Future Generali General Insurance

Future Generali general insurance Company was founded in the year 2006 with a mission of delivering relevant and accessible insurance solutions. The company is a joint collaboration between Future Group, one of India’s leading retailer and Generali Group, an Italy-based insurance company. Future Generali Insurance Company operates in both Life Insurance and General Insurance. It offers a wide range of general insurance products like Future Generali car insurance, Future Generali health insurance, Future Generali Travel Insurance, Future Generali personal accident insurance and Future Generali Home insurance.

With over 11 lakh customers, Future Generali General Insurance Company offers products to fulfil all the insurance needs of people, from personal to commercial, social to rural insurance. As on March 2015, the company’s assets under management were worth over INR 1,900 crore. The company is present in approximately 137 locations across India having about 2,200+ active corporate clients and over 6,100 agents representing the company. Moreover, the Future Generali Insurance Company was awarded an ISO 9001:2008 certification for its quality excellence. Let’s have a look at the company’s product Portfolio.

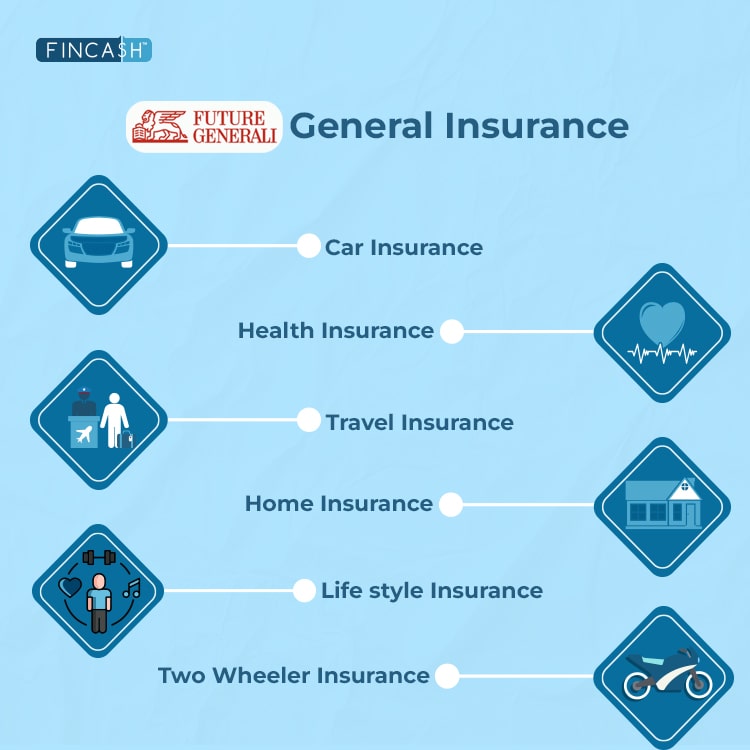

Future Generali General Insurance - Product Portfolio

Here is the list of insurance types in Future Generali's portfolio.

Future Generali Car Insurance

Car insurance covers damages like a broken windshield, dents, third-party liability, personal accident coverage, roadside assistance, etc.

Inclusions of Future Generali Car Insurance

Here is everything included in this plan:

Hassle-Free Claim Process: At Future Generali, the claim process is as simple as purchasing Car Insurance Online. Claims can be easily made online or offline in a few straightforward steps.

6500+ Partner Workshops Across India: Future Generali's new car insurance allows you to repair your car at any of the 6500+ partner workshops nationwide.

Roadside Assistance: No need to panic if your car breaks down in an unfamiliar location with no mechanic. Future Generali's Comprehensive Car Insurance coverage includes roadside assistance, which is available anytime and anywhere you need it.

Towing Assistance (for Accidents): Accidents can be stressful, but worrying about getting your car towed shouldn't be. Future Generali's car insurance provides towing assistance for accidents, ensuring help is available wherever you are.

Anti-Theft Devices: You may qualify for an anti-theft device discount in their Comprehensive Car Policy if your vehicle is equipped with an anti-theft device approved by the Automobile Research Association of India (ARAI).

Future Xpress and Xpress+: Future Generali offers two express claim services – Future Xpress and Future Xpress +. These services prioritise car repairs and claim settlements, allowing you to skip lengthy processes and get back on the road faster.

Exclusions of Future Generali Car Insurance

Here is everything not included in this plan:

Normal Wear, Tear, and General Ageing of the Vehicle: Excludes coverage for deterioration of the car from typical use and ageing.

Loss or Damage Due to War, Mutiny, or Nuclear Risk: Excludes coverage for damage resulting from war, mutiny, or nuclear events.

Accident Outside the Geographical Area: Coverage does not extend to accidents outside specified areas.

Damage by a Person Driving Without a Valid License: Excludes coverage for damage caused by unlicensed drivers.

Damage by a Person Driving Under the Influence: Coverage does not apply if the driver is under the influence.

Future Generali Bike Insurance

The adventures are limitless when you're on the road with your bike. You experience highs and lows along the way. That's why Future Generali's Future Secure Two Wheeler Policy is crucial, providing protection when challenges arise. Ensure your memorable rides are safeguarded by Investing in bike insurance. This coverage shields your bike from damage and you from potential financial setbacks.

Inclusions of Future Generali Bike Insurance

Here is everything included in this plan:

Bike Damage Coverage: If your bike undergoes damages due to accidents or theft, this insurance policy will reimburse all incurred losses.

Personal Accident Coverage: The insurance offers up to ₹ 15 lakhs to provide financial security.

Third-party Liability Protection: The bike insurance includes third-party liability coverage when you're not at fault. This compensates for damages to third-party property, bodily injury, or fatality.

Additional Legal Liability: Cover extends to paid drivers, conductors, or cleaners involved in bike operations, employees driving or travelling in the bike, and non-paying passengers.

Exclusions of Future Generali Bike Insurance

Here is everything not included in this plan:

Normal Wear, Tear, and General Ageing of the Vehicle: The policy excludes the vehicle's natural deterioration and ageing process over time, including the wear on its parts and components due to regular usage and exposure to environmental factors.

Damage Because of a Driver Without License: The policy does not cover any harm caused to the vehicle or by the vehicle when it is being operated by an individual who does not possess a valid driver's license.

Loss or Damage Due to War, Mutiny, or Nuclear Risk: The policy does not cover damages or losses resulting from acts of war, insurgency, rebellion, or nuclear-related incidents.

Any Accident Outside the Geographical Area: Coverage may be limited to incidents within a specific region or jurisdiction.

Damage Because of a Driver Under the Influence: Such instances are excluded from coverage due to the increased risk associated with impaired driving.

Future Generali Health Insurance

Your health is invaluable, yet medical emergencies can strike without warning, leaving you facing hefty bills and stress. This is where health insurance provides crucial support, covering expenses like doctor consultations, hospital stays, and medications.

Here are several health insurance plans that you can find under this category:

- Future Generali Women Insurance Plan

- Future Generali D.I.Y. health insurance plan

- Future Generali FG Health Absolute Plan

- Future Generali FG Health Elite Plan

- Future Generali Health Total Plan

- Future Generali Future Advantage Top-Up Plan

- Future Generali Health Super Saver Plan

- Future Generali Future Health Suraksha Plan

- Future Generali Senior Citizen Insurance Plan

- Future Generali Critical illness insurance Plan

- Future Generali Surakshit Loan Bima Insurance Plan

- Future Generali Affordable Plan Insurance Plan

- Future Generali Aarogya Sanjeevani Policy Plan

- Future Generali Saral Suraksha Bima Policy

- Future Generali Personal Accident Policy

- Future Generali HIV & Disability Suraksha Policy

- Future Generali Hospital Cash Policy

Inclusions of Future Generali Health Insurance

Here is everything included in this plan:

Pre/Post-Hospitalisation Expenses: Medical costs before and after hospitalisation are covered by health insurance, alleviating financial worries.

Preventive Care: Additional health insurance services include regular check-ups, vaccinations, and screenings, aiding in early illness detection.

Daycare Treatment Expenses: Health insurance covers treatment required for hospital stays under 24 hours.

Outpatient Care: Doctor visits, lab tests, and diagnostics are included in health insurance coverage.

Prescription Drugs: Health insurance facilitates coverage for prescribed medications.

Maternity Expenses: Maternity benefits cater to pre and post-natal expenses, ensuring peace during maternity.

Road Ambulance Coverage: Road ambulance charges are part of health insurance coverage, ensuring prompt hospital access.

E-Opinion for Illness or Injury: Online medical consultations for illness or injury are covered under health insurance.

Exclusions of Future Generali Health Insurance

Here is everything not included in this plan:

Non-prescribed Medications: Medications not prescribed by a doctor.

Illness due to Alcohol or Drugs: Health issues resulting from alcohol or drug use.

Hormone Replacement Therapy: Treatment involving hormone supplements for hormonal imbalances.

Congenital Disabilities or Illnesses: Disabilities or illnesses present at birth.

Sex Change Treatment: Medical procedures for gender transition.

Injuries due to War: Physical harm resulting from military conflict.

Future Generali Travel Insurance

When visiting a new city, unforeseen circumstances like medical emergencies or lost luggage can cause stress and financial strain. This insurance plan covers various situations, including trip cancellation, medical emergencies, and lost luggage. It's a cost-effective way to safeguard your investment in the trip and enjoy a worry-free vacation with your family.

Here are the different types of plans available under this category:

- Domestic Travel Insurance

- International Travel Insurance

- Single and Multi-trip Travel Insurance

- Senior Citizen Travel Insurance

- Medical Travel Insurance

- Group Travel Insurance

Inclusions of Future Generali Travel Insurance

Here is everything included in this plan:

Medical Expenses: Costs for sickness and accident-related medical care, emergency evacuation, and dental relief.

Travel Inconvenience: Coverage for hijacking, trip cancellation, missed connections, and passport loss.

Personal Care: Includes compensation for baggage loss, financial emergencies, and delays.

Personal Accident: Protection against accidental death and disablement, including incidents on common carriers.

Exclusions of Future Generali Travel Insurance

Here is everything not included in this plan:

Pre-existing Conditions: Medical conditions present before purchasing the insurance.

Trip Interruptions: Unforeseen incidents before the journey starts affecting travel plans.

Medical Advisories: Ignoring medical advice to travel, risking health complications.

Military Operations: Engaging in armed forces activities.

Nuclear Incidents: Injuries or illnesses from nuclear-related events are not covered.

Restricted Travel: Visiting nations with specific travel advisories or bans.

Self-inflicted Harm: Injuries or illnesses deliberately caused by oneself are excluded.

Mental Health Issues: Conditions related to psychological or nervous disorders are not covered.

Sexually Transmitted Diseases: Illnesses like AIDS, HIV, or STDs are not covered.

Intoxication: Injuries or illnesses resulting from alcohol or drug use aren't covered.

Future Generali Home Insurance Plan

Home insurance offers financial protection against unfortunate circumstances such as fire, theft, natural calamities, etc. The plan also covers precious personal belongings at any additional premium. With this policy, you get wide coverage, quick and straightforward claim settlements, wide networks, swift policy issuance along with affordable premiums.

Inclusions

- Fire

- Theft

- Natural Calamities

- Legal Liabilities

Conclusion

The Future Generali General Insurance Company takes pride in providing superior talent to deliver insurance solutions to cater all the needs of people. With a vision of protecting and enhancing the lives of people, the company offers around 4,350 cashless hospitals and around 900 cashless garages. With the advent of technology, the company also went digital as well. Now, one can renew Future Generali Car Insurance online as well.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.