Best Financial Mutual Funds 2026

A financial Mutual Funds are a part of sector Equity Funds. These funds are also known as ‘Banking & Financial Services Fund’. The aim of these funds is to generate income by Investing in stocks/shares of companies that cater to the banking sector and financial industry. So, let’s understand the future potential of financial funds, along with the best financial mutual funds to invest.

Talk to our investment specialist

Financial Mutual Funds in India

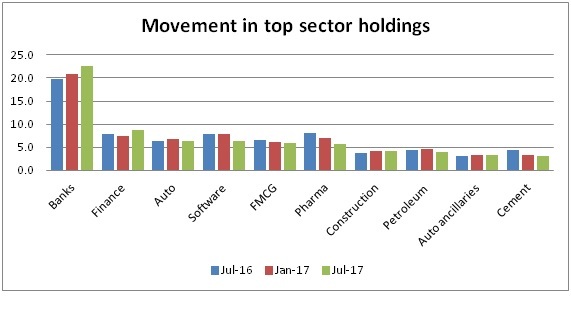

If we look at the July 2017 data released by SEBI, banking and sector funds were the most favored ones. The data shows that Bank and finance- the two leading sectors has shown a sharp surge in share AUM.

As per the Jul’17 statistics, the AUM of the banking sector, which is the leading sector, has moved from 20.9 percent to 22.6 percent in just six months.

How to Invest in Financial Mutual Funds Online?

Open Free Investment Account for Lifetime at Fincash.com.

Complete your Registration and KYC Process

Upload Documents (PAN, Aadhaar, etc.). And, You are Ready to Invest!

Fund Selection Methodology used to find 5 funds

Top Performing Best Financial Mutual Funds FY 26 - 27

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Aditya Birla Sun Life Banking And Financial Services Fund Growth ₹64.83

↑ 0.21 ₹3,641 0.4 7.4 23.4 18 13 17.5 ICICI Prudential Banking and Financial Services Fund Growth ₹138.44

↑ 0.26 ₹10,951 -1.1 3.1 17.3 16.7 12.7 15.9 Invesco India Financial Services Fund Growth ₹147.09

↑ 0.67 ₹1,628 1 6.6 24.5 22.9 15.7 15.1 UTI Banking and Financial Services Fund Growth ₹204.428

↑ 1.05 ₹1,400 2.5 8.5 23.9 18.7 13.2 16.3 Sundaram Financial Services Opportunities Fund Growth ₹111.56

↑ 0.30 ₹1,676 1.7 10.2 22.3 20.4 14.9 16.9 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 20 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Aditya Birla Sun Life Banking And Financial Services Fund ICICI Prudential Banking and Financial Services Fund Invesco India Financial Services Fund UTI Banking and Financial Services Fund Sundaram Financial Services Opportunities Fund Point 1 Upper mid AUM (₹3,641 Cr). Highest AUM (₹10,951 Cr). Bottom quartile AUM (₹1,628 Cr). Bottom quartile AUM (₹1,400 Cr). Lower mid AUM (₹1,676 Cr). Point 2 Established history (12+ yrs). Established history (17+ yrs). Established history (17+ yrs). Oldest track record among peers (21 yrs). Established history (17+ yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 4★ (lower mid). Rating: 3★ (bottom quartile). Rating: 3★ (bottom quartile). Point 4 Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Point 5 5Y return: 12.99% (bottom quartile). 5Y return: 12.73% (bottom quartile). 5Y return: 15.72% (top quartile). 5Y return: 13.20% (lower mid). 5Y return: 14.86% (upper mid). Point 6 3Y return: 18.03% (bottom quartile). 3Y return: 16.74% (bottom quartile). 3Y return: 22.89% (top quartile). 3Y return: 18.66% (lower mid). 3Y return: 20.38% (upper mid). Point 7 1Y return: 23.37% (lower mid). 1Y return: 17.33% (bottom quartile). 1Y return: 24.48% (top quartile). 1Y return: 23.91% (upper mid). 1Y return: 22.31% (bottom quartile). Point 8 Alpha: 0.61 (lower mid). Alpha: -2.00 (bottom quartile). Alpha: 1.75 (top quartile). Alpha: 1.18 (upper mid). Alpha: -0.58 (bottom quartile). Point 9 Sharpe: 1.03 (lower mid). Sharpe: 0.78 (bottom quartile). Sharpe: 1.06 (upper mid). Sharpe: 1.07 (top quartile). Sharpe: 0.88 (bottom quartile). Point 10 Information ratio: 0.25 (bottom quartile). Information ratio: -0.01 (bottom quartile). Information ratio: 0.96 (top quartile). Information ratio: 0.35 (lower mid). Information ratio: 0.71 (upper mid). Aditya Birla Sun Life Banking And Financial Services Fund

ICICI Prudential Banking and Financial Services Fund

Invesco India Financial Services Fund

UTI Banking and Financial Services Fund

Sundaram Financial Services Opportunities Fund

When we speak about the banking and finance sector of India, we have many major players like ICICI Bank Ltd, HDFC Bank Ltd, State Bank of India, Yes Bank Ltd, Axis Bank Ltd, etc. The Indian banking system consists of 26 private sector banks, 27 public sector banks, 1,574 urban cooperative banks, 56 regional rural banks, 46 foreign banks and 93,913 rural cooperative banks in addition to cooperative credit institutions.

Companies that operate within the banking and financial industry are highly regulated. Many good companies aim to deliver consistent performance and returns over the years, as a result, it brings in confidence for investors who are planning to invest in sector funds. However, one should always keep in mind the risk factors of such funds. These funds, sometime, can be at two extremes, they can deliver good returns and can sometimes perform badly too. Therefore, it is advisable that investors who are planning to invest in such sector funds should have a high-risk appetite and also should stay invested for a longer duration. Ideally, one should invest in such funds for diversification purpose.

The primary investment objective of the Scheme is to generate long-term capital appreciation to unit holders from a portfolio that is invested predominantly in equity and equity related securities of companies engaged in banking and financial services. The Scheme does not guarantee/indicate any returns. There can be no assurance that the schemes’ objectives will be achieved. Below is the key information for Aditya Birla Sun Life Banking And Financial Services Fund Returns up to 1 year are on ICICI Prudential Banking and Financial Services Fund is an Open-ended equity scheme that seeks to generate long-term capital appreciation to unitholders from a portfolio that is invested predominantly in equity and equity related securities of companies engaged in banking and financial services. However, there can be no assurance that the investment objective of the Scheme will be realized. Research Highlights for ICICI Prudential Banking and Financial Services Fund Below is the key information for ICICI Prudential Banking and Financial Services Fund Returns up to 1 year are on (Erstwhile Invesco India Banking Fund) The investment objective of the Scheme is to generate long-term capital growth from a portfolio of equity and equity-related securities of companies engaged in the business of banking and financial services. Research Highlights for Invesco India Financial Services Fund Below is the key information for Invesco India Financial Services Fund Returns up to 1 year are on (Erstwhile UTI Banking Sector Fund) Investment objective is "capital appreciation" through investments in the stocks of the companies/institutions engaged in the banking and financial services activities. Research Highlights for UTI Banking and Financial Services Fund Below is the key information for UTI Banking and Financial Services Fund Returns up to 1 year are on Seek capital appreciation by investing predominantly in equity and equity related securities of indian companies engaged in banking and financial Services. Research Highlights for Sundaram Financial Services Opportunities Fund Below is the key information for Sundaram Financial Services Opportunities Fund Returns up to 1 year are on 1. Aditya Birla Sun Life Banking And Financial Services Fund

Aditya Birla Sun Life Banking And Financial Services Fund

Growth Launch Date 14 Dec 13 NAV (20 Feb 26) ₹64.83 ↑ 0.21 (0.32 %) Net Assets (Cr) ₹3,641 on 31 Jan 26 Category Equity - Sectoral AMC Birla Sun Life Asset Management Co Ltd Rating ☆☆☆☆☆ Risk High Expense Ratio 1.99 Sharpe Ratio 1.03 Information Ratio 0.25 Alpha Ratio 0.61 Min Investment 1,000 Min SIP Investment 1,000 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹12,928 31 Jan 23 ₹13,061 31 Jan 24 ₹16,628 31 Jan 25 ₹17,605 31 Jan 26 ₹21,057 Returns for Aditya Birla Sun Life Banking And Financial Services Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 20 Feb 26 Duration Returns 1 Month 2.2% 3 Month 0.4% 6 Month 7.4% 1 Year 23.4% 3 Year 18% 5 Year 13% 10 Year 15 Year Since launch 16.6% Historical performance (Yearly) on absolute basis

Year Returns 2024 17.5% 2023 8.7% 2022 21.7% 2021 11.5% 2020 16.8% 2019 1.1% 2018 14.9% 2017 -2.4% 2016 47.6% 2015 15.7% Fund Manager information for Aditya Birla Sun Life Banking And Financial Services Fund

Name Since Tenure Dhaval Gala 26 Aug 15 10.44 Yr. Data below for Aditya Birla Sun Life Banking And Financial Services Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Financial Services 94.64% Technology 1% Asset Allocation

Asset Class Value Cash 4.36% Equity 95.64% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Bank Ltd (Financial Services)

Equity, Since 31 Dec 13 | ICICIBANK14% ₹504 Cr 3,717,929

↓ -960,000 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Dec 13 | HDFCBANK14% ₹503 Cr 5,408,496 Axis Bank Ltd (Financial Services)

Equity, Since 31 Oct 18 | AXISBANK9% ₹315 Cr 2,302,100 State Bank of India (Financial Services)

Equity, Since 31 Oct 17 | SBIN6% ₹207 Cr 1,918,689 Bajaj Finance Ltd (Financial Services)

Equity, Since 30 Sep 16 | BAJFINANCE5% ₹199 Cr 2,137,250 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 31 Jan 19 | KOTAKBANK4% ₹145 Cr 3,546,665 AU Small Finance Bank Ltd (Financial Services)

Equity, Since 30 Nov 23 | AUBANK4% ₹132 Cr 1,346,861 Shriram Finance Ltd (Financial Services)

Equity, Since 30 Jun 23 | SHRIRAMFIN3% ₹122 Cr 1,198,382 ICICI Lombard General Insurance Co Ltd (Financial Services)

Equity, Since 30 Sep 19 | ICICIGI3% ₹103 Cr 565,076 Billionbrains Garage Ventures Ltd (Financial Services)

Equity, Since 30 Nov 25 | GROWW2% ₹91 Cr 5,134,395 2. ICICI Prudential Banking and Financial Services Fund

ICICI Prudential Banking and Financial Services Fund

Growth Launch Date 22 Aug 08 NAV (20 Feb 26) ₹138.44 ↑ 0.26 (0.19 %) Net Assets (Cr) ₹10,951 on 31 Jan 26 Category Equity - Sectoral AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆☆☆ Risk High Expense Ratio 1.83 Sharpe Ratio 0.78 Information Ratio -0.01 Alpha Ratio -2 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹13,108 31 Jan 23 ₹13,458 31 Jan 24 ₹16,069 31 Jan 25 ₹18,239 31 Jan 26 ₹20,920 Returns for ICICI Prudential Banking and Financial Services Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 20 Feb 26 Duration Returns 1 Month 1.5% 3 Month -1.1% 6 Month 3.1% 1 Year 17.3% 3 Year 16.7% 5 Year 12.7% 10 Year 15 Year Since launch 16.2% Historical performance (Yearly) on absolute basis

Year Returns 2024 15.9% 2023 11.6% 2022 17.9% 2021 11.9% 2020 23.5% 2019 -5.5% 2018 14.5% 2017 -0.4% 2016 45.1% 2015 21.1% Fund Manager information for ICICI Prudential Banking and Financial Services Fund

Name Since Tenure Roshan Chutkey 29 Jan 18 8.01 Yr. Sharmila D’mello 30 Jun 22 3.59 Yr. Data below for ICICI Prudential Banking and Financial Services Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Financial Services 94.04% Health Care 1.07% Technology 0.37% Industrials 0.29% Asset Allocation

Asset Class Value Cash 4.18% Equity 95.82% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Oct 08 | HDFCBANK18% ₹1,921 Cr 20,674,867

↓ -1,418,863 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 08 | ICICIBANK14% ₹1,530 Cr 11,290,200

↓ -2,749,373 Axis Bank Ltd (Financial Services)

Equity, Since 28 Feb 19 | AXISBANK10% ₹1,067 Cr 7,783,679

↑ 1,208,406 State Bank of India (Financial Services)

Equity, Since 31 Oct 08 | SBIN6% ₹683 Cr 6,340,456

↓ -2,310,000 SBI Life Insurance Co Ltd (Financial Services)

Equity, Since 30 Sep 17 | SBILIFE6% ₹647 Cr 3,236,415

↑ 220,210 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 31 Jan 23 | KOTAKBANK5% ₹508 Cr 12,443,955 SBI Cards and Payment Services Ltd Ordinary Shares (Financial Services)

Equity, Since 30 Nov 25 | SBICARD4% ₹392 Cr 5,202,910

↑ 2,680,350 HDFC Life Insurance Co Ltd (Financial Services)

Equity, Since 30 Sep 23 | HDFCLIFE3% ₹383 Cr 5,241,538 LIC Housing Finance Ltd (Financial Services)

Equity, Since 30 Nov 24 | LICHSGFIN3% ₹358 Cr 6,799,870

↑ 2,797,160 ICICI Lombard General Insurance Co Ltd (Financial Services)

Equity, Since 30 Sep 19 | ICICIGI3% ₹327 Cr 1,800,328

↑ 253,640 3. Invesco India Financial Services Fund

Invesco India Financial Services Fund

Growth Launch Date 14 Jul 08 NAV (20 Feb 26) ₹147.09 ↑ 0.67 (0.46 %) Net Assets (Cr) ₹1,628 on 31 Jan 26 Category Equity - Sectoral AMC Invesco Asset Management (India) Private Ltd Rating ☆☆☆☆ Risk High Expense Ratio 2.23 Sharpe Ratio 1.06 Information Ratio 0.96 Alpha Ratio 1.75 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹12,269 31 Jan 23 ₹12,526 31 Jan 24 ₹16,945 31 Jan 25 ₹19,048 31 Jan 26 ₹23,209 Returns for Invesco India Financial Services Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 20 Feb 26 Duration Returns 1 Month 2% 3 Month 1% 6 Month 6.6% 1 Year 24.5% 3 Year 22.9% 5 Year 15.7% 10 Year 15 Year Since launch 16.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 15.1% 2023 19.8% 2022 26% 2021 12.8% 2020 14% 2019 2.4% 2018 21.2% 2017 -0.3% 2016 45.2% 2015 10.4% Fund Manager information for Invesco India Financial Services Fund

Name Since Tenure Hiten Jain 19 May 20 5.71 Yr. Data below for Invesco India Financial Services Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Financial Services 96.43% Technology 1.46% Health Care 0.72% Asset Allocation

Asset Class Value Cash 1.39% Equity 98.61% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jul 08 | HDFCBANK16% ₹264 Cr 2,838,202 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 09 | ICICIBANK14% ₹221 Cr 1,628,734

↓ -497,060 Multi Commodity Exchange of India Ltd (Financial Services)

Equity, Since 28 Feb 22 | MCX7% ₹116 Cr 460,710 Axis Bank Ltd (Financial Services)

Equity, Since 31 May 18 | AXISBANK5% ₹89 Cr 645,964 Karur Vysya Bank Ltd (Financial Services)

Equity, Since 30 Sep 22 | 5900035% ₹80 Cr 2,663,923

↑ 326,356 Shriram Finance Ltd (Financial Services)

Equity, Since 28 Feb 25 | SHRIRAMFIN5% ₹75 Cr 731,682

↑ 168,792 ICICI Prudential Asset Management Co Ltd (Financial Services)

Equity, Since 31 Dec 25 | ICICIAMC4% ₹71 Cr 240,125

↑ 57,230 Cholamandalam Investment and Finance Co Ltd (Financial Services)

Equity, Since 31 Jul 17 | CHOLAFIN3% ₹53 Cr 325,622 Central Depository Services (India) Ltd (Financial Services)

Equity, Since 31 Aug 23 | CDSL3% ₹50 Cr 381,194 Muthoot Finance Ltd (Financial Services)

Equity, Since 31 Jul 24 | MUTHOOTFIN3% ₹44 Cr 116,186 4. UTI Banking and Financial Services Fund

UTI Banking and Financial Services Fund

Growth Launch Date 7 Apr 04 NAV (20 Feb 26) ₹204.428 ↑ 1.05 (0.52 %) Net Assets (Cr) ₹1,400 on 31 Jan 26 Category Equity - Sectoral AMC UTI Asset Management Company Ltd Rating ☆☆☆ Risk High Expense Ratio 2.2 Sharpe Ratio 1.07 Information Ratio 0.35 Alpha Ratio 1.18 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹12,362 31 Jan 23 ₹12,894 31 Jan 24 ₹16,487 31 Jan 25 ₹17,503 31 Jan 26 ₹21,068 Returns for UTI Banking and Financial Services Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 20 Feb 26 Duration Returns 1 Month 3.9% 3 Month 2.5% 6 Month 8.5% 1 Year 23.9% 3 Year 18.7% 5 Year 13.2% 10 Year 15 Year Since launch 14.8% Historical performance (Yearly) on absolute basis

Year Returns 2024 16.3% 2023 11.1% 2022 19.5% 2021 15.1% 2020 14.3% 2019 -5.3% 2018 11.6% 2017 -6.8% 2016 43.5% 2015 13% Fund Manager information for UTI Banking and Financial Services Fund

Name Since Tenure Amit Premchandani 16 Jun 25 0.63 Yr. Bhavesh Kanani 12 Jan 26 0.05 Yr. Data below for UTI Banking and Financial Services Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Financial Services 96.42% Technology 0.96% Asset Allocation

Asset Class Value Cash 2.62% Equity 97.38% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Mar 09 | HDFCBANK15% ₹209 Cr 2,250,000

↑ 75,000 ICICI Bank Ltd (Financial Services)

Equity, Since 30 Apr 04 | ICICIBANK14% ₹193 Cr 1,425,000

↓ -427,344 Axis Bank Ltd (Financial Services)

Equity, Since 30 Jun 18 | AXISBANK10% ₹137 Cr 1,000,000

↑ 75,000 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 30 Sep 18 | KOTAKBANK9% ₹133 Cr 3,250,000

↑ 500,000 State Bank of India (Financial Services)

Equity, Since 28 Feb 18 | SBIN7% ₹92 Cr 850,000 Bajaj Finance Ltd (Financial Services)

Equity, Since 30 Nov 19 | BAJFINANCE5% ₹74 Cr 800,000 Karur Vysya Bank Ltd (Financial Services)

Equity, Since 31 Dec 18 | 5900034% ₹51 Cr 1,700,000 Shriram Finance Ltd (Financial Services)

Equity, Since 31 Jan 24 | SHRIRAMFIN4% ₹51 Cr 500,000 Ujjivan Small Finance Bank Ltd Ordinary Shares (Financial Services)

Equity, Since 30 Apr 25 | UJJIVANSFB3% ₹43 Cr 6,534,317 Multi Commodity Exchange of India Ltd (Financial Services)

Equity, Since 31 Mar 24 | MCX3% ₹38 Cr 150,000 5. Sundaram Financial Services Opportunities Fund

Sundaram Financial Services Opportunities Fund

Growth Launch Date 10 Jun 08 NAV (20 Feb 26) ₹111.56 ↑ 0.30 (0.27 %) Net Assets (Cr) ₹1,676 on 31 Jan 26 Category Equity - Sectoral AMC Sundaram Asset Management Company Ltd Rating ☆☆☆ Risk High Expense Ratio 2.12 Sharpe Ratio 0.88 Information Ratio 0.71 Alpha Ratio -0.58 Min Investment 100,000 Min SIP Investment 100 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹12,383 31 Jan 23 ₹13,241 31 Jan 24 ₹18,148 31 Jan 25 ₹19,256 31 Jan 26 ₹22,940 Returns for Sundaram Financial Services Opportunities Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 20 Feb 26 Duration Returns 1 Month 1.5% 3 Month 1.7% 6 Month 10.2% 1 Year 22.3% 3 Year 20.4% 5 Year 14.9% 10 Year 15 Year Since launch 14.6% Historical performance (Yearly) on absolute basis

Year Returns 2024 16.9% 2023 7.1% 2022 31.1% 2021 16.8% 2020 15.3% 2019 2.7% 2018 26.4% 2017 -3.7% 2016 33.3% 2015 12.8% Fund Manager information for Sundaram Financial Services Opportunities Fund

Name Since Tenure Rohit Seksaria 30 Dec 17 8.1 Yr. Data below for Sundaram Financial Services Opportunities Fund as on 31 Jan 26

Equity Sector Allocation

Sector Value Financial Services 94.32% Technology 1.54% Asset Allocation

Asset Class Value Cash 4.06% Equity 95.86% Debt 0.08% Other 0% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Dec 08 | HDFCBANK17% ₹289 Cr 3,114,256 ICICI Bank Ltd (Financial Services)

Equity, Since 30 Jun 10 | ICICIBANK11% ₹192 Cr 1,416,021 Axis Bank Ltd (Financial Services)

Equity, Since 28 Feb 10 | AXISBANK10% ₹167 Cr 1,217,541

↓ -54,991 State Bank of India (Financial Services)

Equity, Since 31 Dec 08 | SBIN6% ₹108 Cr 1,003,469 DCB Bank Ltd (Financial Services)

Equity, Since 30 Sep 24 | DCBBANK5% ₹81 Cr 4,033,626

↓ -210,006 Shriram Finance Ltd (Financial Services)

Equity, Since 30 Sep 23 | SHRIRAMFIN5% ₹78 Cr 768,924 Bajaj Finserv Ltd (Financial Services)

Equity, Since 31 Mar 25 | BAJAJFINSV5% ₹78 Cr 397,562 Bank of Baroda (Financial Services)

Equity, Since 29 Feb 24 | BANKBARODA4% ₹66 Cr 2,208,626 PNB Housing Finance Ltd (Financial Services)

Equity, Since 31 Jul 24 | PNBHOUSING3% ₹55 Cr 665,351 CSB Bank Ltd Ordinary Shares (Financial Services)

Equity, Since 30 Jun 20 | CSBBANK3% ₹53 Cr 1,199,385

↓ -406,841

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Research Highlights for Aditya Birla Sun Life Banking And Financial Services Fund