Why Income Alone Doesn’t Make You Rich | Build Wealth with Smart Saving Habits

In the world of Personal Finance, one truth often gets ignored: high Income does not guarantee financial success. You can earn ₹1,50,000 a month and still feel broke by the end of it. At the same time, someone earning ₹50,000 could be steadily building wealth. This article breaks down the practical difference between income and wealth, and why your savings rate, money habits, and investment discipline matter more than just the size of your salary.

✅ What Does It Mean to Be “Rich”?

Being rich isn’t just about earning more. It’s about having:

- Control over your time

- Financial freedom from debt

- Security to Handle emergencies

- Assets that generate income while you sleep

If you’re spending everything you earn, you’re not building wealth—you’re just upgrading expenses.

Key Insight: Savings Rate > Salary

"It’s not how much you make, it’s how much you keep."

A savings rate is the percentage of your income that you consistently set aside for future goals—whether through Investing, saving, or debt reduction.

Example:

Person A earns ₹1,50,000 and saves ₹10,000 (savings rate: 6.6%)

Person B earns ₹50,000 and saves ₹8,000 (savings rate: 16%)

Who’s really building wealth faster?

Talk to our investment specialist

Why High Earners Still Stay Broke

Here are some common reasons why high income doesn’t always translate to financial growth:

1. Lifestyle Inflation

As income rises, spending habits expand to match:

- Upgraded car and gadgets

- Costlier rent or Home Loan EMIs

- Frequent vacations, dining out

Result? High income, low savings.

2. Poor Financial Planning

Many high-income professionals:

- Don’t track their expenses

- Avoid goal-based investing

- Delay Retirement planning

Without direction, even large incomes lose their impact.

3. No Emergency Buffer

Surprising but true—many high earners don’t have 3–6 months of expenses saved. One job loss or medical crisis can cause financial panic.

📊 How to Build Wealth — No Matter What You Earn

1. Start Tracking Your Money

Understanding your cash flow is the foundation of wealth-building. Without clarity on your income and expenses, it’s easy to overspend or under-save.

Here’s how to automate success:

- Open a SIP (Systematic Investment plan) for Mutual Funds. Start with just ₹500/month.

- Schedule an auto-transfer from your salary account to a Recurring deposit or mutual fund on the same day you get paid.

- Use a trusted website like Fincash.com—to set up and automate your investments easily.

Automation removes willpower from the equation and ensures you prioritise saving over spending.

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Franklin Asian Equity Fund Growth ₹39.2766

↑ 0.14 ₹315 11.5 24.6 38.6 13.7 2.5 23.7 DSP Natural Resources and New Energy Fund Growth ₹108.584

↓ -0.09 ₹1,573 10.8 23 35.7 24 22.4 17.5 DSP US Flexible Equity Fund Growth ₹78.6408

↓ -0.10 ₹1,068 4.9 17.3 29.3 22.5 16.9 33.8 Aditya Birla Sun Life Banking And Financial Services Fund Growth ₹64.59

↓ -0.67 ₹3,694 1.7 8.4 22.6 17.4 13 17.5 Franklin Build India Fund Growth ₹147.013

↓ -1.68 ₹3,036 1.1 5 19.5 27.6 23.8 3.7 Kotak Equity Opportunities Fund Growth ₹357.346

↓ -3.37 ₹30,039 1.8 6.6 18.2 20.1 17.2 5.6 Invesco India Growth Opportunities Fund Growth ₹100.09

↓ -1.32 ₹9,344 -2.2 -0.9 17.9 24.9 17.4 4.7 Kotak Standard Multicap Fund Growth ₹87.984

↓ -1.06 ₹56,460 1 4.9 17.7 17.7 13.9 9.5 ICICI Prudential Banking and Financial Services Fund Growth ₹137.39

↓ -1.21 ₹11,154 -0.8 3.4 16 16 12.6 15.9 DSP Equity Opportunities Fund Growth ₹636.749

↓ -7.63 ₹17,576 0.3 5.6 14 20.8 16.5 7.1 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 12 Feb 26 Research Highlights & Commentary of 10 Funds showcased

Commentary Franklin Asian Equity Fund DSP Natural Resources and New Energy Fund DSP US Flexible Equity Fund Aditya Birla Sun Life Banking And Financial Services Fund Franklin Build India Fund Kotak Equity Opportunities Fund Invesco India Growth Opportunities Fund Kotak Standard Multicap Fund ICICI Prudential Banking and Financial Services Fund DSP Equity Opportunities Fund Point 1 Bottom quartile AUM (₹315 Cr). Bottom quartile AUM (₹1,573 Cr). Bottom quartile AUM (₹1,068 Cr). Lower mid AUM (₹3,694 Cr). Lower mid AUM (₹3,036 Cr). Top quartile AUM (₹30,039 Cr). Upper mid AUM (₹9,344 Cr). Highest AUM (₹56,460 Cr). Upper mid AUM (₹11,154 Cr). Upper mid AUM (₹17,576 Cr). Point 2 Established history (18+ yrs). Established history (17+ yrs). Established history (13+ yrs). Established history (12+ yrs). Established history (16+ yrs). Established history (21+ yrs). Established history (18+ yrs). Established history (16+ yrs). Established history (17+ yrs). Oldest track record among peers (25 yrs). Point 3 Top rated. Rating: 5★ (top quartile). Rating: 5★ (upper mid). Rating: 5★ (upper mid). Rating: 5★ (upper mid). Rating: 5★ (lower mid). Rating: 5★ (lower mid). Rating: 5★ (bottom quartile). Rating: 5★ (bottom quartile). Rating: 5★ (bottom quartile). Point 4 Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: High. Risk profile: Moderately High. Point 5 5Y return: 2.48% (bottom quartile). 5Y return: 22.38% (top quartile). 5Y return: 16.89% (upper mid). 5Y return: 12.95% (bottom quartile). 5Y return: 23.79% (top quartile). 5Y return: 17.21% (upper mid). 5Y return: 17.43% (upper mid). 5Y return: 13.89% (lower mid). 5Y return: 12.63% (bottom quartile). 5Y return: 16.51% (lower mid). Point 6 3Y return: 13.66% (bottom quartile). 3Y return: 24.03% (upper mid). 3Y return: 22.49% (upper mid). 3Y return: 17.43% (bottom quartile). 3Y return: 27.55% (top quartile). 3Y return: 20.09% (lower mid). 3Y return: 24.85% (top quartile). 3Y return: 17.67% (lower mid). 3Y return: 15.98% (bottom quartile). 3Y return: 20.76% (upper mid). Point 7 1Y return: 38.65% (top quartile). 1Y return: 35.73% (top quartile). 1Y return: 29.29% (upper mid). 1Y return: 22.63% (upper mid). 1Y return: 19.49% (upper mid). 1Y return: 18.22% (lower mid). 1Y return: 17.85% (lower mid). 1Y return: 17.72% (bottom quartile). 1Y return: 16.05% (bottom quartile). 1Y return: 13.95% (bottom quartile). Point 8 Alpha: 0.00 (upper mid). Alpha: 0.00 (upper mid). Alpha: 2.48 (top quartile). Alpha: -1.32 (bottom quartile). Alpha: 0.00 (upper mid). Alpha: -2.40 (bottom quartile). Alpha: -3.20 (bottom quartile). Alpha: 1.61 (top quartile). Alpha: -0.56 (lower mid). Alpha: -0.86 (lower mid). Point 9 Sharpe: 1.54 (top quartile). Sharpe: 0.74 (upper mid). Sharpe: 1.20 (top quartile). Sharpe: 0.84 (upper mid). Sharpe: -0.05 (bottom quartile). Sharpe: 0.04 (bottom quartile). Sharpe: 0.01 (bottom quartile). Sharpe: 0.28 (lower mid). Sharpe: 0.88 (upper mid). Sharpe: 0.13 (lower mid). Point 10 Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: -0.26 (bottom quartile). Information ratio: 0.25 (upper mid). Information ratio: 0.00 (lower mid). Information ratio: -0.05 (bottom quartile). Information ratio: 0.75 (top quartile). Information ratio: -0.04 (bottom quartile). Information ratio: 0.16 (upper mid). Information ratio: 0.34 (top quartile). Franklin Asian Equity Fund

DSP Natural Resources and New Energy Fund

DSP US Flexible Equity Fund

Aditya Birla Sun Life Banking And Financial Services Fund

Franklin Build India Fund

Kotak Equity Opportunities Fund

Invesco India Growth Opportunities Fund

Kotak Standard Multicap Fund

ICICI Prudential Banking and Financial Services Fund

DSP Equity Opportunities Fund

2. Automate Your Savings & Investments

Saving money should be effortless—not something you struggle with every month.

Here’s how to automate success:

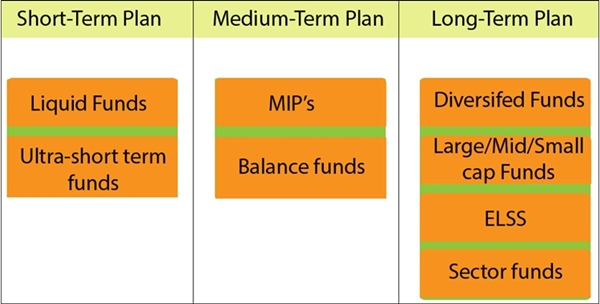

- Open a SIP (Systematic Investment Plan) for mutual funds. Start with just ₹500/month.

- Schedule an auto-transfer from your salary account to a recurring deposit or mutual fund on the same day you get paid.

- Use a trusted website like Fincash.com—to set up and automate your investments easily.

Automation removes willpower from the equation and ensures you prioritise saving over spending.

3. Use the Power of Compounding Early

Compounding is your best friend—but it only works if you give it time.

Consider this example:

- You invest ₹5,000/month at 12% annual returns for 25 years → ₹83.9 lakh

- If you delay by 10 years and invest for just 15 years → ₹24.6 lakh

That’s the cost of waiting. Starting early—even with a small amount—beats investing large sums later.

Pro Tip: Reinvest your dividends or gains instead of withdrawing. Let the Power of Compounding accelerate your wealth.

4. Increase Savings, Not Just Income

Earning more won’t help if your expenses grow just as fast. The key is to widen the gap between income and expenses as your career progresses.

Here’s how to do it:

- Fix a target savings rate. Start with 20%, aim for 30–40% as your income rises.

- For every salary hike, increase your investment contributions before you touch lifestyle upgrades.

- Avoid emotional spending and impulse purchases. Create a wishlist and wait 7 days before buying non-essentials.

- Make saving a habit—not a leftover.

5. Build Multiple Income Streams

Relying on a single salary is risky. Diversifying your income can accelerate wealth creation and provide stability during uncertainty.

Here are three actionable ways to start:

a. Freelancing or Side Hustles: Offer your skills online—writing, design, teaching, consulting. Platforms like Upwork, Fiverr, and LinkedIn can help you find paid gigs.

b. Passive Income: Invest in:

- Dividend-paying mutual funds

- Debt fund for regular payouts

- REITs or rental income assets

c. Monetise Your Knowledge:

- Launch a paid course

- Write and sell an eBook

- Start a YouTube channel or podcast

The idea isn’t to work 24x7—but to make your money and time work smarter for you.

One income is too close to zero. Diversify your Earnings to build resilience and grow faster.

Ideas to consider:

- Freelancing: Writing, consulting, designing, coding

- Passive income: Rent, dividends, interest from debt funds

- Skill monetisation: Launch a course, write an eBook, sell templates

Side incomes not only accelerate savings but also create a cushion against job loss or emergencies.

- Freelancing

- Passive income from investments

- Skill monetisation (writing, courses, etc.)

Real Wealth = Financial Flexibility

The goal isn’t just to “look rich.” It’s to:

- Sleep peacefully with no debt

- Say no to toxic jobs because you have a buffer

- Invest in what you believe in

- Retire (or semi-retire) on your own terms

Final Thoughts: Redefining Rich in 2025

The next time someone tells you how much they earn, ask them this: “How much of it do you keep and grow?”

Because at the end of the day: Income is vanity. Savings and investing are freedom.

By Rohini Hiremath

By Rohini Hiremath

Rohini Hiremath is Head of Content at Fincash.com. With a background in start-ups and a flair for simplifying financial topics, she creates clear, accessible content for a broad audience. She also leads and mentors content teams, promoting thoughtful and effective communication.

You can contact her at rohini.hiremath@fincash.com

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.