Mutual Funds for Stable Returns - How to Grow Your Money Without Constant Market Stress

The best mutual fund isn’t the one that tops the charts in a single year. It’s the one you are able to stay invested in when markets turn volatile. Yet, most investors are taught to chase performance — last year’s top fund, the hottest category, or the most aggressive strategy. And when markets fall, that confidence quickly fades.

This is why more people are now looking for Mutual Funds for stable returns. Your goal should not just be to maximise returns every year, but to grow money steadily without constant stress. In this article, we’ll explain what stable returns really mean, how to identify mutual funds built for consistency, and why hybrid funds often offer the right balance between growth and peace of mind.

If you prefer a visual explanation, we’ve also explained mutual funds for stable returns and the role of hybrid funds in detail in this video. It walks through real-world examples and investor behaviour during market ups and downs, making the concepts easier to understand - ▶️ https://www.youtube.com/watch?v=9lwx5uWNoa4

What Do “Stable Returns” Really Mean in Mutual Funds?

Stable returns do not mean guaranteed or fixed returns. In Mutual Fund Investing, stability refers to -

- Lower Volatility compared to pure Equity Funds

- Better downside protection during market crashes

- Consistent performance across different market cycles

- A return journey that investors can emotionally handle

A fund that delivers 25% in one year and –20% in the next may look attractive on paper, but it is difficult for most investors to stay invested in. On the other hand, funds that deliver reasonable returns with fewer sharp drawdowns often help investors remain invested longer — which is where real wealth creation happens.

Stability is not about avoiding risk completely. It is about managing risk intelligently!

Why Most Investors Struggle With Market Volatility

Investor behaviour plays a far bigger role in returns than most people realise.

Typically -

- When markets rise, investors want more equity

- When markets fall, they suddenly want safety

- Decisions are driven by emotions, not logic

This behaviour leads to buying high, selling low, and constantly switching strategies. The best mutual funds for stable returns are designed not just to manage money — but to manage behaviour.

Talk to our investment specialist

Key Metrics to Identify Mutual Funds for Stable Returns

To judge stability, looking at one-year or recent returns is not enough. What truly matters is how a fund behaves across different market conditions and time periods.

1. Rolling Returns

One of the most reliable measures of consistency is rolling returns. Unlike point-to-point returns, rolling returns show how a fund has performed across multiple overlapping periods, such as every 3-year or 5-year window. This helps investors understand whether returns are repeatable or driven by a single lucky phase. Funds with stable rolling returns usually handle market ups and downs more gracefully.

2. Standard Deviation

Another important metric is standard deviation, which indicates how volatile a fund’s returns are. A lower standard deviation means the fund’s returns fluctuate less, resulting in a smoother Investing experience. For investors seeking stable returns, lower volatility is often more important than chasing the highest possible gains.

3. Sharpe Ratio

The Sharpe ratio helps put returns and risk into context. It measures how much return a fund generates for every unit of risk taken. A higher Sharpe ratio suggests that the fund is being rewarded adequately for the risk it assumes. For stability-focused fund, a consistently healthy Sharpe ratio is often a better signal than high absolute returns.

4. Sortino Ratio

The ratio goes a step further by focusing only on downside risk. Instead of penalising a fund for all volatility, it measures how well the fund protects investors during market declines. This makes the Sortino ratio particularly relevant for conservative investors who care more about avoiding losses than capturing every upside move.

5. Expense Ratio

Finally, the expense ratio plays a silent but critical role in long-term stability. Even a small difference in cost can compound into a large gap over time. Since funds designed for stable returns rely on steady compounding rather than aggressive bets, keeping expenses low becomes especially important.

Best Mutual Funds for Stable Returns in India

When Indian investors look for stable returns, they are usually navigating three realities — market volatility, interest rate cycles, and personal cash-flow needs. Over multiple Indian market cycles — including global financial crises, pandemic crashes, and sharp rate hikes — funds that combine equity growth with debt stability have consistently delivered a better investing experience than single-asset funds.

In the Indian context, hybrid funds have emerged as one of the most practical solutions for stability because they automatically adjust between growth assets and defensive assets. This makes them particularly suitable for investors who do not want to actively track markets or rebalance portfolios on their own.

Rather than relying on one “perfect” fund, Indian investors are better served by choosing categories that are designed to handle uncertainty — and then selecting quality funds within those categories.

Hybrid Funds: The Core Category for Stable Returns

When discussing mutual funds for stable returns, hybrid funds naturally take centre stage. Hybrid funds invest in a combination of equity and debt within a single Portfolio. This structure helps balance growth and safety without requiring investors to make frequent allocation decisions. Instead of reacting emotionally to market movements, hybrid funds follow a disciplined approach based on Asset Allocation and rebalancing.

Why Hybrid Funds Are Designed for Stability

Hybrid funds follow a systematic process. When equity markets rise sharply, these funds reduce equity exposure and move some money into debt. This helps in booking profits and controlling risk. When markets fall, equity becomes cheaper. Hybrid funds then increase equity exposure, allowing investors to accumulate equity at lower prices — something most individuals struggle to do emotionally.

This automatic discipline creates a powerful advantage -

- Humans panic during market falls

- Hybrid funds stay logical

Over time, this leads to smoother returns and a far better investor experience.

What We’ve Observed Across Market Cycles

When we analyse how investors actually behave during volatile phases, one pattern appears repeatedly — investors exit pure equity funds during sharp corrections and re-enter only after markets recover.

Hybrid funds reduce this behavioural damage.

Across multiple market corrections, investors in hybrid funds have generally stayed invested longer because the downside feels manageable. This continuity allows compounding to work uninterrupted, which often matters more than chasing the highest possible return in any single year.

In practice, funds that investors can stay invested in tend to create more wealth than funds that look impressive on paper but feel emotionally difficult to hold. If you want a deeper explanation of how different Hybrid Fund categories work and how SEBI classifies them, we’ve covered that in detail in our dedicated Hybrid Mutual Funds guide.

Who Should Invest in Mutual Funds for Stable Returns?

Stability-focused funds are suitable for -

- Investors who feel anxious during volatility

- First-time mutual fund investors

- Retirees or near-retirees

- Long-term investors who value consistency

They are not meant for chasing quick gains, but for building wealth patiently.

Final Thoughts: Stability Is a Strategy, Not a Compromise

Mutual funds for stable returns are not about playing safe — they are about playing smart. Markets will always fluctuate. Noise will always exist. But wealth rewards those who build systems that help them stay invested calmly and consistently. Hybrid funds, supported by disciplined investing and the right metrics, offer one of the most practical ways to achieve this balance. Wealth doesn’t grow because we predict the market perfectly. It grows because we start, stay consistent, and let time do the heavy lifting.

Frequently Asked Questions (FAQs)

1. Are mutual funds for stable returns safe?

A: Mutual funds do not offer guaranteed returns, but funds designed for stability aim to reduce volatility and protect capital during market downturns. Hybrid and low-volatility funds are generally safer than pure equity funds over short to medium periods.

2. Are hybrid funds better than fixed deposits?

A: Hybrid funds can deliver higher long-term returns than fixed deposits, but they also involve market risk. For investors with a longer horizon, they can be a more efficient alternative.

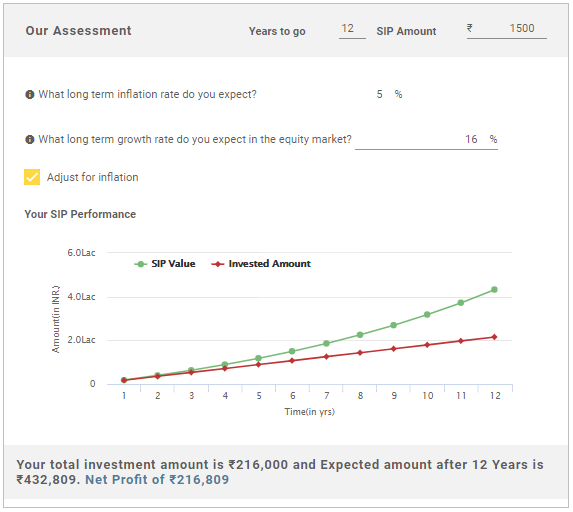

3. Can SIPs help in getting stable returns?

A: Yes. SIPs help average purchase costs over time and reduce timing risk, making returns smoother in volatile markets.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.