Top 10 Tips for Personal Finance to Follow Now!

Managing personal finance is very important, many people neglect managing personal finance basics or even doing essential personal finance planning. This can possibly lead to disastrous results in the future. Hence it is very important to manage personal finances at a very early age. Here we try and give ten important aspects of personal finance that are very important to every individual.

1. Spend less than you earn

A wise man said, “If you buy things you do not need you will soon have to sell things that you need” (~Warren Buffet). So while spending is important to maintain a standard of living, one should not go overboard. One needs to save money at each stage. Procrastination here can lead to disastrous results. Personal finance basics say that this is a cardinal rule, step 1 of managing personal finances begins with savings.

2. Ba a bad customer; manage your credit cards & loans

This is another aspect of getting personal finance basics right. credit cards are great if you use them well and to your advantage. You’ll, of course, be a very bad customer to the company, if you pay your credit cards bills on time, never delay, and use the credit offered to you. And yes, you can even earn cash-back and reward points.

Managing your loans is also very important, one needs to know if you’ve taken loans for possibly appreciating assets (e.g. property) or depreciating assets (e.g vehicle ). Depreciating assets should be limited and the amount of liability taken for appreciating assets should be such that it does not create undue pressure.

Fund Selection Methodology used to find 5 funds

3. Invest in tax saving avenues

In the U.S. adding to the 401(k) is a very good idea. In India, the Public Provident Fund ( PPF) is in excellent avenue due to the fact that:

- Invested amount is tax exempt

- Returns are fixed and tax-free

- This Retirement planning creates a kitty for the future

ELSS, one of the famous tax-saving schemes in Mutual Funds amongst investors. Generally, ELSS Mutual Funds are suitable for all kinds of investors who are willing to take market-linked risks for Tax Planning and saving money. Anyone can invest in ELSS funds at any point of time in their life. Good ELSS returns can be achieved when invested for 5-7 years, so it is suggested not to pull out money once your lock-in ends after 3 years. Try holding it for a longer duration to earn better returns. However, it is suggested to invest in tax saving ELSS funds during the early stage of your career so that your money grows over time and you earn better returns.

Some of the best performing ELSS funds are:

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Bandhan Tax Advantage (ELSS) Fund Growth ₹155.96

↑ 0.36 ₹7,060 -1.5 2.3 12.6 15.8 15.9 8 Tata India Tax Savings Fund Growth ₹46.0015

↑ 0.21 ₹4,566 -0.9 4.4 14.8 16.6 14 4.9 Aditya Birla Sun Life Tax Relief '96 Growth ₹61.68

↑ 0.15 ₹14,993 -1.9 0.4 15.5 15.8 9.6 9.3 DSP Tax Saver Fund Growth ₹144.271

↑ 0.40 ₹17,223 -0.1 4.1 14 20.6 17.1 7.5 HDFC Long Term Advantage Fund Growth ₹595.168

↑ 0.28 ₹1,318 1.2 15.4 35.5 20.6 17.4 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 20 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Bandhan Tax Advantage (ELSS) Fund Tata India Tax Savings Fund Aditya Birla Sun Life Tax Relief '96 DSP Tax Saver Fund HDFC Long Term Advantage Fund Point 1 Lower mid AUM (₹7,060 Cr). Bottom quartile AUM (₹4,566 Cr). Upper mid AUM (₹14,993 Cr). Highest AUM (₹17,223 Cr). Bottom quartile AUM (₹1,318 Cr). Point 2 Established history (17+ yrs). Established history (11+ yrs). Established history (17+ yrs). Established history (19+ yrs). Oldest track record among peers (25 yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 4★ (lower mid). Rating: 4★ (bottom quartile). Rating: 3★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 15.90% (lower mid). 5Y return: 14.01% (bottom quartile). 5Y return: 9.58% (bottom quartile). 5Y return: 17.13% (upper mid). 5Y return: 17.39% (top quartile). Point 6 3Y return: 15.76% (bottom quartile). 3Y return: 16.57% (lower mid). 3Y return: 15.85% (bottom quartile). 3Y return: 20.57% (upper mid). 3Y return: 20.64% (top quartile). Point 7 1Y return: 12.57% (bottom quartile). 1Y return: 14.79% (lower mid). 1Y return: 15.46% (upper mid). 1Y return: 13.96% (bottom quartile). 1Y return: 35.51% (top quartile). Point 8 Alpha: 0.34 (bottom quartile). Alpha: -0.76 (bottom quartile). Alpha: 3.77 (top quartile). Alpha: 1.75 (upper mid). Alpha: 1.75 (lower mid). Point 9 Sharpe: 0.21 (bottom quartile). Sharpe: 0.14 (bottom quartile). Sharpe: 0.50 (upper mid). Sharpe: 0.33 (lower mid). Sharpe: 2.27 (top quartile). Point 10 Information ratio: -0.30 (lower mid). Information ratio: -0.35 (bottom quartile). Information ratio: -0.43 (bottom quartile). Information ratio: 0.93 (top quartile). Information ratio: -0.15 (upper mid). Bandhan Tax Advantage (ELSS) Fund

Tata India Tax Savings Fund

Aditya Birla Sun Life Tax Relief '96

DSP Tax Saver Fund

HDFC Long Term Advantage Fund

4. Better to be safe than sorry, buy Insurance!

Protection is ensuring right personal finance planning. Buying insurance is very important, early on buy life cover in the form of Term Insurance. The earlier you buy, the cheaper it is. Ensure also that you (& family) are covered for medical care also via adequate insurance. Medical costs are going up year on year and good medical care is very expensive. Being not covered or under-covered here could lead to a real hole in your savings.

5. Invest in what you understand or can understand

Don’t buy products that you can’t understand. If you can’t understand a structured product or derivatives then you should not be Investing or trading in them. Invest in simple products and strategies that you can understand. Whether it be stocks or mutual funds, understand what you are getting into.When choosing stocks, make sure you know what you are buying the stock for and be convinced about it. What future does the product of the stock have, what is the quality of management etc? If you can’t analyse stocks, stick to Mutual Funds. Professional managers called fund managers who are well qualified and it's their daily job to manage money will manage funds in a better way. Select your products after careful consideration. Getting the right products in your Portfolio result in better returns.

6. Don't follow the herd, they're almost always wrong

Have a look at the below data of the BSE Sensex(India Equity Benchmark) from 2000 to 2016 against Mutual fund flows (a proxy for investors getting in or out of the market). The herd always seems to exit when the market seems to be forming a bottom and to invest the most when the market is forming a top! So don’t buy at all when everyone seems to be buying and don’t sell when everyone seems to be selling! It's never a good idea.

Talk to our investment specialist

7. Stay invested for a long, really long

It makes sense to stay invested in good companies or stocks for really long. If the management of the company is of good quality, they can make great money for you. Take the example below of the Infosys share ( A software/IT company in India). In 1993, at its IPO 100 shares were bought for a mere 9500 rupees. This money after 24 years is worth nearly USD 1 mn ~ more than INR 5 crores (INR 5,00,00,000), this is a CAGR of more than 50% per annum!

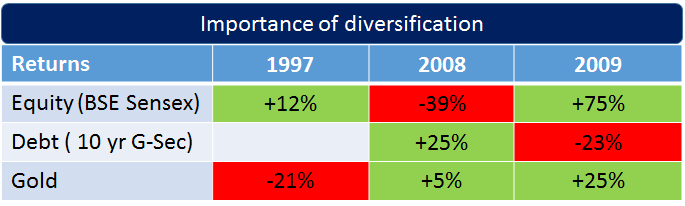

8. Don't put all your eggs in one basket, diversify!

One should not put all their eggs in one basket, what is important is to diversify across asset classes and even stocks/underlying investments. Different asset classes perform in different time periods and hence it's important to make a portfolio of stocks, funds etc. This is amply displayed below by the returns across 3 different asset classes for the calendar years 1997, 2008 and 2009. Different asset classes performed in each year. Also with stocks, it's important to choose not just one player to play a story, but choose more stocks or have many stories to play out. Again with mutual funds, one needs to not hold onto a single manager or single fund, it is better to spread yourself out.

9. Buy & hold is a common adage, but re-balance, it's important!

When creating a portfolio, it's important to Buy and Hold, however, it's also important to weed out non-performers whether it be stocks, mutual funds or any investment. Nobody gets all their decisions right. Even Warren Buffet has made investing mistakes, e.g Saloman Brothers, TESCO, US Airways, Dextor Shoes Company where he has made losses or barely just cashed out. What’s important is to get many more Rights than Wrongs! It is critical to realise a mistake, acknowledge it and move onto a better investment, even if it means cutting losses. Remember a loss eats away into your positive returns.

10. Plan for the future, make a will

Making a will is a very a very important task. Making a basic will is a very easy task and does not take time. Today with the advent of the internet it has become very seamless to create something called an “E-will”. This can be created in a very short span of time and can go a long way in ensuring the succession of assets is smooth.Those who have a great deal of wealth and want advanced services can do estate planning and take requisite steps.

All the above are some of the key steps and aspects that need to be looked at while managing personal finance. Some are basics, while some are related to planning, execution and the future. Taking care of most or all of the above will result in better financial planning and a more secure future!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

You Might Also Like