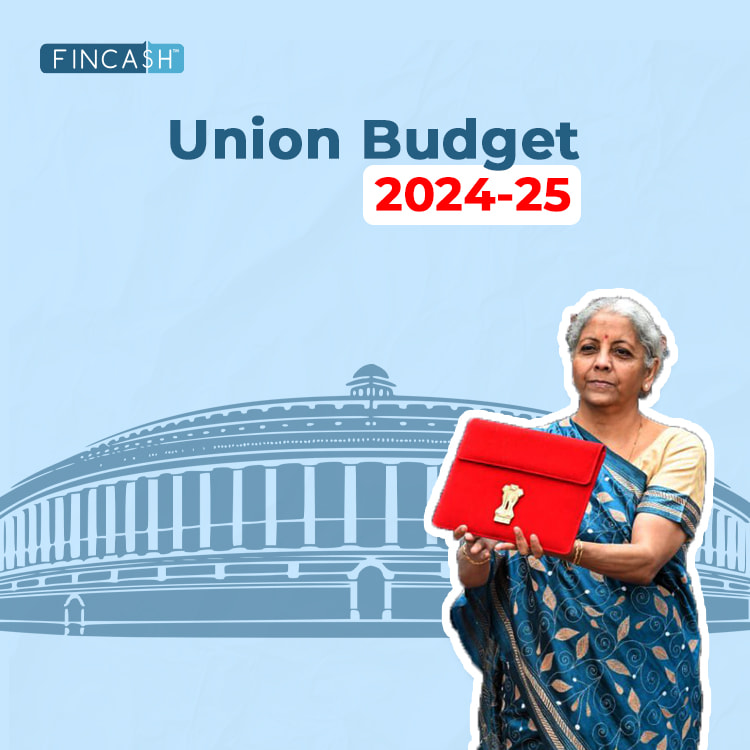

Everything to Know About Interim Budget 2024 - 25

The nationwide anticipation has come to rest as Finance Minister Nirmala Sitharaman has delivered the interim Budget for 2024. While no significant announcements were to be accepted, the Budget brought some possible relief measures. Despite global challenges, President Droupadi Murmu highlighted India's significant achievement in 2023, maintaining its position as the world's fastest-growing major Economy. "India achieved an impressive growth rate of approximately 7.5% for two consecutive quarters," she said, showcasing the flexibility and strength of the Indian economy in adversity. In the current Fiscal Year 2023 - 24, India recorded growth rates of 7.8% and 7.6% in the April-June and July-September quarters.

The Budget addressed several sectors, including individual tax relief and support for industries and farmers. Balancing infrastructure investments with fiscal targets will be crucial. The government aims to boost infrastructure, especially in railways and highways. In this post, let's dive deeper into Interim Budget 2024 and understand what's new for Indian citizens.

Key Highlights of Budget 2024-25

Here are some key highlights of the Interim Budget:

- Estimated gross borrowing for FY25 stands at Rs. 14.13 trillion, showing a decrease from FY24.

- Emphasis on research for self-sufficiency in oilseed production to reduce India's cooking oil imports, currently at 60%.

- An aggressive fiscal consolidation target was set by FM, with the FY25 fiscal deficit target at 5.1%, down from the expected 5.3%.

- Introduction of a housing scheme for middle-class individuals in rented houses, slums, and unauthorised colonies to own their homes.

- Expansion of medical education with the utilisation of existing infrastructure.

- Extension of healthcare coverage under the Ayushman Bharat scheme to all Anganwadi workers and helpers.

- Increased efforts to enhance farmers' Income.

- Promotion of private investment in post-harvest activities.

- Withdrawal of outstanding disputed tax demands, benefiting 1 crore taxpayers.

- Tax rates remain unchanged in the interim Budget 2024, with specific benefits extended to startups and IFSC units until March 2025.

- GST has made 'one nation, one Market, one tax.'

- Under Garib Ka Kalyan, Desh Ka Kalyan, the government assisted 25 crore people in the last ten years in obtaining liberty from poverty.

- A fund of Rs. 1 lakh crore will be instituted, Offering a 50-year interest-free loan. This fund aims to facilitate long-term financing or refinancing at minimal or zero interest rates.

Talk to our investment specialist

Inclusive Development and Growth

The Finance Minister highlights our youthful nation's aspirations, current pride, and optimistic outlook. Emphasising inclusive development and growth, the government has shifted past practices to extend development efforts beyond village boundaries. Comprehensive programs have reached every household and individual through:

- Har Ghar Jal

- Electricity for All

- Cooking Gas for All

Bank Accounts and Financial Services for All

Concerns over food security are being addressed through free rations for 80 crores people, while minimum support prices for farmers are periodically raised. The provision of essential amenities has boosted rural incomes substantially.

Sab Ka Sath, Sab Ka Vikas

According to the FM, the government prioritised policies promoting secularism, curbing corruption, and combating nepotism. They have upheld "Sabka Sath, Sabka Vikas" through comprehensive social and geographical inclusion. Their focus on the underprivileged - whether the poor, women, youth, or farmers - has been unwavering. Over the past decade, the government has liberated 25 crore individuals from multidimensional poverty.

Government's Direct Benefit Transfers (DBT)

The government's successful implementation of Direct Benefit Transfers (DBT) worth Rs. 34 lakhs crores through PM Jan Dhan accounts has resulted in substantial savings, totalling Rs. 2.7 lakhs crores. Finance Minister Ms Sitharaman highlights that these savings are attributable to effectively reducing leakages, thereby strengthening the allocation of funds for Garib Kalyan initiatives to uplift economically disadvantaged sections of society.

Additionally, PM Jan Man Yojana remains steadfast in its commitment to extending crucial assistance to vulnerable tribal communities, highlighting the government's unwavering dedication to inclusive development and welfare programs tailored to the needs of marginalised population segments.

Development Schemes for Farmers

The FM emphasised on Farmers, our "Anna Datas"! Through PM Kisan Samman Yojana, the government provides 11.8 crore farmers, including marginal and small farmers, with direct financial aid annually. Also, PM Fasal Bima Yojana offers crop insurance to 4 crore farmers. These initiatives support farmers in contributing to both national and global food production. Regarding farmer-centric schemes, the FM highlighted that the Electronic National Agricultural Market has integrated 1,361 mandis, benefiting 1.8 crore farmers with a trading volume of 3 lakh crores, setting the stage for inclusive growth.

Strategy for Amrit Kaal

The vision for a Developed India entails prosperity in harmony with nature, modern infrastructure, and equal opportunities for all. The trinity of democracy, demography, and diversity, supported by inclusive efforts, holds the potential to fulfil the aspirations of every Indian.

The government will embrace economic policies fostering sustainable growth, inclusive development, enhanced productivity, and opportunities for all. These policies will empower individuals, generate resources, and facilitate investments. Next-generation reforms will be pursued, with efforts to build consensus among stakeholders for effective implementation.

Making India Viksit Bharat by 2047

The forthcoming years promise unprecedented development, propelling India towards its 2047 developmental goals. The government hopes to achieve comprehensive, inclusive, and pervasive development, encompassing all castes and communities.

Focus on Comprehensive GDP

In addition to achieving robust Economic Growth, the government places equal emphasis on fostering a more holistic GDP — Governance, Development, and Performance. The administration prioritises transparent, accountable, and citizen-centric governance, adopting a "citizen first" approach with minimal government intervention and maximal governance Efficiency.

The government achieved macroeconomic stability, bolstered investments, and witnessed a thriving economy, empowering individuals to pursue their aspirations. Average Real Income has surged by 50%, Inflation remains moderate, and programs and large-scale projects are effectively implemented.

Advantages for Startups

- Tax benefits for startups have been extended until March 2025

- Tax exemption for sovereign wealth funds and pension funds have been extended for an additional year as well until March 2025

- The government is withdrawing certain outstanding direct tax liabilities

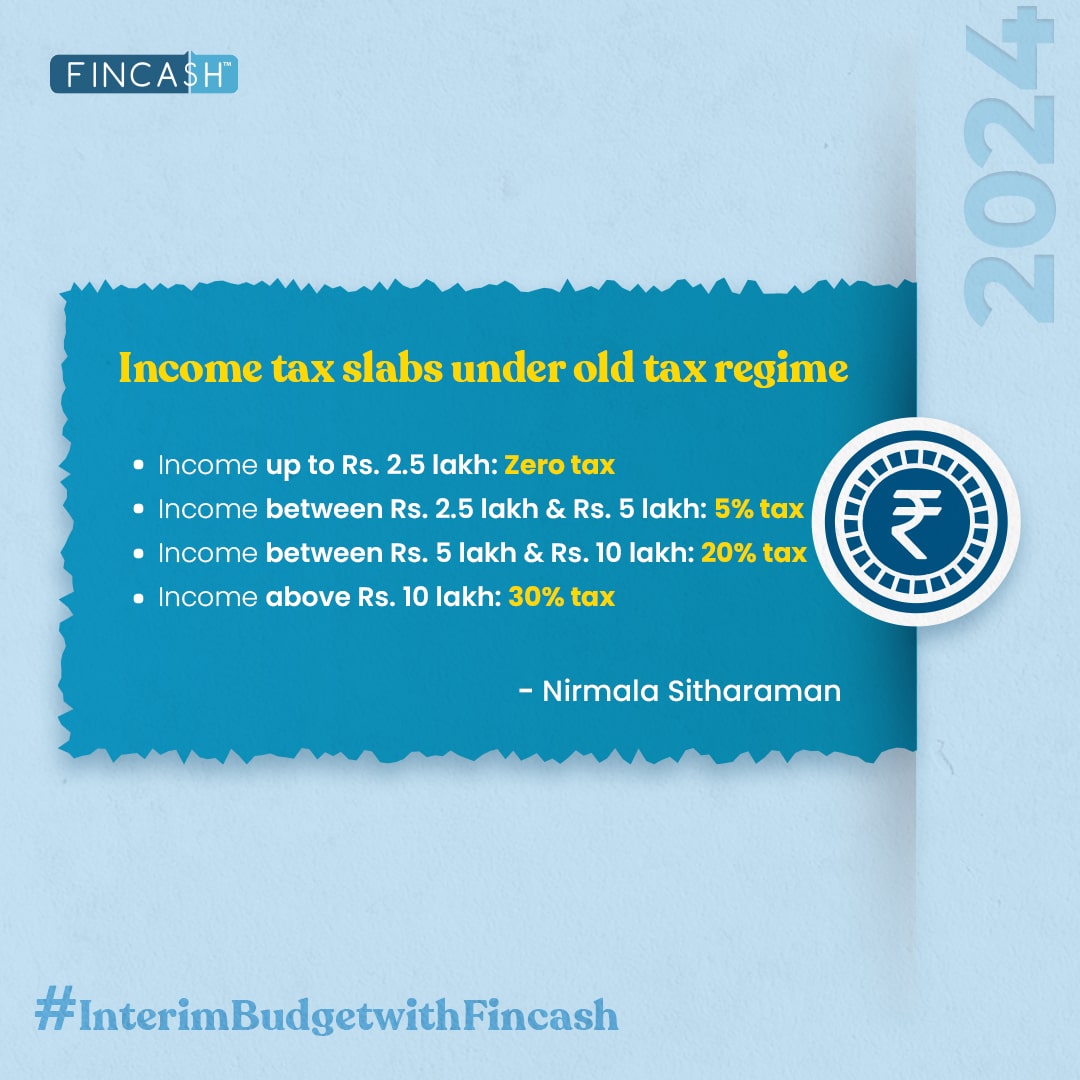

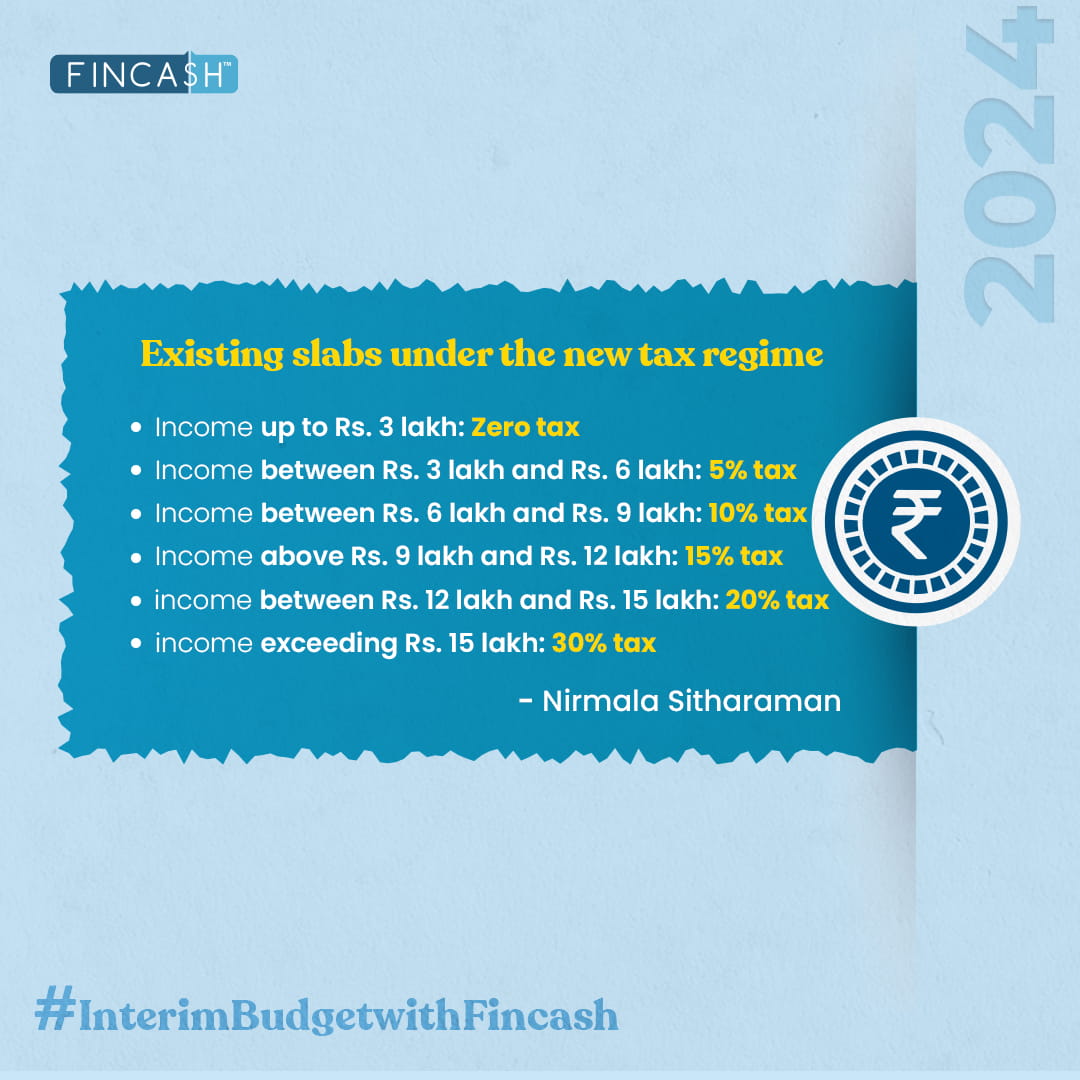

Income Tax Slab Changes

Here are the changes as announced for the income tax Slab:

Income Tax Slabs Under Old Tax Regime

Existing Tax Slabs Under New Tax Regime

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.