+91-22-48913909

+91-22-48913909

Table of Contents

- Why Do you Need Financial Planning?

- Personal Financial Planning- Do it Yourself

- Who is a Financial Planner?

- What Does a Financial Consultant do for you?

- 1. Analyse your Current Financial Situation

- 2. Define your Time Frame and Create a Budget

- 3. Define Goals- Short-Term, Mid-Term and Long-Term

- 4. Asses your Risk

- 5. Decide Asset Allocation

- 6. Product Selection

- 7. Monitor, Review and Re-Balance your Investment Plan

- Common Mistakes While Financial Planning

- 1. Is there any costing incurred behind financial planning?

- 2. Are there risks involved with financial planning?

- 3. What is asset allocation?

- 4. Should I think of tax benefits while planning my finances?

- 5. What should I do about my debts?

- 6. What are unreasonable goals in financial planning?

- 7. What is crisis management?

- 8. When should I purchase luxuries?

- Make Sure you are Getting the Right Financial Planning Advice

- Smart Tips for a Good Financial Plan

- Best Mutual Funds for Aggressive Investors

- Best Mutual Funds for Moderate Investors

- Best Mutual Funds for Conservative Investors

- Common Mistakes While Financial Planning

- 1. Is there any costing incurred behind financial planning?

- 2. Are there risks involved with financial planning?

- 3. What is asset allocation?

- 4. Should I think of tax benefits while planning my finances?

- 5. What should I do about my debts?

- 6. What are unreasonable goals in financial planning?

- 7. What is crisis management?

- 8. When should I purchase luxuries?

- Benefits of Financial Planning

- How to Invest in Mutual Funds Online?

- FAQs

- 1. Is there any costing incurred behind financial planning?

- 2. Are there risks involved with financial planning?

- 3. What is asset allocation?

- 4. Should I think of tax benefits while planning my finances?

- 5. What should I do about my debts?

- 6. What are unreasonable goals in financial planning?

- 7. What is crisis management?

- 8. When should I purchase luxuries?

Financial Planning – A Foundation for Your Future

We all want to be rich and well settled in our lives. We need money for such a lifestyle and that too coming in steadily. Financial planning is the best way to reach your Financial goals and meet future requirements.

So what is financial planning? It is the process of mapping out financial objectives, current & future expenses, assets & liabilities to create a rock solid base for your future financial cash-flows.

There are financial advisors, financial planners or financial consultants that help you create an in-depth Financial plan. A financial plan is a thought-out path taking into consideration various factors such as current and future financial cash-flows & obligations ensuring optimum Wealth Management.

Talk to our investment specialist

Why Do you Need Financial Planning?

Each of us has aspirations, buying a car or a house, a grand marriage, hassle-free retirement, etc. Each of these life goals has a monetary impact attached to it along with the obvious emotional connect. Financial planning helps you to reach those goals without many speed breakers in the path.

A good financial plan with clear objectives and the help of an experienced financial advisor or Financial Planner can assist you in meeting your set targets or goals. It is a common myth that financial planning is only for the rich. One could not be more wrong! A financial plan not only helps you map out your future but also it also helps you become rich. It brings a disciplined approach to your personal and professional life that leads you to your financial goals.

Personal Financial Planning- Do it Yourself

As said above, it is a myth that only rich people do financial planning. You can do it yourself as well. There are certain small things that will help you build a base for a sturdier financial plan.

- Read and get yourself acquainted with financial topics such as Taxes, Investing, loans and personal financial needs.

- Review your current financial status and take time out a carve out at least a rough financial plan for the near future. This would mean figuring out your expenses, current assets, future obligations and goals.

- Be comfortable and firm on your decisions regarding Personal Finance.

- Keep yourself updated about the latest Market trends

But at times you might need help from a professional financial planner to get your finances sorted.

Who is a Financial Planner?

A financial planner or financial advisor is a person who uses his knowledge and expertise in financial planning to help you figure out your life goals and carves out a plan to fulfill the same. The financial planner reviews your present financial status and gives out a plan accordingly. It includes budgeting your Income, raising your saving, Tax Planning, investments, insurance, and Retirement planning. The financial consultant helps you in creating a ‘bigger picture’ of your financial situation and chalks out a path for your future. These investment consultants thus play a very important role in making your financial life more stable.

What Does a Financial Consultant do for you?

As said above, the financial consultant does the financial planning for you. They

- evaluate your risk appetite or risk profile

- make adjustments in your financial plan due to change in circumstances (like an addition to the family, cash-flows, etc.)

- give you a professional opinion about your financial plan and subsequent suggestions or recommendations

- help you improve on managing your expenses

Make Sure you are Getting the Right Financial Planning Advice

Getting the right financial planning advice is a key to your future wealth management. Strong financial planning takes place when one is very clear about their goals and transparent about their current state. Thus an investment consultant will be able to give the best possible guidance for a strong financial plan.

On the other hand, do not blindly trust the financial planner. You should be well aware of the plan that is created for you and verify the same with some basic research. Being acquainted with basic finance trends if not updated well helps even further.

Smart Tips for a Good Financial Plan

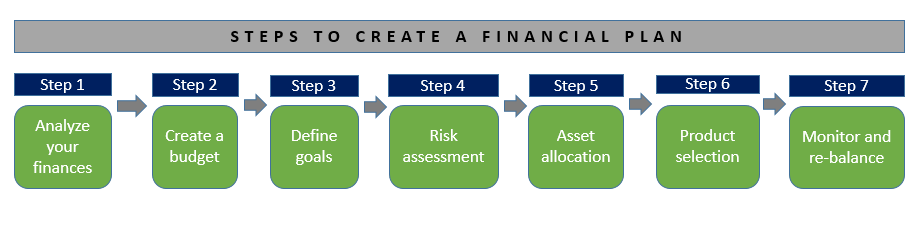

A good financial plan is a subjective term. It differs from person to person according to their individual needs and aims. But to create the best personal financial plan, the steps involved are more or less the same. Let’s look at the steps involved in the process:

1. Analyse your Current Financial Situation

Before setting out to reach your goals, it is necessary that you should be aware of your current situation. A proper analysis with the help of a financial advisor can help you understand your present state and highlight your priorities. For example, after the analysis of your situation, planning for the house is a priority rather than planning for buying a car. Thus, such an analysis helps you plan better and precisely.

2. Define your Time Frame and Create a Budget

It is very important that a clear timeline is defined for a financial plan. It gives you a roadmap to follow, sets your deadlines, and make you act on it. Also, creating a budget sets you in the right direction to reach your goals.

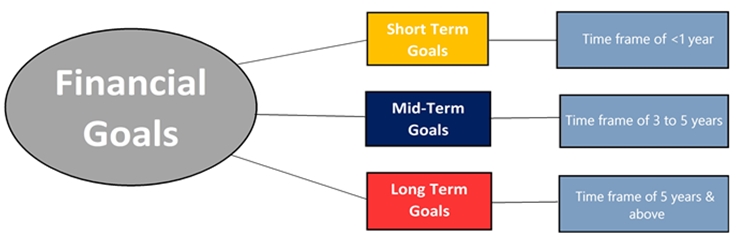

3. Define Goals- Short-Term, Mid-Term and Long-Term

It is an important step to your financial planning. Defining goals set a clear target to be achieved. Your goals can be short-term or long-term. Achieving these targets lead you to your ultimate aim.

4. Asses your Risk

Investing plays a major role in your long-term wealth management. You are never too young or too old to start investing. Investing Early gives you the ability to Handle more risk and thus generate high returns. One should assess their own risk taking ability or undergo the process of Risk assessment to understand what risk they can take. Risk assessment gives you a clear picture of your risk appetite i.e. your ability to take a risk while investing.

5. Decide Asset Allocation

Depending on the market that you choose to invest in you need to decide the mix of equity, debt and other asset classes. Your Asset Allocation can be aggressive (investing mainly in equity), moderate (more inclined toward Debt fund) or it can be conservative (less inclined towards equity). One needs to match their risk profile or risk taking ability with the asset allocation they seek to have in their Portfolio.

Sample Asset Allocation -

| Aggressive | Moderate | Conservative | |

|---|---|---|---|

| Annual Returns (p.a.) | 15.7% | 13.4% | 10.8% |

| Equity | 50% | 35% | 20% |

| Debt | 30% | 40% | 40% |

| Gold | 10% | 10% | 10% |

| Cash | 10% | 15% | 30% |

| Total | 100% | 100% | 100% |

6. Product Selection

After asset allocation, product selection becomes easier. You now have your risk appetite and your asset allocation. This gives you a clear direction towards choosing the right products. For simple to even seasoned investors, Mutual Funds are a preferred route to create their portfolio. However, one of the critical things here to ensure that one gets the right product in their portfolio. For this, one needs to consider various ratings, expense ratios & exit loads, the Asset Management Company etc.

7. Monitor, Review and Re-Balance your Investment Plan

It is necessary to monitor the investments you have made. Regular tracking of the investments reduces the possibility of risk. Also, it gives you an idea about your future investments and how well you are on track to reach your goals. Many people enthusiastically create a top class financial plan. But only a few manage to follow the path. It is not going to be easy, but the plan should be followed as much as possible.

Best Mutual Funds for Aggressive Investors

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) Sub Cat. Motilal Oswal Midcap 30 Fund Growth ₹98.796

↑ 0.99 ₹12,628 18.7 33.8 67.7 38.2 33.8 41.7 Mid Cap JM Multicap Fund Growth ₹107.241

↑ 1.52 ₹3,216 16.7 33.1 64.8 32 27.8 40 Multi Cap Nippon India Small Cap Fund Growth ₹177.05

↑ 1.80 ₹56,469 15.1 25.1 54 31.9 37 48.9 Small Cap Nippon India Multi Cap Fund Growth ₹293.588

↑ 4.27 ₹34,943 11.2 25.6 46.4 31.2 25.4 38.1 Multi Cap Franklin India Smaller Companies Fund Growth ₹183.78

↑ 1.45 ₹14,023 14.5 23.2 55.3 30.1 30.1 52.1 Small Cap HDFC Mid-Cap Opportunities Fund Growth ₹188.025

↑ 2.93 ₹70,570 15 22.6 50.6 29.6 29.7 44.5 Mid Cap Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 26 Jul 24

Best Mutual Funds for Moderate Investors

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) Sub Cat. Aditya Birla Sun Life Medium Term Plan Growth ₹35.374

↑ 0.03 ₹1,862 2.9 4.6 7.6 12.7 8.7 6.9 Medium term Bond ICICI Prudential Gilt Fund Growth ₹94.978

↑ 0.11 ₹6,341 2.7 4.1 7.7 6.5 7.1 8.3 Government Bond SBI Magnum Gilt Fund Growth ₹61.6086

↑ 0.05 ₹8,825 3.4 5 8.3 6.5 6.9 7.6 Government Bond DSP BlackRock Government Securities Fund Growth ₹89.5225

↑ 0.04 ₹1,064 3.9 5.9 9.2 6.2 7.1 7.1 Government Bond Axis Strategic Bond Fund Growth ₹25.8236

↑ 0.02 ₹1,939 2.4 4.4 7.6 6.1 7.1 7.3 Medium term Bond ICICI Prudential Medium Term Bond Fund Growth ₹41.3385

↑ 0.03 ₹6,093 2.3 3.9 7.2 5.9 7.2 7 Medium term Bond Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 26 Jul 24

Best Mutual Funds for Conservative Investors

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2023 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity Sub Cat. Aditya Birla Sun Life Savings Fund Growth ₹510.581

↑ 0.13 ₹14,888 1.8 3.9 7.4 6 7.2 7.89% 5M 16D 6M 7D Ultrashort Bond BOI AXA Liquid Fund Growth ₹2,819.63

↑ 0.53 ₹1,634 1.8 3.7 7.4 5.9 7 7.17% 1M 17D 1M 17D Liquid Fund Axis Liquid Fund Growth ₹2,725.65

↑ 0.50 ₹23,260 1.7 3.7 7.3 5.9 7.1 7.3% 2M 2D 2M 2D Liquid Fund LIC MF Liquid Fund Growth ₹4,429.54

↑ 0.76 ₹10,527 1.8 3.7 7.3 5.8 7 8.05% 2M 2M Liquid Fund Canara Robeco Liquid Growth ₹2,948.07

↑ 0.56 ₹3,945 1.8 3.7 7.3 5.9 7 7.24% 1M 26D 2M 1D Liquid Fund Mahindra Liquid Fund Growth ₹1,594.01

↑ 0.30 ₹1,313 1.8 3.7 7.3 5.9 7.1 7.32% 1M 28D 1M 27D Liquid Fund Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 26 Jul 24

Common Mistakes While Financial Planning

We have listed some of the common mistakes that usually people do while financial planning.

Setting unreasonable goals: Many times people set goals that are almost impossible to achieve. This happens because they don’t analyse their current financial situation.

Making rash decisions: While planning for future, people sometimes tend to lose patience and make decisions instinctively. Those decisions might look correct at that time but may have a negative impact in the long run.

Confuse financial planning with investing: Financial planning is not just about investing. It involves other important things such as wealth management, tax planning, insurance, and retirement planning. Investing is one aspect of a sound financial plan.

Neglecting to evaluate the plan periodically: This is one of the most common mistakes. Evaluating your financial plan periodically gives you an idea where do you stand at the moment. It also gives you an idea what is the way forward and what needs to be changed or added in the current plan to make it more achievable.

Only rich people do financial planning: Another common mistake. Financial planning is for everyone irrespective of their current financial status.

Financial Planning is for older people: You are never too old for planning for your future. It is a best practice that you should start planning your finances as early as possible to achieve your goals and live peacefully.

Financial Planning is Retirement Planning: It is similar misconception like investing. Financial planning helps you build wealth for your retirement. Retirement planning is a subset of financial planning.

Wait for a crisis: Why do you want to wait for an adverse event to hit you to start your financial planning? If you start early and plan better, you will be in a better position to face the crisis.

Benefits of Financial Planning

1. You will be well prepared for the future financially. 2. Your lifestyle will be better than most people with no financial plan. Thus, your stress levels will be lower. 3. You and your family will be secured. 4. With such precise planning, you will be able to map out the road to a stress-free life 5. The most important one – you will control your life & your future!

How to Invest in Mutual Funds Online?

Open Free Investment Account for Lifetime at Fincash.com.

Complete your Registration and KYC Process

Upload Documents (PAN, Aadhaar, etc.). And, You are Ready to Invest!

You need to think long and hard about the future. It is essential that a clear and achievable target is set. Secure your future by creating a plan today!

FAQs

1. Is there any costing incurred behind financial planning?

A: Ideally, if you do financial planning by yourself, then there is no costing incurred. But, if you approach a planner, then it would cost you some money.

2. Are there risks involved with financial planning?

A: The primary risk involved in financial planning is longevity planning. For example, when you plan your finances, you will have to plan the investments as well. Sometimes the interest rates are reduced, and you are unable to acquire the expected returns. As a result, you will have to make adjustments to your financial planning.

3. What is asset allocation?

A: When you create a portfolio of investments, it is essential to diversify your assets. This will ensure that if a particular investment does not perform at par, it will not affect your overall income as you can earn a profit from another. Thus, diversifying your asset is asset allocation.

4. Should I think of tax benefits while planning my finances?

A: Yes, planning your taxes is an essential part of planning your finances. When you think of wealth management, you must plan your investments in such a manner that you can save on your taxes.

5. What should I do about my debts?

A: A part of financial planning is debt management. You can incur debt when you make an essential purchase. For example, if you want to purchase a house, you should take a Home Loan. This can prove to be helpful because it can help you earn tax benefits and, at the same time, not diminish your savings. But you should not incur debts for unnecessary purchases, and you must always strive to repay the debts at the earliest.

6. What are unreasonable goals in financial planning?

A: If you set financial goals beyond your income or investment capacity, it can prove to be unreasonable goals. When you do financial planning, you must take into consideration the expenses that you cannot reduce. After that, with the money that you can save, you should set realistic investment goals.

7. What is crisis management?

A: Even if you plan your finances, you might have to meet certain unforeseen financial expenditures. Hence, when you do financial planning, you must plan for crisis management as well. This is money invested or set aside to be used in case a financial crisis should arise. This negates the risks involved in how you might respond to a financial crisis should it arise without you having prepared for it.

8. When should I purchase luxuries?

A: Purchasing of luxuries should be done only when you have sufficient income at hand. You can do so if one of your investments has matured, and you will not require to make a direct investment or have not planned to make any significant purchases like a house in the near future. Also, if all your debts are cleared, then you can consider spending on luxuries.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

A wonderful input on the subject. Well, articulated and illustrative post. Thanks for sharing.