Indian resident over the age of 18 years is eligible to open this account. An individual can only exit this scheme after reaching the age of 60 years.

7. PMVVY or Prime Minister Vaya Vandana Yojana

This investment scheme is meant for the senior citizens aged above 60 years of age. It is known to offer them the guaranteed return of around 7.4 percent per annum. The scheme offers access to pension scheme that is payable on a monthly, annually, and quarterly basis. The minimum amount that is received in the form of pension is INR 1000.

8. Sovereign Gold Bonds

The Sovereign Gold Bonds were introduced by the Government of India in November 2015. It aims at offering a lucrative alternative to own and save gold. Moreover, the scheme is known to belong to the category of debt funds. Sovereign Gold Bonds or SGBs not only help in tracking the overall import-export value of the given asset, but also helps in ensuring transparency throughout.

SGBs refer to government-based securities. Therefore, these are regarded as completely safe. The respective value gets denominated in multiple grams of gold. As it serves to be the safest substitute for physical gold, SGBs have witnessed immense popularity amongst the investors.

FAQs

1. What is government savings schemes?

A: These are various schemes that are launched by the government to encourage people to save money. The government runs these schemes through banks, financial institutions, and post offices. People investing in these schemes can enjoy tax benefits and earn profit at a Fixed Rate of Interest as decided by the government.

2. What is the benefit of investing in government savings schemes?

A: Besides enjoying tax benefits under Section 80C of the Income Tax Act of 1961, you can also enjoy excellent returns by investing in a government savings scheme. Usually, the returns offered by government savings schemes are higher than that of your regular term deposits.

3. Do government savings schemes have a lock-in period?

A: Yes, the lock-in period of most government savings schemes is higher than that of regular term deposits. For example, the Senior Citizen Saving Scheme has a lock-in period of 5 years. After which, the tenure can be extended for another 3 years.

4. Can the Public Provident Fund be considered a savings scheme?

A: Yes, the PPF is a savings scheme offered by the government to citizens aged between 18 - 60 years. Anyone participating in this scheme can earn an interest of 7.1% per annum. It is one of the oldest and most successful savings schemes run by the government.

5. Is there any savings scheme for the girl child?

A: Yes, the Sukanya Samriddhi Yojana or the SSY scheme was launched under the ‘Beti Bachao Beti Padhao’ campaign, which was started by the Prime Minister of India Shri Narendra Modi in 2015. Under the scheme, parents of a minor girl can open an account on her behalf and deposit a minimum of Rs.1000 annually till she turns fourteen. The government will pay annual interest on the deposit till the girl turns 21. However, money cannot be withdrawn by the parents.

6. What is Atal Pension Yojana?

A: This is a pension scheme that applies only to workers of the unorganized sector. Under this scheme, the workers with a bank account and aged between 18 - 40 years can benefit from pension during old age. This scheme is designed to encourage workers of the unorganized sector to save.

7. Can I enjoy tax benefits under these schemes?

A: Yes, most of these schemes are covered under section 80C of the Income Tax Act of 1961, and you can enjoy tax benefits.

8. Can government schemes be categorized as long-term financial plans?

A: Yes, these are long term Financial plan. The primary reason for this is that these schemes have a long lock-in period. It is expected that you will wait for the scheme to mature before you make a withdrawal. Therefore, these can be termed as long-term financial plans designed to help individuals save more.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Good for students

Very informative for new invester