10 Best Financial Lessons from the Festival of Light - Diwali!

Diwali is a celebration of lights that imparts numerous financial lessons as well. Some lessons include planning financial stability, investments in a diverse Portfolio for various rewards, preventing misfortunes during celebrations, etc.

Diwali is one of India's most loved festivities. It is just around the corner, and you're going to buy gifts and make sure you prevent mistakes while enjoying them. How often do you think you need to plan and make sure you are insured to enable you to face any future financial strain easily? From this holiday season, you can take the following tickets and put them into your life as soon as possible.

Light-up your Financial Life This Diwali 2026

1. Regularly Manage your Portfolio

First of all, every Indian household before Diwali focuses on getting their homes and offices cleaned. Bad attributes and the objects that are no longer of use will be removed. New goods that will be helpful in the future are bought or purchased. It is said that Goddess Lakshmi — the money goddess comes into well-organized, immaculate households only.

Your Investing portfolio also has the same mindset. It is quite crucial that you manage your portfolio efficiently so that all such assets that lie unduly and are useless get disposed of. You should instead plan new assets that may aid you in the future. Your portfolio's purity is vital as it has a huge impact on your future growth.

2. Remove the Obscurity of Financial Ignorance

Diwali is celebrated by lamps that light up the darkness around. A lamp here resembles knowledge that eliminates darkness. Therefore, you should also decrease the financial and investment-related obscurity or ignorance.

You should identify your previous financial errors like:

- Selecting an incorrect financial product: A product-oriented approach rather than a financial planning process-oriented approach.

- Use an incorrect financial scheme or fund to keep your income below the projected level, which won't assist you in achieving your financial objective.

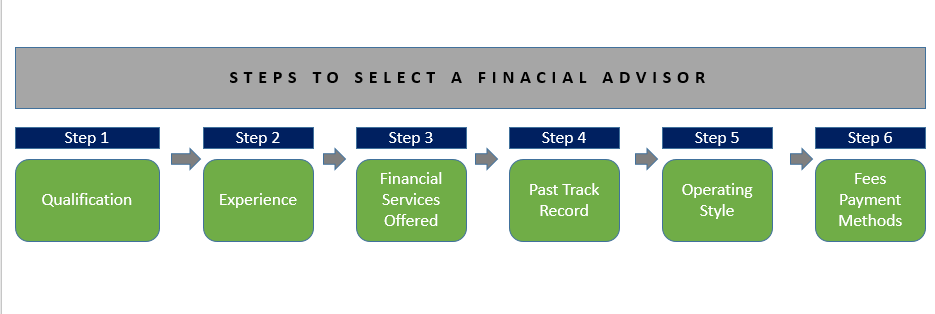

You need to take corrective action after recognizing financial errors so that the same financial errors don't happen next time. You must follow an adequate financial planning method and identify your short and long-term objectives. A financial advisor can assist you in that.

Talk to our investment specialist

3. Completing your future Planning

Indians love Diwali, and during the celebration, they don't resist spending on presents, clothes, cars, and jewellery. You plan to finance the expenses you will have throughout the festival. With your finances, you can apply the same preparation and passion and start investing at a higher premium and benefit from the composition. The sooner you start investing, the higher the compound interest will benefit you.

If you have invested INR 1 lakh today and get a compounded 8% interest, you will earn INR 4,66,095 in return at the end of 20 years. If, after a decade, you invest, you will be getting INR 2,15,892 for the same amount at the same interest rate. The difference is INR 2,50,203 in both figures, and that is the amount you lose.

4. Protect Yourself

When the crackers burst, your parents make sure that you wear clothes that do not catch fire readily and follow steps to prevent malfunctions. Also, in insurance-related affairs, you must take the same care. If you're young and have no severe problems with a health policy, its economic and premium payments will be reduced, and wide coverage will be supplied to you. But this will not happen if you acquire health insurance in the future, and the lenders would demand a large price for not so extensive coverage if there are any health-related problems. If you don't want it, buy health insurance as it might prove to be highly helpful at any instance.

On the other hand, Life Insurance at a premature stage of life is more profitable. The need for life insurance over 25-40 years is high, as you will not save enough to satisfy your needs. If you die, the money from the insurance company ensures that the financial needs of the family are covered. The premium amount of life insurance that you pay depends on your age. If you take the policy from a young age, you can enjoy it.

Understand that investment differs from lifetime financial planning. Financial planning needs a good grasp of risks and profits for diverse assets such as equity and fixed deposits of firms and banks. Thus, while building your portfolio, you need to develop explicit risk management policies.

The safety and proper storage in the form of stocks, reciprocal funds, land, and flat papers, gold and gold ETF, insurance, and other investment, must be in separate locations on homes or banks and elsewhere. Besides the safekeeping of these documents, the information on the location should be a piece of family information and a safety secret.

5. Invest According to your Goals

You buy gifts for Diwali depending on preference, age, and other considerations for your loved ones. Similarly, you need to invest to accomplish your wedding objectives, to buy a house, to train children, to retire, etc. If you have chosen a target, you can start to invest in achieving these goals from an earlier stage. The aims assure that in the future, you have a cash flow. It never hurts to have more money than a financial disadvantage.

6. Remember the Diversity

Diwali is a celebration of lights, but alone, lights aren't enough to celebrate a joyful Diwali. Your festival should be a great combination of buying, celebration, lights, fires, and much more. It is vital to organize, so you don't miss anything.

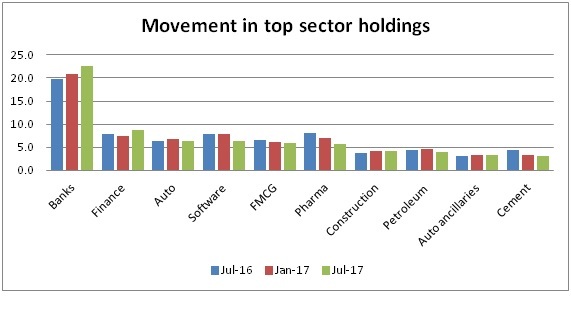

Your investments are also subject to the same formula. As the old phrase goes - don't just put all your eggs in the same basket. Your investment portfolio should be diversified to prevent hazards in the market. To diversify your portfolio, you can invest in goods, such as Gold and Silver. Keep in mind that diversification is essential for a successful investment.

7. Preparing for Emergencies

Whenever several firecrackers have to be burnt, fire extinguishers are kept handy to prevent possible accidents. If you plan investment, you also need a backup by choosing the proper insurance policy, which helps to address certain uncertainties. When unplanned losses occur, preparation with an insurance cover will help.

8. Budget Making

It's simply time to begin budgeting for Diwali. Each rupee earned and spent shall be contained in a budget, and the entire expenditure must be decided and noted down. Thus, it will not reduce your expenditure and won’t make you miserable.

9. Remove the Debt

Before Diwali, try to remove your credit card duties and personal loans. It's time to increase the CIBIL Score, like the removal of unsecured loans, etc. These loans feature large interest rates, and a repayment delay causes a loss of credit. Diwali is the time to remove all such darkness. Ensure that this Diwali, you wipe off the gloom of debt.

10. Let the Celebration be your Life’s only Noise

Lighting and exploding of crackers are associated with Diwali. The sounds of all these festivities are powerful enough to numb your negativity. The heavenly light of the lamps clears all of your negative energy.

The same goes for the realm of investment. All unwanted misunderstandings, rumours, myths, and half-knowledge choices should be avoided. Your financial decisions should not rely on all these noises and should be based on study and analysis. Instead of making an impulsive decision, the assistance should come from a licensed investment adviser.

Conclusion

These were some most effective lessons to be learned from the Diwali. This festival is celebrated in the entire nation. With the celebrations, it is also essential for everyone to have the perfect financial planning, budgeting, investments, and learn all the necessary finance-related lessons.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.