+91-22-48913909

+91-22-48913909

Table of Contents

11টি সেরা লার্জ ক্যাপ ইক্যুইটি ফান্ড 2022৷

আদর্শভাবে, যখন কেউ মনে করেবিনিয়োগ, প্রথম চিন্তা যা একজনের মনে আসে বেশিরভাগই ইক্যুইটি হবে। আপনি আরও অন্বেষণ যখনইক্যুইটি ফান্ড, আপনি বড় ক্যাপ তহবিল হবে.

বড় ক্যাপযৌথ পুঁজি ইক্যুইটিগুলিতে সবচেয়ে নিরাপদ বিনিয়োগগুলির মধ্যে একটি হিসাবে বিবেচিত হয় কারণ এতে ভাল রিটার্ন রয়েছে এবং কম অস্থিরবাজার অন্যান্য ইক্যুইটি ফান্ডের তুলনায় ওঠানামা যেমন, মধ্য এবংছোট ক্যাপ তহবিল. এই তহবিলগুলি বড় কোম্পানির স্টকে বিনিয়োগ করে। ব্লু-চিপ কোম্পানির শেয়ারের দাম বেশি হলেও বিনিয়োগকারীরা তাদের অর্থ বড়-ক্যাপে বিনিয়োগ করতে আগ্রহী।

সেরা বড় ক্যাপ মিউচুয়াল ফান্ড নির্বাচন করা একটি গুরুত্বপূর্ণ কাজ যা যথাযথ গুরুত্ব দেওয়া দরকার। এর নিচে দেখুনবিনিয়োগের সুবিধা বড় ক্যাপ মিউচুয়াল ফান্ডে, কীভাবে সেরাটি নির্বাচন করবেনবড় ক্যাপ তহবিল এবং অবশেষে, 2022 সালে বিনিয়োগ করার জন্য শীর্ষ 10টি সেরা বড় ক্যাপ ফান্ডের একটি তালিকা।

কিভাবে লার্জ ক্যাপ ফান্ড নির্বাচন করবেন?

সঠিক লার্জ-ক্যাপ মিউচুয়াল ফান্ড নির্বাচন করা কখনই সহজ নয়। কিছু তহবিল ভাল কাজ করার প্রবণতা রাখে, যখন অন্যান্য তহবিলগুলি ক্ষয়প্রাপ্ত হয়। কিন্তু, কিছু পরামিতি রয়েছে যা বিনিয়োগকারীদের সঠিক তহবিল নির্বাচন করার সময় দেখতে হবে। একটি তহবিল সম্পর্কে সিদ্ধান্ত নেওয়ার আগে একজনকে বেশ কয়েকটি পরিমাণগত পাশাপাশি গুণগত কারণগুলি দেখতে হবে।

পরিমাণগত কারণ

পারস্পরিকতহবিল রেটিং একটি ভাল শুরু বিন্দু হতে পারে. এটিকে অন্যান্য ডেটা যেমন ফান্ডের বয়স, ব্যবস্থাপনার অধীনে সম্পদ (AUM), অতীতের আয়, ব্যয় অনুপাত, ইত্যাদির সাথে পরিপূরক করা দরকার। উপরন্তু, বিনিয়োগকারীদের একটি তহবিলের গত তিন বছরের কর্মক্ষমতা পরীক্ষা করার পরামর্শ দেওয়া হয়। একটি তহবিলের INR 1000 কোটির বেশি নেট সম্পদ থাকতে হবে এবং গত এক বছরে বড় ক্যাপ স্টকগুলিতে ন্যূনতম গড় বরাদ্দ 65 শতাংশ থাকতে হবে।

Talk to our investment specialist

গুণগত কারণ

ফান্ড হাউসের খ্যাতি, ফান্ড ম্যানেজার ট্র্যাক রেকর্ড এবং বিনিয়োগ প্রক্রিয়ার মতো গুণগত কারণগুলির সাথে এটি আরও ফিল্টার করা দরকার। যে ফান্ড হাউসে আপনার অর্থ বিনিয়োগ করার জন্য আপনার বিশ্বাস আছে তাকে অবশ্যই নির্বাচন করতে হবে। বাজারে একটি শক্তিশালী উপস্থিতি আছে এবং একটি দীর্ঘ এবং সামঞ্জস্যপূর্ণ ট্র্যাক রেকর্ড আছে যে বিভিন্ন তহবিল প্রদান করে ফান্ড হাউস চিহ্নিত করা. একজনকেও দেখতে হবে কতজন ফান্ড শীর্ষ পারফর্মার। একটি ভাল ট্র্যাক রেকর্ড সহ একটি ফান্ড ম্যানেজার আবশ্যক। একটিসম্পদ ব্যবস্থাপনা কোম্পানি একটি সেট প্রাতিষ্ঠানিক বিনিয়োগ প্রক্রিয়ার সাথেও গুরুত্বপূর্ণ কারণ এটি নিশ্চিত করে যে এটি এমন একটি প্রক্রিয়া যা আপনাকে অর্থ উপার্জন করতে সাহায্য করে শুধুমাত্র একজন তহবিল ব্যবস্থাপক (ব্যক্তি - এবং তাই মূল ব্যক্তি ঝুঁকি)। উপরেরটি করার মাধ্যমে, কেউ চেষ্টা করতে পারে এবং সেরা বড় ক্যাপ তহবিল নির্বাচন করতে পারে বা এমনকি সেরা 10টি সেরা বড় ক্যাপ তহবিলের একটি তালিকা তৈরি করতে পারে।

শীর্ষ 11টি সেরা পারফর্মিং লার্জ ক্যাপ মিউচুয়াল ফান্ড FY 22 - 23৷

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) Nippon India Large Cap Fund Growth ₹87.4928

↑ 0.19 ₹29,534 10 21.2 36.6 24.9 20.7 32.1 IDBI India Top 100 Equity Fund Growth ₹44.16

↑ 0.05 ₹655 9.2 12.5 15.4 21.9 12.6 ICICI Prudential Bluechip Fund Growth ₹105.73

↑ 0.28 ₹59,364 9.7 18.2 37 21.5 20.5 27.4 HDFC Top 100 Fund Growth ₹1,130

↓ -0.26 ₹35,435 9.4 14.9 33.9 21.5 18.3 30 BNP Paribas Large Cap Fund Growth ₹222.23

↑ 0.76 ₹2,120 10.9 22.1 40.1 19.9 20.2 24.8 IDFC Large Cap Fund Growth ₹74.796

↓ -0.03 ₹1,515 11.8 20.3 35 18.1 18.8 26.8 Invesco India Largecap Fund Growth ₹67.18

↑ 0.40 ₹1,146 12 20.4 36.8 18.1 19.3 27.8 TATA Large Cap Fund Growth ₹501.147

↑ 0.14 ₹2,316 10.9 18.8 33.4 18.1 18.2 24.5 Edelweiss Large Cap Fund Growth ₹82.95

↑ 0.03 ₹975 9.7 17.5 31.3 17.9 19.1 25.7 Aditya Birla Sun Life Frontline Equity Fund Growth ₹510.13

↓ -0.22 ₹29,104 11.5 18.1 32.1 17.9 18.5 23.1 Kotak Bluechip Fund Growth ₹557.735

↑ 0.09 ₹8,848 12.8 19 33.1 17.1 19.7 22.9 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 24 Jul 24

* AUM/নেট সম্পদ সহ 11টি সেরা লার্জ ক্যাপ মিউচুয়াল ফান্ডের তালিকা >500 কোটি. থাকাতহবিলের বয়স >=3 সাজানো হয়েছে3 বছরসিএজিআর রিটার্নস.

(Erstwhile Reliance Top 200 Fund) The primary investment objective of the scheme is to seek to generate long term capital appreciation by investing in equity and equity related instruments of companies whose market capitalization is within the range of highest & lowest market capitalization of S&P BSE 200 Index. The secondary objective is to generate consistent returns by investing in debt and money market securities. Nippon India Large Cap Fund is a Equity - Large Cap fund was launched on 8 Aug 07. It is a fund with Moderately High risk and has given a Below is the key information for Nippon India Large Cap Fund Returns up to 1 year are on The Investment objective of the Scheme is to provide investors with the opportunities for long-term capital appreciation by investing predominantly in Equity and Equity related Instruments of Large Cap companies. However

there can be no assurance that the investment objective under the Scheme will be realized. IDBI India Top 100 Equity Fund is a Equity - Large Cap fund was launched on 15 May 12. It is a fund with Moderately High risk and has given a Below is the key information for IDBI India Top 100 Equity Fund Returns up to 1 year are on (Erstwhile ICICI Prudential Focused Bluechip Equity Fund) To generate long-term capital appreciation and income distribution to unit holders from a portfolio that is invested in equity and equity related securities of about 20 companies belonging to the large cap domain and the balance in debt securities and money market instruments. The Fund Manager will always select stocks for investment from among Top 200 stocks in terms of market capitalization on the National Stock Exchange of India Ltd. If the total assets under management under this scheme goes above Rs. 1,000 crores the Fund

Manager reserves the right to increase the number of companies to more than 20. ICICI Prudential Bluechip Fund is a Equity - Large Cap fund was launched on 23 May 08. It is a fund with Moderately High risk and has given a Below is the key information for ICICI Prudential Bluechip Fund Returns up to 1 year are on (Erstwhile HDFC Top 200) To generate long term capital appreciation from a portfolio of equity and equity linked instruments. The investment portfolio for equity and equity linked instruments will be primarily drawn from the companies in the BSE 200 Index.

Further, the Scheme may also invest in listed companies that would qualify to be in the top 200 by market capitalisation on the BSE even though they may not be listed on the BSE. This includes participation in large Ipos where in the market

capitalisation of the company based on issue price would make the company a part of the top 200 companies listed on the BSE based on market capitalisation. HDFC Top 100 Fund is a Equity - Large Cap fund was launched on 11 Oct 96. It is a fund with Moderately High risk and has given a Below is the key information for HDFC Top 100 Fund Returns up to 1 year are on (Erstwhile BNP Paribas Equity Fund) The investment objective of the Scheme is to generate long-term capital growth from a diversifi ed and actively managed portfolio of equity and equity related securities. The Scheme will invest in a range of companies, with a bias towards large & medium market capitalisation companies. However, there can be no

assurance that the investment objective of the Scheme will be achieved. The Scheme does not guarantee / indicate any returns. BNP Paribas Large Cap Fund is a Equity - Large Cap fund was launched on 23 Sep 04. It is a fund with Moderately High risk and has given a Below is the key information for BNP Paribas Large Cap Fund Returns up to 1 year are on (Erstwhile IDFC Equity Fund) The investment objective of the scheme is to seek to generate

capital growth from a portfolio of predominantly equity and equity

related instruments (including Equity Derivatives). The scheme

may also invest in debt & money market instruments to generate

reasonable income. However there is no assurance or guarantee that the objectives of the scheme will be realized. IDFC Large Cap Fund is a Equity - Large Cap fund was launched on 9 Jun 06. It is a fund with Moderately High risk and has given a Below is the key information for IDFC Large Cap Fund Returns up to 1 year are on (Erstwhile Invesco India Business Leaders Fund) To generate long term capital appreciation by investing in equity and equity related instruments including equity derivatives of companies which in our opinion are leaders in their respective industry or industry segment. However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved. The Scheme does not assure or guarantee any returns. Invesco India Largecap Fund is a Equity - Large Cap fund was launched on 21 Aug 09. It is a fund with Moderately High risk and has given a Below is the key information for Invesco India Largecap Fund Returns up to 1 year are on To provide income distribution and / or medium to long term capital gains while at all times emphasising the importance of capital appreciation. TATA Large Cap Fund is a Equity - Large Cap fund was launched on 7 May 98. It is a fund with Moderately High risk and has given a Below is the key information for TATA Large Cap Fund Returns up to 1 year are on (Erstwhile Edelweiss Large Cap Advantage Fund) The investment objective is to seek to generate long-term capital appreciation from a portfolio predominantly consisting equity and equity-related securities of the 100 largest corporate by market capitalisation listed in India.

However, there is no assurance that the investment objective of the Scheme will be realized and the Scheme does not assure or guarantee any returns. Edelweiss Large Cap Fund is a Equity - Large Cap fund was launched on 20 May 09. It is a fund with Moderately High risk and has given a Below is the key information for Edelweiss Large Cap Fund Returns up to 1 year are on An Open-ended growth scheme with the objective of long term growth of capital, through a portfolio with a target allocation of 100% equity by aiming at being as diversified across various industries and or sectors as its chosen benchmark index, S&P BSE 200. Aditya Birla Sun Life Frontline Equity Fund is a Equity - Large Cap fund was launched on 30 Aug 02. It is a fund with Moderately High risk and has given a Below is the key information for Aditya Birla Sun Life Frontline Equity Fund Returns up to 1 year are on (Erstwhile Kotak 50 Fund) To generate capital appreciation from a portfolio of predominantly equity and

equity related securities. The portfolio will generally comprise of equity and equity

related instruments of around 50 companies which may go up to 59 companies but will not exceed 59 at any point in time. However, there is no assurance that the objective of the scheme

will be realized Kotak Bluechip Fund is a Equity - Large Cap fund was launched on 29 Dec 98. It is a fund with Moderately High risk and has given a Below is the key information for Kotak Bluechip Fund Returns up to 1 year are on 1. Nippon India Large Cap Fund

CAGR/Annualized return of 13.6% since its launch. Ranked 20 in Large Cap category. Return for 2023 was 32.1% , 2022 was 11.3% and 2021 was 32.4% . Nippon India Large Cap Fund

Growth Launch Date 8 Aug 07 NAV (24 Jul 24) ₹87.4928 ↑ 0.19 (0.22 %) Net Assets (Cr) ₹29,534 on 30 Jun 24 Category Equity - Large Cap AMC Nippon Life Asset Management Ltd. Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.86 Sharpe Ratio 2.55 Information Ratio 2.15 Alpha Ratio 8.02 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 30 Jun 19 ₹10,000 30 Jun 20 ₹7,754 30 Jun 21 ₹12,311 30 Jun 22 ₹13,023 30 Jun 23 ₹17,169 30 Jun 24 ₹23,925 Returns for Nippon India Large Cap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 24 Jul 24 Duration Returns 1 Month 3.1% 3 Month 10% 6 Month 21.2% 1 Year 36.6% 3 Year 24.9% 5 Year 20.7% 10 Year 15 Year Since launch 13.6% Historical performance (Yearly) on absolute basis

Year Returns 2023 32.1% 2022 11.3% 2021 32.4% 2020 4.9% 2019 7.3% 2018 -0.2% 2017 38.4% 2016 2.2% 2015 1.1% 2014 54.6% Fund Manager information for Nippon India Large Cap Fund

Name Since Tenure Sailesh Raj Bhan 8 Aug 07 16.91 Yr. Ashutosh Bhargava 1 Sep 21 2.83 Yr. Kinjal Desai 25 May 18 6.11 Yr. Data below for Nippon India Large Cap Fund as on 30 Jun 24

Equity Sector Allocation

Sector Value Financial Services 35.68% Consumer Cyclical 12.5% Industrials 10.13% Consumer Defensive 9.2% Energy 8.54% Technology 7.1% Utility 5.96% Basic Materials 4.39% Health Care 3.31% Communication Services 1.78% Asset Allocation

Asset Class Value Cash 1.4% Equity 98.6% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Dec 08 | HDFCBANK10% ₹2,896 Cr 17,200,529

↑ 200,000 Reliance Industries Ltd (Energy)

Equity, Since 31 Aug 19 | RELIANCE8% ₹2,285 Cr 7,300,000 ITC Ltd (Consumer Defensive)

Equity, Since 31 Jan 16 | ITC5% ₹1,604 Cr 37,750,240

↑ 1,000,000 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 09 | ICICIBANK5% ₹1,523 Cr 12,700,000

↓ -2,000,000 State Bank of India (Financial Services)

Equity, Since 31 Oct 10 | SBIN5% ₹1,443 Cr 17,000,644

↓ -1,500,000 Axis Bank Ltd (Financial Services)

Equity, Since 31 Mar 15 | AXISBANK4% ₹1,265 Cr 10,000,080 Infosys Ltd (Technology)

Equity, Since 30 Sep 07 | INFY4% ₹1,253 Cr 8,000,084

↑ 1,000,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Sep 07 | LT3% ₹958 Cr 2,700,529 Tata Power Co Ltd (Utilities)

Equity, Since 30 Jun 23 | TATAPOWER3% ₹947 Cr 21,500,000

↑ 2,500,000 Bajaj Finance Ltd (Financial Services)

Equity, Since 31 Dec 21 | BAJFINANCE3% ₹847 Cr 1,190,326

↑ 50,000 2. IDBI India Top 100 Equity Fund

CAGR/Annualized return of 14.2% since its launch. Ranked 45 in Large Cap category. . IDBI India Top 100 Equity Fund

Growth Launch Date 15 May 12 NAV (28 Jul 23) ₹44.16 ↑ 0.05 (0.11 %) Net Assets (Cr) ₹655 on 30 Jun 23 Category Equity - Large Cap AMC IDBI Asset Management Limited Rating ☆☆☆ Risk Moderately High Expense Ratio 2.47 Sharpe Ratio 1.09 Information Ratio 0.14 Alpha Ratio 2.11 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 30 Jun 19 ₹10,000 30 Jun 20 ₹9,378 30 Jun 21 ₹14,442 30 Jun 22 ₹14,499 30 Jun 23 ₹17,853 Returns for IDBI India Top 100 Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 24 Jul 24 Duration Returns 1 Month 3% 3 Month 9.2% 6 Month 12.5% 1 Year 15.4% 3 Year 21.9% 5 Year 12.6% 10 Year 15 Year Since launch 14.2% Historical performance (Yearly) on absolute basis

Year Returns 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 Fund Manager information for IDBI India Top 100 Equity Fund

Name Since Tenure Data below for IDBI India Top 100 Equity Fund as on 30 Jun 23

Equity Sector Allocation

Sector Value Asset Allocation

Asset Class Value Top Securities Holdings / Portfolio

Name Holding Value Quantity 3. ICICI Prudential Bluechip Fund

CAGR/Annualized return of 15.7% since its launch. Ranked 21 in Large Cap category. Return for 2023 was 27.4% , 2022 was 6.9% and 2021 was 29.2% . ICICI Prudential Bluechip Fund

Growth Launch Date 23 May 08 NAV (24 Jul 24) ₹105.73 ↑ 0.28 (0.27 %) Net Assets (Cr) ₹59,364 on 30 Jun 24 Category Equity - Large Cap AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.69 Sharpe Ratio 2.61 Information Ratio 1.08 Alpha Ratio 8.03 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 30 Jun 19 ₹10,000 30 Jun 20 ₹8,813 30 Jun 21 ₹13,398 30 Jun 22 ₹13,995 30 Jun 23 ₹17,310 30 Jun 24 ₹23,956 Returns for ICICI Prudential Bluechip Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 24 Jul 24 Duration Returns 1 Month 4% 3 Month 9.7% 6 Month 18.2% 1 Year 37% 3 Year 21.5% 5 Year 20.5% 10 Year 15 Year Since launch 15.7% Historical performance (Yearly) on absolute basis

Year Returns 2023 27.4% 2022 6.9% 2021 29.2% 2020 13.5% 2019 9.8% 2018 -0.8% 2017 32.7% 2016 7.7% 2015 -0.2% 2014 41.1% Fund Manager information for ICICI Prudential Bluechip Fund

Name Since Tenure Anish Tawakley 5 Sep 18 5.82 Yr. Vaibhav Dusad 18 Jan 21 3.45 Yr. Sharmila D’mello 31 Jul 22 1.92 Yr. Data below for ICICI Prudential Bluechip Fund as on 30 Jun 24

Equity Sector Allocation

Sector Value Financial Services 24.24% Energy 11.77% Consumer Cyclical 11.07% Industrials 9.87% Technology 7.65% Basic Materials 7.15% Consumer Defensive 5.55% Health Care 5.49% Communication Services 4.01% Utility 3.26% Real Estate 1.15% Asset Allocation

Asset Class Value Cash 8.8% Equity 91.2% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Bank Ltd (Financial Services)

Equity, Since 30 Jun 08 | ICICIBANK8% ₹4,861 Cr 40,518,440 Reliance Industries Ltd (Energy)

Equity, Since 30 Jun 08 | RELIANCE8% ₹4,538 Cr 14,495,800

↑ 100,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Jan 12 | LT6% ₹3,648 Cr 10,281,834 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Dec 10 | HDFCBANK5% ₹3,215 Cr 19,092,421

↑ 1,196,164 Axis Bank Ltd (Financial Services)

Equity, Since 31 Mar 14 | AXISBANK5% ₹2,829 Cr 22,358,608 Maruti Suzuki India Ltd (Consumer Cyclical)

Equity, Since 30 Apr 16 | MARUTI5% ₹2,683 Cr 2,229,726

↑ 85,671 Infosys Ltd (Technology)

Equity, Since 30 Nov 10 | INFY4% ₹2,604 Cr 16,620,748

↓ -400,000 UltraTech Cement Ltd (Basic Materials)

Equity, Since 30 Sep 17 | ULTRACEMCO4% ₹2,509 Cr 2,150,633 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Aug 09 | BHARTIARTL4% ₹2,324 Cr 16,091,238 Sun Pharmaceuticals Industries Ltd (Healthcare)

Equity, Since 31 Jul 15 | SUNPHARMA3% ₹1,530 Cr 10,062,064

↑ 500,581 4. HDFC Top 100 Fund

CAGR/Annualized return of 19.4% since its launch. Ranked 43 in Large Cap category. Return for 2023 was 30% , 2022 was 10.6% and 2021 was 28.5% . HDFC Top 100 Fund

Growth Launch Date 11 Oct 96 NAV (24 Jul 24) ₹1,130 ↓ -0.26 (-0.02 %) Net Assets (Cr) ₹35,435 on 30 Jun 24 Category Equity - Large Cap AMC HDFC Asset Management Company Limited Rating ☆☆☆ Risk Moderately High Expense Ratio 1.77 Sharpe Ratio 2.11 Information Ratio 0.9 Alpha Ratio 2.94 Min Investment 5,000 Min SIP Investment 300 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 30 Jun 19 ₹10,000 30 Jun 20 ₹7,812 30 Jun 21 ₹12,101 30 Jun 22 ₹12,584 30 Jun 23 ₹15,905 30 Jun 24 ₹21,431 Returns for HDFC Top 100 Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 24 Jul 24 Duration Returns 1 Month 3.9% 3 Month 9.4% 6 Month 14.9% 1 Year 33.9% 3 Year 21.5% 5 Year 18.3% 10 Year 15 Year Since launch 19.4% Historical performance (Yearly) on absolute basis

Year Returns 2023 30% 2022 10.6% 2021 28.5% 2020 5.9% 2019 7.7% 2018 0.1% 2017 32% 2016 8.5% 2015 -6.1% 2014 46.5% Fund Manager information for HDFC Top 100 Fund

Name Since Tenure Rahul Baijal 29 Jul 22 1.93 Yr. Dhruv Muchhal 22 Jun 23 1.03 Yr. Data below for HDFC Top 100 Fund as on 30 Jun 24

Equity Sector Allocation

Sector Value Financial Services 34.34% Energy 10.72% Industrials 9.38% Technology 8.4% Consumer Defensive 7.88% Consumer Cyclical 7.49% Health Care 6.01% Utility 5.84% Communication Services 4.86% Basic Materials 3.9% Real Estate 0.17% Asset Allocation

Asset Class Value Cash 1.01% Equity 98.99% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Bank Ltd (Financial Services)

Equity, Since 31 Dec 05 | ICICIBANK10% ₹3,604 Cr 30,040,474

↑ 900,000 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jan 10 | HDFCBANK10% ₹3,389 Cr 20,126,319

↑ 650,000 Reliance Industries Ltd (Energy)

Equity, Since 31 Mar 06 | RELIANCE6% ₹2,194 Cr 7,006,781 NTPC Ltd (Utilities)

Equity, Since 30 Jun 15 | NTPC6% ₹2,068 Cr 54,669,743 Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Aug 06 | LT6% ₹1,999 Cr 5,632,954 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Apr 20 | BHARTIARTL5% ₹1,722 Cr 11,921,785 Infosys Ltd (Technology)

Equity, Since 31 Aug 04 | INFY5% ₹1,658 Cr 10,579,648 Axis Bank Ltd (Financial Services)

Equity, Since 31 Jan 07 | AXISBANK4% ₹1,481 Cr 11,702,714 ITC Ltd (Consumer Defensive)

Equity, Since 31 Jan 03 | ITC4% ₹1,347 Cr 31,691,145 Coal India Ltd (Energy)

Equity, Since 30 Sep 17 | COALINDIA4% ₹1,304 Cr 27,557,721 5. BNP Paribas Large Cap Fund

CAGR/Annualized return of 16.9% since its launch. Ranked 38 in Large Cap category. Return for 2023 was 24.8% , 2022 was 4.2% and 2021 was 22.1% . BNP Paribas Large Cap Fund

Growth Launch Date 23 Sep 04 NAV (24 Jul 24) ₹222.23 ↑ 0.76 (0.34 %) Net Assets (Cr) ₹2,120 on 30 Jun 24 Category Equity - Large Cap AMC BNP Paribas Asset Mgmt India Pvt. Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 2.18 Sharpe Ratio 2.73 Information Ratio 0.8 Alpha Ratio 9.14 Min Investment 5,000 Min SIP Investment 300 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 30 Jun 19 ₹10,000 30 Jun 20 ₹9,498 30 Jun 21 ₹13,768 30 Jun 22 ₹13,863 30 Jun 23 ₹16,836 30 Jun 24 ₹23,803 Returns for BNP Paribas Large Cap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 24 Jul 24 Duration Returns 1 Month 3.7% 3 Month 10.9% 6 Month 22.1% 1 Year 40.1% 3 Year 19.9% 5 Year 20.2% 10 Year 15 Year Since launch 16.9% Historical performance (Yearly) on absolute basis

Year Returns 2023 24.8% 2022 4.2% 2021 22.1% 2020 16.8% 2019 17.2% 2018 -4% 2017 37% 2016 -5.5% 2015 5.6% 2014 47.4% Fund Manager information for BNP Paribas Large Cap Fund

Name Since Tenure Jitendra Sriram 16 Jun 22 2.04 Yr. Miten Vora 1 Dec 22 1.58 Yr. Data below for BNP Paribas Large Cap Fund as on 30 Jun 24

Equity Sector Allocation

Sector Value Financial Services 25.44% Consumer Cyclical 13.93% Technology 11.34% Industrials 11.29% Energy 10.58% Consumer Defensive 7.36% Utility 5.3% Health Care 4.96% Basic Materials 4.18% Communication Services 2.45% Asset Allocation

Asset Class Value Cash 2.62% Equity 96.83% Debt 0.55% Top Securities Holdings / Portfolio

Name Holding Value Quantity Reliance Industries Ltd (Energy)

Equity, Since 30 Sep 17 | RELIANCE7% ₹144 Cr 461,500

↑ 20,500 ICICI Bank Ltd (Financial Services)

Equity, Since 30 Jun 12 | ICICIBANK7% ₹144 Cr 1,197,000 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jul 08 | HDFCBANK7% ₹142 Cr 840,600 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Apr 20 | LT5% ₹99 Cr 279,000 Tata Consultancy Services Ltd (Technology)

Equity, Since 30 Jun 18 | TCS4% ₹84 Cr 215,239 Hitachi Energy India Ltd Ordinary Shares (Technology)

Equity, Since 31 Aug 23 | POWERINDIA3% ₹70 Cr 54,000

↓ -4,500 ITC Ltd (Consumer Defensive)

Equity, Since 28 Feb 18 | ITC3% ₹67 Cr 1,575,000 Infosys Ltd (Technology)

Equity, Since 31 Mar 09 | INFY3% ₹56 Cr 360,000 Trent Ltd (Consumer Cyclical)

Equity, Since 31 Jan 21 | TRENT3% ₹54 Cr 99,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 29 Feb 08 | BHARTIARTL2% ₹52 Cr 360,000 6. IDFC Large Cap Fund

CAGR/Annualized return of 11.7% since its launch. Ranked 57 in Large Cap category. Return for 2023 was 26.8% , 2022 was -2.3% and 2021 was 26.8% . IDFC Large Cap Fund

Growth Launch Date 9 Jun 06 NAV (24 Jul 24) ₹74.796 ↓ -0.03 (-0.04 %) Net Assets (Cr) ₹1,515 on 30 Jun 24 Category Equity - Large Cap AMC IDFC Asset Management Company Limited Rating ☆☆ Risk Moderately High Expense Ratio 2.26 Sharpe Ratio 1.94 Information Ratio -0.02 Alpha Ratio 1.38 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 30 Jun 19 ₹10,000 30 Jun 20 ₹9,148 30 Jun 21 ₹13,447 30 Jun 22 ₹13,340 30 Jun 23 ₹16,384 30 Jun 24 ₹22,186 Returns for IDFC Large Cap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 24 Jul 24 Duration Returns 1 Month 4.4% 3 Month 11.8% 6 Month 20.3% 1 Year 35% 3 Year 18.1% 5 Year 18.8% 10 Year 15 Year Since launch 11.7% Historical performance (Yearly) on absolute basis

Year Returns 2023 26.8% 2022 -2.3% 2021 26.8% 2020 17.4% 2019 10.6% 2018 -4.2% 2017 34.2% 2016 5.3% 2015 -5.7% 2014 30.4% Fund Manager information for IDFC Large Cap Fund

Name Since Tenure Sumit Agrawal 1 Mar 17 7.34 Yr. Ritika Behera 7 Oct 23 0.73 Yr. Data below for IDFC Large Cap Fund as on 30 Jun 24

Equity Sector Allocation

Sector Value Financial Services 27.18% Consumer Defensive 13.15% Consumer Cyclical 12.74% Technology 12.64% Energy 9.9% Industrials 7.74% Basic Materials 5.2% Health Care 3.82% Communication Services 3.04% Real Estate 0.97% Asset Allocation

Asset Class Value Cash 3.61% Equity 96.39% Top Securities Holdings / Portfolio

Name Holding Value Quantity Reliance Industries Ltd (Energy)

Equity, Since 28 Feb 07 | RELIANCE10% ₹150 Cr 478,940 HDFC Bank Ltd (Financial Services)

Equity, Since 28 Feb 07 | HDFCBANK9% ₹142 Cr 844,429

↑ 61,377 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 18 | ICICIBANK7% ₹105 Cr 879,061

↑ 41,058 Infosys Ltd (Technology)

Equity, Since 31 Aug 11 | INFY6% ₹87 Cr 552,338

↑ 63,236 Tata Consultancy Services Ltd (Technology)

Equity, Since 31 Mar 18 | TCS5% ₹82 Cr 209,741

↑ 23,260 Grasim Industries Ltd (Basic Materials)

Equity, Since 30 Apr 23 | GRASIM3% ₹49 Cr 182,127

↑ 8,484 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Apr 24 | BHARTIARTL3% ₹46 Cr 318,963 Mahindra & Mahindra Ltd (Consumer Cyclical)

Equity, Since 30 Apr 24 | M&M3% ₹46 Cr 160,518

↓ -35,000 Mankind Pharma Ltd (Healthcare)

Equity, Since 31 May 23 | 5439043% ₹42 Cr 198,575

↑ 46,914 Varun Beverages Ltd (Consumer Defensive)

Equity, Since 31 Aug 23 | VBL3% ₹39 Cr 240,496 7. Invesco India Largecap Fund

CAGR/Annualized return of 13.6% since its launch. Ranked 39 in Large Cap category. Return for 2023 was 27.8% , 2022 was -3% and 2021 was 32.5% . Invesco India Largecap Fund

Growth Launch Date 21 Aug 09 NAV (24 Jul 24) ₹67.18 ↑ 0.40 (0.60 %) Net Assets (Cr) ₹1,146 on 30 Jun 24 Category Equity - Large Cap AMC Invesco Asset Management (India) Private Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 2.37 Sharpe Ratio 2.14 Information Ratio 0.36 Alpha Ratio 3.31 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 30 Jun 19 ₹10,000 30 Jun 20 ₹9,153 30 Jun 21 ₹13,479 30 Jun 22 ₹13,485 30 Jun 23 ₹16,677 30 Jun 24 ₹22,811 Returns for Invesco India Largecap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 24 Jul 24 Duration Returns 1 Month 3.6% 3 Month 12% 6 Month 20.4% 1 Year 36.8% 3 Year 18.1% 5 Year 19.3% 10 Year 15 Year Since launch 13.6% Historical performance (Yearly) on absolute basis

Year Returns 2023 27.8% 2022 -3% 2021 32.5% 2020 14.1% 2019 10.5% 2018 -0.4% 2017 28.3% 2016 2.8% 2015 4.6% 2014 39.5% Fund Manager information for Invesco India Largecap Fund

Name Since Tenure Amit Nigam 3 Sep 20 3.83 Yr. Hiten Jain 1 Dec 23 0.58 Yr. Data below for Invesco India Largecap Fund as on 30 Jun 24

Equity Sector Allocation

Sector Value Financial Services 30.1% Industrials 13.04% Technology 12.47% Consumer Cyclical 10.27% Consumer Defensive 9.18% Energy 8.13% Health Care 6.06% Utility 3.63% Basic Materials 3.28% Real Estate 1.18% Communication Services 1.12% Asset Allocation

Asset Class Value Cash 1.54% Equity 98.46% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 30 Sep 09 | HDFCBANK8% ₹93 Cr 551,145

↑ 67,284 ICICI Bank Ltd (Financial Services)

Equity, Since 30 Sep 19 | ICICIBANK8% ₹90 Cr 753,225 Reliance Industries Ltd (Energy)

Equity, Since 31 Mar 17 | RELIANCE7% ₹80 Cr 256,513

↑ 18,593 Tata Consultancy Services Ltd (Technology)

Equity, Since 31 Jan 24 | TCS4% ₹46 Cr 116,618

↑ 4,259 Infosys Ltd (Technology)

Equity, Since 30 Apr 18 | INFY4% ₹42 Cr 265,086 United Spirits Ltd (Consumer Defensive)

Equity, Since 31 Dec 22 | UNITDSPR3% ₹38 Cr 300,099

↑ 92,432 Britannia Industries Ltd (Consumer Defensive)

Equity, Since 31 Jan 24 | 5008253% ₹34 Cr 62,014

↓ -12,097 Varun Beverages Ltd (Consumer Defensive)

Equity, Since 31 Dec 23 | VBL3% ₹33 Cr 202,175 Axis Bank Ltd (Financial Services)

Equity, Since 30 Nov 20 | AXISBANK3% ₹31 Cr 243,858 NTPC Ltd (Utilities)

Equity, Since 31 May 22 | NTPC3% ₹30 Cr 800,164 8. TATA Large Cap Fund

CAGR/Annualized return of 19.6% since its launch. Ranked 35 in Large Cap category. Return for 2023 was 24.5% , 2022 was 3.3% and 2021 was 32.7% . TATA Large Cap Fund

Growth Launch Date 7 May 98 NAV (24 Jul 24) ₹501.147 ↑ 0.14 (0.03 %) Net Assets (Cr) ₹2,316 on 30 Jun 24 Category Equity - Large Cap AMC Tata Asset Management Limited Rating ☆☆☆ Risk Moderately High Expense Ratio 2.25 Sharpe Ratio 1.98 Information Ratio 0.27 Alpha Ratio 1.22 Min Investment 5,000 Min SIP Investment 150 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 30 Jun 19 ₹10,000 30 Jun 20 ₹8,270 30 Jun 21 ₹12,974 30 Jun 22 ₹12,906 30 Jun 23 ₹15,939 30 Jun 24 ₹21,412 Returns for TATA Large Cap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 24 Jul 24 Duration Returns 1 Month 3% 3 Month 10.9% 6 Month 18.8% 1 Year 33.4% 3 Year 18.1% 5 Year 18.2% 10 Year 15 Year Since launch 19.6% Historical performance (Yearly) on absolute basis

Year Returns 2023 24.5% 2022 3.3% 2021 32.7% 2020 8.3% 2019 12.1% 2018 -3.6% 2017 29.5% 2016 2.9% 2015 1.3% 2014 36% Fund Manager information for TATA Large Cap Fund

Name Since Tenure Abhinav Sharma 5 Apr 23 1.24 Yr. Kapil Malhotra 19 Dec 23 0.53 Yr. Data below for TATA Large Cap Fund as on 30 Jun 24

Equity Sector Allocation

Sector Value Financial Services 28.96% Industrials 13.57% Consumer Defensive 9.85% Utility 9.33% Energy 7.91% Technology 7.65% Consumer Cyclical 7.64% Health Care 6.17% Basic Materials 5.15% Real Estate 1.07% Communication Services 0.82% Asset Allocation

Asset Class Value Cash 1.89% Equity 98.11% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 30 Apr 07 | HDFCBANK9% ₹208 Cr 1,235,950 Reliance Industries Ltd (Energy)

Equity, Since 30 Apr 05 | RELIANCE7% ₹173 Cr 553,000 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Mar 11 | ICICIBANK4% ₹104 Cr 865,300 Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Dec 20 | LT4% ₹96 Cr 270,784 Infosys Ltd (Technology)

Equity, Since 31 Jan 09 | INFY4% ₹87 Cr 558,000 Axis Bank Ltd (Financial Services)

Equity, Since 31 Aug 18 | AXISBANK3% ₹70 Cr 555,000 Sun Pharmaceuticals Industries Ltd (Healthcare)

Equity, Since 30 Jun 23 | SUNPHARMA3% ₹68 Cr 445,000 Mahindra & Mahindra Ltd (Consumer Cyclical)

Equity, Since 31 May 23 | M&M3% ₹64 Cr 225,000 NTPC Ltd (Utilities)

Equity, Since 30 Jun 21 | NTPC2% ₹57 Cr 1,505,000 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 31 Oct 16 | KOTAKBANK2% ₹57 Cr 314,000 9. Edelweiss Large Cap Fund

CAGR/Annualized return of 15% since its launch. Ranked 66 in Large Cap category. Return for 2023 was 25.7% , 2022 was 3.4% and 2021 was 23.4% . Edelweiss Large Cap Fund

Growth Launch Date 20 May 09 NAV (24 Jul 24) ₹82.95 ↑ 0.03 (0.04 %) Net Assets (Cr) ₹975 on 30 Jun 24 Category Equity - Large Cap AMC Edelweiss Asset Management Limited Rating ☆☆ Risk Moderately High Expense Ratio 2.52 Sharpe Ratio 2.09 Information Ratio 0.27 Alpha Ratio 2.08 Min Investment 1,000 Min SIP Investment 100 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 30 Jun 19 ₹10,000 30 Jun 20 ₹9,003 30 Jun 21 ₹13,608 30 Jun 22 ₹13,407 30 Jun 23 ₹16,930 30 Jun 24 ₹22,460 Returns for Edelweiss Large Cap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 24 Jul 24 Duration Returns 1 Month 2.9% 3 Month 9.7% 6 Month 17.5% 1 Year 31.3% 3 Year 17.9% 5 Year 19.1% 10 Year 15 Year Since launch 15% Historical performance (Yearly) on absolute basis

Year Returns 2023 25.7% 2022 3.4% 2021 23.4% 2020 17.3% 2019 11.5% 2018 1.7% 2017 33.8% 2016 0.4% 2015 0.8% 2014 37.7% Fund Manager information for Edelweiss Large Cap Fund

Name Since Tenure Bhavesh Jain 2 May 17 7.17 Yr. Bharat Lahoti 1 Oct 21 2.75 Yr. Data below for Edelweiss Large Cap Fund as on 30 Jun 24

Equity Sector Allocation

Sector Value Financial Services 29.9% Consumer Cyclical 13.08% Industrials 9.76% Technology 8.63% Health Care 8% Energy 7.15% Consumer Defensive 6.6% Basic Materials 6% Utility 3.67% Communication Services 3.32% Asset Allocation

Asset Class Value Cash 1.11% Equity 98.89% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 30 Jun 20 | HDFCBANK7% ₹67 Cr 397,188 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Jan 18 | ICICIBANK7% ₹67 Cr 555,906 Reliance Industries Ltd (Energy)

Equity, Since 30 Apr 10 | RELIANCE5% ₹51 Cr 161,624 Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Dec 10 | LT4% ₹39 Cr 110,293 Infosys Ltd (Technology)

Equity, Since 30 Nov 10 | INFY3% ₹31 Cr 198,029

↑ 24,766 Axis Bank Ltd (Financial Services)

Equity, Since 30 Sep 18 | AXISBANK3% ₹29 Cr 232,440

↑ 10,885 ITC Ltd (Consumer Defensive)

Equity, Since 31 Dec 10 | ITC3% ₹28 Cr 666,588 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Mar 20 | BHARTIARTL3% ₹27 Cr 189,895 Maruti Suzuki India Ltd (Consumer Cyclical)

Equity, Since 30 Jun 15 | MARUTI3% ₹24 Cr 20,350 Tata Consultancy Services Ltd (Technology)

Equity, Since 28 Feb 15 | TCS2% ₹23 Cr 59,962

↑ 3,572 10. Aditya Birla Sun Life Frontline Equity Fund

CAGR/Annualized return of 19.7% since its launch. Ranked 14 in Large Cap category. Return for 2023 was 23.1% , 2022 was 3.5% and 2021 was 27.9% . Aditya Birla Sun Life Frontline Equity Fund

Growth Launch Date 30 Aug 02 NAV (24 Jul 24) ₹510.13 ↓ -0.22 (-0.04 %) Net Assets (Cr) ₹29,104 on 30 Jun 24 Category Equity - Large Cap AMC Birla Sun Life Asset Management Co Ltd Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.73 Sharpe Ratio 2.03 Information Ratio 0.19 Alpha Ratio 1.66 Min Investment 1,000 Min SIP Investment 100 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 30 Jun 19 ₹10,000 30 Jun 20 ₹8,671 30 Jun 21 ₹13,403 30 Jun 22 ₹13,487 30 Jun 23 ₹16,643 30 Jun 24 ₹22,005 Returns for Aditya Birla Sun Life Frontline Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 24 Jul 24 Duration Returns 1 Month 3.3% 3 Month 11.5% 6 Month 18.1% 1 Year 32.1% 3 Year 17.9% 5 Year 18.5% 10 Year 15 Year Since launch 19.7% Historical performance (Yearly) on absolute basis

Year Returns 2023 23.1% 2022 3.5% 2021 27.9% 2020 14.2% 2019 7.6% 2018 -2.9% 2017 30.6% 2016 7.4% 2015 1.1% 2014 44.7% Fund Manager information for Aditya Birla Sun Life Frontline Equity Fund

Name Since Tenure Mahesh Patil 17 Nov 05 18.63 Yr. Dhaval Joshi 21 Nov 22 1.61 Yr. Data below for Aditya Birla Sun Life Frontline Equity Fund as on 30 Jun 24

Equity Sector Allocation

Sector Value Financial Services 31.76% Consumer Cyclical 14.24% Industrials 8.4% Technology 8.25% Consumer Defensive 7.47% Energy 6.86% Health Care 5.68% Basic Materials 5.44% Communication Services 4.6% Utility 2.92% Real Estate 1.29% Asset Allocation

Asset Class Value Cash 2.51% Equity 97.18% Debt 0.31% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 30 Apr 07 | HDFCBANK9% ₹2,482 Cr 14,740,040 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 09 | ICICIBANK8% ₹2,282 Cr 19,021,128 Reliance Industries Ltd (Energy)

Equity, Since 30 Apr 05 | RELIANCE6% ₹1,689 Cr 5,393,755 Infosys Ltd (Technology)

Equity, Since 30 Apr 05 | INFY5% ₹1,571 Cr 10,025,674

↑ 200,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Apr 08 | LT5% ₹1,348 Cr 3,798,215

↓ -14,289 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Oct 17 | BHARTIARTL3% ₹971 Cr 6,727,331

↓ -300,000 Axis Bank Ltd (Financial Services)

Equity, Since 31 Aug 13 | AXISBANK3% ₹954 Cr 7,538,312 Mahindra & Mahindra Ltd (Consumer Cyclical)

Equity, Since 28 Feb 15 | M&M3% ₹915 Cr 3,192,358

↓ -150,000 State Bank of India (Financial Services)

Equity, Since 31 Oct 08 | SBIN3% ₹822 Cr 9,680,311 NTPC Ltd (Utilities)

Equity, Since 29 Feb 16 | NTPC3% ₹795 Cr 21,018,779 11. Kotak Bluechip Fund

CAGR/Annualized return of 18.4% since its launch. Ranked 32 in Large Cap category. Return for 2023 was 22.9% , 2022 was 2% and 2021 was 27.7% . Kotak Bluechip Fund

Growth Launch Date 29 Dec 98 NAV (24 Jul 24) ₹557.735 ↑ 0.09 (0.02 %) Net Assets (Cr) ₹8,848 on 30 Jun 24 Category Equity - Large Cap AMC Kotak Mahindra Asset Management Co Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 1.65 Sharpe Ratio 2.12 Information Ratio -0.16 Alpha Ratio 2.73 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-18 Months (1%),18 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 30 Jun 19 ₹10,000 30 Jun 20 ₹9,211 30 Jun 21 ₹14,370 30 Jun 22 ₹14,171 30 Jun 23 ₹17,250 30 Jun 24 ₹23,027 Returns for Kotak Bluechip Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 24 Jul 24 Duration Returns 1 Month 3.4% 3 Month 12.8% 6 Month 19% 1 Year 33.1% 3 Year 17.1% 5 Year 19.7% 10 Year 15 Year Since launch 18.4% Historical performance (Yearly) on absolute basis

Year Returns 2023 22.9% 2022 2% 2021 27.7% 2020 16.4% 2019 14.2% 2018 -2.1% 2017 29.2% 2016 2.9% 2015 3.8% 2014 42.5% Fund Manager information for Kotak Bluechip Fund

Name Since Tenure Arjun Khanna 30 Apr 22 2.17 Yr. Rohit Tandon 22 Jan 24 0.44 Yr. Data below for Kotak Bluechip Fund as on 30 Jun 24

Equity Sector Allocation

Sector Value Financial Services 26.22% Consumer Cyclical 15.31% Technology 11.07% Industrials 9.11% Basic Materials 8.36% Consumer Defensive 8.34% Energy 6.76% Health Care 4.27% Utility 4.22% Communication Services 3.07% Real Estate 1.24% Asset Allocation

Asset Class Value Cash 1.91% Equity 98.09% Other 0% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jul 23 | HDFCBANK8% ₹666 Cr 3,952,500

↑ 415,000 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 09 | ICICIBANK6% ₹573 Cr 4,780,000 Reliance Industries Ltd (Energy)

Equity, Since 30 Apr 06 | RELIANCE6% ₹495 Cr 1,582,000 Infosys Ltd (Technology)

Equity, Since 31 Oct 04 | INFY5% ₹415 Cr 2,650,000

↑ 200,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Mar 12 | LT4% ₹331 Cr 932,074

↓ -10,000 Mahindra & Mahindra Ltd (Consumer Cyclical)

Equity, Since 30 Jun 20 | M&M3% ₹294 Cr 1,025,000

↓ -50,000 Axis Bank Ltd (Financial Services)

Equity, Since 28 Feb 13 | AXISBANK3% ₹282 Cr 2,230,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Oct 19 | BHARTIARTL3% ₹262 Cr 1,815,000 Maruti Suzuki India Ltd (Consumer Cyclical)

Equity, Since 31 Jul 13 | MARUTI3% ₹226 Cr 187,500

↓ -10,000 Tata Consultancy Services Ltd (Technology)

Equity, Since 31 Aug 17 | TCS2% ₹220 Cr 563,984

সেরা লার্জ ক্যাপ মিউচুয়াল ফান্ডে কেন বিনিয়োগ করবেন

1. স্থিতিশীল বিনিয়োগ

বড় কোম্পানিগুলি সুপ্রতিষ্ঠিত যার মানে তাদের আরও সামঞ্জস্যপূর্ণআয়. লার্জ ক্যাপ ফান্ড এমন কোম্পানিগুলিতে বিনিয়োগ করে যেগুলি বড়, বহু বছর ধরে আছে, স্থিতিশীল কর্মীবাহিনী এবং একটি প্রতিষ্ঠিত পণ্য/পরিষেবা যা রাজস্ব উৎপন্ন করে। এই কারণেই লার্জ ক্যাপ স্টকগুলির সবচেয়ে বড় সুবিধাগুলির মধ্যে একটি হল তারা যে স্থিতিশীলতা প্রদান করে৷ এটি লার্জ ক্যাপ মিউচুয়াল ফান্ডের পোর্টফোলিও এবং এরনা খুব

2. অবিচলিত রিটার্ন

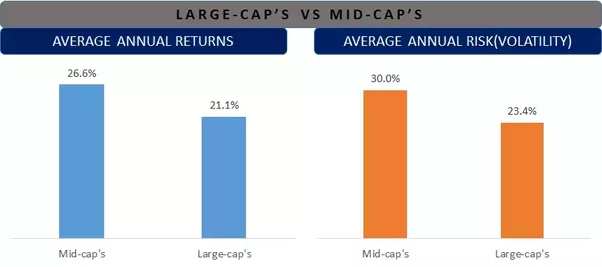

দীর্ঘমেয়াদে, যদিও লার্জ-ক্যাপ ফান্ডগুলি মিড- এবং স্মল-ক্যাপ ফান্ডের তুলনায় কম রিটার্ন দেয়, তবে লার্জ ক্যাপের রিটার্ন আরও স্থির থাকে। মিড-ক্যাপের অস্থিরতা অনেক বেশি এবং কেউ লার্জ ক্যাপের তুলনায় মিড-ক্যাপগুলিতে বেশি লোকসান দেখতে পায়। একটি হিসাবেবিনিয়োগকারী যদি কেউ ইক্যুইটিতে বিনিয়োগ করতে চায়, তাহলে বড় ক্যাপ মিউচুয়াল ফান্ডে বিনিয়োগ একটি সূচনা বিন্দু হতে পারে।

3. কম উদ্বায়ী

লার্জ ক্যাপ ফান্ডগুলি মিড- এবং স্মল-ক্যাপ ফান্ডের তুলনায় কম উদ্বায়ী। এটি ঐতিহাসিক তথ্য দ্বারাও প্রমাণিত। নীচের ছবিতে লার্জ ক্যাপের গত 15 বছরের গড় বার্ষিক আয়ের বিশ্লেষণ রয়েছে৷ এটি বড়-ক্যাপ এবং BSE-এর জন্য একটি প্রক্সি হিসাবে BSE সেনসেক্স ব্যবহার করে করা হয়মিড-ক্যাপ মিড-ক্যাপের জন্য।

4. মাঝারি উচ্চ-ঝুঁকি

যেহেতু বড় কোম্পানিগুলিতে বিনিয়োগ করা হয়, এই তহবিলগুলি মিড- এবং স্মল-ক্যাপ ফান্ডের তুলনায় কম-ঝুঁকিপূর্ণ থাকে। কিন্তু, ইক্যুইটিগুলি স্বল্পমেয়াদে লোকসানের কারণ হতে পারে। অতএব, একজনকে ক্ষতি দেখার জন্য প্রস্তুত থাকতে হবে এবং একই সাথে ঘুম না হারাতে হবে। যদি একজনের একটি দীর্ঘ হোল্ডিং পিরিয়ড থাকে (অন্তত 5 বছরের বেশি) এবং বিনিয়োগের কিছু বেসিক অনুসরণ করে, তাহলে একজন ভাল পরিমাণে লাভ করতে পারে।

অনলাইনে সেরা লার্জ ক্যাপ ফান্ডে কীভাবে বিনিয়োগ করবেন?

Fincash.com এ আজীবনের জন্য বিনামূল্যে বিনিয়োগ অ্যাকাউন্ট খুলুন

আপনার রেজিস্ট্রেশন এবং KYC প্রক্রিয়া সম্পূর্ণ করুন

নথি আপলোড করুন (প্যান, আধার, ইত্যাদি)।এবং, আপনি বিনিয়োগ করতে প্রস্তুত!

উপসংহার

যেহেতু বড় ক্যাপ তহবিলগুলি বড় বাজার মূলধন সহ সংস্থাগুলিতে বিনিয়োগ করে, তাই এই সংস্থাগুলির আকার এবং স্কেল খারাপ বাজার এবং অর্থনৈতিক চক্র থেকে বাঁচার জন্য রয়েছে। অতএব, লার্জ ক্যাপগুলিতে বিনিয়োগকে সমস্ত ইক্যুইটি মিউচুয়াল ফান্ড বিভাগের মধ্যে সবচেয়ে নিরাপদ বলে মনে করা হয়। যাইহোক, একটি সবসময় মনে রাখা উচিত যেঅন্তর্নিহিত বিনিয়োগ ইক্যুইটি এবং এতে ঝুঁকি রয়েছে। যদিও বড় ক্যাপগুলির ঝুঁকি তুলনামূলকভাবে কম, রিটার্নগুলিও স্থির হবে এবং ষাঁড়ের বাজারের পর্যায়গুলিতে ব্যতিক্রমী রিটার্ন নয়। বিনিয়োগকারীরা যারা একটি নির্দিষ্ট মাত্রার ঝুঁকি সহ মাঝারি অথচ টেকসই রিটার্ন পছন্দ করেন; সেরা বড় ক্যাপ তহবিলে বিনিয়োগ করতে পারেন!

এখানে প্রদত্ত তথ্য সঠিক কিনা তা নিশ্চিত করার জন্য সমস্ত প্রচেষ্টা করা হয়েছে। যাইহোক, তথ্যের সঠিকতা সম্পর্কে কোন গ্যারান্টি দেওয়া হয় না। কোনো বিনিয়োগ করার আগে স্কিমের তথ্য নথির সাথে যাচাই করুন।

Superb. Gave very depth information.

Very good and give us about best largecap fund somtimes