SIP 2022 – 2023 ಗಾಗಿ ಭಾರತದಲ್ಲಿ ಅತ್ಯುತ್ತಮ ಮ್ಯೂಚುಯಲ್ ಫಂಡ್ಗಳು

ಒಂದು ವ್ಯವಸ್ಥಿತಹೂಡಿಕೆ ಯೋಜನೆ (SIP) ಅತ್ಯಂತ ಪರಿಣಾಮಕಾರಿ ಮಾರ್ಗವೆಂದು ಪರಿಗಣಿಸಲಾಗಿದೆಮ್ಯೂಚುವಲ್ ಫಂಡ್ಗಳಲ್ಲಿ ಹೂಡಿಕೆ ಮಾಡಿ, ವಿಶೇಷವಾಗಿ ದೀರ್ಘಕಾಲ-ಅವಧಿ ಯೋಜನೆ. ದೀರ್ಘಾವಧಿಯ ಉಳಿತಾಯ ಯೋಜನೆಯನ್ನು ಕಾರ್ಯಗತಗೊಳಿಸಲು ಹೂಡಿಕೆದಾರರಿಗೆ ಪ್ರತಿ ತಿಂಗಳು ನಿರ್ದಿಷ್ಟ ದಿನಾಂಕದಂದು ಘಟಕವನ್ನು ಖರೀದಿಸಲು ಇದು ಅನುಮತಿಸುತ್ತದೆ. ಹೂಡಿಕೆದಾರರು ಹಾಯಾಗಿರಲು ಕಾರಣಗಳಲ್ಲಿ ಒಂದಾಗಿದೆಹೂಡಿಕೆ SIP ನಲ್ಲಿ ಅವರು ನೀಡುವ ನಮ್ಯತೆ. ಹೂಡಿಕೆದಾರರು ಮಾಡಬಹುದುSIP ನಲ್ಲಿ ಹೂಡಿಕೆ ಮಾಡಿ ಮಾಸಿಕ, ತ್ರೈಮಾಸಿಕ ಅಥವಾ ವಾರಕ್ಕೊಮ್ಮೆಆಧಾರ, ಅವರ ಅನುಕೂಲಕ್ಕೆ ತಕ್ಕಂತೆ. ಒಬ್ಬರು ಅದನ್ನು ಹೇಗೆ ಸಾಧಿಸಬಹುದು ಎಂಬುದರ ಕುರಿತು ಇನ್ನಷ್ಟು ತಿಳಿದುಕೊಳ್ಳೋಣಹಣಕಾಸಿನ ಗುರಿಗಳು ವ್ಯವಸ್ಥಿತ ಹೂಡಿಕೆ ಯೋಜನೆಗಳೊಂದಿಗೆ, ಹೇಗೆಸಿಪ್ ಕ್ಯಾಲ್ಕುಲೇಟರ್ ಜೊತೆಗೆ ಹೂಡಿಕೆಯಲ್ಲಿ ಸಹಕಾರಿಯಾಗಿದೆಅತ್ಯುತ್ತಮ ಮ್ಯೂಚುಯಲ್ ಫಂಡ್ಗಳು SIP ಗಾಗಿ ಭಾರತದಲ್ಲಿ.

SIP- ಆರ್ಥಿಕ ಗುರಿಗಳನ್ನು ಸಾಧಿಸಲು ಸೂಕ್ತ ಮಾರ್ಗ

SIP ಅನ್ನು ಸುಲಭವಾಗಿ ತಮ್ಮ ಹೂಡಿಕೆಗಳನ್ನು ಪೂರ್ವ-ಯೋಜನೆ ಮತ್ತು ಅವರ ಹಣಕಾಸಿನ ಗುರಿಗಳಿಗೆ ಅನುಗುಣವಾಗಿ ಹೂಡಿಕೆ ಮಾಡುವ ರೀತಿಯಲ್ಲಿ ವಿನ್ಯಾಸಗೊಳಿಸಲಾಗಿದೆ. ಆದರೆ, SIP ಮೂಲಕ ಗುರಿಗಳನ್ನು ಸಾಧಿಸಲು ದೀರ್ಘಕಾಲ ಹೂಡಿಕೆ ಮಾಡಬೇಕು. ಸಾಮಾನ್ಯವಾಗಿ, SIP ಅನ್ನು ಗುರಿಗಳನ್ನು ಯೋಜಿಸಲು ವ್ಯಾಪಕವಾಗಿ ಬಳಸಲಾಗುತ್ತದೆ-

Talk to our investment specialist

- ಕಾರು ಖರೀದಿ

- ಮನೆ ಖರೀದಿ

- ಮದುವೆ

- ಮಗುವಿನ ಶಿಕ್ಷಣ

- ಅಂತರರಾಷ್ಟ್ರೀಯ ಪ್ರವಾಸಕ್ಕಾಗಿ ಉಳಿಸಿ

- ನಿವೃತ್ತಿ

- ವೈದ್ಯಕೀಯ ತುರ್ತುಸ್ಥಿತಿಗಳು ಇತ್ಯಾದಿ.

ಒಬ್ಬರು ಕನಿಷ್ಠ INR 500 ಮತ್ತು INR 1000 ಮೊತ್ತದೊಂದಿಗೆ SIP ಗಳಲ್ಲಿ ಹೂಡಿಕೆ ಮಾಡಲು ಪ್ರಾರಂಭಿಸಬಹುದು. ಒಮ್ಮೆ ನೀವು SIP ನಲ್ಲಿ ಹೂಡಿಕೆ ಮಾಡಲು ಪ್ರಾರಂಭಿಸಿದ ನಂತರ ನಿಮ್ಮ ಹಣವು ಸ್ಟಾಕ್ಗೆ ತೆರೆದುಕೊಂಡಂತೆ ಪ್ರತಿದಿನವೂ ಹೋಗಲಾರಂಭಿಸುತ್ತದೆಮಾರುಕಟ್ಟೆ. ಅದಕ್ಕಾಗಿಯೇ SIP ಗಳನ್ನು ಒಂದು ಮಾರ್ಗವಾಗಿ ಹೆಚ್ಚಾಗಿ ಆದ್ಯತೆ ನೀಡಲಾಗುತ್ತದೆಇಕ್ವಿಟಿ ಫಂಡ್ಗಳು. ಇದಲ್ಲದೆ, ಐತಿಹಾಸಿಕವಾಗಿ, ಈಕ್ವಿಟಿ ಸ್ಟಾಕ್ಗಳಲ್ಲಿನ ಹೂಡಿಕೆಯು ಇತರ ಎಲ್ಲಾ ಆಸ್ತಿ ವರ್ಗಗಳ ನಡುವೆ ಪ್ರಭಾವಶಾಲಿ ಆದಾಯವನ್ನು ನೀಡಿದೆ, ಹೂಡಿಕೆಯನ್ನು ಶಿಸ್ತು ಮತ್ತು ದೀರ್ಘಾವಧಿಯ ಹಾರಿಜಾನ್ನೊಂದಿಗೆ ಮಾಡಿದ್ದರೆ.

ಇಕ್ವಿಟಿಯಲ್ಲಿನ SIP ಮಾರುಕಟ್ಟೆಯ ಸಮಯದ ಅಪಾಯವನ್ನು ತಪ್ಪಿಸಲು ಸಹಾಯ ಮಾಡುತ್ತದೆ ಮತ್ತು ಹೂಡಿಕೆಯ ವೆಚ್ಚವನ್ನು ಸರಾಸರಿ ಮಾಡುವ ಮೂಲಕ ಸಂಪತ್ತು ಸೃಷ್ಟಿಗೆ ಅನುಕೂಲವಾಗುತ್ತದೆ. ಇನ್ನು ಕೆಲವನ್ನು ನೋಡೋಣSIP ನ ಪ್ರಯೋಜನಗಳು ಇದು ದೀರ್ಘಕಾಲೀನ ಗುರಿಗಳನ್ನು ಸಾಧಿಸಲು ಸಹಾಯ ಮಾಡುತ್ತದೆ:

ಸಂಯೋಜನೆಯ ಶಕ್ತಿ- ನೀವು ಅಸಲು ಮಾತ್ರ ಆಸಕ್ತಿಯನ್ನು ಪಡೆದಾಗ ಸರಳ ಆಸಕ್ತಿ. ಚಕ್ರಬಡ್ಡಿಯ ಸಂದರ್ಭದಲ್ಲಿ, ಬಡ್ಡಿ ಮೊತ್ತವನ್ನು ಅಸಲಿಗೆ ಸೇರಿಸಲಾಗುತ್ತದೆ ಮತ್ತು ಹೊಸ ಅಸಲು (ಹಳೆಯ ಅಸಲು ಮತ್ತು ಲಾಭಗಳು) ಮೇಲೆ ಬಡ್ಡಿಯನ್ನು ಲೆಕ್ಕಹಾಕಲಾಗುತ್ತದೆ. ಈ ಪ್ರಕ್ರಿಯೆಯು ಪ್ರತಿ ಬಾರಿಯೂ ಮುಂದುವರಿಯುತ್ತದೆ. SIP ರಿಂದಮ್ಯೂಚುಯಲ್ ಫಂಡ್ಗಳು ಕಂತುಗಳಲ್ಲಿ ಇವೆ, ಅವು ಸಂಯುಕ್ತವಾಗಿರುತ್ತವೆ, ಇದು ಆರಂಭದಲ್ಲಿ ಹೂಡಿಕೆ ಮಾಡಿದ ಮೊತ್ತಕ್ಕೆ ಹೆಚ್ಚಿನದನ್ನು ಸೇರಿಸುತ್ತದೆ.

ಅಪಾಯ ಕಡಿತ- ಒಂದು SIP ದೀರ್ಘಾವಧಿಯವರೆಗೆ ಹರಡಿರುವುದರಿಂದ, ಒಬ್ಬರು ಷೇರು ಮಾರುಕಟ್ಟೆಯ ಎಲ್ಲಾ ಅವಧಿಗಳು, ಏರಿಳಿತಗಳು ಮತ್ತು ಹೆಚ್ಚು ಮುಖ್ಯವಾಗಿ ಕುಸಿತಗಳನ್ನು ಹಿಡಿಯುತ್ತಾರೆ. ಕುಸಿತಗಳಲ್ಲಿ, ಹೆಚ್ಚಿನ ಹೂಡಿಕೆದಾರರನ್ನು ಭಯವು ಸೆಳೆದಾಗ, SIP ಕಂತುಗಳು ಹೂಡಿಕೆದಾರರು "ಕಡಿಮೆ" ಖರೀದಿಸುವುದನ್ನು ಖಾತ್ರಿಪಡಿಸುವುದನ್ನು ಮುಂದುವರಿಸುತ್ತವೆ.

SIP ಗಳ ಅನುಕೂಲತೆ- ಅನುಕೂಲತೆಯು SIP ಯ ದೊಡ್ಡ ಪ್ರಯೋಜನಗಳಲ್ಲಿ ಒಂದಾಗಿದೆ. ಬಳಕೆದಾರರು ಒಂದು ಬಾರಿ ಸೈನ್-ಅಪ್ ಮಾಡಬೇಕು ಮತ್ತು ದಾಖಲೆಗಳ ಮೂಲಕ ಹೋಗಬೇಕು. ಒಮ್ಮೆ ಮಾಡಿದ ನಂತರ, ನಂತರದ ಹೂಡಿಕೆಗಳಿಗೆ ಡೆಬಿಟ್ಗಳು ಸ್ವಯಂಚಾಲಿತವಾಗಿ ನಡೆಯುತ್ತವೆಹೂಡಿಕೆದಾರ ಕೇವಲ ಹೂಡಿಕೆಗಳನ್ನು ಮೇಲ್ವಿಚಾರಣೆ ಮಾಡಬೇಕು.

SIP 2022 - 2023 ಗಾಗಿ ಭಾರತದಲ್ಲಿ ಅತ್ಯುತ್ತಮ ಮ್ಯೂಚುಯಲ್ ಫಂಡ್ಗಳು

SIP ಗಾಗಿ ಅತ್ಯುತ್ತಮ ಲಾರ್ಜ್ ಕ್ಯಾಪ್ ಫಂಡ್ಗಳು

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Nippon India Large Cap Fund Growth ₹93.8953

↑ 0.49 ₹50,876 100 0.4 3.1 16.6 19.3 17.4 9.2 ICICI Prudential Bluechip Fund Growth ₹114.46

↑ 0.46 ₹78,502 100 -0.5 3.3 14.6 18.2 15.5 11.3 DSP TOP 100 Equity Growth ₹483.231

↑ 2.93 ₹7,285 500 -0.2 2.8 11.6 18 13.5 8.4 Bandhan Large Cap Fund Growth ₹79.957

↑ 0.37 ₹2,051 100 0.2 3.8 16.8 17.8 13.1 8.2 Invesco India Largecap Fund Growth ₹70.44

↑ 0.21 ₹1,718 100 -1.3 2.4 15.4 17.7 14 5.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Nippon India Large Cap Fund ICICI Prudential Bluechip Fund DSP TOP 100 Equity Bandhan Large Cap Fund Invesco India Largecap Fund Point 1 Upper mid AUM (₹50,876 Cr). Highest AUM (₹78,502 Cr). Lower mid AUM (₹7,285 Cr). Bottom quartile AUM (₹2,051 Cr). Bottom quartile AUM (₹1,718 Cr). Point 2 Established history (18+ yrs). Established history (17+ yrs). Oldest track record among peers (22 yrs). Established history (19+ yrs). Established history (16+ yrs). Point 3 Top rated. Rating: 4★ (upper mid). Rating: 2★ (bottom quartile). Rating: 2★ (bottom quartile). Rating: 3★ (lower mid). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 17.39% (top quartile). 5Y return: 15.55% (upper mid). 5Y return: 13.50% (bottom quartile). 5Y return: 13.15% (bottom quartile). 5Y return: 13.96% (lower mid). Point 6 3Y return: 19.34% (top quartile). 3Y return: 18.21% (upper mid). 3Y return: 18.00% (lower mid). 3Y return: 17.77% (bottom quartile). 3Y return: 17.70% (bottom quartile). Point 7 1Y return: 16.58% (upper mid). 1Y return: 14.55% (bottom quartile). 1Y return: 11.61% (bottom quartile). 1Y return: 16.85% (top quartile). 1Y return: 15.40% (lower mid). Point 8 Alpha: -0.94 (upper mid). Alpha: 1.30 (top quartile). Alpha: -1.17 (lower mid). Alpha: -2.13 (bottom quartile). Alpha: -5.05 (bottom quartile). Point 9 Sharpe: 0.29 (upper mid). Sharpe: 0.48 (top quartile). Sharpe: 0.26 (lower mid). Sharpe: 0.21 (bottom quartile). Sharpe: 0.04 (bottom quartile). Point 10 Information ratio: 1.37 (top quartile). Information ratio: 1.26 (upper mid). Information ratio: 0.74 (lower mid). Information ratio: 0.72 (bottom quartile). Information ratio: 0.67 (bottom quartile). Nippon India Large Cap Fund

ICICI Prudential Bluechip Fund

DSP TOP 100 Equity

Bandhan Large Cap Fund

Invesco India Largecap Fund

SIP ಗಾಗಿ ಅತ್ಯುತ್ತಮ ಮಲ್ಟಿ ಕ್ಯಾಪ್ ಫಂಡ್ಗಳು

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) HDFC Equity Fund Growth ₹2,096.5

↑ 6.02 ₹96,295 300 1.1 4.8 17.4 22.3 20.2 11.4 Motilal Oswal Multicap 35 Fund Growth ₹58.5129

↓ -0.02 ₹13,862 500 -6.6 -4.5 7.4 22.2 13 -5.6 Nippon India Multi Cap Fund Growth ₹301.432

↑ 1.28 ₹50,352 100 -0.8 0.5 17.9 22.1 21.6 4.1 Mahindra Badhat Yojana Growth ₹36.2846

↑ 0.15 ₹6,133 500 -0.1 3.4 18.7 21.4 18.6 3.4 Aditya Birla Sun Life Manufacturing Equity Fund Growth ₹33.99

↑ 0.23 ₹1,099 1,000 1.9 7.4 21.8 21.3 15.3 3.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary HDFC Equity Fund Motilal Oswal Multicap 35 Fund Nippon India Multi Cap Fund Mahindra Badhat Yojana Aditya Birla Sun Life Manufacturing Equity Fund Point 1 Highest AUM (₹96,295 Cr). Lower mid AUM (₹13,862 Cr). Upper mid AUM (₹50,352 Cr). Bottom quartile AUM (₹6,133 Cr). Bottom quartile AUM (₹1,099 Cr). Point 2 Oldest track record among peers (31 yrs). Established history (11+ yrs). Established history (20+ yrs). Established history (8+ yrs). Established history (11+ yrs). Point 3 Rating: 3★ (upper mid). Top rated. Rating: 2★ (lower mid). Not Rated. Not Rated. Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: High. Point 5 5Y return: 20.17% (upper mid). 5Y return: 13.02% (bottom quartile). 5Y return: 21.55% (top quartile). 5Y return: 18.62% (lower mid). 5Y return: 15.29% (bottom quartile). Point 6 3Y return: 22.33% (top quartile). 3Y return: 22.15% (upper mid). 3Y return: 22.09% (lower mid). 3Y return: 21.36% (bottom quartile). 3Y return: 21.31% (bottom quartile). Point 7 1Y return: 17.44% (bottom quartile). 1Y return: 7.39% (bottom quartile). 1Y return: 17.87% (lower mid). 1Y return: 18.72% (upper mid). 1Y return: 21.83% (top quartile). Point 8 Alpha: 3.70 (top quartile). Alpha: -12.91 (bottom quartile). Alpha: -1.30 (lower mid). Alpha: -1.73 (bottom quartile). Alpha: 0.00 (upper mid). Point 9 Sharpe: 0.53 (top quartile). Sharpe: -0.51 (bottom quartile). Sharpe: -0.05 (lower mid). Sharpe: -0.07 (bottom quartile). Sharpe: -0.05 (upper mid). Point 10 Information ratio: 1.24 (top quartile). Information ratio: 0.54 (lower mid). Information ratio: 0.64 (upper mid). Information ratio: 0.17 (bottom quartile). Information ratio: 0.00 (bottom quartile). HDFC Equity Fund

Motilal Oswal Multicap 35 Fund

Nippon India Multi Cap Fund

Mahindra Badhat Yojana

Aditya Birla Sun Life Manufacturing Equity Fund

SIP ಗಾಗಿ ಅತ್ಯುತ್ತಮ ಮಿಡ್ ಕ್ಯಾಪ್ ಫಂಡ್ಗಳು

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) ICICI Prudential MidCap Fund Growth ₹321.25

↑ 3.53 ₹7,132 100 2.9 8.1 29.4 25.3 20.6 11.1 TATA Mid Cap Growth Fund Growth ₹450.965

↑ 1.81 ₹5,497 150 0.6 5.4 21.2 22.6 18.4 5.8 BNP Paribas Mid Cap Fund Growth ₹106.439

↑ 0.83 ₹2,313 300 1.2 6.5 19.1 21.7 18.5 2.5 Aditya Birla Sun Life Midcap Fund Growth ₹798.55

↑ 3.10 ₹6,301 1,000 -0.8 1.9 18.8 20.9 18.1 4.4 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 4 Funds showcased

Commentary ICICI Prudential MidCap Fund TATA Mid Cap Growth Fund BNP Paribas Mid Cap Fund Aditya Birla Sun Life Midcap Fund Point 1 Highest AUM (₹7,132 Cr). Lower mid AUM (₹5,497 Cr). Bottom quartile AUM (₹2,313 Cr). Upper mid AUM (₹6,301 Cr). Point 2 Established history (21+ yrs). Oldest track record among peers (31 yrs). Established history (19+ yrs). Established history (23+ yrs). Point 3 Rating: 2★ (lower mid). Rating: 2★ (bottom quartile). Top rated. Rating: 3★ (upper mid). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: High. Risk profile: Moderately High. Point 5 5Y return: 20.64% (top quartile). 5Y return: 18.39% (lower mid). 5Y return: 18.48% (upper mid). 5Y return: 18.07% (bottom quartile). Point 6 3Y return: 25.32% (top quartile). 3Y return: 22.61% (upper mid). 3Y return: 21.65% (lower mid). 3Y return: 20.94% (bottom quartile). Point 7 1Y return: 29.36% (top quartile). 1Y return: 21.18% (upper mid). 1Y return: 19.06% (lower mid). 1Y return: 18.80% (bottom quartile). Point 8 Alpha: 4.76 (top quartile). Alpha: -0.26 (upper mid). Alpha: -3.59 (bottom quartile). Alpha: -1.66 (lower mid). Point 9 Sharpe: 0.33 (top quartile). Sharpe: 0.07 (upper mid). Sharpe: -0.14 (bottom quartile). Sharpe: -0.01 (lower mid). Point 10 Information ratio: -0.16 (top quartile). Information ratio: -0.48 (upper mid). Information ratio: -0.91 (bottom quartile). Information ratio: -0.60 (lower mid). ICICI Prudential MidCap Fund

TATA Mid Cap Growth Fund

BNP Paribas Mid Cap Fund

Aditya Birla Sun Life Midcap Fund

SIP ಗಾಗಿ ಅತ್ಯುತ್ತಮ ಸ್ಮಾಲ್ ಕ್ಯಾಪ್ ಫಂಡ್ಗಳು

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Nippon India Small Cap Fund Growth ₹164.458

↑ 0.53 ₹68,287 100 -3.6 -1.7 14.3 21.2 23.6 -4.7 DSP Small Cap Fund Growth ₹196.515

↑ 0.84 ₹16,935 500 -0.8 1 20 20.6 20.5 -2.8 Sundaram Small Cap Fund Growth ₹259.069

↓ -0.24 ₹3,401 100 -2.3 2 20.8 20.5 20.2 0.4 Franklin India Smaller Companies Fund Growth ₹164.073

↑ 0.31 ₹13,238 500 -4.2 -2.6 11.3 19.4 19.8 -8.4 HDFC Small Cap Fund Growth ₹135.293

↑ 0.33 ₹37,753 300 -4.7 -3.8 15.5 18.8 20.8 -0.6 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Nippon India Small Cap Fund DSP Small Cap Fund Sundaram Small Cap Fund Franklin India Smaller Companies Fund HDFC Small Cap Fund Point 1 Highest AUM (₹68,287 Cr). Lower mid AUM (₹16,935 Cr). Bottom quartile AUM (₹3,401 Cr). Bottom quartile AUM (₹13,238 Cr). Upper mid AUM (₹37,753 Cr). Point 2 Established history (15+ yrs). Established history (18+ yrs). Oldest track record among peers (21 yrs). Established history (20+ yrs). Established history (17+ yrs). Point 3 Top rated. Rating: 4★ (upper mid). Rating: 3★ (bottom quartile). Rating: 4★ (lower mid). Rating: 4★ (bottom quartile). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 23.59% (top quartile). 5Y return: 20.47% (lower mid). 5Y return: 20.17% (bottom quartile). 5Y return: 19.83% (bottom quartile). 5Y return: 20.83% (upper mid). Point 6 3Y return: 21.19% (top quartile). 3Y return: 20.64% (upper mid). 3Y return: 20.53% (lower mid). 3Y return: 19.36% (bottom quartile). 3Y return: 18.83% (bottom quartile). Point 7 1Y return: 14.26% (bottom quartile). 1Y return: 20.03% (upper mid). 1Y return: 20.77% (top quartile). 1Y return: 11.27% (bottom quartile). 1Y return: 15.51% (lower mid). Point 8 Alpha: -1.23 (bottom quartile). Alpha: 0.00 (upper mid). Alpha: 3.98 (top quartile). Alpha: -5.23 (bottom quartile). Alpha: 0.00 (lower mid). Point 9 Sharpe: -0.42 (bottom quartile). Sharpe: -0.25 (lower mid). Sharpe: -0.16 (top quartile). Sharpe: -0.60 (bottom quartile). Sharpe: -0.23 (upper mid). Point 10 Information ratio: -0.02 (lower mid). Information ratio: 0.00 (top quartile). Information ratio: -0.20 (bottom quartile). Information ratio: -0.26 (bottom quartile). Information ratio: 0.00 (upper mid). Nippon India Small Cap Fund

DSP Small Cap Fund

Sundaram Small Cap Fund

Franklin India Smaller Companies Fund

HDFC Small Cap Fund

SIP ಗಾಗಿ ಅತ್ಯುತ್ತಮ ELSS (ತೆರಿಗೆ ಉಳಿತಾಯ ಮ್ಯೂಚುಯಲ್ ಫಂಡ್ಗಳು).

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) SBI Magnum Tax Gain Fund Growth ₹451.682

↑ 2.46 ₹32,609 500 0.7 4.2 13.5 23.9 19.2 6.6 Motilal Oswal Long Term Equity Fund Growth ₹49.4264

↑ 0.29 ₹4,341 500 -7.5 -2.7 15.6 21.9 16.9 -9.1 HDFC Tax Saver Fund Growth ₹1,456.65

↑ 5.11 ₹17,163 500 -0.2 2.6 14.7 21.3 19.4 10.3 DSP Tax Saver Fund Growth ₹145.728

↑ 0.56 ₹17,609 500 1.5 6 16.4 20.9 17.1 7.5 IDBI Equity Advantage Fund Growth ₹43.39

↑ 0.04 ₹485 500 9.7 15.1 16.9 20.8 10 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary SBI Magnum Tax Gain Fund Motilal Oswal Long Term Equity Fund HDFC Tax Saver Fund DSP Tax Saver Fund IDBI Equity Advantage Fund Point 1 Highest AUM (₹32,609 Cr). Bottom quartile AUM (₹4,341 Cr). Lower mid AUM (₹17,163 Cr). Upper mid AUM (₹17,609 Cr). Bottom quartile AUM (₹485 Cr). Point 2 Established history (18+ yrs). Established history (11+ yrs). Oldest track record among peers (29 yrs). Established history (19+ yrs). Established history (12+ yrs). Point 3 Rating: 2★ (lower mid). Not Rated. Rating: 2★ (bottom quartile). Top rated. Rating: 3★ (upper mid). Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 19.21% (upper mid). 5Y return: 16.94% (bottom quartile). 5Y return: 19.40% (top quartile). 5Y return: 17.06% (lower mid). 5Y return: 9.97% (bottom quartile). Point 6 3Y return: 23.90% (top quartile). 3Y return: 21.95% (upper mid). 3Y return: 21.34% (lower mid). 3Y return: 20.87% (bottom quartile). 3Y return: 20.84% (bottom quartile). Point 7 1Y return: 13.49% (bottom quartile). 1Y return: 15.59% (lower mid). 1Y return: 14.72% (bottom quartile). 1Y return: 16.45% (upper mid). 1Y return: 16.92% (top quartile). Point 8 Alpha: -0.86 (bottom quartile). Alpha: -16.15 (bottom quartile). Alpha: 2.58 (top quartile). Alpha: -0.15 (lower mid). Alpha: 1.78 (upper mid). Point 9 Sharpe: 0.10 (bottom quartile). Sharpe: -0.43 (bottom quartile). Sharpe: 0.41 (upper mid). Sharpe: 0.16 (lower mid). Sharpe: 1.21 (top quartile). Point 10 Information ratio: 1.95 (top quartile). Information ratio: 0.53 (bottom quartile). Information ratio: 1.27 (upper mid). Information ratio: 0.96 (lower mid). Information ratio: -1.13 (bottom quartile). SBI Magnum Tax Gain Fund

Motilal Oswal Long Term Equity Fund

HDFC Tax Saver Fund

DSP Tax Saver Fund

IDBI Equity Advantage Fund

SIP ಗಾಗಿ ಉತ್ತಮ ವಲಯದ ನಿಧಿಗಳು

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) DSP Natural Resources and New Energy Fund Growth ₹106.79

↓ -0.56 ₹1,573 500 9.2 21.7 34.4 22.9 21.4 17.5 SBI PSU Fund Growth ₹36.7055

↑ 0.18 ₹5,817 500 7.8 17.7 33.3 34.3 27.5 11.3 Invesco India PSU Equity Fund Growth ₹68.86

↑ 0.52 ₹1,449 500 3.1 11.2 33.1 32.2 25.9 10.3 UTI Transportation & Logistics Fund Growth ₹295.897

↑ 0.66 ₹4,084 500 0.8 6.9 29 25.4 19.1 19.5 SBI Banking & Financial Services Fund Growth ₹46.82

↑ 0.28 ₹10,106 500 3.4 9.3 28.4 22.6 14.1 20.4 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 17 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary DSP Natural Resources and New Energy Fund SBI PSU Fund Invesco India PSU Equity Fund UTI Transportation & Logistics Fund SBI Banking & Financial Services Fund Point 1 Bottom quartile AUM (₹1,573 Cr). Upper mid AUM (₹5,817 Cr). Bottom quartile AUM (₹1,449 Cr). Lower mid AUM (₹4,084 Cr). Highest AUM (₹10,106 Cr). Point 2 Established history (17+ yrs). Established history (15+ yrs). Established history (16+ yrs). Oldest track record among peers (21 yrs). Established history (10+ yrs). Point 3 Top rated. Rating: 2★ (bottom quartile). Rating: 3★ (upper mid). Rating: 3★ (lower mid). Not Rated. Point 4 Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Point 5 5Y return: 21.39% (lower mid). 5Y return: 27.55% (top quartile). 5Y return: 25.92% (upper mid). 5Y return: 19.13% (bottom quartile). 5Y return: 14.11% (bottom quartile). Point 6 3Y return: 22.86% (bottom quartile). 3Y return: 34.34% (top quartile). 3Y return: 32.18% (upper mid). 3Y return: 25.42% (lower mid). 3Y return: 22.60% (bottom quartile). Point 7 1Y return: 34.36% (top quartile). 1Y return: 33.34% (upper mid). 1Y return: 33.14% (lower mid). 1Y return: 29.01% (bottom quartile). 1Y return: 28.43% (bottom quartile). Point 8 Alpha: 0.00 (upper mid). Alpha: -0.22 (bottom quartile). Alpha: -1.90 (bottom quartile). Alpha: 0.00 (lower mid). Alpha: 1.96 (top quartile). Point 9 Sharpe: 0.74 (lower mid). Sharpe: 0.33 (bottom quartile). Sharpe: 0.27 (bottom quartile). Sharpe: 0.90 (upper mid). Sharpe: 1.08 (top quartile). Point 10 Information ratio: 0.00 (upper mid). Information ratio: -0.47 (bottom quartile). Information ratio: -0.37 (bottom quartile). Information ratio: 0.00 (lower mid). Information ratio: 0.89 (top quartile). DSP Natural Resources and New Energy Fund

SBI PSU Fund

Invesco India PSU Equity Fund

UTI Transportation & Logistics Fund

SBI Banking & Financial Services Fund

SIP ಗಾಗಿ ಅತ್ಯುತ್ತಮ ಕೇಂದ್ರೀಕೃತ ನಿಧಿಗಳು

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) ICICI Prudential Focused Equity Fund Growth ₹97.41

↑ 0.05 ₹14,569 100 1.3 6 21.8 23.6 19 15.4 HDFC Focused 30 Fund Growth ₹242.704

↑ 0.83 ₹26,537 300 1.4 4.7 17.4 22 21.5 10.9 SBI Focused Equity Fund Growth ₹376.732

↑ 0.23 ₹43,173 500 0.2 8.5 18.1 19.4 14.6 15.7 DSP Focus Fund Growth ₹56.092

↑ 0.16 ₹2,687 500 0.3 5.2 15 19.2 13.5 7.3 Aditya Birla Sun Life Focused Equity Fund Growth ₹149.707

↑ 0.44 ₹8,209 1,000 1.8 7.3 17.2 17.9 13.9 10.1 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary ICICI Prudential Focused Equity Fund HDFC Focused 30 Fund SBI Focused Equity Fund DSP Focus Fund Aditya Birla Sun Life Focused Equity Fund Point 1 Lower mid AUM (₹14,569 Cr). Upper mid AUM (₹26,537 Cr). Highest AUM (₹43,173 Cr). Bottom quartile AUM (₹2,687 Cr). Bottom quartile AUM (₹8,209 Cr). Point 2 Established history (16+ yrs). Oldest track record among peers (21 yrs). Established history (21+ yrs). Established history (15+ yrs). Established history (20+ yrs). Point 3 Rating: 2★ (bottom quartile). Rating: 3★ (upper mid). Rating: 2★ (bottom quartile). Rating: 3★ (lower mid). Top rated. Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 19.03% (upper mid). 5Y return: 21.52% (top quartile). 5Y return: 14.61% (lower mid). 5Y return: 13.49% (bottom quartile). 5Y return: 13.91% (bottom quartile). Point 6 3Y return: 23.56% (top quartile). 3Y return: 22.03% (upper mid). 3Y return: 19.41% (lower mid). 3Y return: 19.21% (bottom quartile). 3Y return: 17.89% (bottom quartile). Point 7 1Y return: 21.82% (top quartile). 1Y return: 17.37% (lower mid). 1Y return: 18.11% (upper mid). 1Y return: 14.95% (bottom quartile). 1Y return: 17.15% (bottom quartile). Point 8 Alpha: 7.16 (upper mid). Alpha: 3.31 (lower mid). Alpha: 7.50 (top quartile). Alpha: -0.18 (bottom quartile). Alpha: 2.34 (bottom quartile). Point 9 Sharpe: 0.70 (upper mid). Sharpe: 0.52 (lower mid). Sharpe: 0.79 (top quartile). Sharpe: 0.15 (bottom quartile). Sharpe: 0.35 (bottom quartile). Point 10 Information ratio: 1.72 (top quartile). Information ratio: 0.99 (upper mid). Information ratio: 0.32 (bottom quartile). Information ratio: 0.52 (lower mid). Information ratio: 0.15 (bottom quartile). ICICI Prudential Focused Equity Fund

HDFC Focused 30 Fund

SBI Focused Equity Fund

DSP Focus Fund

Aditya Birla Sun Life Focused Equity Fund

SIP ಗಾಗಿ ಉತ್ತಮ ಮೌಲ್ಯ ನಿಧಿಗಳು

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Nippon India Value Fund Growth ₹232.309

↑ 0.64 ₹9,153 100 -0.9 4.5 14.9 23 18.9 4.2 Aditya Birla Sun Life Pure Value Fund Growth ₹128.721

↑ 0.56 ₹6,411 1,000 0.5 6.3 16.7 20.8 16.6 2.6 ICICI Prudential Value Discovery Fund Growth ₹492

↑ 1.61 ₹61,272 100 -0.2 4.8 15.3 20.7 20.2 13.8 HDFC Capital Builder Value Fund Growth ₹775.081

↑ 1.83 ₹7,652 300 0.5 5 18.8 20.3 16.6 8.6 Tata Equity PE Fund Growth ₹358.373

↑ 0.46 ₹9,061 150 -1 4.6 15.5 19.9 16.3 3.7 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 18 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Nippon India Value Fund Aditya Birla Sun Life Pure Value Fund ICICI Prudential Value Discovery Fund HDFC Capital Builder Value Fund Tata Equity PE Fund Point 1 Upper mid AUM (₹9,153 Cr). Bottom quartile AUM (₹6,411 Cr). Highest AUM (₹61,272 Cr). Bottom quartile AUM (₹7,652 Cr). Lower mid AUM (₹9,061 Cr). Point 2 Established history (20+ yrs). Established history (17+ yrs). Established history (21+ yrs). Oldest track record among peers (32 yrs). Established history (21+ yrs). Point 3 Not Rated. Rating: 3★ (upper mid). Rating: 2★ (bottom quartile). Rating: 3★ (lower mid). Top rated. Point 4 Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Risk profile: Moderately High. Point 5 5Y return: 18.86% (upper mid). 5Y return: 16.56% (bottom quartile). 5Y return: 20.19% (top quartile). 5Y return: 16.63% (lower mid). 5Y return: 16.29% (bottom quartile). Point 6 3Y return: 23.01% (top quartile). 3Y return: 20.82% (upper mid). 3Y return: 20.66% (lower mid). 3Y return: 20.33% (bottom quartile). 3Y return: 19.92% (bottom quartile). Point 7 1Y return: 14.85% (bottom quartile). 1Y return: 16.66% (upper mid). 1Y return: 15.33% (bottom quartile). 1Y return: 18.83% (top quartile). 1Y return: 15.52% (lower mid). Point 8 Alpha: -3.34 (lower mid). Alpha: -4.92 (bottom quartile). Alpha: 5.80 (top quartile). Alpha: 0.83 (upper mid). Alpha: -3.79 (bottom quartile). Point 9 Sharpe: -0.07 (lower mid). Sharpe: -0.08 (bottom quartile). Sharpe: 0.74 (top quartile). Sharpe: 0.23 (upper mid). Sharpe: -0.07 (bottom quartile). Point 10 Information ratio: 1.54 (top quartile). Information ratio: 0.58 (bottom quartile). Information ratio: 0.97 (lower mid). Information ratio: 1.10 (upper mid). Information ratio: 0.96 (bottom quartile). Nippon India Value Fund

Aditya Birla Sun Life Pure Value Fund

ICICI Prudential Value Discovery Fund

HDFC Capital Builder Value Fund

Tata Equity PE Fund

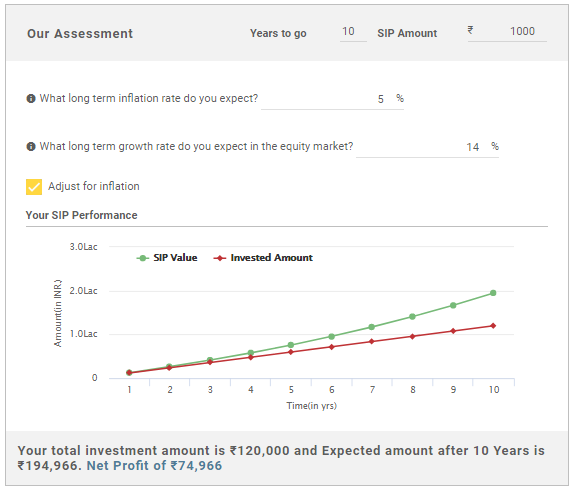

SIP ಕ್ಯಾಲ್ಕುಲೇಟರ್

ಮ್ಯೂಚುಯಲ್ ಫಂಡ್ಗಳಲ್ಲಿ ಹೂಡಿಕೆ ಮಾಡುವಾಗ ಹೂಡಿಕೆದಾರರು ಬಳಸಬಹುದಾದ ಪರಿಣಾಮಕಾರಿ ಸಾಧನಗಳಲ್ಲಿ SIP ಕ್ಯಾಲ್ಕುಲೇಟರ್ ಒಂದಾಗಿದೆ. ಕಾರು/ಮನೆ ಖರೀದಿಸಲು ಹೂಡಿಕೆ ಮಾಡಲು, ನಿವೃತ್ತಿ ಯೋಜನೆ, ಮಗುವಿನ ಉನ್ನತ ಶಿಕ್ಷಣ ಅಥವಾ ಯಾವುದೇ ಇತರ ಆಸ್ತಿಗಾಗಿ, SIP ಕ್ಯಾಲ್ಕುಲೇಟರ್ ಅನ್ನು ಬಳಸಬಹುದು. ನಿರ್ದಿಷ್ಟ ಹಣಕಾಸಿನ ಗುರಿಯನ್ನು ತಲುಪಲು ಹೂಡಿಕೆಗೆ ಅಗತ್ಯವಿರುವ ಹೂಡಿಕೆಯ ಮೊತ್ತ ಮತ್ತು ಅವಧಿಯನ್ನು ಲೆಕ್ಕಹಾಕಲು ಇದು ಸಹಾಯ ಮಾಡುತ್ತದೆ. ಆದ್ದರಿಂದ, ಸಾಮಾನ್ಯ ಪ್ರಶ್ನೆಗಳು "ಎಷ್ಟುSIP ನಲ್ಲಿ ಹೂಡಿಕೆ ಮಾಡಿ ಅಥವಾ ಆ ಸಮಯದವರೆಗೆ ನಾನು ಹೇಗೆ ಹೂಡಿಕೆ ಮಾಡಬೇಕು", ಈ ಕ್ಯಾಲ್ಕುಲೇಟರ್ ಬಳಸಿ ಪರಿಹರಿಸುತ್ತದೆ.

SIP ಕ್ಯಾಲ್ಕುಲೇಟರ್ ಅನ್ನು ಬಳಸುವಾಗ, ಒಬ್ಬರು ಕೆಲವು ವೇರಿಯಬಲ್ಗಳನ್ನು ಭರ್ತಿ ಮಾಡಬೇಕು, ಅದರಲ್ಲಿ (ವಿವರಣೆಯನ್ನು ಕೆಳಗೆ ನೀಡಲಾಗಿದೆ)-

- ಅಪೇಕ್ಷಿತ ಹೂಡಿಕೆಯ ಅವಧಿ

- ಅಂದಾಜು ಮಾಸಿಕ SIP ಮೊತ್ತ

- ನಿರೀಕ್ಷಿಸಲಾಗಿದೆಹಣದುಬ್ಬರ ಮುಂಬರುವ ವರ್ಷಗಳಲ್ಲಿ ದರ (ವಾರ್ಷಿಕ).

- ಹೂಡಿಕೆಗಳ ಮೇಲೆ ದೀರ್ಘಾವಧಿಯ ಬೆಳವಣಿಗೆ ದರ

ಒಮ್ಮೆ ನೀವು ಮೇಲೆ ತಿಳಿಸಲಾದ ಎಲ್ಲಾ ಮಾಹಿತಿಯನ್ನು ಫೀಡ್ ಮಾಡಿದ ನಂತರ, ಕ್ಯಾಲ್ಕುಲೇಟರ್ ನಿಮಗೆ ನಮೂದಿಸಿದ ವರ್ಷಗಳ ನಂತರ ನೀವು ಸ್ವೀಕರಿಸುವ ಮೊತ್ತವನ್ನು (ನಿಮ್ಮ SIP ರಿಟರ್ನ್ಸ್) ನೀಡುತ್ತದೆ. ನಿಮ್ಮ ನಿವ್ವಳ ಲಾಭವನ್ನು ಹೈಲೈಟ್ ಮಾಡಲಾಗುತ್ತದೆ ಇದರಿಂದ ನಿಮ್ಮ ಗುರಿಯ ನೆರವೇರಿಕೆಗೆ ಅನುಗುಣವಾಗಿ ನೀವು ಅಂದಾಜು ಮಾಡಬಹುದು.

ಅತ್ಯುತ್ತಮ ಮ್ಯೂಚುಯಲ್ ಫಂಡ್ಗಳಲ್ಲಿ ಹೂಡಿಕೆ ಮಾಡುವುದು ಹೇಗೆ?

Fincash.com ನಲ್ಲಿ ಜೀವಮಾನಕ್ಕಾಗಿ ಉಚಿತ ಹೂಡಿಕೆ ಖಾತೆಯನ್ನು ತೆರೆಯಿರಿ.

ನಿಮ್ಮ ನೋಂದಣಿ ಮತ್ತು KYC ಪ್ರಕ್ರಿಯೆಯನ್ನು ಪೂರ್ಣಗೊಳಿಸಿ

ದಾಖಲೆಗಳನ್ನು ಅಪ್ಲೋಡ್ ಮಾಡಿ (PAN, ಆಧಾರ್, ಇತ್ಯಾದಿ).ಮತ್ತು, ನೀವು ಹೂಡಿಕೆ ಮಾಡಲು ಸಿದ್ಧರಿದ್ದೀರಿ!

ಇಲ್ಲಿ ಒದಗಿಸಲಾದ ಮಾಹಿತಿಯು ನಿಖರವಾಗಿದೆ ಎಂದು ಖಚಿತಪಡಿಸಿಕೊಳ್ಳಲು ಎಲ್ಲಾ ಪ್ರಯತ್ನಗಳನ್ನು ಮಾಡಲಾಗಿದೆ. ಆದಾಗ್ಯೂ, ಡೇಟಾದ ನಿಖರತೆಯ ಬಗ್ಗೆ ಯಾವುದೇ ಗ್ಯಾರಂಟಿಗಳನ್ನು ನೀಡಲಾಗುವುದಿಲ್ಲ. ಯಾವುದೇ ಹೂಡಿಕೆ ಮಾಡುವ ಮೊದಲು ದಯವಿಟ್ಟು ಸ್ಕೀಮ್ ಮಾಹಿತಿ ದಾಖಲೆಯೊಂದಿಗೆ ಪರಿಶೀಲಿಸಿ.