Why are FATCA & Bank Details Required for Mutual Funds Investment?

When it comes to Mutual Fund investment, people need to comply with the laws prescribed by the government. These laws are implemented to prevent money laundering and tax evasion activities with respect to Mutual Fund investments in India. Therefore, people need to furnish certain details in the form of Know-Your-Customer (KYC). So, let us look at the two important aspects of KYC, that is, the importance of FATCA and Bank account details in Mutual Fund investments.

Why FATCA is Required in Mutual Funds?

FATCA refers to Foreign Account Tax Compliance Act. This act was implemented in the USA with an objective to prevent tax evasion. In India, there are a number of people from various countries are investing in Mutual Funds. Therefore, there needs a system through which government can track all financial transactions in an efficient and transparent manner. With a view to counter this measure, the Government of India signed an agreement with the Government of US called the Inter-Governmental Agreement. This act enables the automated exchange of information between both the countries.

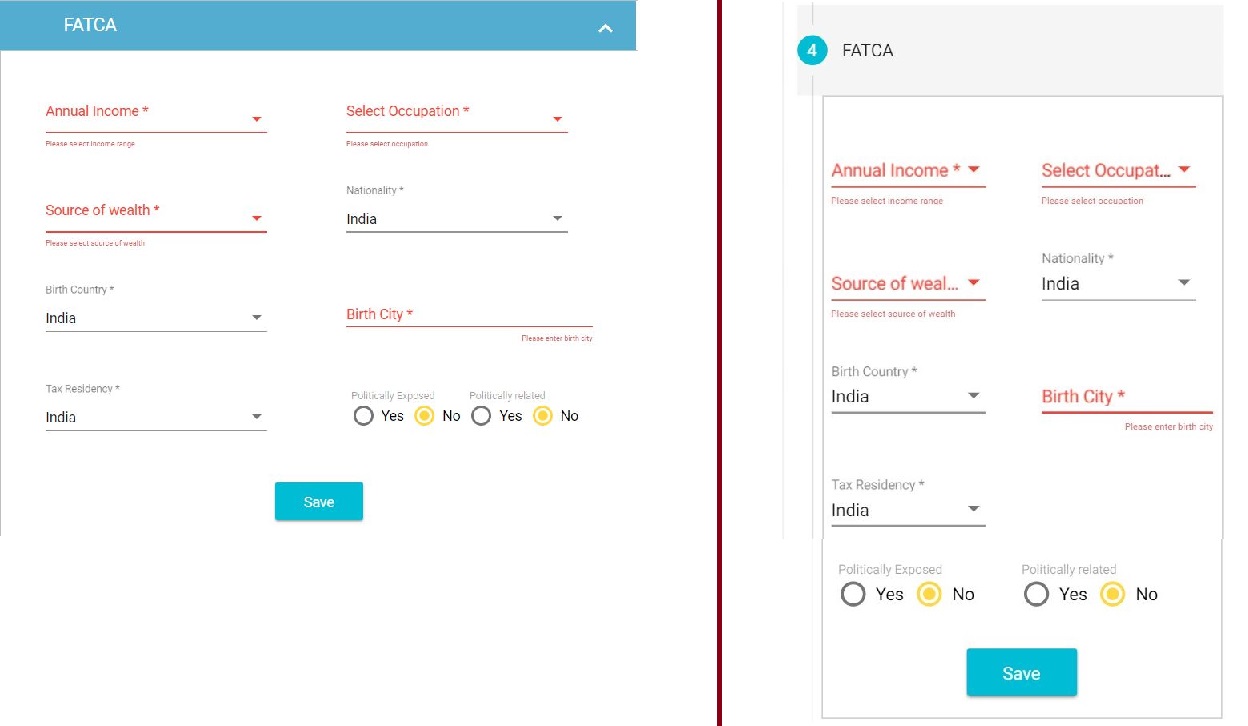

As per the act, since June 2016, all investors including old and new who wish to make any investments like Mutual Funds or Fixed deposits need to furnish the additional FATCA requirements along with the regular KYC requirements. The FATCA is a self-certified form in which the individual needs fill details such as place of birth, occupation, Income, the source of wealth, and tax residency. In addition, they also need to mention whether they are politically exposed or politically related. This form is available on the fund house’s website and also with other distributors.

FATCA is not just related to Indian resident investors. Even NRI investors also need to furnish this details. These rules are in place since September 2015, to make the process of information exchange and taxation simple and efficient. The desktop and mobile view of the FATCA form on the website of Fincash.com is as follows.

Why Bank Details are Mandatory During Mutual Fund Investments?

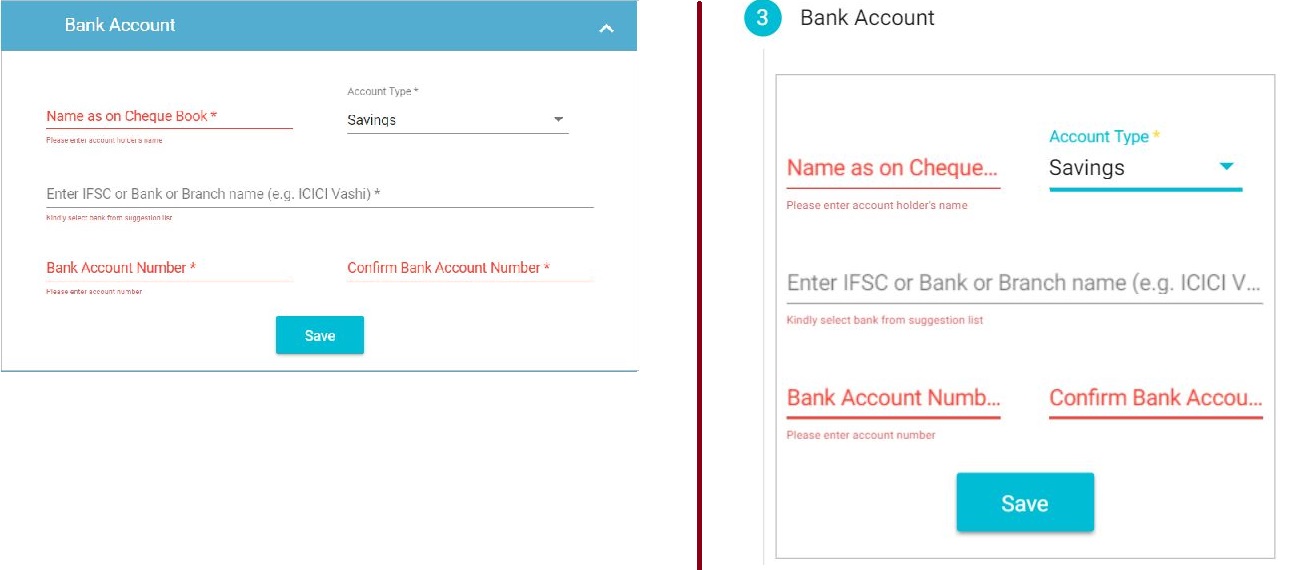

Furnishing bank details is again important while doing Mutual Fund investments. This is in respect to PMLA or Prevention of Money Laundering Act. As per this act, people need to give their bank details while making any investments such as fixed deposits, Mutual Funds, insurance, and much more to prove the source of funds. This step is to ensure that money laundering is prevented and whatever money people get is through the proper channel. Here, people need to enter their bank account number, account type, IFSC Code, and Name on the cheque book. Also, they need to upload a copy of their bank statement or first page of the bank passbook. The desktop and mobile view of bank details on the website of Fincash.com is as follows.

Hope, the above explanation clears the importance of Mutual Fund investments.

In case, if you still have any queries, You can contact us on 8451864111 on any working day between 9.30am to 6.30 pm or write a mail to us anytime at support@fincash.com.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.